Singapore traders go 'huat ah'!

The bullish sentiment that has lifted the Singapore market this year continued on Thursday, with the benchmark Straits Times Index (STI) hitting an early-morning intraday high of 3,158.26 points.

That eased down to 3,136.48 points by the market's close, near the year's high and up by around 14 points. However, the gainers-losers ratio was much closer at 245-239. Value traded was at a robust S$1.8 billion and volume traded, at 2.8 billion shares, was not too shabby either.

The STI is up a lucky 8.88 per cent year-to-date, or a US dollar-adjusted 11.6 per cent, making it one of the best performers in Asia. Market activity was dominated by optimism about the Jardine stable, Singapore banks, and other major blue-chip counters such as Keppel Corp, CapitaLand and City Developments.

Jardine Matheson Holdings reported results on Thursday. Underlying profit attributable to shareholders was up 2 per cent to US$1.4 billion while gross revenue, including a complete accounting of all its associates and joint ventures, was up 11 per cent to US$72.4 billion. Several segments performed well, with Jardine Cycle & Carriage's Indonesian core business Astra improving along with non-Astra interests. Jardine Motors' China business announced higher sales of Mercedes-Benz cars at better margins. Retail giant Dairy Farm also grew profits.

Read also: Even in weak market, racial bias trumps profit for many Singapore landlords

The broad market was positive in spite of the likelihood of a mid-March interest-rate hike jumping upon hawkish comments by a few US Federal Reserve governors. After Friday comments by Fed chair Janet Yellen and vice-chair Stanley Fischer, one more data point, the February non-farm payroll report, will come on March 10, said Bank of Singapore chief economist Richard Jerram.

But he noted that the PCE (personal consumption expenditure) measure of inflation, which the Fed prefers, was still chugging along, not rising very fast to trigger urgent hikes. "At the moment, our base case is three rate hikes in 2017 and a further four in 2018, but big tax cuts could speed up the pace."

Read also: Steady gains in Singapore market

Striking a contrarian note on the market optimism was Steen Jakobsen, chief economist and chief investment officer of Saxo Bank Group, who was in town to meet clients. Mr Jakobsen, who advises market players such as hedge funds and family offices, told BT there is a "huge gap between reality and perception".

US PCE inflation, which is just under the Fed's 2 per cent long-term target, is nothing to shout about, he said, though not negative either. Spending and credit data does not impress him. And purchasing managers' indices, while showing accelerating activity, are just "survey data" instead of "hard data", he said.

Valuations in the United States are also expensive. Headline inflation will come down in the months ahead as the base effect from last year's lows fades. He is disappointed at how little detail US President Donald Trump has provided on his plans. Thus Mr Jakobsen is defensive, with an emphasis on fixed income, a neutral weight on equity and a higher-than-usual allocation to gold.

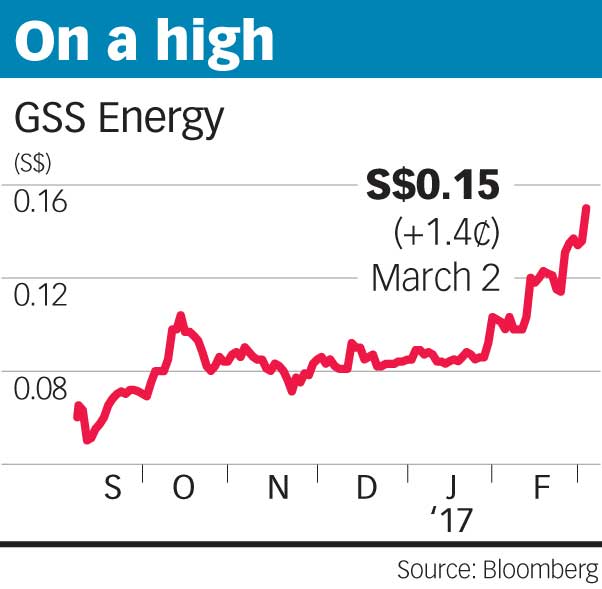

In the local bourse, a notable top volume stock was GSS Energy. The counter had recovered to a high not seen since 2015. It was up 1.4 cent to 15 Singapore cents, or 10 per cent, on 83 million shares traded. On Wednesday, GSS Energy said CEO Sydney Yeung Kin Bond had raised his stake in the firm by four million shares on March 1. The inside share purchase builds upon positive momentum for the counter. Its recent results show a return to profitability contributed entirely by its precision engineering business.

Another counter with a price spike was Bukit Sembawang Estates. The counter rose 38 cents or 7.8 per cent to S$5.23. Like the STI, its high was not seen since the mid-2015 market collapse. The trigger appeared to be a "not rated" report by DBS Group Research, which highlighted the company as a potential takeover target."Assuming the price of undeveloped land is marked to market prices, we estimate Bukit Sembawang is worth S$7.55 a share. If we factor in its full development potential from its undeveloped landbank, excluding any potential uplift in plot ratio, revised net asset value could rise to S$10.35 a share."

This article was first published on Mar 03, 2017.

Get The Business Times for more stories.