Sometimes, this time really is different

The four most dangerous words in investing are "This time it's different." But investing is challening because sometimes, this time really is different.

Sir John Templeton, one of the true investing greats, once said that the four most dangerous words in investing are "This time it's different."

He wanted to warn us that if we ignore history, we're doing so at our own peril. As French writer Jean-Baptiste Alphonse Karr once stated, "the more things change, the more they stay the same".

But what makes investing so challenging is that sometimes, this time really is different.

WHEN DIVIDEND YIELDS CHANGE PERMANENTLY

There were two huge crashes in the US stock market in the early 20th century. One happened in 1929, during the infamous Great Depression, when US stocks fell by more than 80 per cent at the 1932 bottom. The other, which is less well-known, occurred in the first decade of the 1900s and was known as the Panic of 1907.

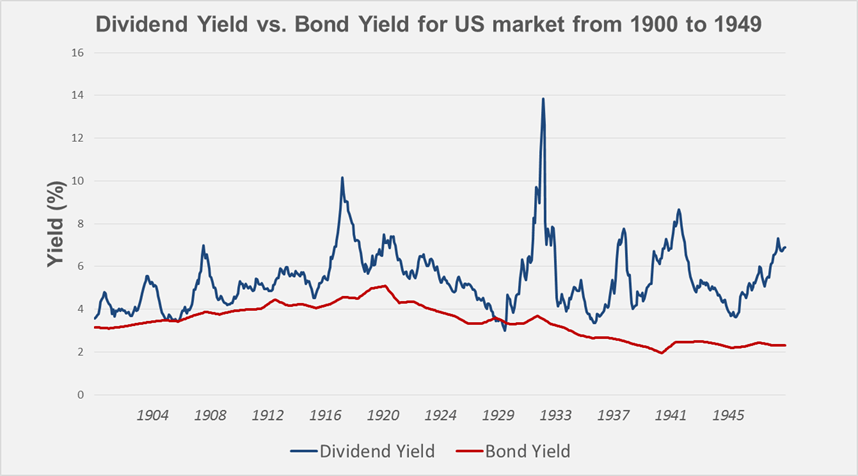

Something interesting happened prior to both of these crises. In the first half of the 20th century, the dividend yield of US stocks were higher than the country's bond yield most of the time. The only two occasions when the dividend yield fell below the bond yield were - you guessed it - just before the Panic of 1907 and the Great Depression.

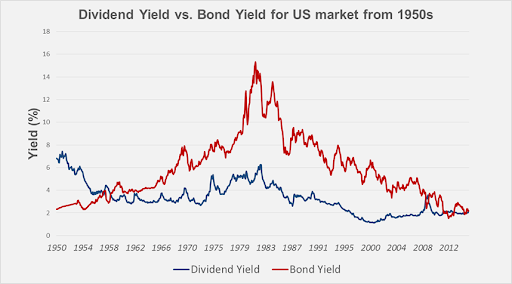

Knowing what happened in the first half of the 1900s, it's easy for us to think that US stocks would crash the next time the dividend yield fell below the bond yield. So guess what happened when the dividend yield of US stocks started once again to slip behind the bond yield in the late 1950s?

The bond yield ended up staying higher than the dividend yield all the way until it was late into the first decade of the 2000s!

If we were investing in the US in the 1950s and wanted to invest based on the historical relationship between dividend and bond yields in the first-half of the 1900s, we had no chance at all to invest for decades.

And yet from 1955 (before the dividend yield fell below the bond yield) to 2008 (when the dividend yield briefly became higher than the bond yield again), the S&P 500's price increased by nearly 2,400 per cent.

[[nid:469472]]

WHEN A SIGN OF CHEAPNESS STOPS WORKING

Walter Schloss is one of my investing heroes, but he's not too well-known among the general public. That's a real pity because Schloss's track record is astounding.

From 1956 to 2000, Schloss's investment firm produced an annualised return of 15.3 per cent, turning every $1,000 invested into more than $525,000. Over the same time frame, the US stock market, as a whole, had compounded at merely 11.5 per cent per year - $1,000 would have become just $120,000.

In 1985, Schloss was interviewed by the investing publication Barron's. During the interview, he recounted a story involving his one-time boss and fellow investing luminary, Benjamin Graham:

"Graham used to have this theory that if there were no working capital stocks around, that meant the market was too high…

… [That's] because historically, when there were no working capital stocks, the market collapsed. That worked pretty well till about 1960, when there weren't any working capital stocks, but the market kept going up. So that theory went out."

Schloss provided an explanation of what a working capital stock is in the same interview:

"Suppose a company's current assets are $10 million; the current liabilities are $3 million. There's $7 million in working capital. And, they are, say, $2 million in debt. Take that off. So there's $5 million of adjusted working capital. And say there are 100,000 shares, so they got $50 a share of working capital.

Now, if that stock were selling at 30 bucks a share, it would be kind of interesting."

To put it simply, working capital stocks are stocks that are priced very cheaply compared to the assets they own. Graham's theory was that if the market no longer has such cheap stocks, then a crash is imminent.

The model worked fine for a while, then it stopped working, as working capital stocks became scarce near-permanently from the 1960s onwards. In fact, Schloss had to change his investment strategy. During an interview with Outstanding Investors' Digest in the late 1980s, Schloss said (emphasis is mine):

[[nid:466650]]

"Yes. I think it has - largely because of the situation in the market. Graham-Newman [Benjamin Graham's investment firm] used to buy working capital stocks - which I thought was a great idea.

But by 1960, there were practically no working capital stocks. With the exception of 1974, at the very bottom of that market, there have been practically no working capital stocks.

A good way of seeing it is to look at Value Line's [a business publication showing financial numbers of US stocks] list of working capital stocks. If you go back 15 years, you'll see they have some on the list. Today, there are very few. And the ones that are on the list are really pretty bad - often with a lot of debt - especially in relationship to the equity.

With working capital stocks gone, we look next at book value."

Schloss was right to have tweaked his strategy. The US stock market has been marching higher - much higher - since the disappearance of working capital stocks. From the start of 1960 to today, the S&P 500 has increased from 60 points to over 3,000. That's more than a 50-fold jump in value.

RECOGNISING WHEN THINGS ARE DIFFERENT

It's important for us to acknowledge that conditions in financial markets can change in permanent or near-permanent ways to severely blunt the usefulness of historical experience.

The limits of using history can be applied to individual stocks too. For instance, it's tempting for us to conclude that a stock is a bargain if it has lower valuations now compared to its own history. But we should also carefully consider if there's anything that has permanently changed.

Bankruptcy risks. Industry obsolesce. Incompetent management. Absurdly high valuations in the past. These factors, and more, could render history useless as a guide for the future.

Many investors love to look at historical valuation data when studying the markets. I do too. But when doing so, it's crucial to remember that things can change. What has worked in the past may no longer be valid in the future. We need to recognise that sometimes, this time really is different.

This article was first published in The Good Investors. All content is displayed for general information purposes only and does not constitute professional financial advice.