What happens if your housing loan deductions reach your CPF Basic Retirement Sum?

When buying a house, some of us would use our CPF savings to pay for our housing loans. But the thing about CPF is that it’s for retirement, so there’s a limit to how much you can use it for housing. Since the limit depends on the Basic Retirement Sum, what happens if your housing loan deductions reach it?

Before we explain further, let’s first talk about what and how much you can use your CPF Ordinary Account (OA) savings for housing.

Most people use their CPF OA savings for their property downpayment. Some use it to pay off their housing loan as well, whether it’s HDB loan or bank loan.

But the usage of CPF OA savings is not limited to those. It can also be used to pay your stamp duties and legal fees. And if you’re paying the home loan for your HDB flat with CPF, you’ll need to be insured under the Home Protection Scheme (HPS), which will be paid using CPF.

For private properties, you can also use the CPF OA savings to pay for the loan for house construction or the purchase of vacant land.

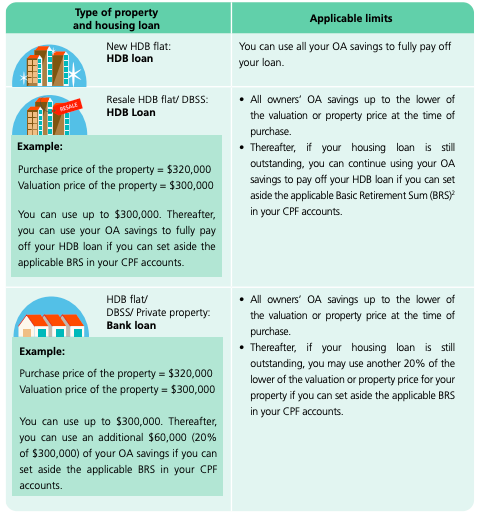

At the same time, there’s a limit to how much you can use your CPF for housing. Generally, it depends on the type of your home loan and property.

Ultimately, CPF savings is meant for your retirement so there are some limits to adhere to. This ensures you don’t spend too much of it on your housing loan at the expense of your retirement funds.

One of the major rules is that you can’t use your CPF if the property has less than 20 years of lease remaining.

For most people, the property bought has a remaining lease covering the youngest owner until age 95. As of 10 May 2019, the limit on the use of CPF savings depends on the type of property and housing loan.

Other than the Loan-to-Value (LTV) limit, there’s no limit to how much you can use your CPF savings if you’re buying a BTO with an HDB loan. So you can use all your OA savings to pay off the loan.

The limit is the lower of the valuation or the property price at the time of purchase. This is also known as the valuation limit. If you want to use more than this limit, you’ll need to set aside the Basic Retirement Sum (BRS) in your CPF accounts first.

Let’s say the purchase price of the property is $320,000 and its valuation is $300,000. If you want to use more than the $300,000 limit to pay off your remaining loan, you’ll need to set aside the BRS first.

Similar to resale flats bought with HDB loan, the limit is the lower of the valuation or property price at the time of purchase if you don’t set aside the BRS in your CPF.

But if you set aside the BRS in your CPF, you can use up to 20 per cent of either the valuation or property price (whichever is lower) from your OA savings to pay off your loan. This essentially means that you can use up to the withdrawal limit, which is 120 per cent of the valuation limit.

Using the same figures to illustrate, you’ll be able to use up to $300,000 + additional $60,000 = $360,000 if you set aside BRS in your CPF account.

For properties with a remaining lease that doesn’t cover the youngest owner till age 95, the limit to how much you can use your OA savings will be prorated based on the youngest owner’s age.

Already bought at least one property with your CPF savings? If you’re buying a new property that can cover you till you’re 95, you’ll need to set aside the BRS in your CPF account.

Otherwise, you’ll have to set aside the Full Retirement Sum (FRS) before buying another property.

Now that you know about the limit, you might be wondering what these retirement sums are all about.

They basically refer to the amount of CPF savings that will be set aside for retirement. When you turn 55, a Retirement Account (RA) will be formed. Savings from your Special Account and OA will be transferred to this RA to meet the Retirement Sum.

The retirement sum depends on your age. It will be higher for those who turn 55 in the later years due to inflation and the higher cost of living in future.

Here are the retirement sums for those turning 55, up to the year 2022. If you’re below 55, you can refer to the current BRS.

| 55th birthday in the year of | Basic retirement sum | Full retirement sum | Enhanced retirement sum |

|---|---|---|---|

| 2017 | $83,000 | $166,000 | $249,000 |

| 2018 | $85,500 | $171,000 | $256,500 |

| 2019 | $88,000 | $176,000 | $264,000 |

| 2020 | $90,500 | $181,000 | $271,500 |

| 2021 | $93,000 | $186,000 | $279,000 |

| 2022 | $96,000 | $192,000 | $288,000 |

After the savings are transferred to meet the Retirement Sum, you can use the remaining balance to pay for your housing loan.

So even as you continue to work after 55, you can still use the monthly contributions that go into your OA to service your mortgage. This applies even if you don’t meet the Retirement Sum.

If you plan to use more than the valuation limit to pay your housing loan with CPF, you can top up your CPF to continue paying your mortgage with it. However, do note the 120 per cent withdrawal limit if you’re taking a bank loan.

Planning to continue using your OA to pay for your housing loan after you turn 55? You can apply to reserve your OA savings before they’re transferred to your RA.

You can either reserve all or part of your OA savings via MyCPF Online Services at least three weeks before your 55th birthday.

But even if you’ve submitted the request to reserve your OA savings, the CPF Board can still transfer it if any of the following happens:

In addition, doing so lowers the amount set aside for retirement. It also affects the amount that you can withdraw and receive in monthly payouts. Alternatively, you might want to fork out cash to pay your remaining mortgage.

You might also want to note that if you ever sell your property, you’ll need to put back the CPF savings used plus the 2.5 per cent accrued interest into your CPF account. So before you jump into paying off your mortgage with your CPF savings, be sure to plan your financials first.

ALSO READ: CPF housing withdrawal limits: What you need to know