75-year-old retiree loses $1m in China officials impersonation scam

SINGAPORE - Within two months of her first phone call with the scammers, $1 million had been drained from her Central Provident Fund (CPF) account and sent to multiple bank accounts both in Singapore and abroad.

Madam Fong (not her real name), 75,said that for eight weeks, the scammers would call her three times a day when her husband was at work and later even delivered a mobile phone to her home to video call her on video conferencing platform TeamLink.

In a conference call with the media facilitated by the Singapore Police Force on Friday (April 22), the retiree said the person who spoke to her claimed to be from the authorities in China and informed her that her name had come up in a money laundering case there. He also warned her not to involve her family members to protect them.

Madam Fong, who has not recovered any of the $1 million so far - her case is under investigation - is hoping that by speaking out, she can highlight the menace dubbed the China officials impersonation scams.

She is one of 109 victims who have fallen prey to this scam variant since January this year and at least $14.6 million has been lost in that time.

When asked if she thought it was strange that officials constantly asked her over the phone about her family members' whereabouts and if she was alone at home, Madam Fong, who lives with her husband and a domestic helper, said: "I thought they just wanted to protect my family."

Madam Fong, who used to run a chemical trading company with her husband, suffered a spinal fracture a few years ago and uses a wheelchair on occasion these days.

She said that in mid-December, she received a call from an automated voice claiming to be from the Ministry of Health.

[[nid:558947]]

They patched her through to an "agent" who told her that her name was used for a money laundering case in China and she should assist with investigations.

Madam Fong agreed and provided her personal details to the agent, including her NRIC number and home address.

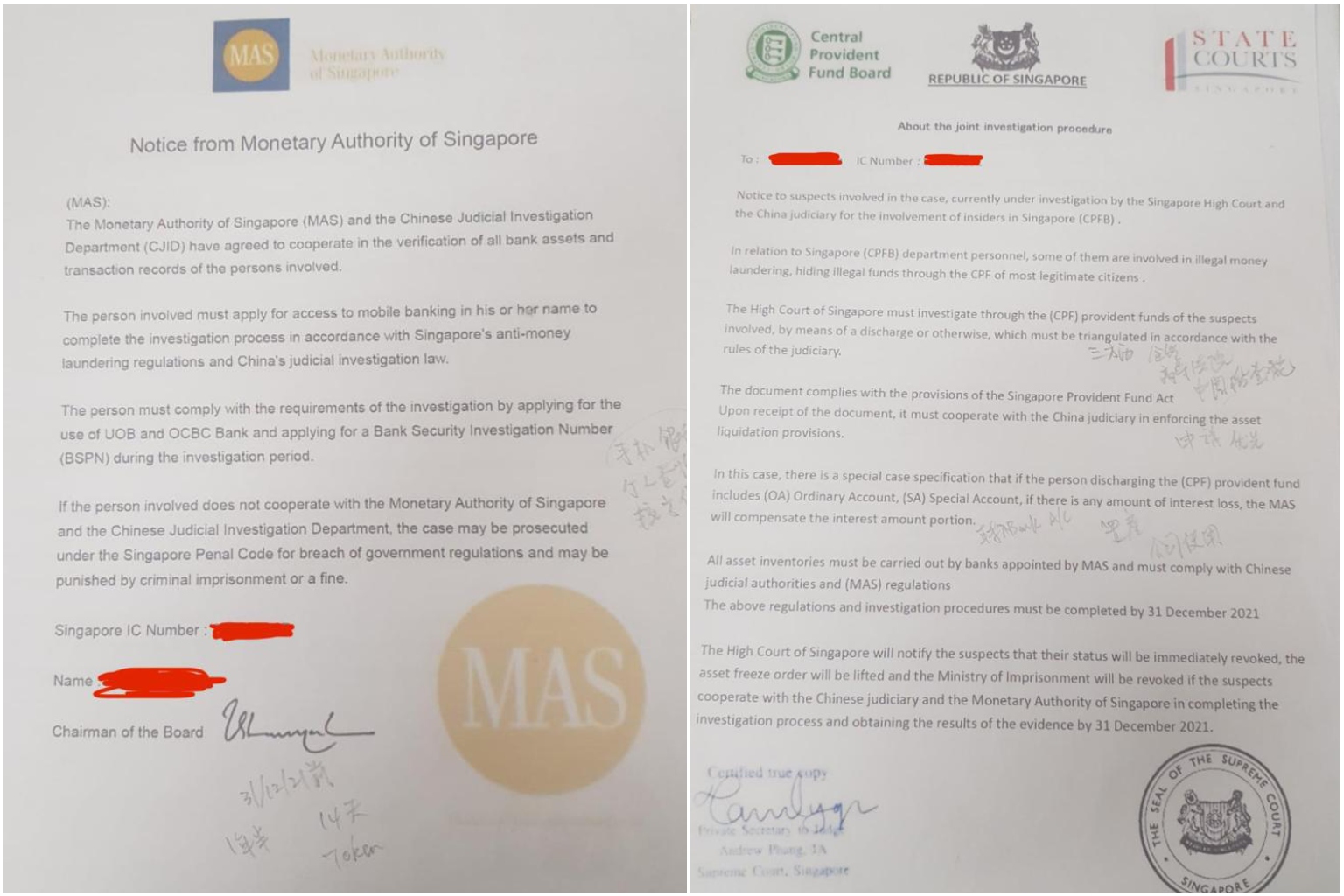

She then received hand-delivered letters outside her door purportedly from government agencies here including the police, the Attorney-General Chambers and Monetary Authority Singapore.

The scammers sent her a mobile phone using the same method soon after.

"My home Wi-Fi is not very good so they said they will send me a phone to help me to talk and cooperate with them," said Madam Fong.

She neither recalls authorising the transfer of the CPF money to her UOB account, which would require Singpass verification, or transferring the money from her UOB account to the unknown bank accounts.

She also does not recall going to a UOB outlet in Orchard Road to give authorisation to start Internet banking for her account.

The $1 million from her CPF account was transferred to her UOB account and on to other unknown accounts between Jan 28 and Feb 3.

Madam Fong's husband and daughter, who were by her side during the conference call on Friday, said that while her mind is sound, she does occasionally forget things these days.

A spokesman from UOB said on Friday that scammers will not be able to access customers' funds as long as they do not share their banking details, passwords, and one-time passwords (OTPs) with anyone else.

He added that for every Internet withdrawal, UOB will send an alert via SMS and customers can then check transactions as they happen and report any unauthorised transactions to the bank.

"Withdrawals must also be authorised by the account holder only either by a digital or hard token," he said.

UOB alerted the police's anti-scam centre to Madam Fong's transactions and officers visited her at her home on Feb 4, but she was not convinced they were the police.

Madam Fong said she only realised she had been duped when she messaged the scammer after the police visit and did not get a reply.

This article was first published in The Straits Times. Permission required for reproduction.