Downsizing your HDB: how to do it right

Have you ever looked at the BTO launches released every quarter and wondered why there are some 2-room Flexi flats being offered? You are probably not the only one who is left wondering. The fact is, they are launched for a specific reason - to cater the senior Singaporeans/PRs who are looking to downsize their HDB.

WHAT IS HDB DOWNSIZING?

Downsizing, or rightsizing (as HDB puts it), is the concept of converting your HDB flat into a size that is optimum for you. If you are a senior Singaporean/PR who is aged 55 and above, you might consider downsizing your flat as you no longer need a big flat given that your kids are already starting their own family.

WHY SHOULD YOU CONSIDER DOWNSIZING?

While most people who have considered downsizing (or downsized) did it out of financial consideration, there are social considerations to support this idea too.

THE FINANCIAL CONSIDERATION

Downsizing is one of the ways you can unlock value from your property. When you downsize your property, you will make a net sale proceed which can be used to fund your retirement.

Let's say you sell your current property (a 5-room HDB) at S$500,000. After which, you decide to downsize to a smaller unit (e.g. a 3-room HDB) that costs S$300,000. This translates to a net sale proceed of S$200,000. This S$200,000 can be used to pay off any or all of the following:

Your existing home loan

Accrued interest if you borrowed from CPF

Resale levy if you bought a subsidized flat as your first property (non-resale)

Deductibles of up to S$15,000 for ancillary costs

After paying off all the levy, accrued interest, existing loan and ancillary costs, you may be left with some funds for your retirement.

THE SOCIAL CONSIDERATION

Let's also look at the social perspective for downsizing. In recent years, HDB has been experimenting with the idea of a Kampung. HDB wants to recreate the days of Singapore's Kampung life when neighbours used to be close to each other and did everything together, leading to the creation of Singapore's first retirement community at Kampung Admiralty.

Kampung Admiralty is made up of 100-plus studio apartments that are elderly friendly. Every studio apartment is fitted with a range of elderly-friendly features such as retractable clothes-drying racks. But more than just being fitted with elderly-friendly infrastructure, Kampung Admiralty encourages active interaction among residents.

Kampung Admiralty comes with a multitude of facilities to drive social cohesion. For example, Kampung Admiralty has a community farm for residents to grow food crops with their neighbours. There is also an NTUC Active Aging Hub with day care, home care, and rehabilitation services for those who need the services. A community plaza is also there for residents to organise activities for fellow residents and socialise with each other.

WHAT OPTIONS DO YOU HAVE WHEN YOU DOWNSIZE?

If you are starting to give downsizing a serious thought, you should know that there are two options for you: Buying on the resale market or applying for a new launch.

1.BTO: 2-ROOM FLEXI FLATS WITH SHORT LEASE

Under HDB's 2-room Flexi scheme, you can apply for a short-lease 2-room flat during the quarterly BTO launches. You can choose from leases that range between 15 to 45 years to ensure that you have a roof over your head till age 95. This option typically gives you the best outcome if you are downsizing to unlock value from your home. It is no wonder why 90 per cent of senior flat buyers opt for these 2-room Flexi units with a shorter lease.

2. SBF: 2-ROOM FLEXI FLATS

Apart from the BTO option, there is the option of buying a balance flat during the sale-of-balance (SBF) flat offering exercise. The SBF exercise takes place twice a year in May and November in conjunction with the BTO exercise. SBF gives you an additional option to find the right HDB for downsizing. However, there is a tendency for SBF flats to cost slightly more than BTO flats, especially if there is a short waiting time to the flat's completion.

(P.S. If you are thinking of buying a 2-room Flexi unit from the SBF exercise, make sure you check the lease period before committing).

3. BTO, SBF: OTHER TYPES OF FLATS

If you feel that the 2-room Flexi units aren't for you, then you also have the option of applying for other types of flats. This can be done through either the BTO or SBF exercise. There is no restriction on the room type or location for your downsized flat.

4. RESALE MARKET

Besides BTO and SBF, there is also the resale market. You can buy a smaller HDB unit from an existing owner who is planning to let go of his/her unit. One drawback, however, of this option is that the price of your new home will be on the higher side. After all, the price of flats on the secondary market is pegged to the market value of recently transacted flats in the vicinity.

Downsizing your home through the resale market might mean that you end up with limited money due to the relatively higher selling price of your new home compared to BTO or SBF flats.

TIPS TO KNOW WHEN YOU ARE DOWNSIZING YOUR FLAT

1. HDB SILVER HOUSING BONUS

If you are planning to downsize to a small HDB flat (3-room or smaller), then be sure to check if you can tap onto the Silver Housing Bonus (SHB).

Silver Housing Bonus is a scheme that was introduced by HDB to encourage elderly homeowners to downsize their HDB flat. The idea is simple. If you downsize your HDB and use the net sale proceeds to top up your CPF retirement account, you will receive a cash bonus of up to S$20,000 from HDB.

WHO QUALIFIES FOR THE HDB SILVER HOUSING BONUS?

In order to qualify for HDB's SHB, there are three criteria that you need to meet:

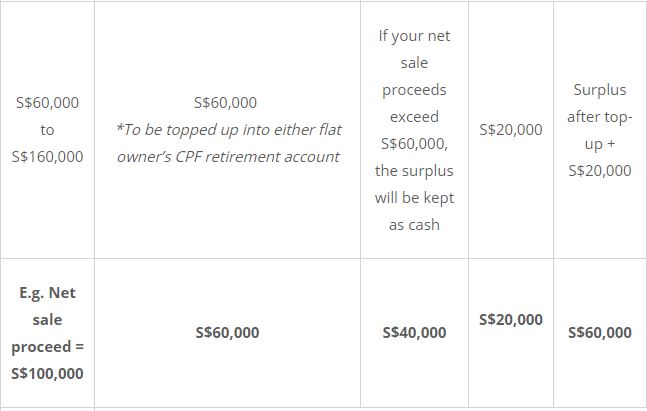

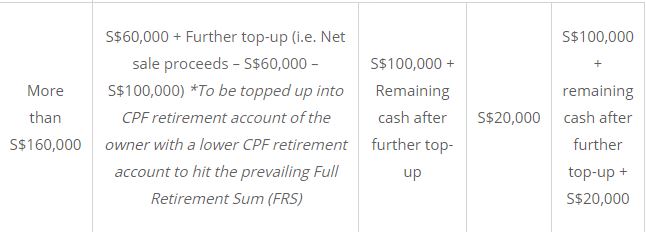

HOW TO CALCULATE HOW MUCH CASH AND HDB SILVER HOUSING BONUS YOU WILL GET?

2. WATCH OUT FOR THE RESALE LEVY

If the current property that you are staying in is a subsidised flat, then this applies to you. When you sell your HDB, DBSS or EC that comes with the CPF Housing Grant for another subsidized HDB, you will be charged a resale levy. However, if you buy a resale flat instead, you will not be charged a resale levy.

This article was first published in BankBazaar.SG.