Top subscription services that make your life easier (and how to make the most of them)

How many subscription services do you currently pay for? If you are like us, you will have quite a few: Netflix, Spotify or Apple Music, transport and food-related memberships…

We looked at the popular monthly subscriptions Singaporeans use often, its prices and benefits. It turns out, there are ways to shave off a few bucks in some of these subscriptions. The secret is to bundle them or to share. Keep on reading to find out how.

Popular Subscriptions and Memberships That Singaporeans Use

Monthly subscriptions are great for services and products we consume consistently. Because we pay a fixed fee, the more we used them, the more value we get out of them.

Also, the payments are automated so, once you subscribe, you don't have to make a conscious effort to purchase it again. You just keep on using it.

Here are some of the most popular ones in each category.

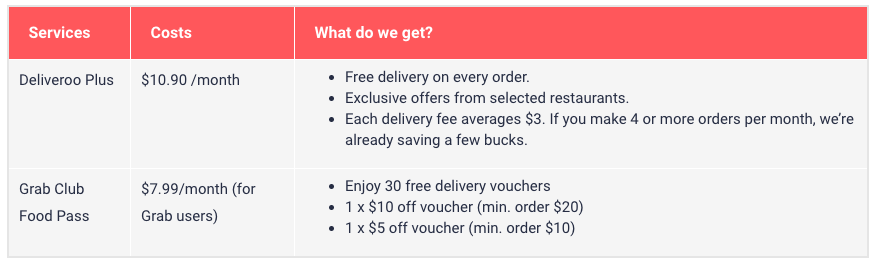

FOOD

Can I save on these food-related memberships?

Both memberships are only worth the price if you order food regularly.

If you usually ride with Grab, Grab Food is a good choice because it comes with added perks: you can pay with GrabPay and earn GrabRewards to be exchanged with vouchers for rides, for example.

Grab with SCORE (see Lifestyle section), gives you 10 free delivery vouchers per month (min. order of $20) but you don't get the discount vouchers of the Club Pass.

EATING OUT

How can I save?

Burpple is viewed as more "wallet-friendly" when compared with The Entertainer. There are 2 main points of comparison when it comes to redeeming 1-for-1 food deals: the yearly fee is higher with The Entertainer, and Burpple offers a bigger selection of popular F&B outlets.

The Entertainer offers 1-for-1 deals in more than just restaurants, but the food deals are the more popular ones. If you intend to use it across categories and shop for beauty and shopping deals, then it is easier to break even.

The Entertainer membership is free if you have an HSBC credit card.

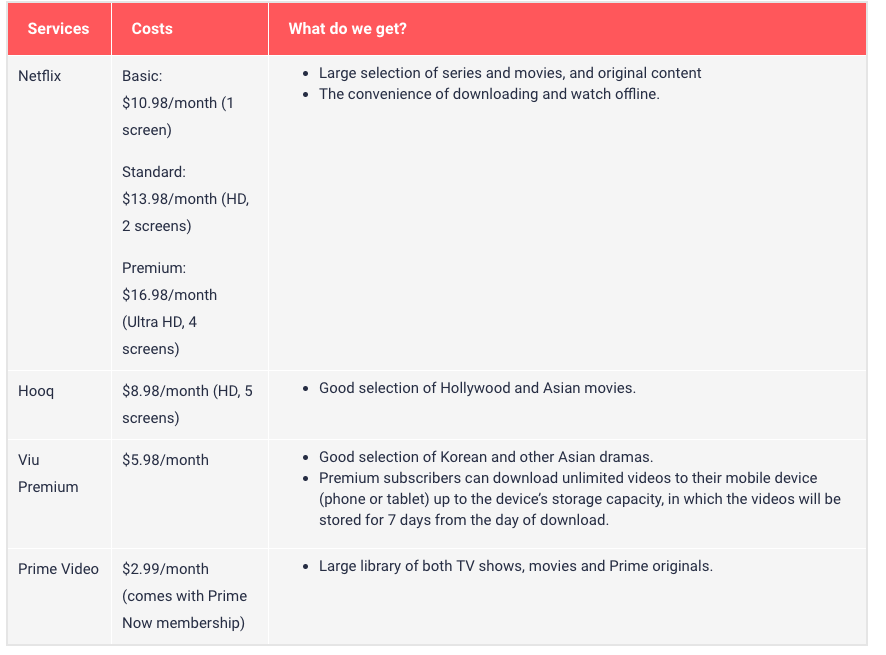

TV/MOVIE

How can I save?

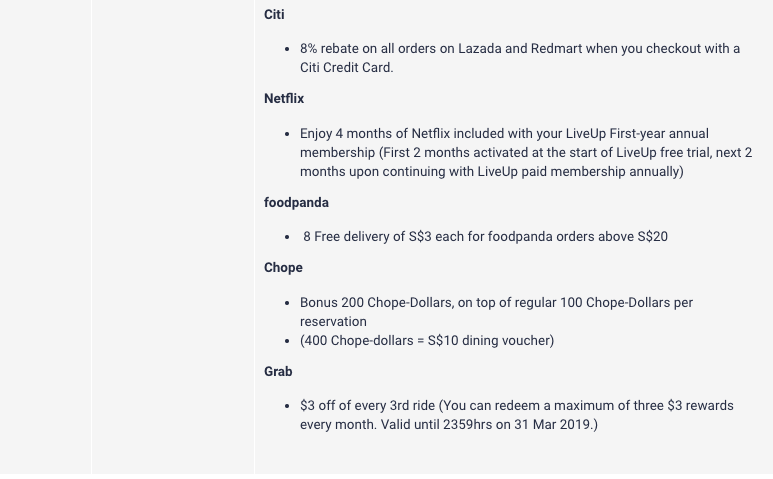

If you buy a LiveUp membership programme, you get Netflix for free for 4 months (The first 2 months activated at the start of LiveUp free trial, next 2 months when you buy LiveUp yearly membership).

If you enjoy Viu or Hooq, Singtel Cast is a good option for you because it offers some discount if you contract for a year. With Cast, you get 2 months free of Viu or Hooq and the subsequent monthly payments cost $4.90/month with a 12-month contract. Note: This is an offer for Singtel Postpaid Mobile, Fibre Broadband and Singtel TV customers.

Netflix Premium can cost up to $204/year but is a good choice if you share the cost with 3 other family members. The subscription allows for 4 screens so you can get the fam to pay for their share.

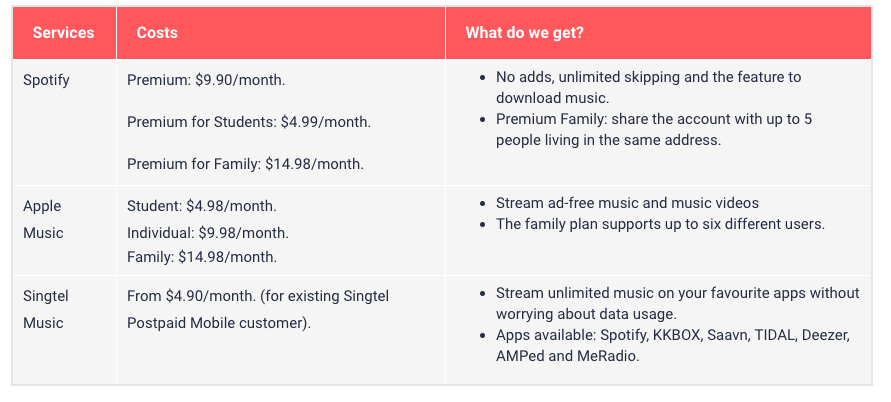

MUSIC

How can I save?

Spotify for Family can be shared with 6 more people under the same address. If you share the yearly cost, it turns out to be only $30 per pax for an entire year of unlimited music and no ads. Also, because it allows you to download music, you don't have to spend your data on it. Just download your fav playlists to take with you, and you're set.

Singtel Music gives you unlimited music on our favourite apps (Spotify, KKBOX, Saavn, TIDAL, Deezer, AMPed and MeRadio) from just $4.90/month ($8.90/month for Spotify) with no local data charges, if you have a contract. And, for Spotify, you get charged only $1/month for the first 2 months. - If you are paying a Spotify Premium by yourself and you are already a Singtel customer than this saves you a couple of bucks per month.

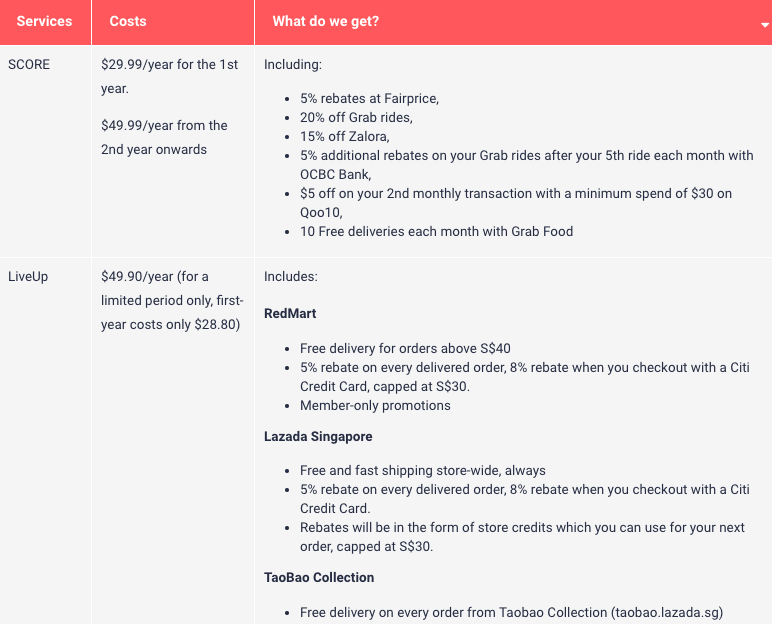

LIFESTYLE/GROCERIES

How can I save?

The choice of membership comes down to an important question: Which of those services do you use the most? Which bank cards do you have?

LiveUp gives you pretty sweet rebates if you have a Citi Card.

Amazon prime is a popular choice among families with babies because they often have discounts for baby products such as diapers that can be delivered in 2-hours time for free.

SCORE sounds like a good deal if you have an OCBC card, frequently take Grab and make regular visits to FairPrice but if you look at the fine print, there are quite a few conditions to redeem the offers.

BOOKS

How can I save?

Why pay for books when you can read for free? Opt for the free version with Overdrive and rent books from our National Library Board. That's all you need.

Amazon offers an exciting "Kindle Unlimited" plan, but unfortunately, it is not yet available in Singapore.

GAMES

How can I save?

The choice for this category will depend on your gaming habits and which console you use. There are plenty of free games out there to keep you entertained. But if you play for a few hours each week and like variety, then the subscriptions above make sense.

OTHERS

How can I save?

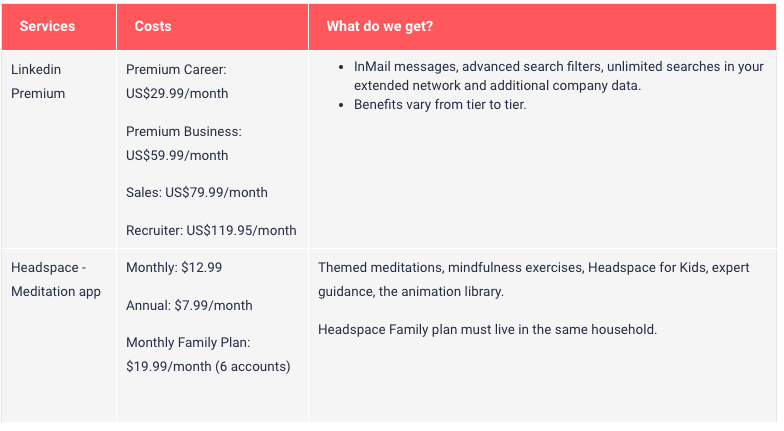

Linkedin is a great social media channel for professionals. If you use it for your job (HR or Sales), then you can get your company to reimburse you for that expense. Otherwise, you can get most of the benefits of it with the free version.

Wellness apps are becoming increasingly popular, with Headspace being one of the top ones for meditation. If you are into it but don't necessarily want to pay a monthly fee, look for free options. There are plenty of other apps and even Youtube videos that fulfil the same purpose.

Subscriptions: do they make our lives easier?

Paying a subscription for services that we love and use often does make life more comfortable (and in some cases, it is cheaper) but it comes with a caveat. Because the payments are automated, it gets easier to forget that we are paying for it. We may end up subscribing to things that we otherwise would not buy.

Take my example: I love coffee and eventually subscribed to a weekly gourmet coffee subscription. The coffee was great, but I ended up with more coffee than I could drink. I was spending on something I didn't consume entirely. The subscription seemed like a good deal at first, but it was a waste of money for me. Which made me wonder, how much money was I bleeding on these seemingly cheap and innocent subscriptions?

Subscriptions are great, but they need to be reevaluated often. I took the time to list all the membership fees and subscriptions I had (books, coffee, domains, paid apps, etc.) and realised that I didn't use half of them often enough to make the cost worth it. They were costing me around $50 per month in total. That's $600 per year! I cancelled them.

Take charge of your subscription services

Bottom line:

Evaluate the subscriptions you have periodically.

Keep a list of the services you pay for and keep track of when the payments are due.

Do your math and confirm if you are getting enough value out of them. If not, cancel them.

Subscribe to services with caution. Read the T&Cs and choose the payment method carefully. Paypal payments are usually easier to cancel than credit card payments.

Create calendar reminders of all free trials you subscribe to and cancel the service in time, so you don't incur on unnecessary expenses for a service you don't want to use.

There are many, many more services we could list. Which ones do you use often? Do you know of any way to save even more on these services? Share your tips with us below!

Not fond of food-related subscriptions but still want to save when you eat out? Well, then try ShopBack GO. There aren't subscription fees or any strings-attached, only cashback into your account.

This article was first published in Shopback.