Singapore monetary policy caught between rock and hard place

SINGAPORE - Singapore is caught between a rock and a hard place: easing its exchange rate-based monetary policy would strengthen its export competitiveness after China's devaluation of its yuan but may drive out capital and raise borrowing costs in a slow economy.

Shrinking factory output, an economic contraction and months of falling consumer prices have revived speculation the Monetary Authority of Singapore (MAS) may ease policy at its next review in October. China's currency devaluation to prop up the world's second-largest economy has only added to the expectations. Yet, the MAS said last week its current monetary policy remains appropriate.

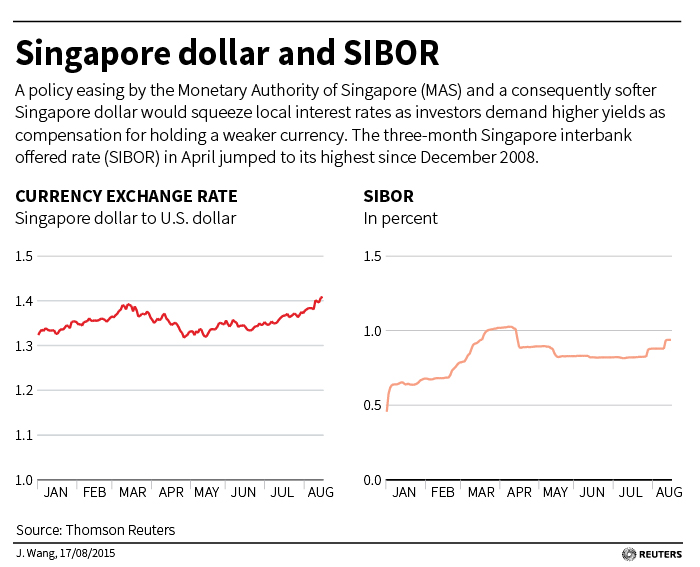

The MAS manages monetary policy by letting the Singapore dollar rise or fall against the currencies of the country's main trading partners within an undisclosed trading band. But an MAS easing and a consequently softer Singapore dollar would squeeze local interest rates as investors demand higher yields as compensation for holding a weaker currency. The Singapore dollar has lost nearly 6 percent against the U.S. dollar this year, after a surprise MAS easing in January. With the currency's weakness, the three-month Singapore interbank offered rate (SIBOR) jumped to 1.02705 percent in April, its highest since December 2008. The three-month SIBOR, used to set interest rates on mortgages, hit a four-month high of 0.93908 percent on Friday.

Higher interest rates, aside from inflicting pain on property owners, also weigh on returns from Singapore real-estate investment trusts (REITs) - the biggest in Asia outside of Japan. OCBC Investment Research said the average borrowing cost of REITs under its coverage rose to 2.9 percent as of the end of March, up 5 basis points (bps) from the preceding three months. It said an increase of 100 bps in borrowing costs could cut average distribution per unit forecast for the fiscal year by 2.1 percent and the next fiscal year by 1.9 percent.

SIBOR will test 1.3 percent this year, and a potential central bank easing may push it to 1.5-2.0 percent, said Commonwealth Bank of Australia's Asian currency analyst Andy Ji."Any easing will instil further depreciation expectation which leads to capital outflows and oblige the central bank to intervene. Both lift domestic interest rates," said Ji, adding he expected the central bank to stay put in October. "I don't think the MAS has the appetite to lift rates higher by either further easing or even suggesting it may ease. Managing exchange rate is about managing expectation of resultant capital flows."