Travelling in Europe? Don't forget to claim the VAT

A trip to Europe generally involves some sort of shopping: from souvenirs for friends and family back home to the branded bag you always dreamt of having, you will want to bring something with you.

In Europe, goods and services are subjected to VAT but this is a tax that applies to residents. If you pay this tax when you are shopping abroad, you can seek a refund for this tax expense.

As a traveller, here is how you can claim and get your tax refund on your Europe shopping.

TL;DR - WHY IS VAT REFUND IMPORTANT?

Asian travellers are known to purchase luxury goods when travelling to Europe. The refund amount for these high ticket items is quite substantial. You would be losing money if you don't ask for a refund.

Take this example:

A Balenciaga bag bought in Paris can cost you around S$2700. The VAT rate in France is 20 per cent so you can get a refund of S$540.

WHAT IS VAT?

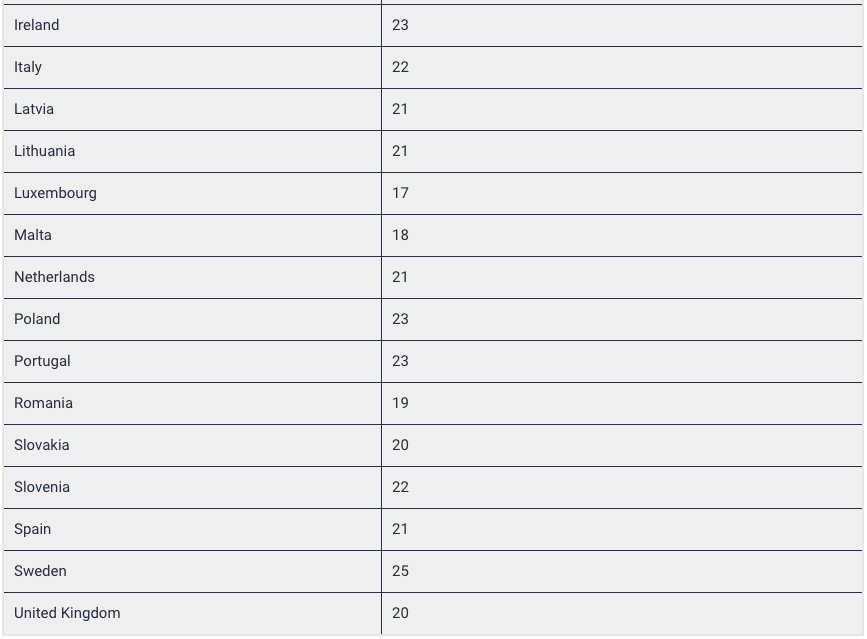

Value-Added Tax is applied to most all good and services within the European Union. It varies from country to country but the average rate is around 21 per cent.

List of the VAT Rates Applicable on European Union Member Countries (updated for 2019)

ARE YOU ELIGIBLE TO CLAIM VAT IN EUROPE?

Visitors - For EU countries, only people who reside outside of the European Union are eligible for a VAT refund. In most of the countries, you must leave the country within three months of purchase in order to receive a refund.

Tax-free shopping - While shopping in some outlets you might notice "Tax-Free" signage. This doesn't mean that the items are already exempted from taxes, it simply means that VAT refunds are applicable for the items sold in the store.

THE SIMPLE WAY TO GET A VAT REFUND

First, you must know that VAT refunds are only possible for goods purchased, not services. Also, some countries imposed a minimum purchase amount on your receipts. In France, for example, you need to spend a minimum of EUR175 on every single receipt to qualify for a refund.

HOW TO GO ABOUT ASKING FOR A REFUND?

1. At the shop, present your passport before making the payment.

2. You will be given a tax-free form to complete. In some cases, the refund is immediate.

3. Keep the form and the receipts with your purchased items. You'll need them at the airport. (Note: Keep your items unused.)

4. The last step is obtaining customs stamp at the airport. Here is what you'll need to do:

Before departure, get early to the airport to go to the customs to get the stamp. Allocate enough time for this as it is a process that usually takes time and might there be a queue at busier airports.

The customs officer will inspect your purchased items and compare them with the receipts to confirm if they match. That is why it is important to keep the products you bought wrapped and unused.

After getting the stamp, head to the tax refund office to claim your refund right away or mail that paperwork later. Check the terms and conditions for both of these situations.

You'll only need to head to the tax refund office only if the shops where you bought your products from work with a third-party company for the refund service. You will find this by checking the logo on the tax-free forms provided. If unsure, just ask at the shop at the moment of purchase.

USING A REFUND COMPANY

Europe has 2 big tax refund organisations, Global Blue and Planet- and they work with different retailers. If the shops were you bought your items from work one of these refund services, you will find their offices inside the airport. (Global Blue is available in the following countries.)

Pros and Cons: This is a convenient way of processing a VAT refund because you get it in cash immediately but these companies usually charge you an admin fee of 4 per cent for the service.

The refund will be in the currency of the country from which you depart. You can ask to be reimbursed in a different currency but the exchange rates used for this aren't the most favourable. There is also an option to credit the refund to your credit card.

MAILING YOUR FORM TO GET A REFUND

If you wish to avoid the admin fee, you can also process the refund over mail. This will take a longer time to be processed so be prepared to wait a few months. All you need to do is to drop all the forms and receipts (and a pre-addressed envelope you can request at the retail shops) at a mailbox usually located in the customs office at the airport.

There are 2 ways you can receive our refund via this method: either via a credit card refund or via check in the mail. Remember that the check might come in a foreign currency and you might incur in extra fees to cash it.

FREQUENTLY ASKED QUESTIONS

CAN'T I JUST PAY MY GOODS WITHOUT THE VAT AT THE SHOP?

The law is the law. You must pay the full amount of the goods and ask for a refund later by complying with the process described above.

WHAT IF I'M LEAVING THE COUNTRY BY BUS OR TRAIN?

It will be possible to get your customs stamps at the major train stations but it is advisable to do some research before departure to make sure you get the stamp in time.

I'M TRAVELLING TO THE UK. HOW WILL BREXIT AFFECT THE VAT REFUND PROCEDURE?

While we are still uncertain of the details of Brexit, if the UK leaves the European Union without a deal, the VAT refund both to and from the UK will no longer be possible to process electronically. According to recent information published by the French tax office, the present claims should be submitted as soon as possible to avoid the scenario described above.

This article was first published in Shopback.