The UOB One Card comes with 15% cashback, but do you know how it works?

Other credit cards have come, gone or been rebranded, but the UOB One Card is still going strong. This entry level credit card has a reputation for being one of the best cashback cards in town, with an impressive maximum cashback rate of 15 per cent.

The catch? The card is also notorious for its devilishly complicated mechanism and onerous minimum spending requirements.

Let’s see what the UOB One Card looks like in 2023 and if it’s still worth the effort.

| UOB One Card Review—Is it MoneySmart? | ||

| Overall: ★★★★☆Best for: Folks who spend more at merchants like McDonald’s, Shopee, Giant, and SimplyGo. Also, you need to consistently spend $500, $1,000 or $2,000 a month for the entire quarter in order to hit the minimum spends to receive the cashback. | ||

| Category | Our rating | The deets |

| Earn rates: Cashback | – Up to 15per cent cashback at selected merchants for new-to-UOB cardmembers: McDonald’s, Grab, Shopee, SimplyGo, 7-Eleven, Guardian, UOB Travel, and more. – View how the additional and enhanced cashback mechanisms work. It’s kinda tricky. – Up to 3.33 per cent quarterly (base) cashback on other retail spend – Up to 4.33 per cent cashback on Singapore Power utilities bill – Cashback is given on a quarterly basis, i.e. you need to hit the minimum spends for 3 consecutive months in the same quarter to qualify for a certain cashback tier. | |

| Earn categories | ||

| Annual fees and charges | ★★★★☆ | S$194.40 annual fee (first year waived)First Supplementary Card free, $97.20 for subsequent Supplementary Cards. |

| Accessibility | ★★★★☆ | Minimum income requirement: $30,000 (Singaporeans and PRs, salaried workers) / $40,000 (Singaporeans and PRs who are self-employed or commission-based; non-Singaporeans) |

| Extras/periphery rewards | ★★☆☆☆ | – At SPC Stations, up to 22.66per cent savings on fuel purchases – At Shell Stations, up to 21.15per cent savings on fuel purchases – Enjoy up to 50per cent off with UOB dining privileges (e.g. 1-for-1 buffet at Marriott Café Buffet, Orchard Café and Café Mosaic) – Complimentary travel insurance coverage: Public Conveyance Personal Accident coverage of S$500,000; Emergency Medical Assistance, Evacuation & Repatriation coverage of up to S$50,000 due to an accident or illness (including due to Covid-19) |

| Sign-up bonus | ★★☆☆☆ | Get S$350 Grab Vouchers when you successfully apply for an eligible UOB Credit Card and spend a min. of S$1,000 for 2 consecutive months from card approval date. Valid till 31 Oct 2023. |

The UOB One Credit Card is a cashback credit card that offers cashback on almost all types of daily spending.

In theory, this sounds great. No need to worry about spending categories because the card just gives you cashback on pretty much anything you buy. Right? Well, not exactly.

To qualify for the cashback, you need to watch out for the minimum spending requirements. You’ve gotta meet certain requirements for all three months in a quarter in order to snag that sweet, sweet cashback.

One other thing: The UOB One Card is not to be confused with the UOB One Account (a savings account) and the UOB One Debit Card (which offers less generous cashback). You don’t need to have either of those to use the UOB One Credit Card.

UOB One is an entry level credit card, so you can sign up for it with a salary of $30,000 per year. Here are the card’s main terms and conditions.

| UOB One Credit Card | |

| Annual Fee | $194.40 |

| Annual Fee Waiver | First year |

| Supplementary Card Annual Fee | Free for first card, $97.20 for additional cards |

| Interest Free Period | 21 days |

| Annual Interest Rate | 26.9per cent |

| Late Payment Fee | $100 |

| Minimum Monthly Repayment | 3per cent or $50, whichever is higher |

| Foreign Currency Transaction Fee | 3.25per cent |

| Cash Advance Transaction Fee | 8per cent with minimum fee of $15 |

| Overlimit Fee | $40 |

| Minimum income | $30,000 |

| Card Association | Visa |

| Contactless Payment | Visa Contactless, Apple Pay, Samsung Pay |

Before we get into the juicy 15 per cent cashback that everyone has their eyes on, let’s talk about the UOB One Card’s base/quarterly cashback rate. The card used to offer up to five per cent cashback on all spending, but its glory days are over. These days, the maximum cashback rate you can earn on uncategorised spending is 3.33 per cent.

Here’s how it works. In order to qualify for cashback, you need to meet a minimum spending requirement every month in a quarter. The first quarter of the year runs from January to March. So, you would need to meet the minimum spending requirement in January, February and March to qualify in that quarter.

If you manage to do that, you will get a lump sum of cashback for that entire quarter.

There are 3 tiers of cashback, depending on how much you spend, as follows:

| Tier | Minimum spend for the quarter | Minimum card transactions for the quarter | Cashback for the quarter | Maximum cashback per cent |

| 1 | $500 | 5 | $50 | 3.33per cent |

| 2 | $1,000 | 5 | $100 | 3.33per cent |

| 3 | $2,000 | 5 | $200 | 3.33per cent |

Let’s say you spend exactly $2,000 in January, February and March. You will receive $200 cashback for that quarter, which translates to a cashback rate of 3.33 per cent.

If you meet the minimum spending requirement of $2,000 only in January and February and then spend only $500 in March, your cashback for that quarter will fall to $50.

The only exception is the very first quarter you have your UOB One Card. According to their UOB One Card cashback T&Cs, clause 4.2, UOB will pro-rate your cashback only for this first quarter. For example, if you hit the minimum spend for the first two months but not the third month, UOB will be nice and give you two-thirds of the quarterly cashback. After the first quarter, no such niceties.

The UOB One Card is probably feeling a bit self-conscious about the fact that its quarterly cashback has fallen from five per cent to 3.33 per cent. To continue making itself look attractive, it now offers additional cashback in several categories.

Basically, when you spend in one of these categories, your cashback gets bumped up. The actual amount of additional cashback depends on the spending tier you hit that quarter.

You’ve probably heard about the UOB One Card giving cardholders a fat 15 per cent cashback rate. It’s true — but how you get there is pretty complicated. Stay with us now, we’ll take you through it.

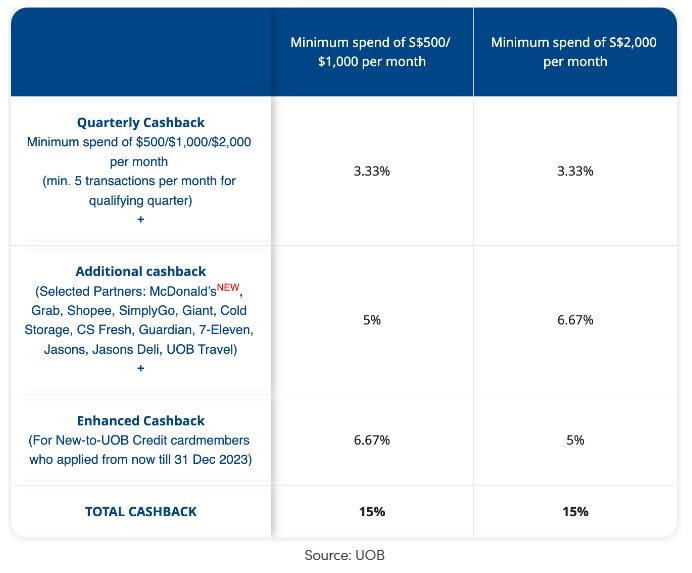

This is a table from UOB summarising how the UOB One Card’s cashback works:

Let’s take you through it.

What the Enhanced Cashback does is even out the overall cashback you earn with the UOB Card for all spend tiers — only from now till the end of the promotion period though. From now till Dec 31, you can get up to 15 per cent cashback whether you spend $500, $1,000, or $2,000 a month.

You can earn UOB One cashback on almost all spending, but there are a few exceptions. Here’s a selection of what you cannot earn cashback on:

These exclusions are pretty typical of credit card cashback programmes. Basically, don’t expect to earn cashback when you pay hospital bills, insurance bills, your kids’ school fees, NETS transactions, fines or your latest Singapore Pools bets.

According to the UOB One Card cashback T&Cs, clauses 4.7 and 5.4, the cashback you earn can’t be redeemed for rewards or withdrawn as cash. Instead, it’ll be used to offset your UOB One Card credit card bill for the next month, after a qualifying quarter. This applies to the quarterly, additional, and enhanced cashback.

Also note that the cashback also only offset the principal cardmember’s transactions, and not any of the supplementary cardmembers’ bills, if any.

The UOB One’s mechanism is different from that of most cashback cards which just give you back a percentage of your spending in cashback.

Instead, you get your cashback in a lump sum. Once you’ve hit the minimum spending requirement in your desired tier, you don’t get any extra cashback by spending more that much — doing so will just lower your cashback percentage.

So, if you’re aiming to spend $2,000 every month in the quarter to qualify for Tier 3 cashback, don’t go overboard and charge a $30,000 Rolex watch to your card.

You should also take pains to track your spending and be aware of how much you’ve spent in the quarter. Be careful when it comes to spending that takes place close to the end of the month, as it might be carried over to the next month. When in doubt, call the bank to enquire about your recorded spending for the present or past month.

Also, don’t forget that you need to make at least five transactions on the card each month in a quarter in order to qualify for the cashback!

The UOB One Card gives cashback, so apparently wanting to earn rewards points as well is too much to ask — your spending on the UOB One Card will not contribute to your store of UNI$.

If you want to earn UNI$, you can turn to these UOB rewards cards instead:

The UOB One Card’s biggest drawback is its mechanism. Having to hit the minimum spending requirement for three months in a quarter is quite a burden, and in order to maximise your card you need to monitor your spending to ensure you don’t exceed the minimum spending requirement in your tier by too much.

If you’re the meticulous type and don’t cringe at the thought of having to monitor how much you’ve spent on the card each month, the maximum cashback rate of 3.33 per cent is actually decent considering it’s doled out regardless of spending category. The first tier only requires you to spend $500 per month (every month in a quarter) and still entitles you to up to 3.33 per cent base cashback.

The card is probably still the most generous cashback card for miscellaneous spending, and the bonus interest on things like Grab rides and our McDonald’s meals makes it even more attractive.

However, if you find that you tend to spend overwhelmingly on just a few types of things like dining or petrol, you might be better off with a card that gives you a higher cashback rate in these spending categories.

If you’re thinking of signing up for the UOB One Card and happen to be one of the first 100 customers to sign-up in October 2023, you can get S$350 Grab Vouchers. To qualify, you’ll have to spend $1,000 for 2 consecutive months from your card approval date. Promotion valid till Oct 31, 2023.

Check the UOB One Card page for the latest promotions!

If the UOB One’s cashback mechanism makes your head spin, we don’t blame you. Check out these cards instead:

Citi Cashback+ Mastercard: Get six per cent cashback on dining worldwide, eight per cent at supermarkets and grocery stores worldwide and up to 20.88 per cent fuel savings at Esso and Shell. Minimum spending requirement is $800 per month.

Standard Chartered Simply Cash Credit Card: 1.5 per cent cashback on all spending with no minimum spending and no cashback cap.

American Express True Cashback Card: 1.5 per cent on all spending with no minimum spending and no cashback cap.

In case you’re wondering, here’s how we decide on our credit card rankings.

| Is that credit card MoneySmart? Our MoneySmart credit card ranking rubric | |

| Category | Our rating |

| Overall | The average rating for the credit card on the whole, calculated from the ratings for the individual categories below. Plus, we’ll give you a one-liner on who we think the credit card is best suited for. |

| Earn rates: Air miles / Cashback / Rewards points | Air miles ✈️✈️✈️✈️✈️ / Cashback / Rewards points . This category looks at the depth rather than breadth of earn rates.

|

| Earn categories | This category looks at the breadth rather than depth of your earnings.

|

| Annual fees and charges |

|

| Accessibility | Minimum income requirements:

Exclusivity: We dock 1-2 stars if there is/are another category/categories that make the card exclusive and very specific to a certain clientele. |

| Extras/periphery rewards | These include:

We count the number of benefits and award between 0.5 to 2 stars for each, depending on how good the perk is. |

| Sign-up bonus |

|

ALSO READ: UOB Lady's Card: New design and rewards earn rates sweeten the deal for this revamped card

This article was first published in MoneySmart.