5 best travel insurance plans in Singapore with Covid-19 coverage (2022)

As travel becomes possible again (woohoo!), travel insurance is now once again something that is relevant in our lives.

Remember the good old days when lost luggage was your biggest worry? These days, the most likely mishaps to happen are related to Covid-19, whether they be an infection or a trip cancellation.

Not all insurers cover Covid-19, but a handful do - to varying extents. Here's a comparison of the five best plans in Singapore.

When the Covid-19 pandemic started, most insurers did not extend their coverage to Covid-19-related mishaps.

The pandemic was quickly considered a "known event", which insurers usually do not offer compensation for. So, if your flight got cancelled because of Covid-19, you'd be out of luck.

Now. as travel restrictions get lifted, insurance companies are rushing for a slice of the pie. Since the virus looks like it's here to stay, insurers are starting to offer coverage specifically for Covid-19.

But Covid-19 coverage is such a new thing that it can vary quite a bit from insurer to insurer. Given a bit of time, insurers will start to understand what their competitors are offering and coverage across the board is likely to become more similar.

Do note that the plans still exclude travelling against a travel advisory put in place by the Singapore government or by the local authority at your trip destination. So be sure to check announcements on both ends before you depart.

Another common exclusion is failing to take precautions against Covid-19. This is broadly worded in the insurance policy but could include not following any Covid-19 regulations at your destination or on the plane. So make sure you wear your mask whenever it's required and don't go attending any illegal raves.

|

Travel insurance provider |

Premium* |

Key features |

|

FWD |

$28.70 |

|

|

AIG |

$72 |

|

|

AXA |

$79 |

|

|

Sompo |

$103 |

|

|

NTUC Income |

$95 |

|

* For a one-week trip to Germany

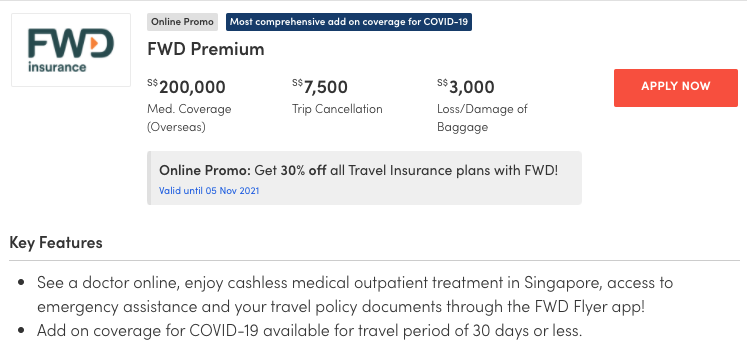

FWD offers some of the cheapest travel insurance plans in Singapore, so this is a budget-friendly option if you're already baulking at the cost of all the antigen tests you'll have to take before and after your trip.

Here's a quick run-through of the Covid-19 coverage offered by this plan:

The plan reimburses some of your travel-related expenses if you are diagnosed with Covid-19 no more than 30 days before your scheduled departure date, or if you have to change your itinerary because of a Covid-19 diagnosis while overseas.

You also get to claim medical expenses and a hospital cash benefit if you get hospitalised overseas or for up to 14 days in Singapore upon your return.

The coverage is very bare bones but the plan is frickin cheap. Get this if you can't afford anything else.

Here's a quick run-down of the plan's main offerings:

This plan offers compensation if you catch Covid-19 in Singapore and have to postpone your trip, or if you or a family member catch the virus before your departure date and you have to cancel your trip because of that. You also get medical coverage and a quarantine allowance.

This is quite a decent list of benefits compared to what the other plans are offering, but there are a few perks missing from the list, including a daily hospital cash benefit, early return home and trip interruption due to quarantine or other government advisories.

Overall, the plan is on the cheap side but honestly quite bare bones. If you can afford this plan, you could also just spend a few more bucks to get a better one.

READ ALSO: Travel insurance claims guide - what to do, what receipts to keep and more

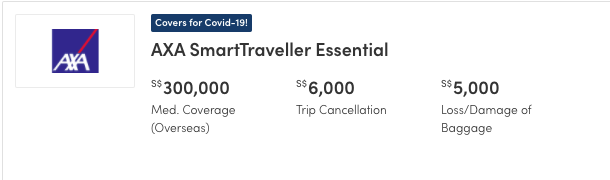

Here's what this plan gets you:

The medical expenses category is quite generous here. You can claim for costs incurred within 90 days of your trip.

One perk that not all insurers offer is overseas quarantine allowance if you're forced to hole up in a hotel or quarantine centre overseas due to a Covid-19 infection.

You can't claim for this if you're already claiming for hospitalisation, though you'd have to be really unlucky to get both quarantined AND hospitalised in one trip.

AXA also tends to be quite flexible when it comes to trip curtailment or rearrangement.

You can claim under this section not only if you yourself catch Covid-19 but if there is a death in your family due to Covid-19, public transport gets cancelled due to Covid-19 or there is a Covid-19 outbreak at your destination which prevents you from continuing on your trip.

In short, this plan has one of the most comprehensive benefits lists available, and it isn't even that expensive. This one gets a thumbs-up.

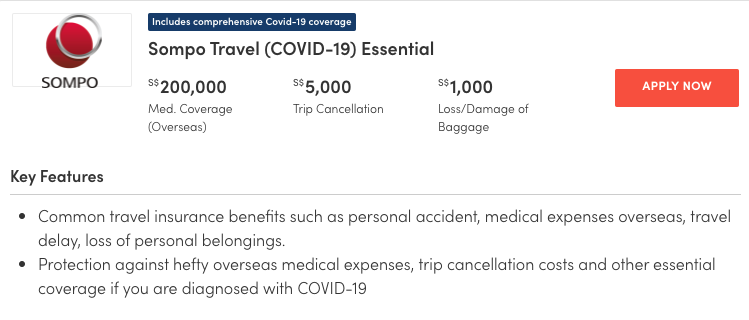

The key benefits are as follows:

Compensation for trip cancellation or postponement is offered if you, an immediate family member or a travelling companion also insured by Sompo, got diagnosed with Covid-19 not more than 30 days before your departure date.

If your travel partner gets infected you can choose to claim for your travel expenses rather than go alone.

The same goes for trip curtailment while overseas. While on your trip, you can make a claim for having to change your itinerary if your travelling companion or an immediate family member back in Singapore gets diagnosed with Covid-19 and you need to cut short your trip to return to Singapore.

Medical expenses can be claimed for a period of up to 45 days (the first day being the day you first seek treatment while overseas) or when the limit in your benefits table is first reached, whichever happens first.

Note that you might be left high and dry if you are ill for more than 45 days.

Overall, this plan is generous when it comes to changes to your travel plans, but not so much when it comes to medical treatment. It's probably best if you are young, have no existing health issues and have already been vaccinated.

Here's a run-down of the key benefits:

NTUC Income offers up to $150,000 worth of overseas medical expenses and up to $150,000 worth of evacuation or repatriation expenses if you contract Covid-19 overseas. This coverage is valid for the first 90 days of your trip.

They have recently enhanced their Covid-19 cover to allow claims for trip cancellations and postponements due to you (or your travel companion) being diagnosed with Covid-19 or getting issued an isolation order by the government.

Covid-19 vaccine complications are now covered under medical expenses as well. For more details on what is covered, refer to the NTUC Income website and policy conditions.

There are no excluded countries due to Covid-19 except for Afghanistan, Iraq, Liberia, Sudan and Syria, which are normally excluded from the regular travel insurance plan as well.

In addition, NTUC Income has collaborated with Raffles Medical to offer Covid-19 (PCR) swab test at $124.2 along with a series of other types of pre-departure tests.

First of all, when booking your trip, you should retain all receipts, tickets and itineraries in case your trip has to be cancelled or altered.

At the first sign of a Covid-19 infection or related travel disruption, you should call your insurer and ask for guidance. Many insurers maintain a 24-hour hotline for travel claims.

[[nid:549261]]

To make a claim you will usually have to submit your insurer's form with supporting documents within the deadline mentioned in your contract (usually 30 days). Don't wait until you're back in Singapore to check which documents you need.

If you catch Covid-19 while you're in Singapore, you will likely have to submit the results of a PCR Swab Test or Antigen Rapid Test conducted at a clinic or hospital.

It gets a bit more complicated if you're overseas. The insurer will likely require documentation from the hospital as well as a doctor's letter stating that you are unfit to travel and/or recommending treatment.

If you need to be quarantined overseas, you should make sure you have a quarantine order from the government, otherwise you may not be able to claim for quarantine allowance. Remember to ask for this as not all countries automatically issue such documentation.

This article was first published in MoneySmart.