COE analysis December 2022 first round: Christmas dip

PUBLISHED ONDecember 09, 2022 5:19 AMBYBen Chia

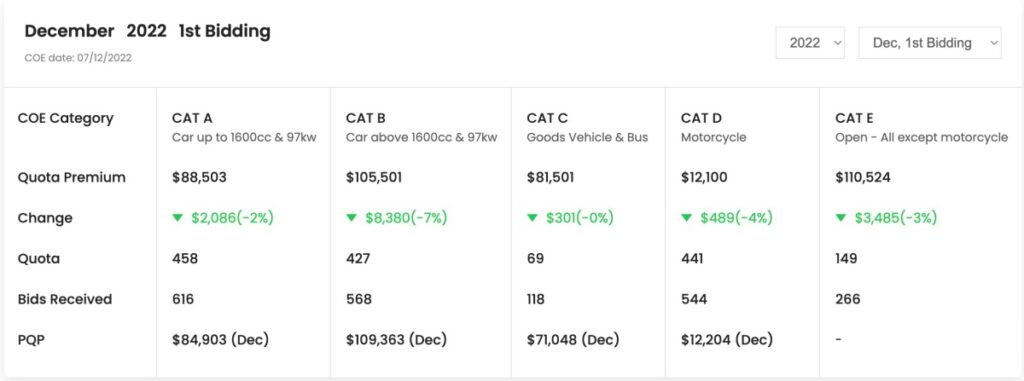

PUBLISHED ONDecember 09, 2022 5:19 AMBYBen ChiaSINGAPORE - The first Certificate of Entitlement (COE) bidding exercise for December 2022 saw premiums drop slightly across the board for all categories, following the record-breaking highs achieved in the preceding months.

In Cat A, which is reserved for cars with internal combustion engine (ICE) that are less than 1.6-litres in capacity and output of less than 130hp, and electric cars with an output of less than 147hp, prices went down by $2,086 to end at $88,503.

Category B, which is for ICE cars with engines that make more than 130hp, or are above 1.6-litres in capacity, and electric cars with outputs of more than 147hp, saw the biggest dip this round, with prices falling by $8,380 to end the bidding at $105,501.

Category E meanwhile, which is open to all vehicles except motorcycles, but usually ends up being used for big cars, saw a drop of $3,485 to end at $110,524, which is an all-time high for COE premiums in the history of the system.

In theory, the end of the year should see a flurry of activity, as brands rush to meet their year end sales targets, and customers look to secure their new rides before the year is out. But this year has been an unusual one, with its endless unpredictability that seems to defy logic.

On paper, everything seems to have panned out as it should. The reduced COE quota means that supply is restricted, and therefore premiums have gone up, as it should in a typical supply-and-demand market system. But yet at the same time, car showrooms have been seeing poor customer traffic for most of the year, and the weak demand should, in theory, have helped balance things out a little.

Instead, what we’ve been seeing is COE prices reaching new record highs, which can be baffling and hard to reconcile with what brands and their salespeople are seeing on the ground. After all, if nobody is buying cars, then where is the demand coming from?

Much has been said about the effect that fleet operators, such as car sharing and private hire rental firms, have made on the COE system this year, and there’s no question that they have been a major disruptive factor in causing what we’re seeing today. But the latest dip in COE prices may suggest that such firms may be slightly easing off on adding to their fleets, for now at least, and we may see a bit of respite from continually-spiralling COE premiums.

Still, those expecting more big drops in premiums shouldn’t hold their breath, as the quota is expected to remain low for the coming year.

More pertinently, January sees the return of the Singapore Motorshow after a two year hiatus, and brands will be going all out to woo customers back again with deals and offers, and we should expect to see a further spike in premiums in the aftermath. In the meantime, the latest dip should probably be seen as more of a temporary blip, rather than a true indicator of what’s coming ahead.