Estate settlement in Singapore for your deceased loved ones: Here's what you need to do after the funeral

While most people will offer their condolences and help for the funeral, the steps to take after a funeral are often undiscussed.

As it can be confusing to deal with the money, property and possessions (their ‘estate’) of the person who passed away without a helping hand, here is a guide to estate settlement.

All assets of monetary value form the estate of the person who passed away. This includes bank accounts, investments, some instances of insurance, safe deposit boxes, physical possessions, properties and vehicles.

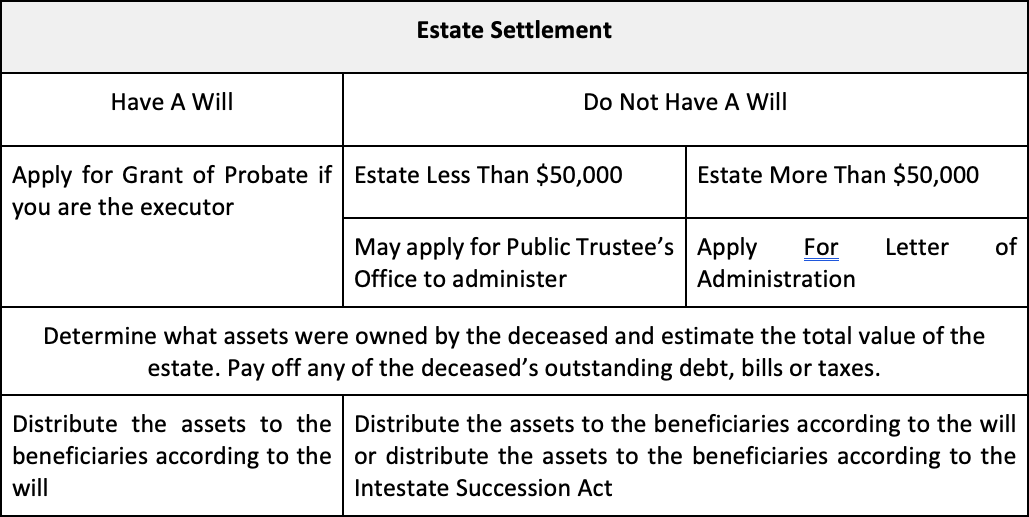

The first step is to check if the person who has passed away has written a will.

If there is a will, the executor will have to apply for a Grant of Probate to distribute the estate in accordance to the will. The executor is someone named in the will, or in an update to the will (a ‘codicil’), as a person who is nominated to distribute the estate.

You can check for a will by:

If there is no will, the estate will be distributed in accordance to the Intestate Succession Act. You will have to apply for a Letter of Administration to administer the estate.

The administrator is someone who is appointed by the court to manage and distribute the estate of a deceased person according to the Intestate Succession Act.

For estates with less than $50,000 value, you may apply for the Public Trustee to administer the estate instead.

The executor or the administrator will then

CPF savings are not part of the estate and are excluded from distribution by a will. CPF savings will be distributed to the nominated beneficiaries if the deceased has made a CPF nomination.

If there is no CPF nomination, the monies will be distributed in accordance with the Intestate Succession Act.

[[nid:492450]]

However, CPF investments (cash and investments held in the CPF Investment Accounts (CPFIS-OA and CPFIS-SA)) are part of the estate and will be distributed in accordance to the will or intestacy law if there is no will.

Insurance policies with irrevocable nominations are also excluded from distribution of an estate and will be distributed directly to the beneficiaries.

Properties with joint tenancy are excluded from the estate and the will but properties with tenancy-in-common are not. The deceased’s share of the tenancy-in-common can be distributed as part of the estate.

For properties with joint tenancy, the ownership will pass on to the surviving joint tenant.

For example, if you and your spouse purchased a HDB as joint tenancy, upon your passing, the HDB will go to your spouse. You cannot leave the HDB to your parents (or anyone) in your will as it does not form part of your estate.

The Intestate Succession Act sets out the distribution of assets when a person passes away without a will. It determines who are the eligible beneficiaries and the proportion of the estate received by each beneficiary.

The Intestate Succession Act does not apply to the estate of any Muslim citizen or permanent resident in Singapore. Instead, Muslim inheritance law will apply for Muslim citizens or permanent residents in Singapore.

Here is the default distribution of estate assets according to Intestate Succession Act.

| Surviving Beneficiaries | Distribution |

| Only spouse. No children, no parents |

100 per cent to spouse. |

| Only parents. No spouse, no children |

100 per cent to parents, to be shared equally. |

| Spouse and children. | – 50 per cent share to surviving spouse. – 50 per cent share to be shared equally among children and, where they have already died, their children. – Parents are not entitled to anything. |

| Only children. No spouse. |

– 100 per cent to children, to be split equally amongst them. If any of the children is deceased, their children can claim the share accordingly. – Parents are not entitled to anything. |

| Spouse and parents. | – 50 per cent to spouse. – 50 per cent to parents, to be shared equally. |

| Only sibling(s). No spouse, no children/descendants, no parents. |

100 per cent to be shared equally among siblings and, where they have already died, their children. |

| Only grandparents. No spouse, no children/descendants, no parents, no siblings and their children. |

100 per cent to surviving grandparents, to be shared equally. |

| Uncles and Aunts No spouse, no children/descendants, no parents, no siblings and their children, no grandparents. |

100 per cent to uncles and aunts, to be shared equally. |

| If all above scenarios do not apply | Government is entitled to the estate. |

* Intestate law only recognises legitimate or legally adopted children and the descendants of these children. Illegitimate children and transferred children are not entitled under intestate law.

The Public Trustee under the Public Trustee’s Office under the Ministry of Law can only administer estates that are not more than $50,000 value and under specific conditions.

The Public Trust cannot act on your behalf, if:

This means that there are some common scenarios in which you cannot rely on the Public Trustee to administer the estate. For example:

As you go through the process of estate settlement, you will need to have on hand documents to verify your identity, the deceased’s identity, the beneficiaries’ identity and to prove the relationships.

Do keep originals and certified true copies of the follow documents:

It is good practice to make multiple certified true copies as you may need to file them with various agencies or organisations.

If you are the executor of a will, you will need to apply for the Grant of Probate to the Family Courts, if the deceased’s estate is valued at $5,000,000 and below or to the Family Division of the High Court, if the total value of the deceased’s estate exceeds $5,000,000.

It is advisable to engage a lawyer to help you with the application as there are many documents required to be filed and submitted to the court.

However, if you wish to apply for a Grant of Probate on your own, you can refer to the Probate and Administration Toolkit on the Family Justice Courts website.

The three main stages in the application for Grant of Probate are:

You can apply to be an administrator if you are an immediate family member of the deceased.

According to the Intestate Succession Act, the following people are entitled to apply for the Letters of Administration, in order of priority:

Based on the order of priority, if the children of the deceased wish to be administrator(s), the deceased’s surviving spouse should renounce their right to apply for Letters of Administration.

The court will grant the Letters of Administration to the applicant which the court assesses to be the best person to manage the deceased’s estate. There can be a maximum of four administrators for the same estate.

The process is similar to that for Grant of Probate. You can refer to the Probate and Administration Toolkit if you wish to do it yourself.

Typically, the lawyer fees for a simple Grant of Probate range from $1,000 to $1,500 and the fees for Letter of Administration may be slightly more higher by an additional $100 to $200.

The fees increase with the complexities of the case and if there is contention.

The fees for administration by the Public Trustee are tiered, to a maximum of $1,522.50 for an estate of $50,000.

Aside from the probate process or the estate administration, there are also less obvious tasks that you will need to do after the passing of a loved one.

This would include stopping or transferring auto bill payments (such as mobile and utilities), GIRO deductions, subscriptions, closing their online accounts (such as emails, cloud storage and social media).

You will also need to deal with their physical possessions and perhaps the pets.

The entire process can be draining and long-drawn so take the necessary time to grieve before tackling these tasks and engage the help of other loved ones or friends to support you in the process.

Sample checklist for estate settlement:

This article was first published in Dollars and Sense.