HDB maisonette guide: 5 things to consider before buying executive maisonettes

Growing up as a regular Housing and Development Board (HDB) flat dwelling kid in Singapore, I was always found it fun to visit my friends at their houses to chill.

As I was living in Tampines at that time, I had a few friends who were living in HDB executive maisonettes.

Young impressionable me was blown away by the fact that there were HDB flats that had two stories and lots of living space.

And I think lots of people share my view considering how desirable executive maisonettes (EMs) in Singapore are.

If you are looking to buy an HDB executive maisonette flat, here are five things you need to consider before buying!

Before we begin, here’s some background to HDB EMs.

For the initiated, the word Maisonette is derived from the French ‘maisonnette’, meaning ‘little house.’

But compared to regular HDB flats, HDB Maisonettes are anything but little as they are actually HDB flats with two distinct floors.

There are three types of maisonettes: five -room Maisonettes, Executive Maisonettes and Penthouse Maisonettes.

Like the name suggests, penthouse maisonettes are built on the highest level of HDB flats.

The first floor is usually designated for common areas like the living room, dining room, and kitchen while the second floor houses the bedrooms and bathrooms.

These flats are quite popular in Singapore due to the following reasons I have identified:

As such, we have seen EMs being sold for prices of up to $1 million .

| HDB Town | Latest Transaction Price | Floor Area (Square Feet) | Flat Age (Years) | Number of Maisonettes |

|---|---|---|---|---|

| Central | ||||

| Bishan | $530,000 - $1,138,000 | 1,539 - 2,142 | 29 - 35 | 59 |

| Toa Payoh | $535,000 - $970,000 | 1,550 - 1,787 | 32 - 37 | 27 |

| North | ||||

| Sembawang | $605,000 | 1,518 | 23 | 1 |

| Woodlands | $470,000 - $670,000 | 1,518 - 1,668 | 25 - 33 | 44 |

| Yishun | $505,000 - $683,500 | 1,561 - 1,572 | 33 - 35 | 40 |

| North-East | ||||

| Ang Mo Kio | $750,000 and $845,000 | 1,572 and 1,593 | 25 | 2 |

| Hougang | $495,000 - $1,000,000 | 1,432 - 1,938 | 24 - 38 | 77 |

| Sengkang | $565,000 - $718,000 | 1,528 - 1,550 | 22 | 4 |

| Serangoon | $625,000 - $960,000 | 1,539 - 1,647 | 24 - 37 | 27 |

| East | ||||

| Bedok | $425,000 - $890,000 | 1,475 - 1625 | 32 - 37 | 25 |

| Geylang | $630,000 - $960,000 | 1,496 - 1,636 | 34 - 38 | 18 |

| Kallang/Whampoa | $700,000 - $910,000 | 1,475 - 1,615 | 34 - 38 | 7 |

| Pasir Ris | $427,000 - $840,000 | 1,561 - 2,034 | 25 - 33 | 53 |

| Tampines | $505,000 - $820,000 | 1,561 - 1,658 | 24 - 37 | 64 |

| West | ||||

| Bukit Batok | $518,000 - $890,000 | 1,507 - 1,690 | 24-37 | 35 |

| Bukit Merah | $816,000 - $880,000 | 1,496 | 37 | 2 |

| Bukit Panjang | $499,000 - $818,000 | 1,528 - 1,668 | 22 - 34 | 33 |

| Bukit Timah | $920,000 - $990,000 | 1,561 - 1,615 | 32 - 33 | 7 |

| Choa Chu Kang | $480,000 - $900,000 | 1,539 - 2,314 | 23 - 32 | 37 |

| Clementi | $760,000 - $890,000 | 1,528 - 1,690 | 36 - 37 | 10 |

| Jurong East | $538.000 - $868,000 | 1,528 - 1,711 | 23 - 37 | 18 |

| Jurong West | $470,000 - $700,000 | 1,528 - 1,711 sq. | 24 - 37 | 39 |

| Queenstown | $890,000 - $958,000 | 1,572 - 2,067 | 26 - 28 | 4 |

Speaking of price, EMs are not cheap considering that you are buying older HDB flats that are anywhere from 22 – 38 old.

An EM in a mature estate like Bishan will cost you anywhere from $530,000 – $1,138,000 !

Even in a non-mature estate like Jurong West, an EM will cost $470,000 – $700,000.

But if you are looking for a house that is bigger than 1,500 square feet (~139 square metres), your options are limited to executive flats.

| DB Flat Types | Two-room flexi | Three-room | Four-room | Five-room | 3Gen | Executive flat |

|---|---|---|---|---|---|---|

| Rough floor area (square feet) | 387 & 484 | 647 to 700 | 969 | 1,184 | 1,238 | 1,400 |

| Total no. of bedrooms | One | Two | Three | Three | Four | Three |

| Total no. of bathrooms | One | Two | Two | Two | Three | Two |

But, EMs have the benefit of having two levels which gives a bit of the ‘landed experience’ at HDB prices.

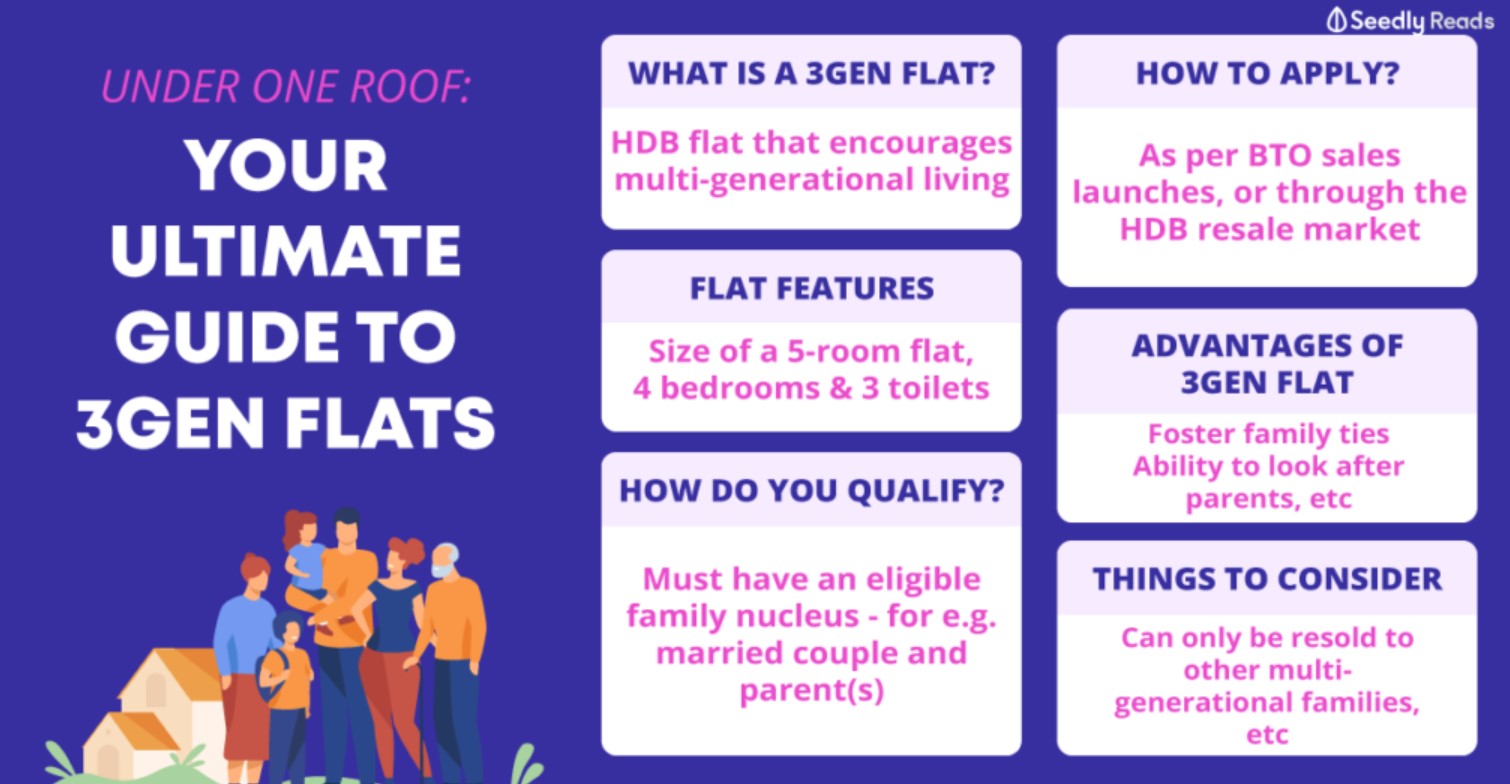

The next best options are 3Gen HDB flats that top out at about 1,238 square feet. Not to mention the many requirements for you to buy one.

But if space is your priority, EMs provide quite good value for money.

To illustrate this, let’s compare private non-landed homes in the Rest of Central Region (RCR) and an EM in Bishan which is part of the RCR.

The median price for non-landed homes in the RCR in the fourth quarter of 2020 stands at $1,704 per square foot.

Comparatively, a quick check on PropertyGuru revealed that an EM in Bishan costs anywhere from $526 – $731 per square foot.

Even the most expensive EM listing in Bishan costs about $1.18 million for a 1,614 square foot flat which is not cheap but more affordable in comparison.

Whereas a non-landed private home in Bishan of the same size would cost about $2.75 million!

Despite EMs providing more value per square foot, you need to really consider if you need the extra space.

With a house that big, you will need to spend more time, energy and money to maintain it.

If you think that doing housework in your current four-room HDB flat is hard, think of the amount of housework you have to do for a bigger EM with a staircase.

Sure you can hire a house cleaning service:

But, that is an added expense that you have to consider.

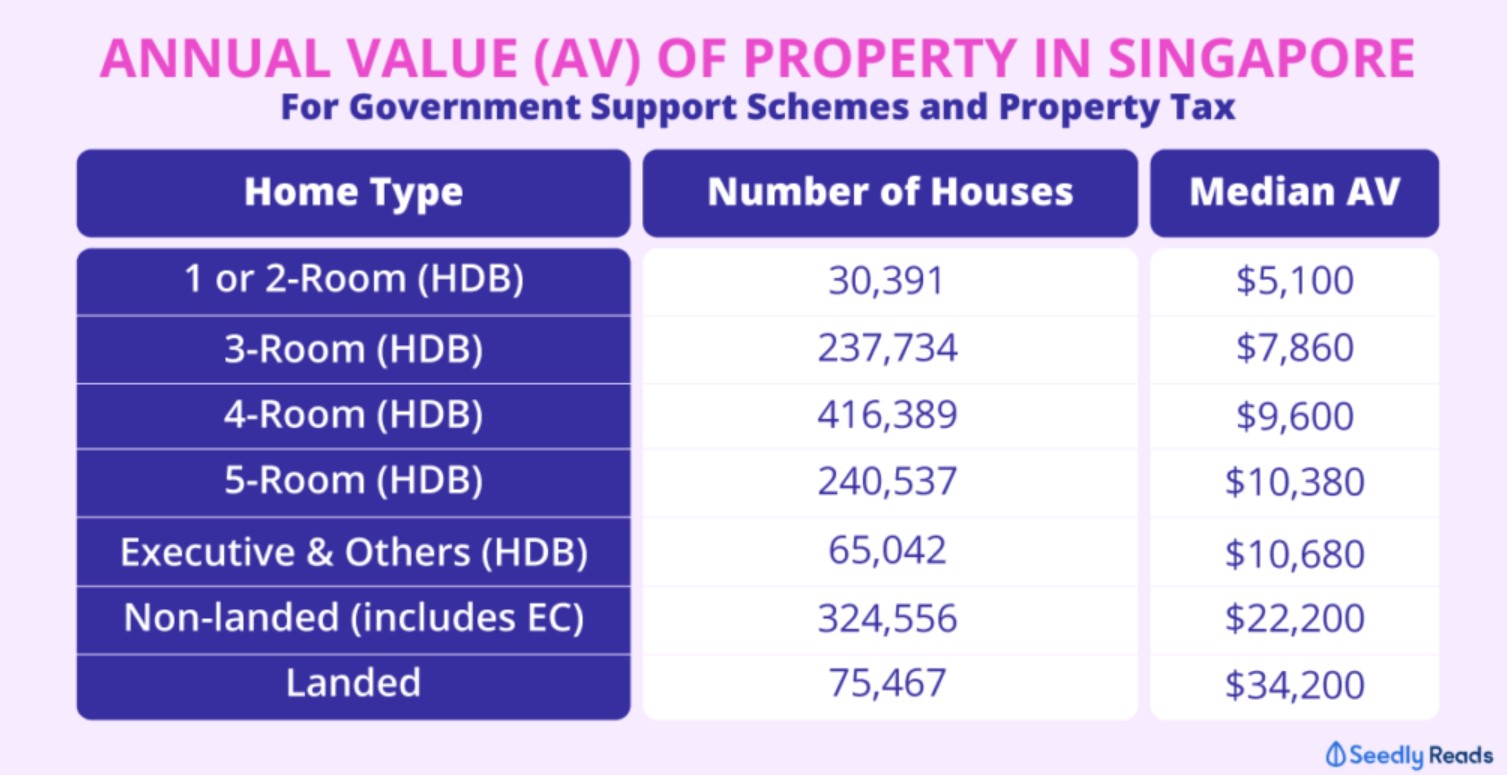

Also, you will also pay slightly more property taxes for the bigger, more expensive EM.

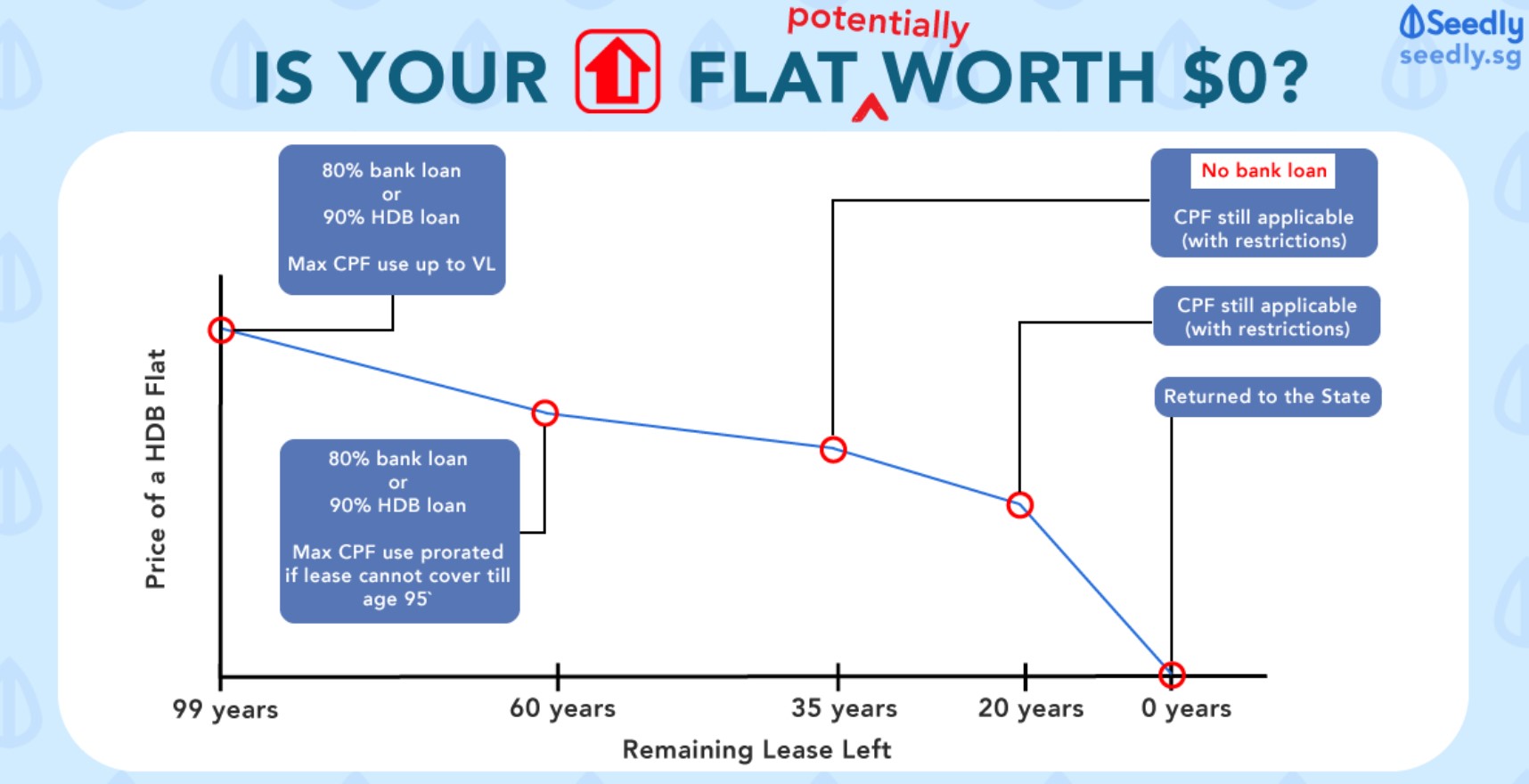

One important thing to take note of is that these HDB EMs are quite old with many of them only having about 61 -77 years left on the lease.

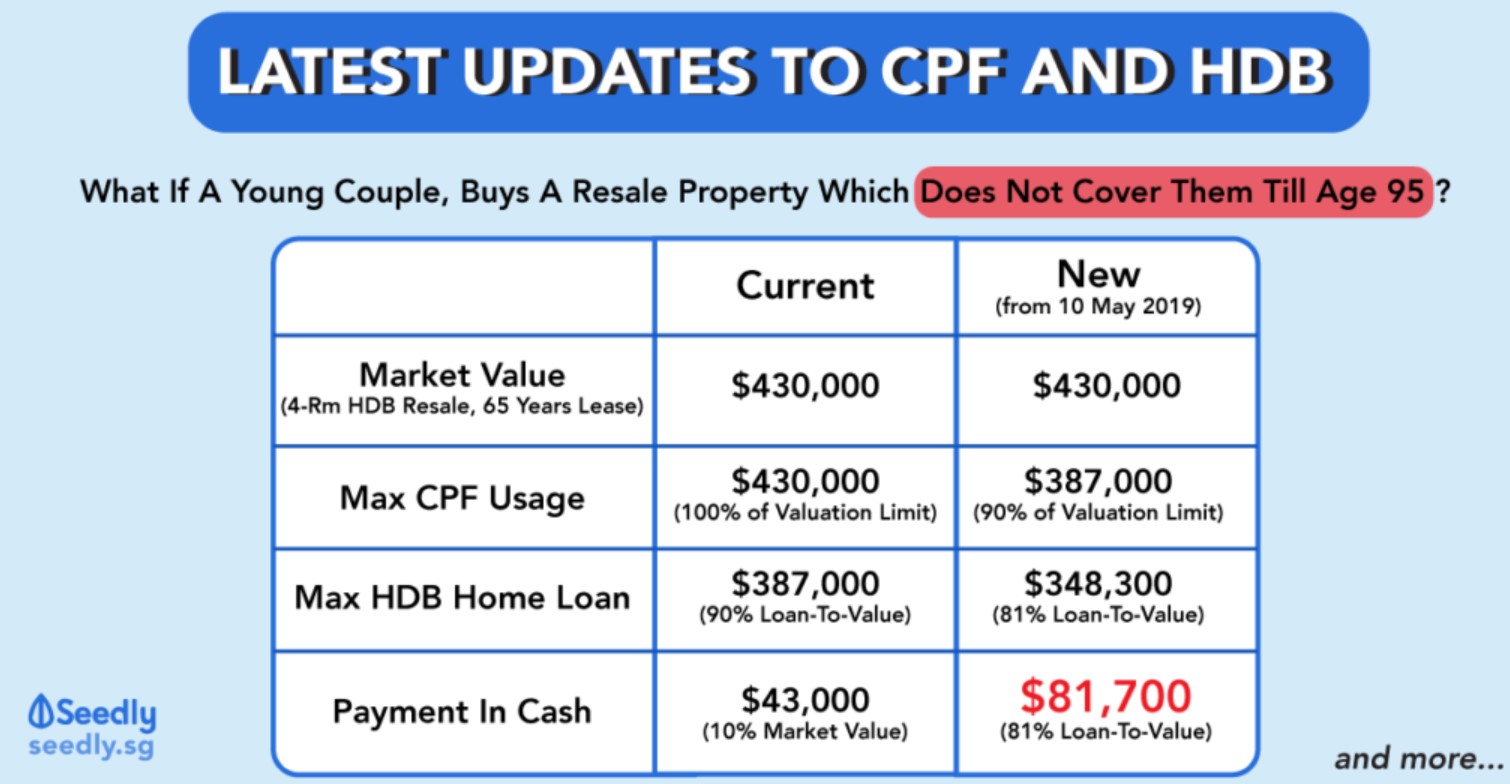

It is important for you to know about the May 2019 updates to CPF usage and HDB housing loans.

Regardless of whatever type of loan you take up, the first criteria for you to use your CPF Ordinary Account (OA) funds for housing , is that NO CPF can be used if the property’s remaining lease is less than 20 years .

[[nid:520351]]

Also, the amount you can borrow for the HDB loan depends on whether the remaining lease can cover the youngest buyer until age 95 and beyond.

If the property’s lease can cover the youngest buyer till 95 years and beyond, buyers can loan up to the full loan-to-value (LTV) limit of 90per cent

However, if the property cannot cover the youngest buyer till 95 years and beyond, the loan-to-value (LTV) limit will be pro-rated based on the number of years that the remaining lease can cover the youngest buyer to age 95.

You will also have to take into account that you might outlive your flat considering that life expectancy in Singapore is increasing steadily and the number of years left on your flat’s lease will not increase.

Although HDB EMs provide more value per square foot, the absolute value of the flat is still quite high.

You can expect to pay anywhere from $470,000 to about $1.2 million for an EM.

This means that the downpayment will be higher too.

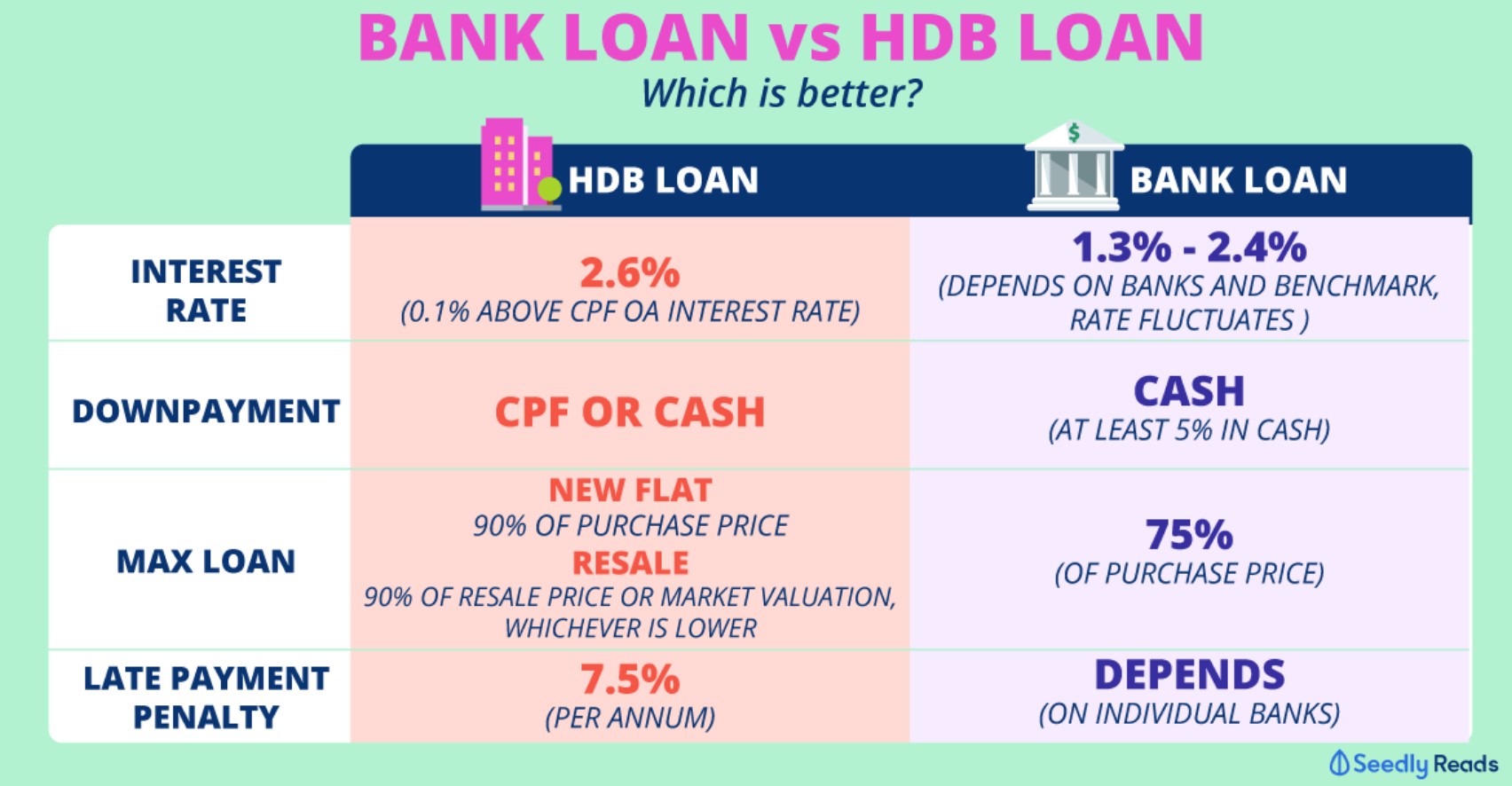

Let’s say you were taking an HDB housing loan.

Although you can obtain a loan that can cover up to 90 per cent of the purchase price of the house, you will still need to cough up the remaining 10 per cent using cash and/or your Central Provident Fund (CPF) OA funds.

Also since HDB EMs have fewer years left on the lease, you might not be able to borrow the full 90 per cent because of the lease and the youngest buyer’s age. This means that you might have to fork out more cash for the downpayment .

[[nid:521041]]

Not to mention that you will have to consider that you will have to pay cash-over-valuation (COV) in cash to secure the much sought after HDB EM.

FYI: COV is defined as the difference between the transacted price and the unit’s official valuation. HDB does not publish the COV data.

But according to Sofian Roslan, an associate marketing director at ERA Realty ( via CNA ):

"Paying a COV of $10,000 to $20,000 is "quite common" now. "But I've heard from colleagues who have transacted about $60,000 to $70,000 (in COV). These are common at mature estates where the older blocks are with limited supply, so these are those that command high COVs." He added that other flat types, such as jumbo flats and executive apartments, typically attract higher premiums"

On top of the downpayment and COV, you will have to factor in renovation costs for EMs which start from about $20,880 and will have to be paid for in cash.

Don’t be fooled by the huge million-dollar EM transactions you see on the news.

Although they are sought after, an HDB EM is still an HDB flat with an expiring lease at the end of the day.

The reality is that young couples buying a flat today probably will not see such a huge appreciation because “our economy is maturing and it cannot grow as fast anymore”.

Unfortunately for most Singaporeans, we’ve also forgotten that we will only own our HDB flat for 99 years or even less for the older HDB EMs.

This means that at some point in time, our property will depreciate in value . Or as some property experts call it, lease decay.

There’s a chance that the value of your property might not appreciate enough for you to see the kind of returns that you’re expecting from this ‘investment’ of your capital.

Also, unless you actually sell your HDB flat in order to reap the kind of capital appreciation that you want. Otherwise, any appreciation of your property is merely a paper gain .

And the longer you hold your HDB flat, there’s also a chance that it’ll reach the point where potential sellers might not want to consider your property anymore because of the remaining lease .

Especially if your HDB flat lease is 60 years or less.

Yeah… Sorry to be the bearer of bad news.

When your property has less than 60 years of lease left, it gets harder to sell because CPF usage is restricted and bank loans are tightened .

Considering that the majority of Singaporeans use their CPF to finance their homes, this can be a problem.

And with many of the EMs only having about 61 -77 years left on the lease, your future EM might be harder to sell in the future.

So who are EMs for?

In my opinion, EMs are a more cost-effective option compared to private property for families who are looking for lots of living space and for those who want the ‘landed experience’ for cheap.

Instead of pinning your hopes that your EM will be an appreciating asset, you might want to consider that you are renting out a large comfortable house for the rest of your life instead.

After all, nothing lasts forever.

This article was first published in Seedly.