House hunting advice: I have a budget of $4m for a bachelor pad. How do I narrow down my choice?

Hi,

I'm looking for a bachelor pad I can live for a long time. Thinking of a 2+1 or 3br, budget around $4 million.

Have seen a bunch of places and am quite torn over the following:

Current favorites (and I've read all your reviews):

Also, like cosmopolitan and trillium so this just goes to show how too many choices makes the decision hard.

Any advice on how I should approach this?

Thanks!

Hey there!

Thank you for writing to us and thanks for sharing your intended purchase.

Buying a property is a huge decision - especially for long-term own stay with value retention in mind.

I noticed that you have shortlisted developments in the CCR. CCR resale prices have rebounded 9.1 per cent year on year based on the latest September SRX report.

Do be mindful that CCR developments can sometimes be volatile especially during a market downturn, hence, entering a product at a peak or premium will put you at a bigger risk during the property downturn.

Since you are buying it for long term own stay, we would suggest not to conflate it with investment. What matters most is to find a unit that ticks most of your boxes. Capital appreciation will also depend on overall market sentiments.

To further narrow down to the ideal location; factors such as proximity to your workplace/areas you frequent as well as proximity to basic amenities could be some factors to look at in helping you with your decision making.

Here are some of our inputs for the developments that you have shortlisted.

Freehold new launch development in District 9.

Price has generally remained stable since launch, currently standing at an average of $31xx PSF.

Layout:

At 1,528 sq ft, this three-bedroom private lift unit is decently sized in today's context. It has an efficient and squarish dumbbell layout with a decent size living and dining area. It also has a good amount of kitchen countertop space with access to a proper yard area; great for laundry!

All bedrooms are connected to a bathroom, making it a good en-suite setup. It also offers a spacious master bedroom with a walk-in wardrobe. The Master bathroom comes with a bathtub and shower set up.

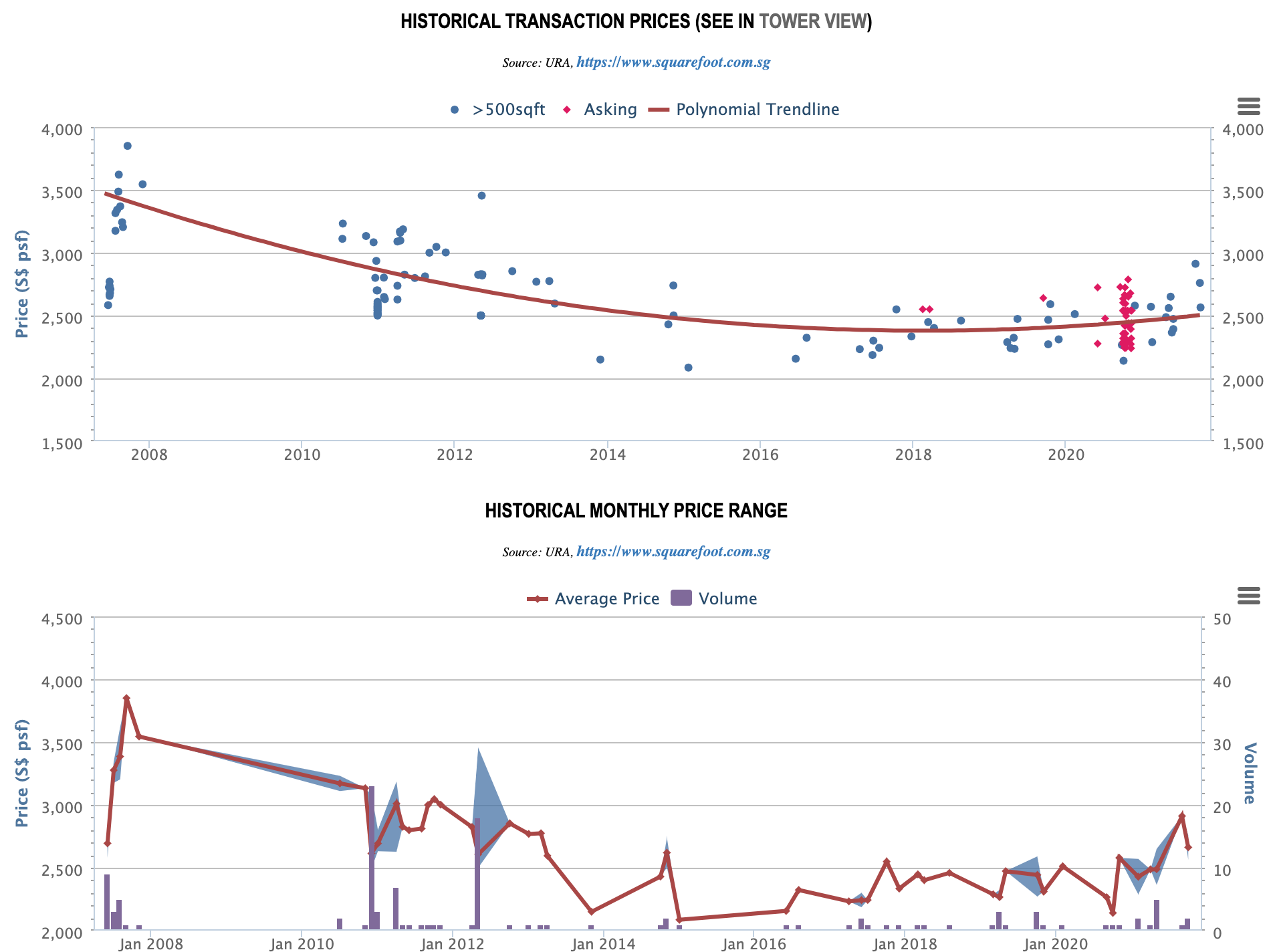

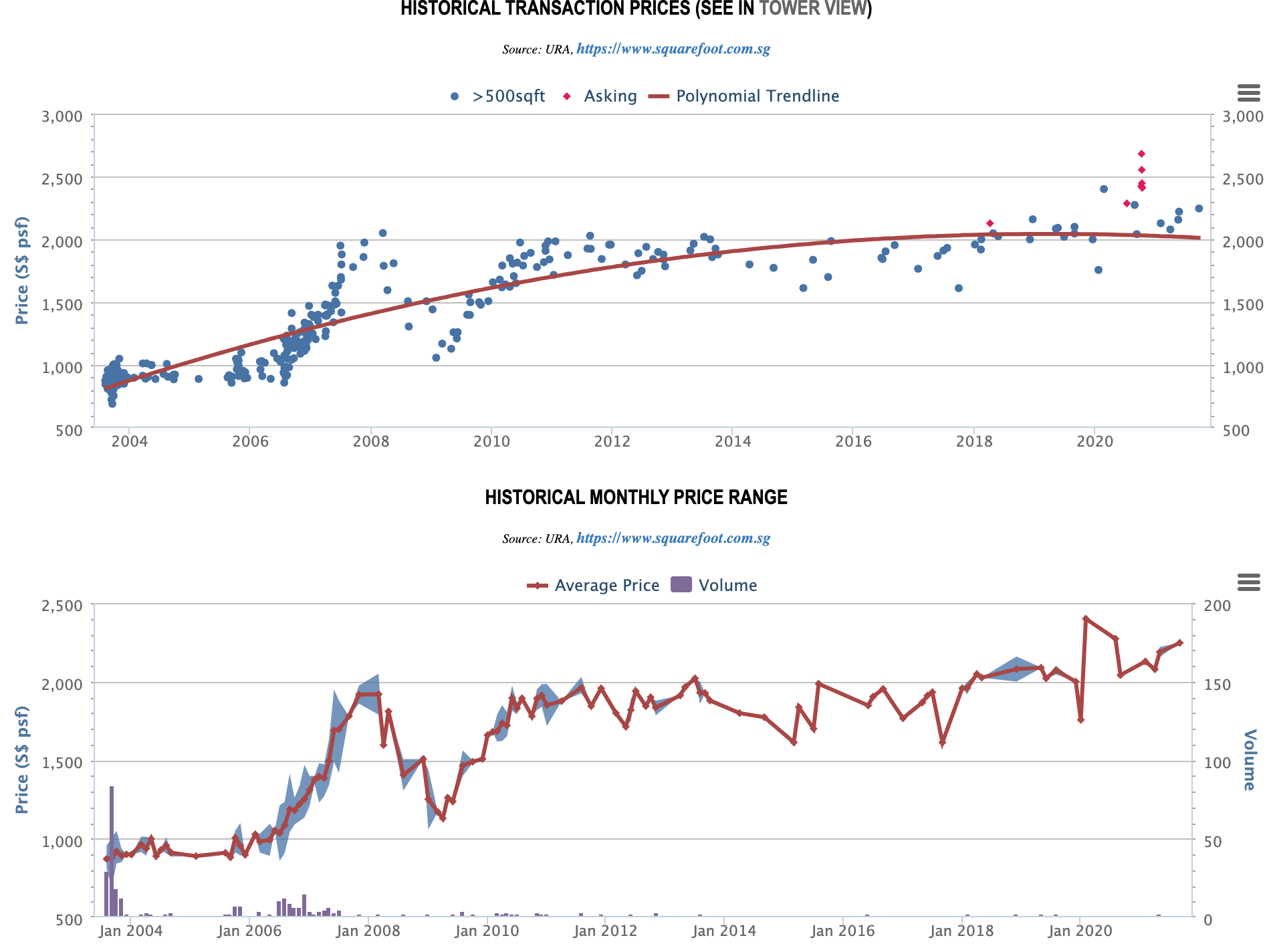

Despite its freehold status, Paterson Suites has seen its price declining over the years before it started picking up again this year with a healthy volume.

There have been 11 units transacted to date this year at an average of $25xx PSF as compared to only four transactions for the whole of 2020.

To be fair, it has faced seven years of the TEL Orchard Station construction inconvenience and the area will be reinstated soon.

On a similar note, the reinstated plot located north of Paterson Suite is slated for residential with commercial space at level one based on the latest URA master plan.

With a higher plot ratio, the north-facing stacks may likely have their view blocked in the future.

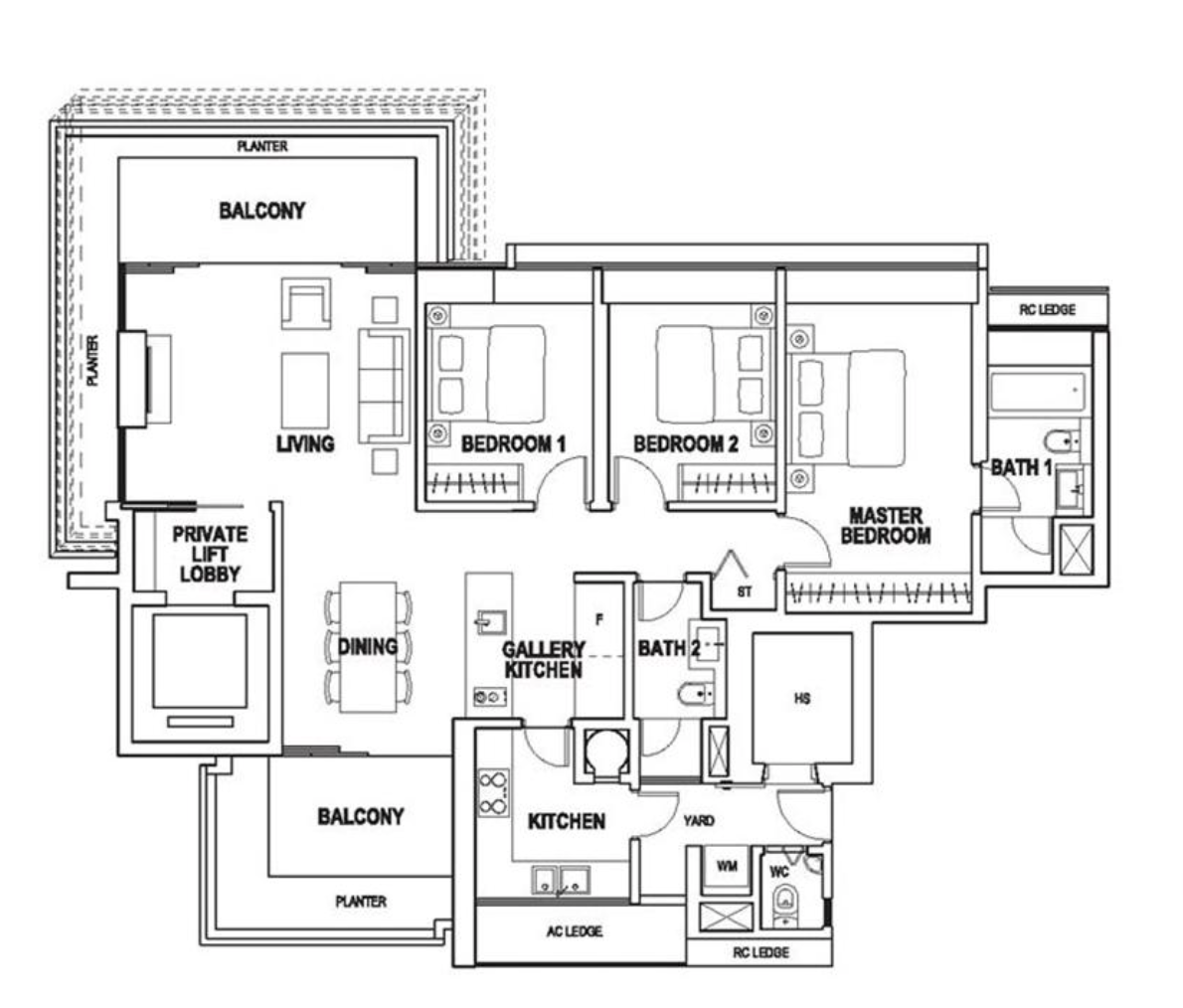

At 1,679 sq ft, the three bedders come in spacious with the provision of a private lift.

It has a squarish layout with great views of the Orchard vicinity. It also has a great living and dining space with two balconies; hence offering dual views! A good-sized kitchen with ample kitchen countertop space is also a plus.

The unit also comes with an in-unit household shelter; great for storage as well as a proper yard area - great for laundry. However, the unit comes with bay windows and planters which takes up the valuable space that you might not be willing to pay for.

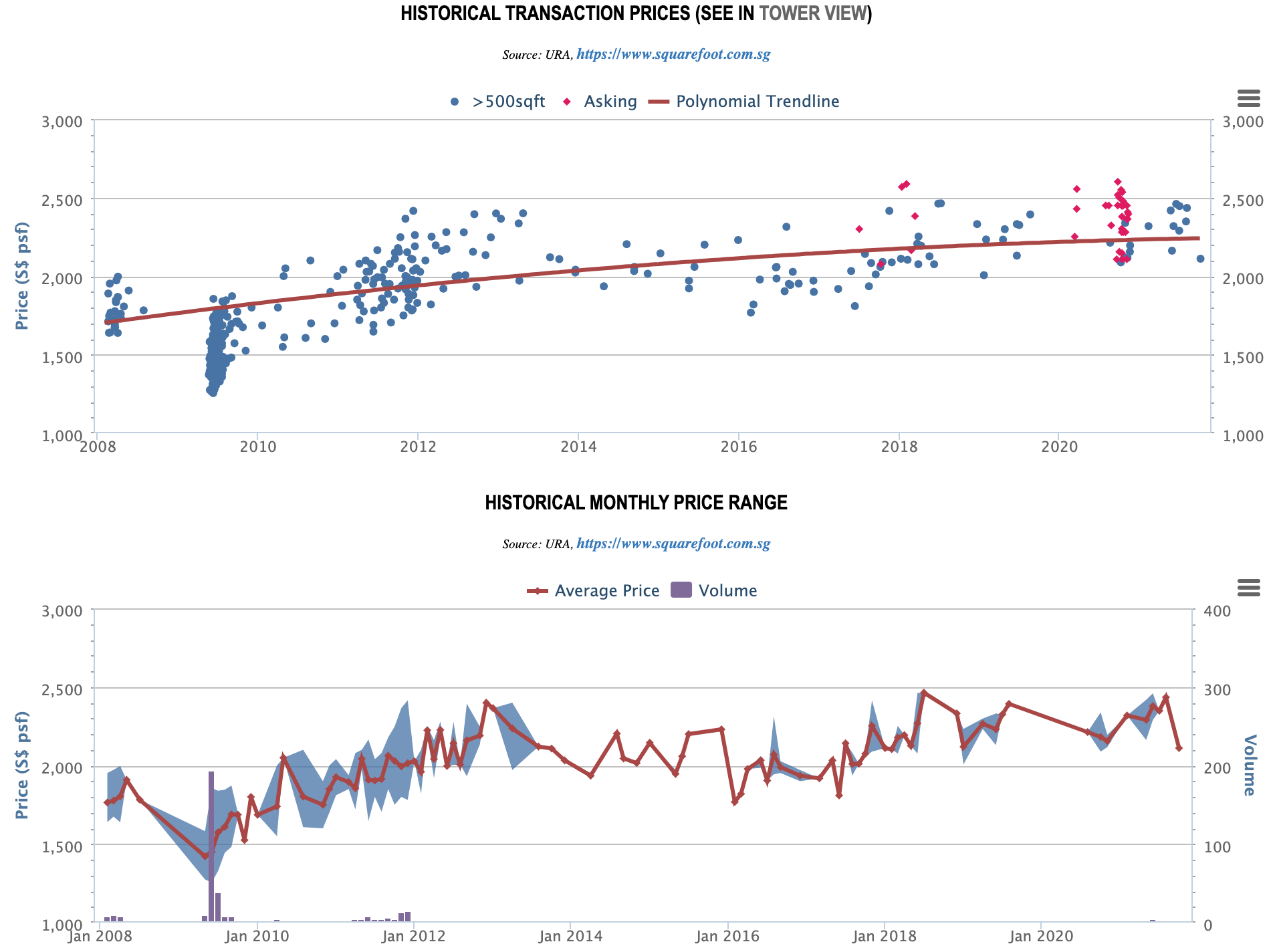

Price has appreciated well over the years for Martin Place Residences. The current average psf stands at $23xx PSF with 10 transactions to date this year as compared to seven transactions for the whole of 2020.

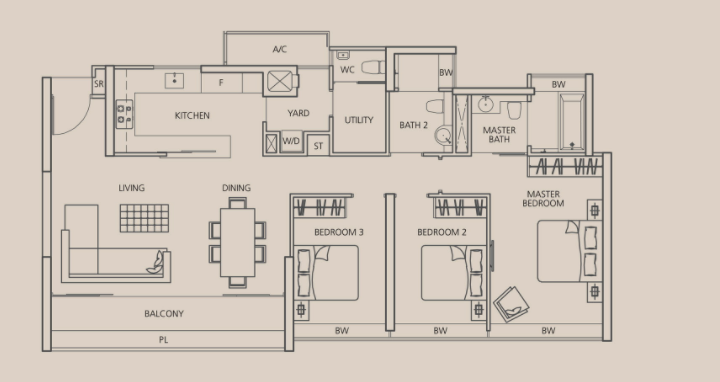

At 1,421 sq ft, this unit is spacious for a non-private lift with three bedrooms. It has an efficient and squarish layout with a good kitchen and bedroom size. The unit also comes with a proper yard area; great for laundry and an en-suite utility room.

However, the unit comes with bay windows and planters which again, may not be space you'd want to pay for.

To date this year, there were only five units transacted, which was for an average of $22xx PSF. Despite the age of the development, prices have remained resilient over the years.

At 1,410 sq ft, the three bedder layout is squarish and efficient. It has spacious bedrooms and living/dining space too. The unit also comes with an enclosed kitchen, proper yard area; great for laundry, and an in-unit Household Shelter; great for storage!

Since it is for long-term own stay, if time permits, I would suggest walking around each area to have a feel of the environment prior to deciding on a location.

Factors like the proximity to amenities, transport nodes, your workplace, and other frequented places should also be taken into considerations.

Depending on the resale unit condition, do factor in renovation cost as well.

Because this is an own-stay objective more than anything else, I can't exactly speak for which project would be appealing to you. Personally though if I had to choose, I might plunge for Paterson Suites if I can enter at a 2.3/2.4k PSF level.

At that price point, considering it is freehold, plus there is possible further future upside from the Orchard rejuvenation and a new project next door that could pull up prices.

Of course, views might be blocked here but I do think at that price point your value will still be retained.

This article was first published in Stackedhomes.