If I get Covid-19, what will I need to pay?

As more Singaporeans flock back home from overseas countries, the number of Covid-19 cases in Singapore continue to rise. What happens if you really do get tested positive for Covid-19? Here's a look at what the government and insurance companies are covering.

No one could have anticipated this pandemic to take over our normal routines in 2020. As the Coronavirus outbreak continues to affect more countries globally with little signs of slowing down, countries are closing their borders to foreigners and also deterring their own citizens from travelling out of the country.

We previously looked at whether your travel insurance will cover Covid-19 and also shared 10 things you can do with your existing travel fund, now that you won't be travelling for the next few months.

This has not only paused our travel plans, but it has also disrupted our day-to-day lives in numerous ways. Companies are implementing work-from-home measures and numerous social distancing measures have been enforced by the government. It is, after all, better to be home and safe than be sorry.

With the number of confirmed cases in Singapore on the rise (mostly imported as of now), it's not surprising that many of us are worried about our own well-being and that of our loved ones.

And so, we take a look at what the Singapore government will compensate you for as well as the additional Covid-19 coverage being provided by insurance companies.

Back in February, the Ministry of Health (MOH) announced back that the Singapore Government is paying for hospital bills incurred by Coronavirus patients in public hospitals. However, since March 7, 2020, this was changed to only apply to Singapore citizens, Singapore residents and long term pass holders.

| Testing Fees | Hospital Fees | |

| Singaporeans | Waived | Government to pay |

| Singapore Residents | Waived | Government to pay |

| Long-term pass holders | Waived | Government to pay |

| Short-term visit pass holders | Waived | To pay yourself |

The Singapore government will pay for the Covid-19 testing fees. The cost of each testing kit is about $260 to $270.

All patients suspected of being infected by the Coronavirus must be admitted to hospitals for isolation and management to prevent community transmission.

Patients have been conveyed to visit hospitals around Singapore such as the National Centre for Infectious Diseases (NCID), Ng Teng Fong General Hospital (NTFGH) and Khoo Teck Puat Hospital (KTPH).

The Singapore government will pay for hospital bills in full for Singapore Residents and long term pass holders who are admitted to public hospitals for Covid-19.

You will not need to foot your hospitalisation bill. This means that the government will be covering the costs involved should you contact Covid-19. However, this coverage does not extend to outpatient treatment.

The testing fee will continue to be waived by MOH for all short-term visit pass holders (STVP). This is part of Singapore's public health measures to identify and initiate contact tracing for confirmed cases who may have been infectious while in Singapore.

From March 7, 2020, foreigners who are short-term visit pass holders (STVP) who seek treatment for Covid-19 in Singapore will need to pay for the cost of their treatment and hospital stay. This announcement came after a spike in the number of cases in Singapore that were imported from other countries.

Insurance companies have stepped in with free Covid-19 coverage that will be extended to all their eligible customers. If you have specific insurance plans with these insurance companies in Singapore, here's a summary of the additional coverage being provided in the unfortunate event that you contact Covid-19.

| Insurance Provider | Coverage | Eligibility | Validity |

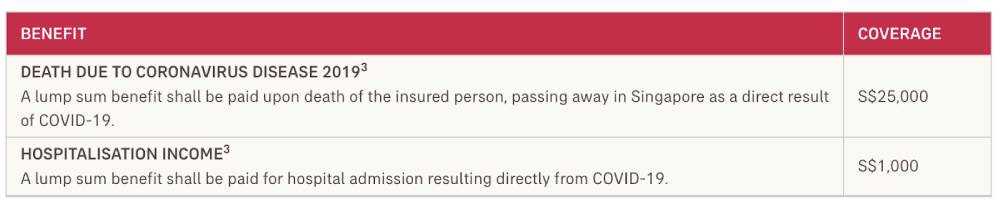

| AIA |

$1,000 (lump-sum) Hospitalisation income $25,000 Death benefit |

Singapore Resident* with a valid NRIC/FIN. Must have an inforce Life Insurance or Accident & Health Insurance policy that has been issued on or before July 31, 2020. | Up till Dec 31, 2020 or 30 days after the DORSCON level has officially stepped down to green (whichever is earlier) |

| AXA |

$200 per day Hospital Income Benefit (Up to 90 days) $20,000 Death Benefit |

Must have an in-force Life, Shield, Individual Health, Lifestyle (Travel, Personal Accident, Home and Domestic Helper) or Motor Policy(ies) with AXA | From Feb 1, 2020 to Sept 30, 2020; after DORSCON level has officially stepped down to green; or when AXA’s Covid-19 Care Package fund of $500,000 has been fully utilised (whichever is earlier). |

| DBS/POSB | $100 per day if hospitalised (up to 14 days) $1,000 lump sum payout if admitted to Intensive Care Unit (ICU) |

Account holders that sign up from now till March 31, 2020. | Your cover starts immediately once you submit your application, and expires automatically at the end of 30 days |

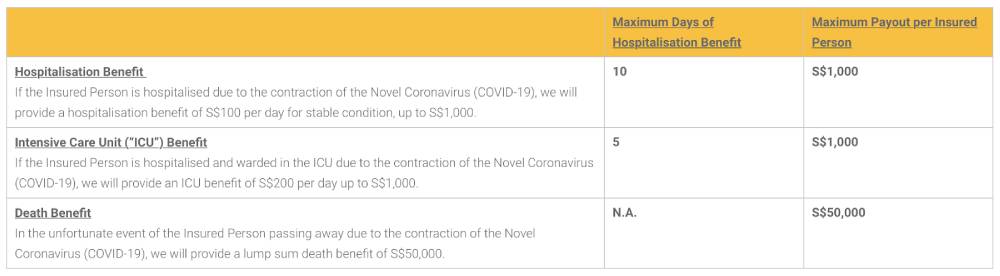

| Etiqa |

$100 per day Hospitalisation Benefit (for stable condition, capped at $1,000) $200 per day Intensive Care Unit (ICU) Benefit (capped at $1,000) $50,000 Death Benefit |

Must have an inforce life protection or insurance savings plans with Etiqa | |

| Great Eastern |

$200 per day Hospital Income Benefit (Up to 60 days) $20,000 Death Benefit |

Must have a Life or Accident and Health (“A&H”) policy, including Dependants’ Protection Scheme (“DPS”) and ElderShield scheme issued by GELS; or the policyholder of all in-forced Personal Lines insurance policies under Great Eastern General Insurance Limited, except for single or one-way travel policies. | From Feb 14, 2020 to Dec 31, 2020; or the date when an aggregate of $1 million has been paid out from the Great Eastern Covid-19 Customer Care Fund (whichever is earlier). |

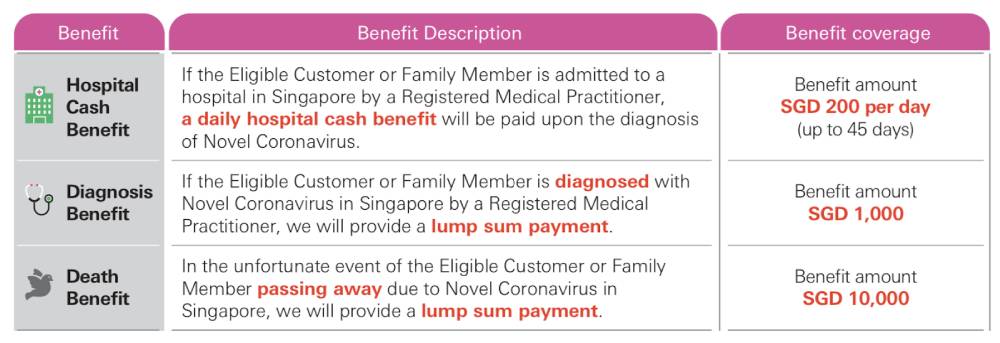

| HSBC Insurance | $200 per day for hospitalisation (up to 45 days) $1,000 lump sum upon diagnosis $10,000 Death Benefit |

Must have an insurance policy issued by HSBC Life. | From Feb 7, 2020 until Feb 6, 2021. |

| Manulife |

$1,500 payout upon diagnosis of COVID-19 $2,000 additional payout for hospitalization of 5 days or more for confirmed diagnosis of COVID-19 $30,000 Death Benefit |

All existing individual inforce/new policyholders and individual life customers of Manulife. | Feb 17, 2020 until June 1, 2020 |

| NTUC Income | $100 per day for hospitalisation (up to 30 days) $10,000 Death Benefit |

Individuals insured by Income’s Personal Accident (PA) plans with infectious disease cover. | From Feb 17, 2020 until Aug 31, 2020. |

| Prudential |

$500 one-time cash benefit for those quarantined $200 daily cash benefit for those hospitalised (up to 3 months) |

Individuals and employees of Prudential’s corporate and SME customers holding an in-force insurance policy with Prudential Singapore, residing in Singapore with a valid NRIC/FIN, and their family members. | From Jan 23, 2020 till June 30, 2020. |

Here are the full details of the Covid-19 support being provided by insurance companies for their customers in Singapore.

AIA is providing existing customers with free additional insurance cover against Covid-19. All eligible customers will automatically benefit from this free additional insurance cover with immediate effect with no action or additional purchase required.

These guaranteed benefits can be received up till Dec 31, 2020 or 30 days after the Disease Outbreak Response System Condition (DORSCON) level has officially stepped down to green - whichever is earlier.

Full details are here.

AXA has introduced their Covid-19 Protection Campaign, providing complimentary coverage against Covid-19 for their customers. Healthcare frontliners fighting the pandemic will receive doubled protection.

Here's the protection being provided to customers, as well as the doubled protection for healthcare frontliners.

Full details are here.

DBS is offering all DBS/POSB customers and their immediate family complimentary Covid-19 relief insurance coverage to cushion the expenses of Covid-19 patients. Will receive:

To start your 30 days free coverage under Covid-19 Hospital Cash, you have to complete an online form by March 31, 020. This free coverage will expire automatically at the end of 30 days and no payment is required.

Full details are here.

Etiqa Insurance Singapore has introduced Financial Assistance Benefit to those insured with their life insurance policies in light of the Novel Coronavirus (Covid-19) outbreak. You will be eligible for this benefit if you have an existing life protection and insurance savings plans with Etiqa.

Full details are here.

Great Eastern launched a $1 million customer care fund to help any policyholders and their immediate families who are hospitalised due to Covid-19. The benefits of the Customer Care Fund are:

Full details are here.

You and your family members will receive the following Complimentary Special Benefits with cover guaranteed for a full year, if you have an insurance policy with HSBC Life.

Full details are here.

Manulife set up a $1 million Covid-19 support fund to provide additional protection coverage to customers in Singapore, at no added cost. All Customers of Manulife Singapore who contracted Covid-19 and/or died due to Covid-19 infection are eligible for these benefits:

This is effective from Feb 17, 2020 until June 1, 2020 for all existing individual inforce/new policyholders and individual life insureds of Manulife.

Full details found here.

From Feb 17, 2020, if you hold either of 2 Income PA plans, PA Assurance with Infectious Disease cover and Personal Accident Infectious Disease policy, you will enjoy extended Covid-19 coverage. More specifically, customers will receive:

Also, Income's Group Employee Benefits policies now cover Covid-19. From now till May 31, 2020, employees of organisations insured by Income's Group Employee Benefits policies will be offered a cash pay-out of $100 per day of hospitalisation in Singapore (up to 30 days), and a pay-out of $20,000 in the unfortunate event of death due to the new coronavirus.

Full details are here.

ALSO READ: Covid-19 health insurance - 8 insurers with free coronavirus coverage

Prudential Singapore's PRUcare Package provides cash benefits to not only those hospitalised due to Covid-19, but also to those that are quarantined due to being in close contact with confirmed cases.

Here's what Prudential's PRUcare Package provides:

Relief for SMEs: A care package to ensure employees of SMEs covered by its Group Insurance, continue to receive medical coverage throughout this period.

You can qualify for the PRUcare Package as long as at the time of quarantine or hospital admission for Covid-19, you already have an inforce policy with Prudential and meet the eligibility criteria.

Full details are here.

Besides paying for the testing fee as well as the hospital bills of Singaporeans, Singapore Residents and long-term pass holders, the Singapore government has also put in place other efforts to help citizens tide through this difficult period.

During Budget 2020, an $800 million Covid-19 package was announced to help Singapore recover from this coronavirus outbreak. Deputy Prime Minister and Finance Minister Heng Swee Keat has also shared that a second Covid-19 relief package is currently in preparation.

For the latest updates on the coronavirus, visit here.

This article was first published in SingSaver.com.sg.