A recap of all the new launch condos in 2021

2021 has been an interesting year. Mask-wearing, SafeEntry and the changes in phases (we’ve lost count of how many times we’ve entered a new phase) remind us the pandemic hasn’t ended yet.

At the same time, looking at the robust property market this year, it doesn’t feel like we’re in a pandemic anymore.

Given the positive economic outlook, we’ve seen several condo projects slated for last year being launched this year. Some of these new launch condo projects have even made headlines and chalked up record deals.

With the year ending soon, we thought it’s apt to look back and recap on the new condo projects launched in 2021, including those launching this month.

| Project name | District | Region | Type of sale | Tenure | Developer |

| Amber Sea | 15 | RCR | En bloc (former Amber Glades) | Freehold | Urban Park (Far East Organization) |

| Bartley Vue | 19 | OCR | GLS | 99-year | Wee Hur (Bartley) |

| Cairnhill 16 | 9 | CCR | En bloc (former Cairnhill Heights) | Freehold | TSky Cairnhill |

| CanningHill Piers | 6 | CCR | En bloc (former Liang Court) | 99-year | Legend Quay (CDL/ CapitaLand) |

| Grange 1866 | 10 | CCR | En bloc (former iLiv@Grange) | Freehold | Grange 1866 |

| Irwell HIll Residences | 9 | CCR | GLS | 99-year | CDL Perseus |

| J@63 | 15 | RCR | – | Freehold | Distinct Home (TKJ) |

| Jervois Mansion | 10 | CCR | Redevelopment (former Jervois Mansions) | Freehold | Kimen Realty |

| Klimt Cairnhill | 9 | CCR | En bloc (former Cairnhill Mansions) | Freehold | Glopeak Development (Low Keng Huat Singapore Limited) |

| Les Maisons Nassim | 10 | CCR | Redevelopment of former bungalow | Freehold | Shun Tak Residential Development |

| Liv @ MB | 15 | RCR | En bloc (former Katong Park Towers) | 99-year | BSEL Development (Bukit Sembawang Estates Limited) |

| M Suites | 14 | RCR | En bloc (former semi-detached houses) | Freehold | FG Resource |

| Mattar Residences | 14 | RCR | – | 99-year | L.K. Ang Construction (Hock Lian Seng Holdings/ Keong Hong Holdings/ TA Corporation) |

| Midtown Modern | 7 | CCR | GLS | 99-year | Guoco Midtown II /Midtown Modern |

| Mori | 14 | RCR | En bloc (formerly terrace houses) | Freehold | RL East (Roxy-Pacific Holdings) |

| Normanton Park | 5 | RCR | En bloc (former Normanton Park) | 99-year | Kingsford Huray Development |

| One Bernam | 2 | CCR | GLS | 99-year | HY-MCC (Bernam) |

| One-North Eden | 5 | RCR | GLS | 99-year | One North Development |

| Parc Central Residences EC | 18 | OCR | GLS | 99-year | Hoi Hup Realty and Sunway Developments |

| Parc Greenwich EC | 28 | OCR | GLS | 99-year | Fernvale Lane (Frasers Property) |

| Park Nova | 10 | CCR | En bloc (former Park House) | Freehold | Shun Tak Cuscaden Residential |

| Pasir Ris 8 | 18 | OCR | GLS | 99-year | Phoenix Residential / Phoenix Commercial (Allgreen Properties / Kerry Properties) |

| Peak Residence | 11 | CCR | En bloc (former Peak Court) | Freehold | Tuan Sing Holdings and Rich Capital Holdings |

| Perfect Ten | 10 | CCR | En bloc (former City Towers) | Freehold | Japura Development (Cheung Kong Property Development) |

| Provence Residence EC | 27 | OCR | GLS | 99-year | MCC Land (Canberra) |

| Rymden 77 | 15 | RCR | En bloc (former bungalows) | Freehold | QHS Development |

| The Atelier | 9 | CCR | En bloc (former Makeway View) | Freehold | Bukit Sembawang Estates |

| The Commodore | 27 | OCR | GLS | 99-year | JBE (Canberra) |

| The Reef At King’s Dock | 4 | CCR | Redevelopment of former shipyard of Keppel Shipyard | 99-year | Harbourfront Three |

| The Watergardens At Canberra | 25 | OCR | GLS | 99-year | United Venture Development (2020) (UOL/ UIC/ Kheng Leong Company) |

| Zyanya | 14 | RCR | En bloc (former Advance Apartment) | Freehold | NNB 8 Development |

A number of them were previously slated for launch last year (and featured in our 2020 new launch condo list). But their launches were pushed back to this year due to the pandemic. This includes Midtown Modern , Klimt Cairnhill and Perfect Ten.

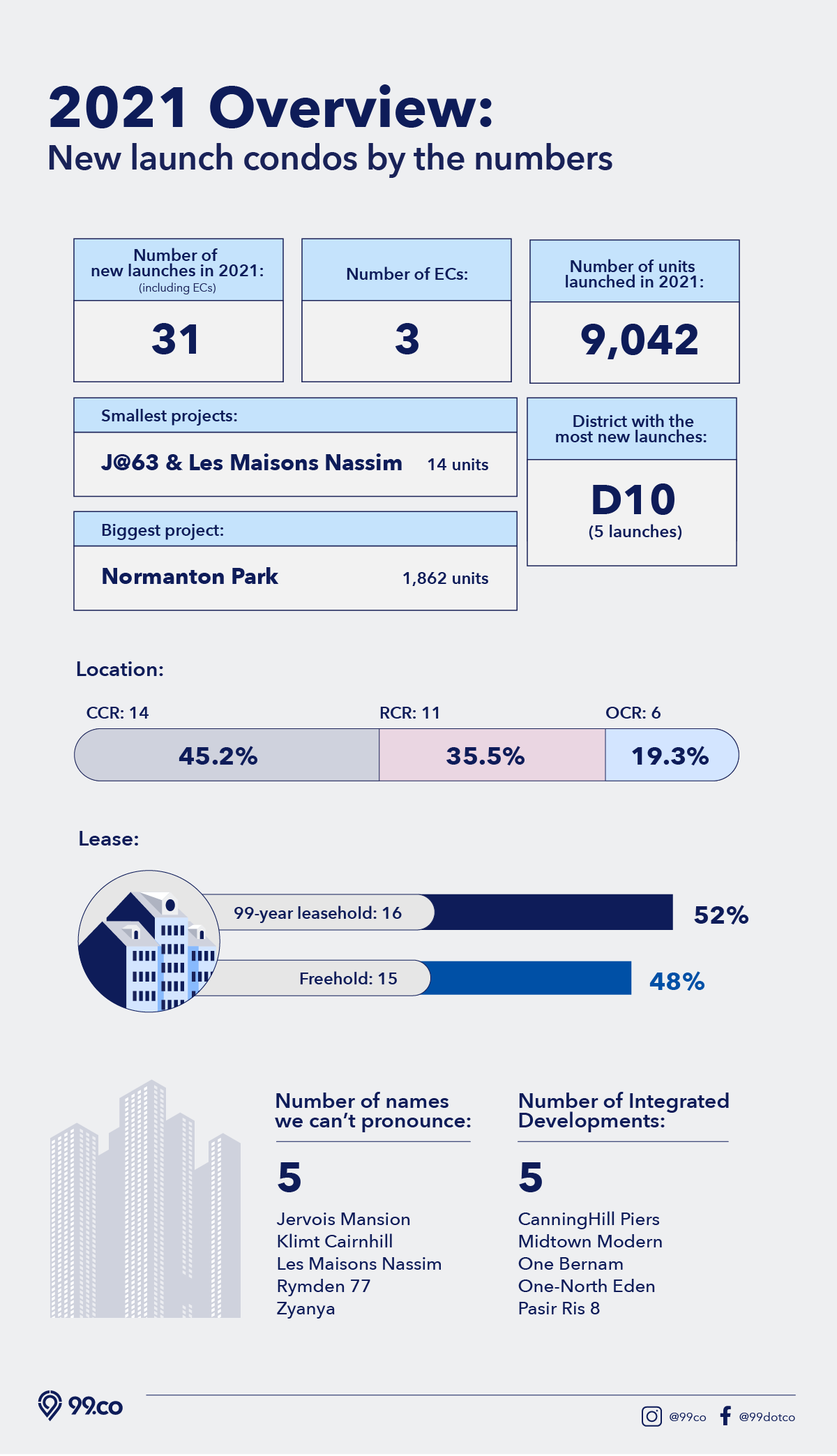

Around half of the new launch condo projects (15) are from en bloc sales, with 10 from the 2017 – 2018 en bloc fever. The remaining projects are mostly from the government land sales (GLS) programme (11).

Tenure wise, slightly more than half come with a 99-year tenure.

Similar to 2020, we’re also seeing mainly small to medium projects being launched this year. The only large project launched in 2021 is Normanton Park, which had its developer hit with a no-sale license back in January 2019.

Another notable aspect we noticed this year is the number of integrated developments launched. This is despite the fact that work-from-home and online shopping are not going away as we move towards post-pandemic recovery.

On the other hand, there’s some anticipation that people will eventually return to the office. And things are looking optimistic for the physical retail front, and people are heading back to the malls.

Despite construction delays due to manpower and supply shortages, we’ve seen high demand for these new launch condos for the past year. This is likely due to the recovering economy and low interest rates.

More are also buying now as they expect prices to increase in future, especially as the supply of new condo units is declining.

In fact, we’ve seen strong sales since the start of the year. For instance, Normanton Park, the first launch of the year back in January, saw around one-third of its units sold on the first day of sales.

Another strong launch was for One-North Eden, which sold 85 per cent of its units over the launch weekend.

One noteworthy project in the CCR is Jervois Mansion. The developer had sold 104 out of the 105 units put up for sale during the launch weekend in October.

There’s also CanningHill Piers, which became the best selling launch in the Central area this year after selling 77 per cent of its units during the launch weekend in November.

Over in the OCR, there’s the launch of Pasir Ris 8 back in July. Despite six rounds of price reviews, it saw 85 per cent of its units sold over the launch weekend.

Given the robust sales for these new launches in 2021, it’s no surprise that the number of units sold in the first 10 months of this year has exceeded the number sold in the entire year of 2018, 2019 and 2020.

So it’s expected that we’ll see an eight-year high of around 12,000 to 13,000 new units sold.

On top of robust sales across all three market segments, we’ve also seen a few record-breaking deals.

For instance, back in May, a Park Nova penthouse set a record for the highest price psf in the Orchard Boulevard area when it was sold for $5,838 psf.

Around six months later, we saw a Les Maisons Nassim penthouse sold for $75 million or S$6,210 psf, making it possibly the most expensive penthouse sold in recent years.

Notably, both projects are developed by Shun Tak Holdings, founded by the late casino tycoon Stanley Ho.

Barring any cooling measures, we expect prices to continue increasing at a healthy pace as supply declines.

As of Q3 2021, 17,410 new condo units remain unsold. Additionally, most of the 2017 – 2018 en bloc cycle projects have already been launched in these two years. So there will be fewer new launches in 2022.

Another factor driving up prices is the higher land cost. Due to developers’ dwindling land bank, we’ve seen stronger demand for land bids, as shown by the prices paid for the GLS plots this year.

For instance, the Lentor Central site was sold for $784.1 million, translating to $1,204 psf per plot ratio. Expected to be launched next year, the units could potentially be sold for around $2,000 psf.

The increasing construction costs from the manpower crunch and supply chain disruptions will continue to raise prices as well.

At the same time, we don’t think there will be any cooling measures anytime soon.

In general, prices have been growing at a pretty healthy rate. According to URA, the price index of non-landed private properties was 157.1 in Q1, before increasing to 159.9 in Q3. This translates to a percentage change of 1.8 per cent.

Likewise, interest rates have started increasing. Coupled with current measures that prevent overleveraging, such as the 75 per cent loan-to-value ratio , 60 per cent Total Debt Servicing Ratio (TDSR) and stamp duties, demand will probably be at a healthy level.

Still, if you’re looking to buy a new launch condo in 2022, it pays to be prepared, in case of any cooling measure announcement.

ALSO READ: 7 stunning sea view condos in Singapore

This article was first published in 99.co.