Save up to $15k a year: Singaporean shares how he does it in viral post

PUBLISHED ONDecember 09, 2020 11:00 AMBYMelissa Teo

PUBLISHED ONDecember 09, 2020 11:00 AMBYMelissa Teo Adulting is tough. While having a job means getting money coming in, this is also the time that you realise what it means to be responsible for your expenses, as many people also are working towards big ticket items like a house or a car.

One young Singaporean realised that "spending habits are huge contributing factors which make you wealthy" and decided to try to find ways to cut down on his expenditure, and shared his tips on social media.

In the now-viral Facebook post, Clyde Chye shared that after going through their expenses, his girlfriend, Cristelle Lim, and him realised that if they were to budget their money properly, they could actually save around an additional $10,000 a year.

He went on to detail how he changed his spending habits, highlighting items that could be eliminated from daily expenses.

Speaking to AsiaOne, Chye explained that the pair came to the realisation that many people, especially those who were younger, had the potential to save more for their future goals. He feels that the tips he has shared are sustainable methods are easy for people to adopt and adapt.

And he is walking the talk too. The couple has been putting these tips to practice since March 2020.

Regarding food, Chye said that on weekdays, instead of splurging $10 for every meal, he would give himself a budget of $5. This means no upsizing of meals and not ordering additional drinks or sides. Going by the usual three meals a day, he reckoned this saved him $15 a day, amounting to $300 a month.

He also avoids getting his caffeine fix through bubble tea or coffee from chains like Starbucks. Instead, he goes for a $1.50 cup of coffee. This means saving $6 a day and $120 a month.

While food delivery is convenient, the delivery fees add up, hence, Chye has stopped ordering in. He estimates that buying his own food saves him approximately $36 a month.

On weekends, the couple eschews eating out in favour of cooking at home. Hence, they spend $20 instead of $150 every week. They also watch shows on Netflix as opposed to going to the cinema. This works out to saving $92 monthly on shows, and in total of their typical weekend expenses, he calculates that they save $612 every month.

He also talks about how he has managed to save quite a fair bit from avoiding ride sharing services like Grab and Gojek. Instead, he sticks to taking public transport, which he says saves him an additional $100 a month.

He also suggests reviewing bills, unused subscriptions, insurance and lifestyle memberships to see where spending can be further reduced. For himself, he weeded out the extras and saved around $82 a month.

Based on his calculations, this is a total of $1,250 savings a month and assuming every month is the same, works out to $15,000 saved in a year.

That doesn't mean that he is a miser though. He acknowledges that he would still upsize the occasional meal and order from Starbucks once in a while, as he has a "surplus of $5,000" to spend without affecting his goal, which is to save $10,000 a year. He even spent a four-digit sum in a day, he divulged in his post.

The changes that he implemented to his lifestyle were more doable than he had anticipated, he tells AsiaOne, sharing that tracking his expenses on an app helped make it really easy too. "As I look at how my progress is going weekly, it gives me a sense of achievement."

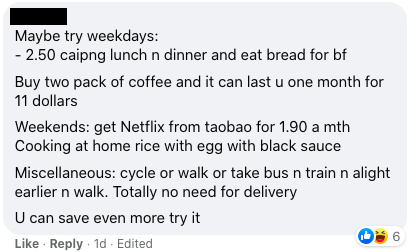

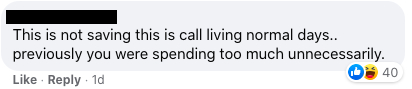

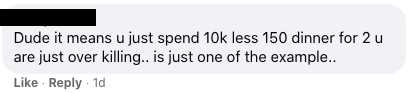

While his tips might seem like common sense, his post has resonated with many, garnering nearly 3,000 shares (and counting) and well over 100 comments. Some like-minded netizens also shared their cost-saving tips.

However, there were some who felt like Chye's initial spending was already on the extravagant side.

Nevertheless, the general idea behind cutting down on expenditure is a good one and with all things, there is no one size fit all formula. Instead, take the suggestions that work for your lifestyle and the big idea to find ways to cut down where possible.

melissateo@asiaone.com