Should you get a term life insurance plan? We explain how it works

One of the most common types of insurance policies that you would hear of is a term life insurance plan. A term life insurance plan provides you with life insurance payout in the event of death, total and permanent disability or terminal illness.

This sum of money would be particularly important for your loved ones who will no longer be able to have the financial support that you provide for them. The insurance payout from a term life plan will ensure that your loved ones will be able to continue living their lives with minimal disruption to their standard of living.

FINITE TERM LIFE INSURANCE COVERAGE

As its name suggests, term life insurance plans provide you with life insurance coverage for a fixed period of time. In the event that death, total and permanent disability or terminal illness occurs during this period, the sum assured would be paid out.

In the (fortunate) event that death, total and permanent disability or terminal illness does not occur during the insured period, the policy expires with no payout being made.

If you choose to stop paying your premiums before the policy expires, your coverage simply ceases at that point in time and you no longer enjoy insurance coverage. Unlike whole life plans, there is no surrender value to be paid out.

HOW MUCH COVERAGE SHOULD YOU HAVE?

If budget is not a concern, all of us would want to buy as much coverage as we possibly can. This, of course, isn't realistic, since we all live in the real world where any insurance coverage that we buy will cost us.

There are two key factors that you should consider when determining the coverage amount that you need. If need be, you should also work with a trusted insurance advisor to better understand the coverage amount that you need and are able to afford.

[[nid:458421]]

Loans that you have: Ideally, any loans that you take on should also be insured for. This is to ensure that your insurance payout will be sufficient for your loved ones to be able to settle any outstanding loans that they are not liable to pay for in your absence. Examples of such loans will include your housing loans, car loans and renovation loans.

How much your loved ones will need for daily living: Consider your children, your parents (if you are supporting them) and your spouse (if he/she isn't working), how much financial support will they need if you are no longer providing for them? For your children, you may wish to provide them with sufficient income till they are adult and able to work and provide for themselves. In the case of your parents, you should estimate how much income they need each month to support themselves. A lump sum amount from the insurance payout can then be used to top up their CPF Retirement Account, ensuring that they will not outlive their savings.

While it might be tempting to buy more coverage than you actually need, it's important to remember that the premium you pay for term coverage is non-recoverable. So, there isn't much value to over-insuring yourself.

REASONS WHY YOU MAY CHOOSE A TERM LIFE INSURANCE PLAN

By now, you would know that term life insurance plans are purely for protection purposes over a defined period of time.

For example, if you have outstanding loans (e.g. housing loan), these loans should already be paid off by a certain period in time. Your kids and parents, who are reliant on your financial support today, are not going to (hopefully) need your support for the rest of your life.

This is why term life insurance plans cover you only for a period of time. During this period, you will pay the insurance premiums and receive the coverage that you want, until the policy lapses or if you choose to cancel it prematurely - which is also possible if you no longer feel you need the coverage that it provides you for.

WHEN SHOULD YOU BUY A TERM LIFE INSURANCE PLAN?

Key milestones in life - such as getting your first job, buying an HDB flat, having children, taking up a business loan - are common occasions when you should review your insurance coverage needs and possibly, increase your term life insurance coverage amount if it's required.

Of course, you may also want to consider getting a whole life insurance plan instead. Ultimately, however, you need to consider your budget and your reasons for wanting to buy a life insurance plan and ensure that the policies that you buy fit both your budget and needs. You can read up more about the differences between term and whole life insurance plans here.

HOW TO UNDERSTAND A TERM LIFE INSURANCE PLAN?

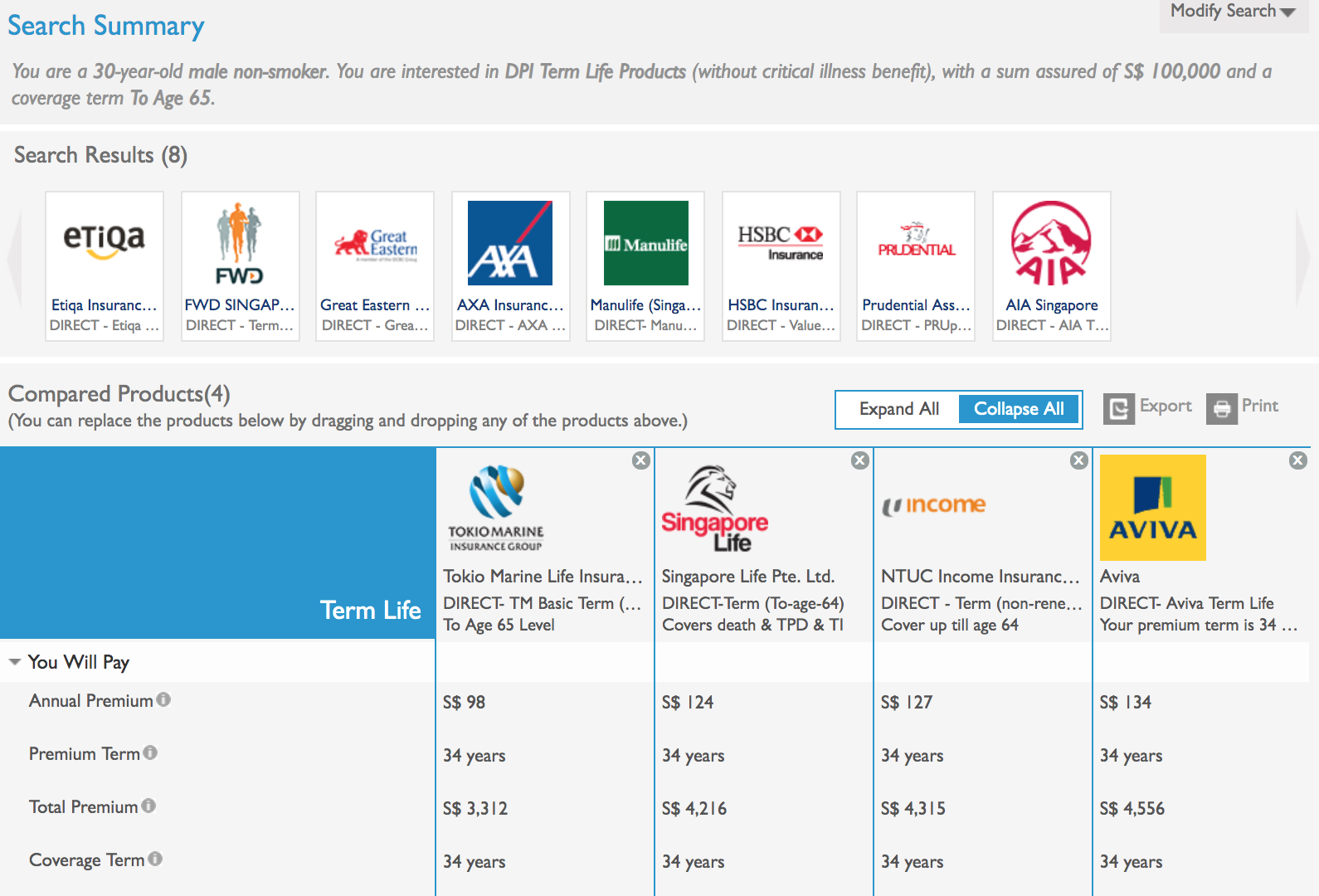

Based on a quick search that we did on compareFirst, we found that for a 30-year-old male non-smoker looking for sum assured of $100,000 till age 65, we can expect to pay around $100 to $150 a year in premium.

Source: compareFIRST

Beyond just the premium, there may also be some additional details that would differentiate the term life insurance plans offered by each insurer. So, it's worth checking out the product brochure for these plans and/or to speak to a trusted financial adviser to find out more.

You want to ensure that not only would the term life plan that you buy be suitable for you, but that the coverage amount that you are purchasing and how much you are paying for the coverage is right for you. You may also be able to purchase an additional rider such as critical illness protection which can be added on top of your term life insurance coverage.

GET PERSONALISED ANSWERS TO YOUR INSURANCE QUERIES

If you have any thoughts pertaining to term-life insurance plans, or just have an insurance-related topic that you wish to discuss, you can join the Insurance Discussion SG Facebook Group, which is Singapore's largest insurance discussion community to get the views of others.

Alternatively, if you have a specific insurance-related question that you wish to ask privately, DollarsAndSense is teaming up with fundMyLife to help people in Singapore get their insurance questions answered - for free. You can find out more about advisors on fundMyLife here.

COMPARE AND BUY INSURANCE ONLINE

Gain access to more than 500,000 insurance quotes almost instantly by using MoneyOwl's comparison tool.

Simply visit MoneyOwl's website to find the most suitable insurance for you and your family. Embark on your protection journey today!

This article was first published in Dollars and Sense.