Valentine's Day credit card promos (2026): Flowers, jewellery, experiences and more

Valentine's Day has a way of making things feel extra… special. The same bouquet costs a touch more, and regular menus now get thinner — with more zeros doing the talking. Love may be timeless, but Valentine's definitely adds posh — and a little pressure — to the bill.

The answer isn't skipping the celebration altogether (come on!). It's playing it smarter. With the right credit card, you can let the perks do the heavy lifting while focusing on the romance. We've rounded up Singapore's best Valentine's Day credit card promos in 2026, so the gestures land — and the bill doesn't steal the spotlight.

Yes, flowers are predictable. They're also timeless, expected, and oddly hard to mess up — which explains why we keep going back every year. But they're rarely a small purchase in Singapore. Between premium imports, same-day delivery, and Valentine's mark-ups, bouquets can easily creep into "did I really just spend that much?" territory.

Good news is several banks are offering V-Day's flower promotions this year, helping you stick with convention — without paying more than you need to:

If you don't have time to swing by a florist on the way home, ordering online can be a lifesaver — some credit cards make that choice even sweeter.

For instance, the Citi SMRT Card lets you earn up to five per cent SMRT$ on online purchases (incl. groceries + transport) when you spend at least $500 a month. That's a handy way to stretch your V-Day buys a little further.

If flowers are the base line, then jewellery is the step up. As the saying goes, "Diamonds are Forever" — a great symbol of lasting love to present to your significant other. Should you be thinking of adding a little sparkle this Valentine's Day, here are the promotions worth knowing about:

When it comes to jewellery purchases, cards with uncapped rewards can be especially useful.

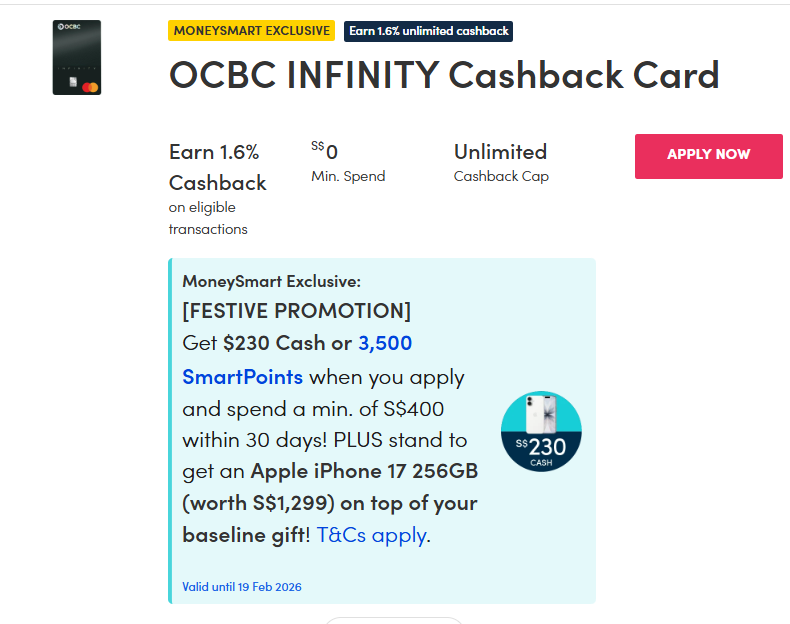

Options like the Citi Cash Back+ Card and OCBC INFINITY Card offer unlimited cashback, making them a fuss-free fit for larger, one-off Valentine's Day purchases-no category juggling, minimum spend requirements or monthly caps to keep track of.

Sure, flowers or jewellery mark the occasion. Yet beauty and wellness show love and care beyond it. Whether it's the skincare sets they swear by or a spa treatment they've been meaning to book, these gifts are about helping your significant other feel looked after and appreciated.

If that's the case, check out the promotions we've uncovered:

Again, if you can only afford to buy gifts online-the DBS Woman's Card is worth to keep in mind. It earns up to five DBS Points for every $5 spent on eligible online purchases, which works out to two miles/ dollar-making your checkouts more rewarding.

Valentine's Day isn't (and shouldn't be) a one-way spoiling situation. If your partner cares more about specifications than roses — regardless of who's holding the bouquet — these promotions make returning the love easy and functional:

If you're a DBS cardholder, the DBS Live Fresh Card probably needs no introduction. For electronics and computer purchases-whether online or in-store-you can earn up to six per cent cashback on eligible shopping spend once you hit the card's monthly qualifying spend, which makes it handy for big gadget buys.

How about a cable car ride or a hands-on workshop to create your own signature scents? If love, for you, is about the shared experiences rather than the tangibles, these ongoing activities and their promotions might be more your speed:

Note: Some of the Standard Chartered promotions above are tied to either Visa or Mastercard, so it's worth double-checking the card network before you pay.

The Standard Chartered Simply Cash Credit Card runs on the Mastercard network, making it eligible for Mastercard-specific deals.

If you're using a Visa, options include the Standard Chartered Smart Credit Card and the Standard Chartered Journey Credit Card.

Here's how the cards stack up:

If you and "pookie" are overdue for some proper quality time, a romantic getaway usually does the trick. Why not turn it into a short overseas escape? Here's a round-up of credit card promos that can help you book for a little less.

If you're flying with a Citibank card, there's a solid spread of airline discounts to tap on — with savings ranging from seven per cent to 10 per cent off across flights to dozens of destinations worldwide, from regional routes to long-haul trips:

HSBC's airline offers see a slight upgrade this year. EVA Air now offers higher discounts on Up fares (Business, Premium Economy, and Standard Economy), making it a stronger deal than in 2025. Meanwhile, the year-long partnership with Qatar Airways continues under HSBC's Home & Away privilege programme:

DBS continues to pull its weight when it comes to flight deals, with five per cent-10 per cent off airfare and savings of up to $150 across major airlines. That said, 2026 comes with changes worth knowing.

Singapore Airlines luggage freebie is officially gone, replaced by a more practical $50 cash discount per person disbursed monthly — and yes, they go fast. So set an alarm for the second Tuesday of each month.

Emirates has also sweetened the deal with Saver fare discounts of up to 15 per cent for selected European cities, beating last year's cap of 10 per cent.

For UOB, its Travel Insider is still a handy place for Singaporeans to map out their journey and book flights. Selected airline deals are curated for cardholders, with some discounts applied automatically while others require promo codes.

Here's how its current airfare promotions stack up:

OCBC's flight promos are rather curated with a smaller set of airline partnerships continuing into the year, while others like Emirates are still pending renewal for their partnership promos.

Here's what's worth keeping an eye on:

Maybank didn't just copy-paste last year's flight deals into 2026. With refreshed promo codes and extended travel windows, the highlight is Malaysia Airlines-now offering up to 15 per cent off, beating last year's 10 per cent ceiling for some fare tiers:

Instead of taking to the skies, you can also sail the seas this Valentine's Day. Cruise through the day in style with these:

Valentine's Day doesn't have to be all or nothing.

It can be a mix of small gestures, smart choices, and moments that feel personal rather than overdone. Whether you're travelling, staying in, or heading out for a drink or two, these extra tips show how a little planning can add up — without taking anything away from the romance.

Think of this Valentine's getaway as just the beginning. If you're already spending on flights and hotels, you might as well earn rewards that help pay for your next trip — something future you will definitely appreciate.

This is the card for people who like playing the long haul. Book your stay via Citi's travel partners and you'll rack up serious mileage:

Once you're overseas, put your meals, shopping and rides on the same card to earn 2.2 Citi Miles per S$1.

The real win? Citi Miles never expire, so this Valentine's trip could easily become next year's anniversary flight!

Flying Singapore Airlines or Scoot? This card earns its keep without being dramatic about it. You'll earn 3 KrisFlyer miles per S$1 on Singapore Airlines, Scoot, KrisShop and Pelago bookings — all the essentials for planning a proper getaway.

Quick reminder: If you want to unlock bonus miles on dining and transport, you'll have to have $1,000 annual spend with the SIA Group

Not every Valentine's needs a reservation or a dress code. Sometimes, the best dates happen at home — and they're also the easiest to qualify for credit card promos:

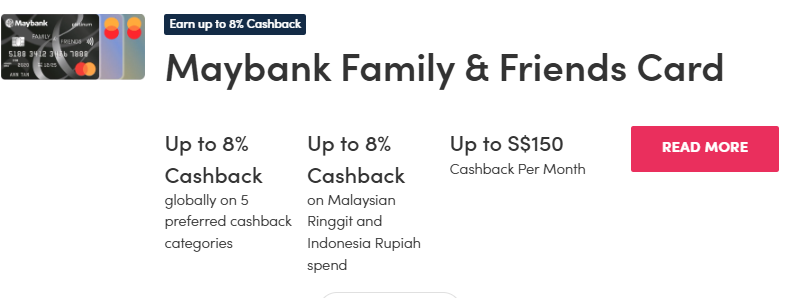

For avid cashback fans, the Maybank Family & Friends Card is another neat alternative. Select "Dining & Food Delivery" and "Groceries" as two of your five preferred categories and enjoy eight per cent cashback-just as long as you hit the $800 monthly spend.

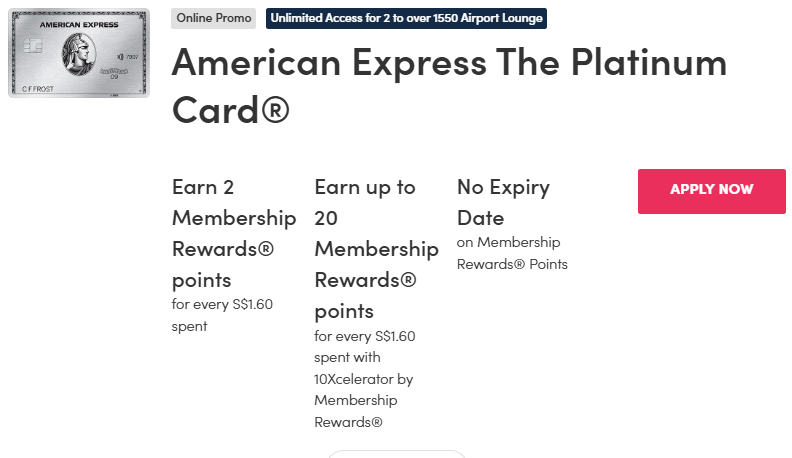

If you're still heading out, yet both parties are more martini-over-mains types, certain American Express cards can make that first round a little sweeter. Via Chillax 2026, you'll enjoy 1-for-1 first drinks at spots like Lady Wu and Here Kitty Kitty — with no 12-course needed. Eligible cards include:

See what entails:

Valentine's doesn't need a master plan or a spreadsheet. A little foresight is all it takes to let rewards work with you, not against you. Explore and choose the card that fits the plan, let the perks fade into the background, and enjoy the date, the trip, or the drinks without a second thought.

This isn't about min-maxing romance — it's about being just a little savvier, so you can give the moment (and the person across that table) your fullest attention!

[[nid:729785]]

This article was first published in MoneySmart.