What an HDB second-timer must know before deciding to sell

Say you've been living in your first HDB flat for five years now (or more), and you're thinking of selling your flat to get a BTO/SBF or resale flat (or upgrade to a new EC).

In an ideal scenario, you'd profit from your first flat, put some of that cash towards your second flat, and put the rest in the bank for a rainy day. Unfortunately, things are not quite that simple for the HDB second-timer.

There's your resale levy to consider, plus the fact that your sale proceeds have to go back to your CPF account before you can take out any cash. In this article, we break it down for you.

HDB considers second-timers as those who have bought their HDB flat through either of these routes:

Essentially, you're considered a second-timer if you have enjoyed a housing subsidy before, and plan to get subsidised housing again.

You're not considered a second-timer if you're buying a resale flat without CPF grants or private property.

Now that we've laid out under what circumstances you're a second-timer, let's dive into what you should know before selling your flat.

Here are a few scenarios in which you have to pay the resale levy:

| First HDB flat | Second HDB flat | Need to pay resale levy? |

|---|---|---|

| BTO/ SBF/ open booking | BTO/ SBF/ open booking | Yes |

| BTO/ SBF/ open booking | New launch EC | Yes |

| Resale flat with grants | BTO/ SBF/ open booking | Yes |

| New launch EC | BTO/ SBF/ open booking | Yes |

If you buy your second subsidised flat before selling your first subsidised flat, your resale levy will be deducted from the sale proceeds, with any shortfall to be paid in cash.

Alternatively, if you sell your first subsidised flat before you buy your second subsidised flat, you'll have to pay your resale levy in cash upon getting the keys to your second flat.

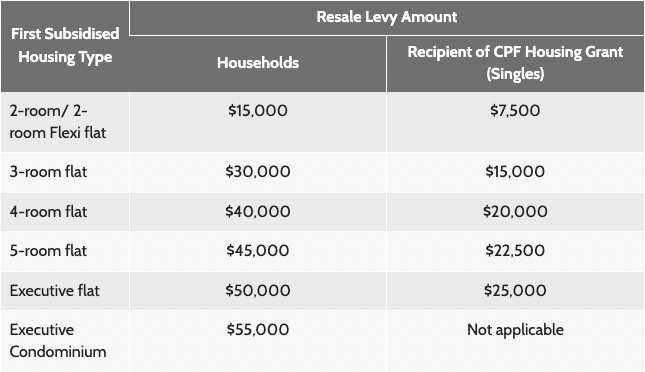

The amount payable depends on the size of your first flat:

Upon selling your flat, you'll also have to refund to your CPF account the principal amount that you've withdrawn, and the 2.5 per cent accrued interest you would have earned if your CPF savings were not withdrawn from your CPF account to pay for the house.

Now, your accrued interest is computed on your principal amount on a monthly basis (at the prevailing CPF Ordinary Account interest rate) and compounded yearly.

What many homeowners fail to realise is that this accrued interest continues to compound even when their flat has been fully paid off. The longer the money is withdrawn from your CPF account, the more interest you'll have to return to your CPF when you sell your flat.

To view your current accrued interest, log into your CPF account and go to "My CPF", followed by "Home ownership" dashboard. Here's where you can see the total amount of CPF monies used for housing and accrued interest.

Alternatively, you can refund back into your CPF account the money (partially or in full) used for housing way before you decide to sell it, under the CPF Voluntary Housing Scheme.

This helps you to reduce the accrued interest that you would need to pay if you were to refund it when you sell your flat.

If you're taking a second HDB concessionary loan, you'll get to keep only 50 per cent of the cash proceeds. You can retain up to $20,000 in your CPF OA account and use the remaining amount to pay for the flat.

So the amount of financing you can get from the second HDB loan will be reduced by the CPF refund and part of the cash proceeds to ensure that you don't overborrow.

If you're taking a second housing loan from HDB, you'll initially be charged commercial interest rates. These rates are pegged to the average non-promotional interest rate for the purchase of HDB flats offered by the three local banks.

After you've sold your current flat, the CPF refund and up to 50 per cent of the cash proceeds from the sale of your flat will be used to reduce the housing loan amount for the next flat.

Once this is done, the loan will be converted to an HDB concessionary loan rate (currently at 2.6 per cent).

You can retain up to $20,000 of the CPF monies refunded in your CPF OA.

Apply for the Enhanced Contra Facility (ECF), which allows you to sell your existing flat and buy another resale HDB flat using the sale proceeds and refunded CPF monies. Do note your refunded CPF monies cannot be used for stamp duty and conveyancing fees.

This allows you to reduce the amount of cash and housing loan needed to pay for the next flat.

However, take note that this facility is only applicable if you're selling your current flat and buying your next flat at the same time.

You'll need to indicate in your resale application forms for both the sale and purchase of the flats that you're opting for ECF and submit these within seven days. On top of that, the buyer of your current flat and seller of your next flat will need to submit their resale application within the same period.

That means it involves coordinating among three parties (you, the buyer of your current house and the seller of your next house) so we suggest hiring an agent to help you with this.

The resale completion takes around eight weeks after HDB accepts the resale application. It's also when HDB invites you and the buyer to attend the completion appointment to handover the property.

[[nid:604298]]

And you'll need to move out of your old house by then.

But what if your next house hasn't finished getting renovated yet? Or you need more time to pack your things?

Renting may not be a good idea if you're only looking to rent for a couple of months (the lease of traditional rents are typically one or two years). As a tenant, it's also not a good time to rent given the sky-high rent prices.

What you can do is to ask your buyer for a Temporary Extension of Stay during the negotiation stage. This arrangement allows you to stay in your old flat for up to three months after the resale completion. You can then make the request in your resale application, while the buyer will consent to it in their resale application.

You must have committed to buying a completed residential property in Singapore (i.e. you've exercised the Option to Purchase (OTP) or signed the Sale and Purchase Agreement)

You must not be renting out the whole flat during the resale application

This also means that you can't request for this if you're buying a BTO or EC that isn't completed yet.

It's also recommended that you and the buyer have a written agreement for this, including any payments for this.

This is because during the extension, the buyer is the owner of the flat, so they will be paying the costs and expenses of the house. This includes:

Plus, this extension puts a delay in the commencement of the buyer's Minimum Occupation Period (MOP).

So if your next house isn't ready yet, don't forget to negotiate with your buyer to request for an extension.

In the current hot market, it may be a good time to cash out and sell your flat and move to your next property, whether it's a bigger flat, condo or a smaller flat.

At the same time, don't forget about the costs incurred on your current flat, such as the resale levy, the amount to return to your CPF account and other miscellaneous expenses.

Bearing this in mind, make sure you do your sums clearly so that you won't get stuck in a tight spot. You can use HDB's Sale Proceeds Calculator to estimate the amount of cash you'll receive from the sale of your flat. Good luck!

ALSO READ: 7 useful questions to ask your property agent before you buy or sell your property

Additional reporting by Virginia Tanggono