Your Medisave account in Singapore - How to make the most of it

Every month, a chunk of your salary gets deposited into your CPF Medisave Account. If you’re self-employed, you can’t escape this either as you’re forced to make Medisave contributions every time tax season rolls around. There are no two ways around it—the government says you have to, and so it must be.

But how many of you have actually successfully used your Medisave funds or even know what they can be used for? There’s a good chance that those who are still young and healthy have no clue.

Your Medisave account, as the name suggests, contains money that is set aside to pay healthcare costs.

But that doesn’t mean you can try to pay using Medisave when you’re going to the doctor for an MC because you couldn’t wake up for work. You’re only allowed to tap into your Medisave funds in certain situations, and there are usually limits on how much you can withdraw.

Ultimately, that cash in your Medisave account is your money. So it pays to know when you can use it and how, so you can squeeze as much utility as you can out of every cent you put in.

By the end of this article, you’ll understand what you can use your Medisave on and how to use it.

WHAT IS A MEDISAVE ACCOUNT AND WHERE CAN YOU FIND IT?

[embed]https://www.youtube.com/watch?v=V2akdRnUKxI[/embed]

Central Provident Fund (CPF) savings play a huge role in Singapore’s social security system. A set of CPF accounts is opened for every Singapore Citizen and Permanent Resident as follows:

To check the balance in your Medisave account and other CPF accounts, simply log in to the CPF website using your Singpass.

HOW MUCH IS THE MEDISAVE CONTRIBUTION?

Every month, a chunk of your salary gets deducted before your boss hands it over to you, and is deposited into your CPF accounts. The bulk of your CPF contributions go into your OA.

| Your age | CPF contribution rates | ||

| By Employer (% of wage) | By Employee (% of wage) | Total % of wage | |

| 55 and below | 17 | 20 | 37 |

| Above 55 to 60 | 13 | 13 | 26 |

| Above 60 to 65 | 9 | 7.5 | 16.5 |

| Above 65 | 7.5 | 5 | 12.5 |

The percentage that gets deducted from your salary is under the “By Employee” section. So if you’re under the age of 55, 20% of your salary gets deducted every month and deposited into your CPF accounts.

That means that if your salary is officially $4,500, $900 (20% x $4,500) of that money will be deducted every month and deposited into your CPF accounts. Your take-home pay will thus be $3,600.

(In case you’re wondering, the figures under the “By Employer” column indicate how much your employer needs to fork out IN ADDITION to your salary and deposit into your CPF accounts. No wonder your boss is always in a foul mood! You’re thus receiving the equivalent of 37% of your salary in your CPF accounts every month if you’re under the age of 55, even though only 20% gets deducted from your salary.)

But what we’re interested in right now is the money in your Medisave Account. So, how much of your salary is going into this account?

| Your age | Allocation rates for monthly wages of $750 and above | ||

| Ordinary Account (% of wage) | Special Account (% of wage) | Medisave Account (% of wage) | |

| 35 and below | 23 | 6 | 8 |

| Above 35 to 45 | 21 | 7 | 9 |

| Above 45 to 50 | 19 | 8 | 10 |

| Above 50 to 55 | 15 | 11.5 | 10.5 |

| Above 55 to 60 | 12 | 3.5 | 10.5 |

| Above 60 to 65 | 3.5 | 2.5 | 10.5 |

| Above 65 | 1 | 1 | 10.5 |

You’ll notice an interesting pattern here. As you age, a smaller and smaller percentage of your salary gets deposited in your OA and SA. Conversely, your Medisave contribution actually INCREASES from the age of 35 to 50.

WHEN DOES MONEY GET DEPOSITED INTO YOUR MEDISAVE ACCOUNT?

When your Medisave account gets its contributions depends on your employment situation.

[[nid:439443]]

Your employer is required to make the deposit of your CPF contributions, including your Medisave contributions, by the end of each month. You should be able to see your CPF and Medisave contributions reflected in your account balance when you log into the CPF portal soon after.

You are also entitled to late payment interest at a rate of 1.5% for every day after the end of the month your employer is late by.

If your CPF contributions still have not come in by the 14th of the following month (or on the next working day if the 14th is a weekend or public holiday), your employer has defaulted.

If you suspect that your employer has not been making your CPF contributions promptly or is trying to cheat you out of them (as some employers have been found guilty of doing), make sure you remind them and, if they still persist, raise the issue with MOM.

Self-employed people are not required to make contributions to their CPF Ordinary or Special Accounts.

But guess what, Medisave contributions are compulsory so long as you earn more than $6,000 in a year (after deducting all allowable business expenses, capital allowances and trade losses as approved by IRAS).

The Medisave contribution rate for self-employed persons is as follows.

| Below 35 years | 35 to below 45 years | 45 to below 50 years | 50 years and above | |

| Above $6,000 to $12,000 | 4% | 4.5% | 5% | 5.25% |

| Above $12,000 to $18,000 | 4% to 8%, calculated according to this formula: [[480+0.1600(NTI-12000)]x100/NTI | 4.5% to 9% calculated according to this formula: [[540+0.1800(NTI-12000)]x100/NTI | 5% to 10% calculated according to this formula: [[600+0.2000(NTI-12000)]x100/NTI | 5.25% to 10.5 % calculated according to this formula: [[630+0.2100(NTI-12000)]x100/NTI |

| Above $18,000 | 8% (max $5,760) | 9% (max $6,480) | 10% (max $7,200) | 10.5% (max $7,560) |

As you can see, the Medisave contribution rates for self-employed persons earning $18,000 and above per year are the same as those for employees.

To make things simple for you, you can use the CPF Board’s Self-Employed Medisave Contribution Calculator to see exactly how much you need to contribute this year.

Every year during tax season, after filing your taxes, IRAS will send you a Notice of Computation indicating the amount of Medisave contributions you need to make, calculated based on your income and age.

You will then have 30 days to deposit the money into your CPF account. This can be done on your bank’s internet banking website.

HOW MUCH DO YOU GET IN MEDISAVE INTEREST?

All the money in your CPF accounts earns interest, but the interest rates vary depending on which account they’re in.

Your Medisave balance currently earns interest at a rate of 4% per annum. This is an extremely good rate, considering it is completely risk-free.

WHAT IS THE MEDISAVE LIMIT AND WHAT HAPPENS WHEN YOU EXCEED IT?

So maybe you’ve got a huge income and actually want to deposit more money into your Medisave account. After all, the 4% risk-free interest rate is very attractive, and since you estimate that your healthcare costs will be much higher when you’re older, why not?

[[nid:438375]]

Well, there is actually a maximum amount of money your Medisave Account can contain. That is known as the Basic Healthcare Sum (BHS).

The BHS is adjusted every year in January, and in 2019 is $57,200 for those aged 65 and below. Once you turn 65, your BHS is frozen and no longer rises.

The BHS is the maximum your Medisave Account can contain. If you try to top up your Medisave Account above the BHS, any excess money goes into your Special Account (if you’re under the age of 55) or Retirement Account (if you’re 55 and older). The good news is that like your Medisave Account, your Special/Retirement Account also earns interest at a rate of 4%.

The Basic Healthcare Sum is designed to be a ceiling rather than a floor, so it does not affect how much you can withdraw. Even if you don’t meet the Basic Healthcare Sum, you can still use Medisave for approved purposes, or withdraw your CPF RA savings when you reach the age of 55.

WHAT CAN YOU USE MEDISAVE FOR?

So this is the question we all have on our lips. What can we actually use the money in our Medisave accounts for?

Unless otherwise stated, you can use your Medisave money to pay for not just yourself, but also immediate family members.

To learn more, please visit the MOH webpage on Medisave Withdrawal Limits.

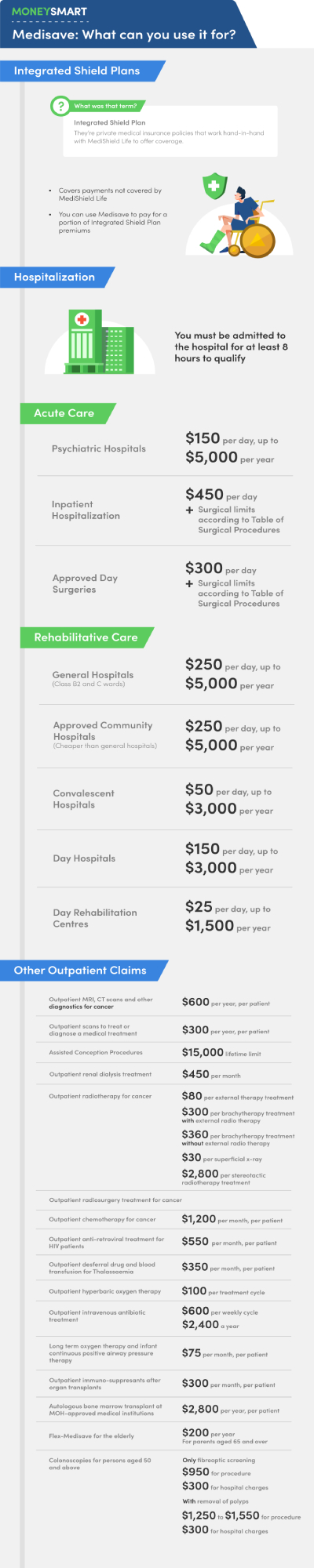

INTEGRATED SHIELD PLANS

Even if you are in perfect health, your Medisave funds can still come in handy. You can use yours to buy private medical insurance that can cover payments above what MediShield Life covers, and above what the Medisave withdrawal limits allow.

Integrated Shield Plans are private medical insurance policies that work hand-in-hand with MediShield Life to offer coverage. Your insurance will cover the payments that are not covered by MediShield Life. This is crucial if you intend to use private hospitals or upgrade to B1 and above wards.

You can use Medisave to pay for a portion of your Integrated Shield Plan premiums. The withdrawal limits are as follows:

HOSPITALISATION

| Acute Care | |

| Inpatient hospitalisation | $450 per day + Surgical limits according to the Table of Surgical Procedures |

| Approved day surgeries | $300 per day + Surgical limits according to the Table of Surgical Procedures |

| Inpatient hospitalisation (for psychiatric treatment) | $150 per day up to $5,000 a year |

| Rehabilitative Care | |

| Stay in approved community hospitals | $250 per day up to $5,000 a year |

| Day rehabilitation centres | $25 per day, up to a maximum of $1,500 per year |

| Stay in approved convalescent hospitals | $50 per day, up to a maximum of $3,000 a year |

Medisave can be used to pay medical bills, but the catch is that your condition must be serious enough to warrant a withdrawal. And hospitalisation is one indicator that you’re ill enough.

You must be admitted to the hospital for at least 8 hours to qualify under this category.

There are several types of institutions you can make a withdrawal at, such as the following:

GENERAL HOSPITALS

You are allowed up to $450 a day for stays at public hospitals. This sum includes up to $30 for doctor’s daily attendance fees (if your doctor’s attendance fees exceed $30 you’ll need to pay the excess on your own). For psychiatric treatment, your yearly cap is $5,000.

The Medisave withdrawal limits are meant to cover stays in Class B2 and C wards at public hospitals. So if you choose to go private or upgrade to a Class B1 or A ward, your Medisave will not cover the full stay, and you’ll have to top up the difference.

APPROVED COMMUNITY HOSPITALS

Community hospitals are cheaper than general hospitals, and are usually targeted at patients who are not critically ill, but who might need rehabilitation, such as after a fracture.

You get to use up to $250 a day for daily hospital charges, including $30 for doctor’s daily attendance fees. You’re allowed to claim up to $5,000 a year for stays at community hospitals.

CONVALESCENT HOSPITALS

You can also make claims for convalescent hospital stays at a lower withdrawal limit of $50 a day, which includes $30 for doctor’s attendance fee. Your yearly cap for convalescent hospital claims is $3,000.

PSYCHIATRIC HOSPITALS

Stays in psychiatric hospitals are also eligible for claims of up to $150 a day, including up to $50 a day for doctor’s fees. You can claim up to $5,000 a year for stays in psychiatric hospitals.

APPROVED SURGICAL OPERATIONS AND DAY SURGERY

You can make claims for surgical operations regardless of whether you are warded at the hospital overnight or not.

The amount you can claim for the surgical procedure depends on the type and complexity of the operation. This can range anywhere from $250 to $7,550. Be sure to ask your healthcare provider how much of the cost of any surgical procedure you’ll be able to pay for using Medisave.

Getting day surgery and going home right after that? You can still withdraw up to $300 per day for daily hospital charges, including up to $30 for doctor’s daily attendance fees.

TREATMENT AT DAY HOSPITALS OR DAY REHAB CENTRES

[embed]https://www.youtube.com/watch?v=p8wIeX4jHuM[/embed]

If you’re receiving treatment at a day rehab centre or day hospital, you can make a claim even if you’re not technically being warded.

You can claim up to $25 a day for treatment at day rehabilitation centres and a maximum of $1,500 a year.

Your claim limit for treatment at day hospitals is $150 a day, including a maximum of $30 for doctor’s fees, and a max of $3,000 a year.

OUTPATIENT TREATMENT

When you seek outpatient treatment at hospitals, it means you are not warded. Generally, you are not allowed to pay with Medisave when you seek outpatient treatment at hospitals.

BUT, if you are suffering from one of the illnesses approved under the Chronic Disease Management Programme, you can make a claim for outpatient treatment even if you are not hospitalised.

You are entitled to claim up to $400 a year to manage diseases under the Chronic Disease Management Programme, subject to 15% co-payment. When calculating spending limited by the $400 cap, you must also include money spent on vaccinations and mammogram or newborn screening.

Here are the conditions that enable you to make claims for outpatient treatment:

You can also make outpatient claims for the following procedures.

MATERNITY

Are you or a family member expecting? You can withdraw up to $450 for each day in the hospital and up to $900 for pre-delivery medical expenses.

Also, you will be allowed to withdraw an additional $750 for vaginal delivery and up to $2,150 for caesarian delivery.

It doesn’t matter whether you are at a public or private hospital, although if you go over the withdrawal limits you will of course have to foot the remainder of the bill.

SCREENING

Just because you’re not sick doesn’t mean you can’t use your Medisave funds. You can make withdrawals to pay for the following types of screening:

Make sure you go to an approved screening centre so your claim will be valid. You can find a list of approved centres for mammograms and colonoscopies here.

VACCINATION

You can use Medisave to pay for certain vaccinations. Your withdrawal limit is $400 a year, and this limit includes not just vaccinations but also money spent on screening and treating the illnesses under the Chronic Disease Management Programme.

Here are the approved vaccinations:

END-OF-LIFE CARE

| End-of-Life Care | |

| Stay in approved hospices | $200 per day |

| Home palliative care/Day hospice care | $2,500 per patient per lifetime The $2,500 Medisave lifetime withdrawal limit is shared between home palliative (adults and paediatrics) care and day hospice care. For day hospice and adult home palliative patients diagnosed with terminal cancer or end stage organ failure, there will not be any withdrawal limit if the bill is paid using the patient’s own Medisave Account. |

You can withdraw up to $2,500 in a lifetime per patient for day hospice and home palliative care.

And if you’re withdrawing your Medisave funds to use for yourself and not a family member, no withdrawal limit will be imposed on you if you’ve been diagnosed with terminal cancer or end stage organ failure.

MEDISAVE WITHDRAWAL - HOW TO CLAIM?

[[nid:449999]]

You can make withdrawals from your Medisave account by filling in the Medical Claims Authorisation Form authorising the medical institution to use your Medisave funds to cover your treatment.

You must also submit the form if you are using MediShield Life and an Integrated Shield Plan to pay for your treatment.

The good news is that hospitals and other medical institutions will be able to help you with the administrative work. Just tell them you want to use your Medisave/MediShield/Integrated Shield Plan to pay and ask if they can help you with the paperwork.

If you’re tired of filling out the form every single time you want to make Medisave withdrawals, you can submit the Medical Claims Authorisation Form (Multiple Institutions) to authorise the use of Medisave, MediShield Life and your Integrated Shield Plan to be used for current and future medical treatment at all participating institutions, which include most of Singapore’s hospitals, polyclinics as well as the National Cancer/Dental/Heart/Skin/Eye centres.

This article was first published in MoneySmart .