10 best savings accounts in Singapore with the highest interest rates (December 2025)

Boy, 2025 sure has been a whirlwind for savers. As we amble into the last month of the year, let's take a look at what 2025 has had in store for our favourite savings accounts:

The savings account landscape has changed and continues to change fast. Banks are making it trickier than ever to score the top rates. Between ever-shifting hoops-salary credit, card spend, insurance, investments, and more-savvy savers need to keep up with the latest updates.

To help you out with navigating savings accounts in Singapore, we've compiled the best savings accounts in Singapore with the highest interest rates in 2025 for different personal and financial needs.

Note: We update this article on a monthly basis with the latest rates. The rates below were updated on 1 Dec 2025.

| Savings account | Effective interest rates (p.a.) | Best for |

| Standard Chartered BonusSaver | Up to 8.05% (on first $100,000, fulfil 4 criteria) | High spenders |

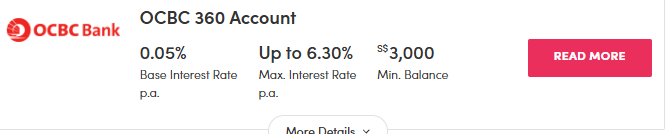

| OCBC 360 | Up to 5.45% (on first $100,000, fulfil 5 criteria) | Lower income earners ($1,800 min. salary) |

| Citi Wealth First Account | Up to 7.51% (on first $50,000 – $500,000, fulfil 5 criteria) | Those with other Citibank products |

| Bank of China Smart Saver | Up to 4.60% (on first $100,000, fulfil 4 criteria) | High spenders |

| UOB One | Up to 1.90% (on first $150,000, fulfil 2 criteria) | Freelancers & self-employed |

| Maybank Save Up | Up to 3.33% (on first $75,000, fulfil 3 criteria) | Home, education, car loan users |

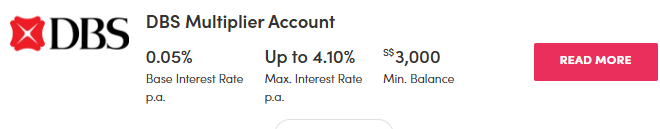

| DBS Multiplier | Up to 4.10% (on first $50,000 – $100,000, fulfil 3 criteria) | Salaried workers |

| CIMB FastSaver | 2.50% (on first $25,000, fulfil 2 criteria) | Young adults starting their careers |

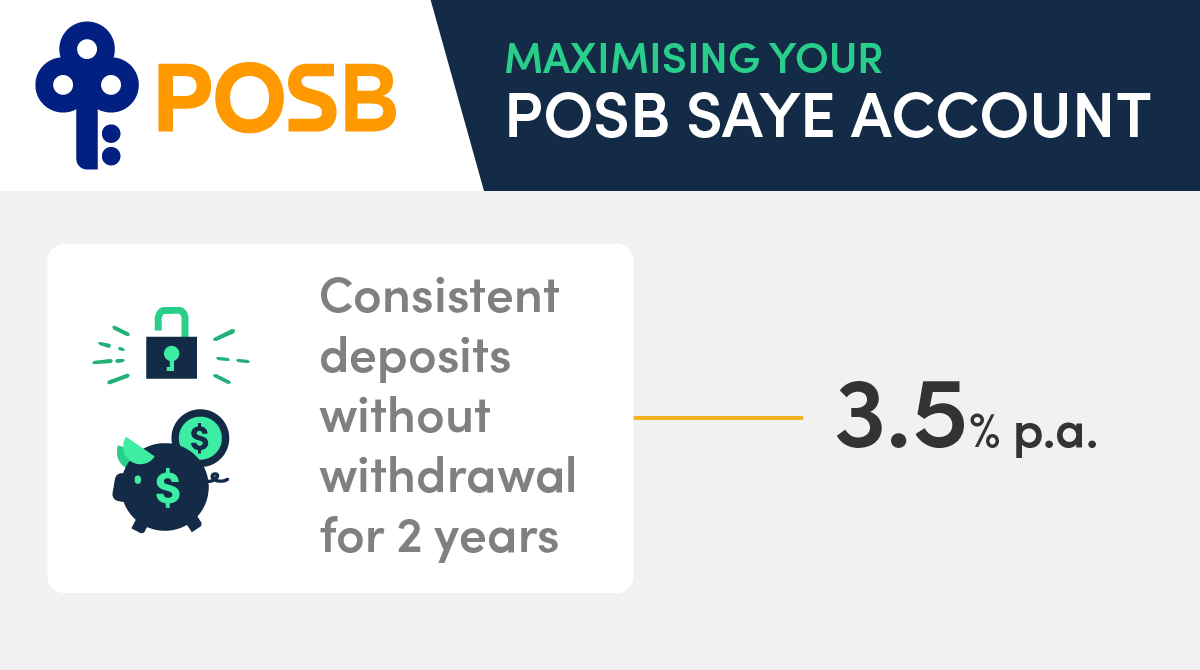

| POSB SAYE (Save As You Earn) | 3.50% (just deposit and maintain money, no criteria to fulfil!) | Students or first-jobbers |

| HSBC Everyday Global Account | Up to 3.10% (register and qualify for the HSBC Everyday+ Rewards Programme) | HSBC Everyday+ Rewards Programme, HSBC Everyday Global Debit Card users |

Most savings accounts require you to jump through a whole bunch of hoops to enjoy their best rates. But let's be realistic here. Most of us aren't going to be taking a home loan, buying insurance from the bank, and investing with the bank-and certainly not all at the same time.

What will you earn if you only fulfil two or three criteria, such as crediting your salary and spending on your credit card? Here's our realistic summary for those with $50,000 and $100,000 to stash away:

| Savings account and the 2-3 easiest requirements to fulfil | Effective interest rate and earnings on first $50,000 | Effective interest rate and earnings on first $100,000 |

| Citi Wealth First Account Save $3,000/month + Spend $250/month | 3.01% (up to first $50,000) You earn: $1,505 per year (~$125 per month) | 1.53% p.a. (for regular Citibanking customers, 3.01% only applies to the first $50,000) You earn: $1,530 per year ($128 per month) |

| Standard Chartered BonusSaver Credit min. $3,000 salary + Spend $1,000/month | 3.05% p.a. (up to first $100,000) You earn: $1,525 ($127.08 per month) | 3.05% p.a. (up to first $100,000) You earn: $3,050 ($254.17 per month) |

| UOB One Credit min. $1,600 salary + Spend $500/month | 1.00% p.a. (up to first $75,000) You earn: $500 per year (~$42 per month) | 1.38% p.a. (EIR on first $100,000) You earn: $1,375 per year (~$115 per month) Note: The maximum EIR of 1.90% p.a. applies on first $150,000. |

| OCBC 360 Credit min. $1,800 salary + Spend $500/month + Save $500/month | 2.05% p.a. (up to first $75,000) You earn: $1,025 per year (~$85 per month) | 2.45% p.a. (EIR on first $100,000) You earn: $2,450 ($204 per month) |

| Bank of China SmartSaver Credit min. $2,000 salary ($3,000 from 1 Nov 2025) + Spend $750/month | 1.20% p.a. (up to first $100,000) You earn: $600 per year (~$50 per month) | 1.20% p.a. (up to first $100,000) You earn:$1,200 per year (~$100 per month) |

| Maybank Save Up Programme Credit min. $2,000 salary + Spend $500/month | 1.24% p.a. (up to first $50,000) You earn: $619 per year (~$52 per month) | 1.12% p.a. (EIR on first $100,000, since bonus interest only applies to the first $75,000) You earn: $1,121.50 per year (~$93 per month) |

| DBS Multiplier Credit salary + 1 category ($500 min. in monthly transactions) | 1.80% p.a. (up to first $50,000) You earn: $900 per year (~$75 per month) | 0.925% p.a. (since 1.80% p.a. only applies up to first $50,000) You earn: $927 per year (~$77 per month) |

| CIMB FastSaver Credit salary/schedule GIRO transfer + Spend $800/month on CIMB Visa Signature Credit Card | 1.79% p.a. (up to first $50,000) You earn: $1,040 per year (~$87 per month) | 1.42% p.a. (EIR on first $100,000) You earn: $1,790 per year (~$149 per month) |

| POSB SAYE (Save As You Earn) No requirements, but cannot withdraw for 2 years | 3.50% p.a. You earn: $1,750 per year (~$146 per month) | 3.50% p.a. You earn: $3,500 per year (~$292 per month) |

| HSBC Everyday+ Rewards Programme Deposit min. $2,000 and make 5 transactions | Up to 3.10% p.a. interest + 1% cashback (capped at $300 a month) You earn: $1,550 per year (~$129 per month) (excludes cashback) | Up to 3.10% p.a. interest + 1% cashback (capped at $300 a month) You earn: $3,100 per year (~$258 per month) (excludes cashback) |

Note: The table above assumes you have a regular banking relationship. If you earn more, spend more, or are a premier or private banking client, you may enjoy better rates. Read the individual sections on each savings account below to find out more.

Citibanking, Citi Priority | Citigold | Citigold Private Client |

| Deposit amount | First $50,000 | First $250,000 |

| Base interest rate | 0.01% p.a. | |

| Spend (min. $250/month on Citibank Debit Mastercard) | 1.5% p.a. | |

| Invest (min. $50,000/month) | 1.5% p.a. | |

| Insure (min. $50,000/month) | 1.5% p.a. | |

| Borrow (min. $500,000 home loan) | 1.5% p.a. | |

| Save (min. $3,000/month) | 1.5% p.a. | |

| TOTAL | 7.51% p.a. | |

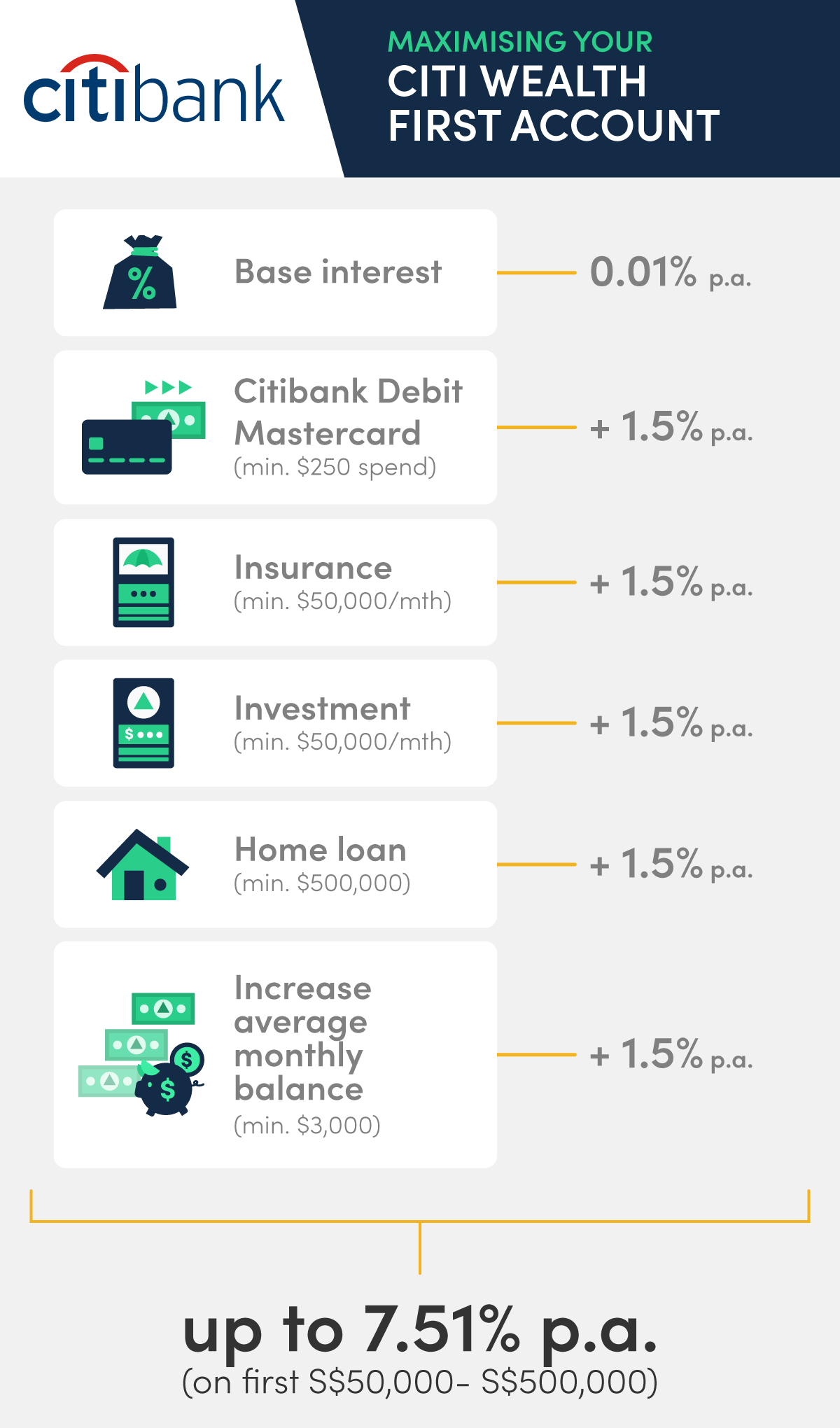

The Citi Wealth First Account has a simple mechanic for calculating its total interest rate: base interest (0.01 per cent) + bonus interest (up to 7.50 per cent).

Its base interest starts at 0.01 per cent for everyone, whether you're a Citibanking, Citi Priority, Citigold, or Citigold Private Client customer. That's the lowest base interest rate out of all the savings accounts on this list.

Next, beef up that measly 0.01 per cent up with bonus interest rates. You get different bonus rates depending on which of the following categories you fulfil:

If you fulfil all of the transaction categories above, the maximum interest rate you can get with the Citi Wealth First Account is a generous 7.51 per cent. That's one of the highest rates among the savings accounts this month.

Plus, it applies to the first $50,000 to $150,000 in your account, and not just the first $25,000 after the first $100,000 or something like that (looking at you, UOB One). That means 7.51 per cent p.a. is the effective interest rate!

Realistically speaking, most of us can only deposit our salaries in the account, i.e. "Save", and "Spend". If you only fulfil these two criteria, you'll earn 3.01 per cent p.a. interest on the Citi Wealth First Account. That's $1,505 earned per year from your first $50,000.

The only advantage to starting a Citigold or Citigold Private Client banking relationship is that the bonus interest rates can apply to a larger sum of money. For Citibanking and Citi Priority customers, bonus interest rates are applied to only the first $50,000, according to the Citi Wealth First T&Cs (Clause 7). This increases to $250,000 for Citigold and $500,000 for Citigold Private Client.

Citi Wealth First Account

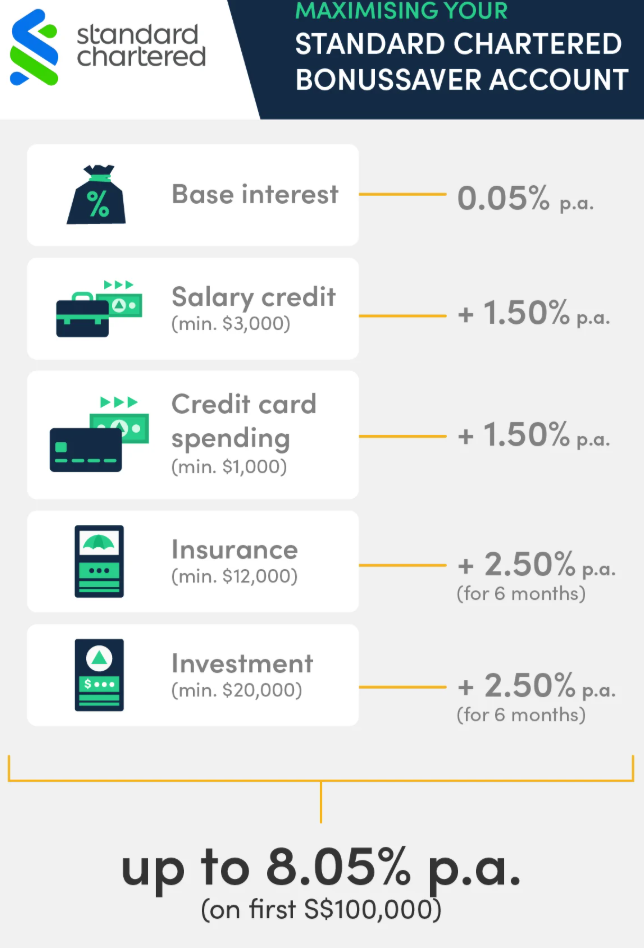

The Standard Chartered BonusSaver savings account just got a boost. After being nerfed on 1 Jan 2025 to a maximum interest rate of 6.05 per cent p.a., it's now back up to a maximum of 8.05 per cent p.a.-the highest in the account's history.

Here's a breakdown of the changes that took effect on June 1, 2025:

| Transactions | Current interest rates |

| None (base interest) | 0.05% |

| Salary credit (min. $3,000) | |

| Credit card spending (min. $1,000) | |

| Invest in eligible unit trust (min. $20,000) | |

| Buy eligible insurance (min. $12,000) | |

| Total interest |

While 8.05 per cent p.a. is very high, it isn't easy to hit this maximum interest rate on the Standard Chartered BonusSaver. You'd need to fulfil all four requirements: credit your salary, spend on your credit card, invest, and buy insurance. Tough!

If you only catch the lowest hanging fruit, salary credit and credit card spending, you'll still earn a decent 3.05 per cent p.a. However, for meeting the same two requirements, even the nerfed UOB One Account (3.30 per cent p.a. on first $150,000) is more attractive. If you can also save at least $500 a month, the OCBC 360 account (3.30 per cent p.a. on first $100,000) is also comparable.

On the plus side, 8.05 per cent p.a. is applied to the entire sum of $100,000, whereas accounts like the UOB One savings account are only going to give the highest interest rate to a smaller sum based on a tiered system. (Check our review of the UOB One account to see the effective interest rates on the entire $100,000 sum.)

Do note that you only get the bonus interest for crediting your salary if you're earning at least $3,000 per month. If you earn less, I suggest the OCBC 360 savings account instead-it'll give you 2.00 per cent p.a. interest on your first $100,000 for crediting a minimum salary of $1,800.

Standard Chartered Bonus Saver

The UOB One Account did us all a great service from December 2022 to April 2024, offering a rate of up to 7.80 per cent (EIR: 5.00 per cent p.a.) back then for simply spending on a UOB credit card and crediting our salaries to the account. Oh, the glory days.

But Singapore's highest interest savings account relinquished its throne on 1 May 2024 when it reduced its maximum interest rate to 6.00 per cent p.a. (EIR: 4.00 per cent p.a.). Exactly one year later, it got nerfed again on May 1, 2025 (up to 5.30 per cent p.a., EIR: 3.30 per cent p.a.).

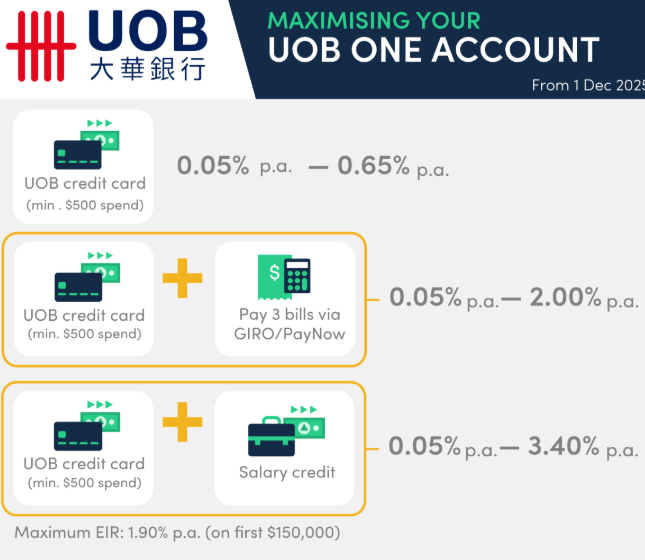

And now, from Dec 1, 2025, we're looking at an EIR of just 1.90 per cent p.a. with the UOB One Account.

UOB One savings account interest rates

| Account Monthly Average Balance | $500 spend per month on eligible UOB Card | $500 spend per month on eligible UOB Card + 3 GIRO debit transactions | $500 spend per month on eligible UOB Card + credit salary via GIRO |

| First $75,000 | 0.65% | 1.00% | |

| Next $50,000 | 0.05% | 2.00% | |

| Next $25,000 | 0.05% | 0.05% | |

| Above $150,000 | 0.05% | 0.05% | 0.05% |

The highest tiered interest is now 3.4 per cent p.a., down from 4.50 per cent p.a.

However, remember that the advertised interest rates above are only applied on specific tiers-for example, the 3.40 per cent only applies to the $25,000 after your first $125,000.

To properly assess your earnings with the UOB One Account, what you need to look at is the effective interest rate-the true interest rate on the full amount you deposit in your UOB One Account.

Effective interest rates on UOB One Account (p.a.) | ||

| Account Monthly Average Balance | $500 spend per month on eligible UOB Card | $500 spend per month on eligible UOB Card + 3 GIRO debit transactions |

| $75,000 | 0.65% | 1.00% |

| $125,000 | 0.41% | 1.40% |

| $150,000 | 0.35% | 1.18% |

The maximum EIR you can earn with UOB One is 1.90 per cent (from Dec 1, 2025) on your first $150,000. This assumes you spend on a UOB credit card and credit your salary to the account (we'll get to the mechanics in the sub-section below).

While it is a drop, the 1.90 per cent p.a. is at least simple to achieve-just fulfil two easy criteria of crediting your salary and spending on a UOB card.

However, comparatively, Standard Chartered will give you a higher rate of 2.05 per cent p.a. to fulfil the same criteria.

There's also the OCBC 360 savings account, which is the closest competitor to UOB One. It offers 2.45 per cent p.a. for those who credit their salary, spend on an OCBC credit card, and save at least $500 a month.

Although this rate is higher, note that the last criterion of saving money puts some restrictions on your account withdrawals-you have to make sure your average balance increases by $500 each month.

How to maximise interest on the UOB One savings account

At least UOB didn't change the mechanics of how to earn bonus interest on the UOB One. That means this advantage of the UOB One account remains intact-its criteria to snag the highest interest rate is easy peasy. You only need to fulfil these 2 requirements:

Credit your salary to the UOB One account via GIRO

Spend at least $500 spend per month on an eligible UOB Card

The eligible cards you can hit the $500 spend on are:

Among these cards, the UOB One Card is one of the best cards to pair with the UOB One savings account. Find out why in our full review of the UOB One account.

If you prefer a card with $0 minimum spend, the recently revamped UOB Lady's Card is right up your alley. And yes, men can apply too!

UOB One savings account

| Transactions | Interest rate (first $75,000) | Interest rate (next $25,000) |

| None (base interest) | 0.05% | 0.05% |

| Salary credit (min. $1,800, GIRO/FAST/PayNow) | + 1.20% | + 2.40% |

| Increase average monthly balance (min. $500) | + 0.40% | + 0.80% |

| Spend (min. $500 on selected OCBC credit cards) | + 0.40% | |

| Insure in selected products (min $2,000) | + 1.20% (first 12 months) | + 2.40% (first 12 months) |

| Invest in selected products (min. $20,000) | + 1.20 % (first 12 months) | + 2.40% (first 12 months) |

| Maintain average daily balance of min. $250,000 | + 2.00% | |

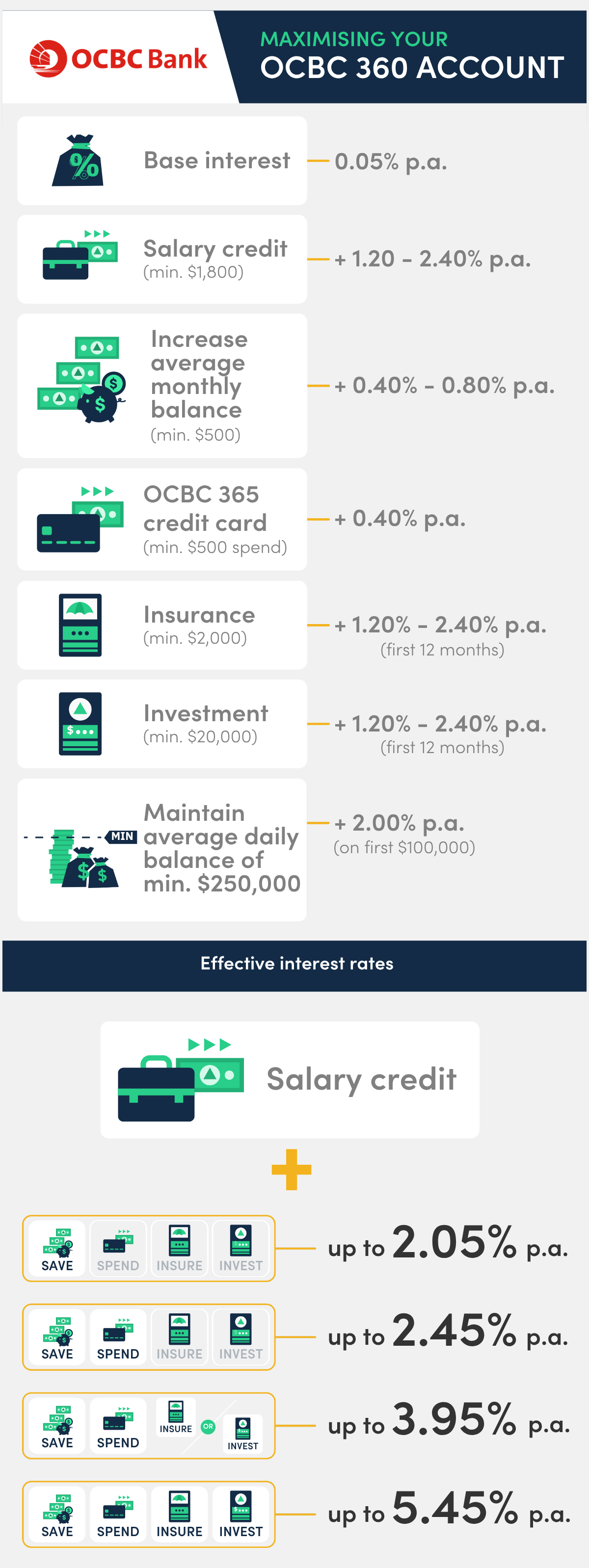

The OCBC 360 savings account starts at a base interest of 0.05 per cent p.a. You get this on any amount you put in the account.

From there, the OCBC 360 savings account then gives you varying bonus rates for crediting your salary, spending on your credit card (minimum of $500/month), growing your balance, insuring and investing. You can mix and match the criteria you want to fulfil to unlock different interest rates. However, these bonus rates apply only to the first $100,000 in your account.

Depending on the combination of criteria you fulfil, this is what your maximum Effective Interest Rate (EIR) will be on your first $100,000:

| Criteria met | Effective interest rate | Interest earned (on $100,000) |

|---|---|---|

| Salary + Save | 2.05% p.a. | $2,050 |

| Salary + Save + Spend | 2.45% p.a. | $2,450 |

| Salary + Save + Spend + Insure or Invest | 3.95% p.a. | $3,950 |

| Salary + Save + Spend + Insure + Invest | 5.45% p.a. | $5,450 |

Realistically, most of us will likely only fulfil three criteria: Salary, Save, and Spend. Once you fulfil these three criteria, the maximum EIR you can enjoy is 2.45 per cent p.a.

To recap, its closest competitor, the UOB One account, currently gives you an EIR of 2.50 per cent p.a., making the two pretty even. So, how do you decide between the 2?

OCBC 360 vs UOB One savings account

In absolute terms, you currently earn 0.55 per cent more with the OCBC 360 one (2.45 per cent p.a.) than the UOB One savings account (1.90 per cent p.a.).

Other plus points in favour of OCBC 360 include:

You might notice that UOB One's 1.90 per cent p.a. applies to the first $150,000, whereas OCBC 360's 2.45 per cent applies to the first $100,000. If you have $125,000, which account is better?

Here's a breakdown based on current structures (as of 1 Dec 2025 for UOB One):

| Deposit Balance | UOB One Account (1.90% p.a. on first $150,000) | OCBC 360 Account (2.45% p.a. on first $100,000, 0.05% thereafter) | Winner (Higher interest) |

|---|---|---|---|

| $75,000 | $1,425.00 | $1,837.50 | OCBC 360 |

| $125,000 | $2,375.00 | $2,462.50 | OCBC 360 (by $87.50) |

| $150,000 | $2,850.00 | $2,475.00 | UOB One |

Calculations are based on annualised rates, before compounding.

In summary:

If you typically keep more than $125,000 in savings and can meet the card spend + salary credit criteria, UOB One gives you the higher overall return — yes, even after the upcoming nerf.

Otherwise, OCBC 360 is the better bet for smaller balances or if you're already crediting your salary there.

OCBC 360 savings account: Additional salary bonus

OCBC is offering new customers an additional 0.50 per cent p.a. interest on their salary bonus for the first two months. This applies if you sign up buy Dec 31, 2025.

The additional 0.50 per cent p.a. brings your salary bonus interest up to 2.00 per cent p.a. for the first two months. While that isn't long, I'd say take what you can get.

| Existing salary bonus interest | Additional salary bonus interest (2 months) | Total salary bonus interest |

|---|---|---|

1.50% p.a. (EIR) | +0.50% p.a. (EIR) | 2.00% p.a. (EIR) |

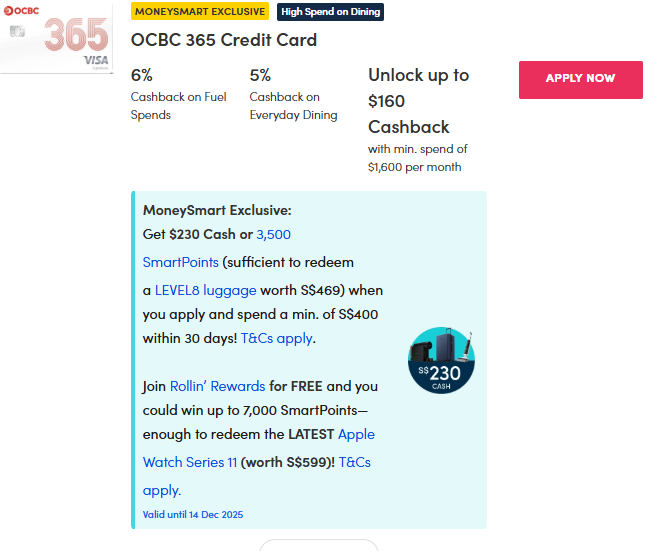

Recommended cards for the OCBC 360 savings account

The bonus 0.40 per cent p.a. interest for credit card spending is an easy one to hit, but do note that the $500 monthly spend applies only to selected OCBC credit cards:

My top pick is the OCBC 365 Credit Card for its high cashback rates, subject to a minimum monthly spend of $800:

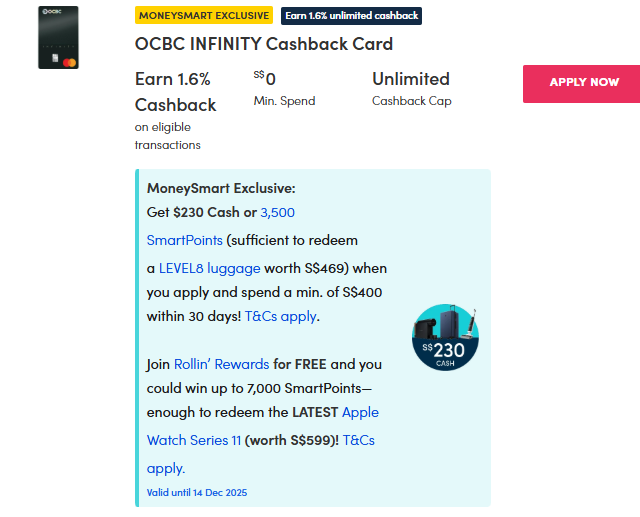

But if you've jumped through enough hoops for your savings account and just want a blanket 1.6 per cent cashback rate from your credit card, the OCBC INFINITY Cashback Card is a better fit.

OCBC 360

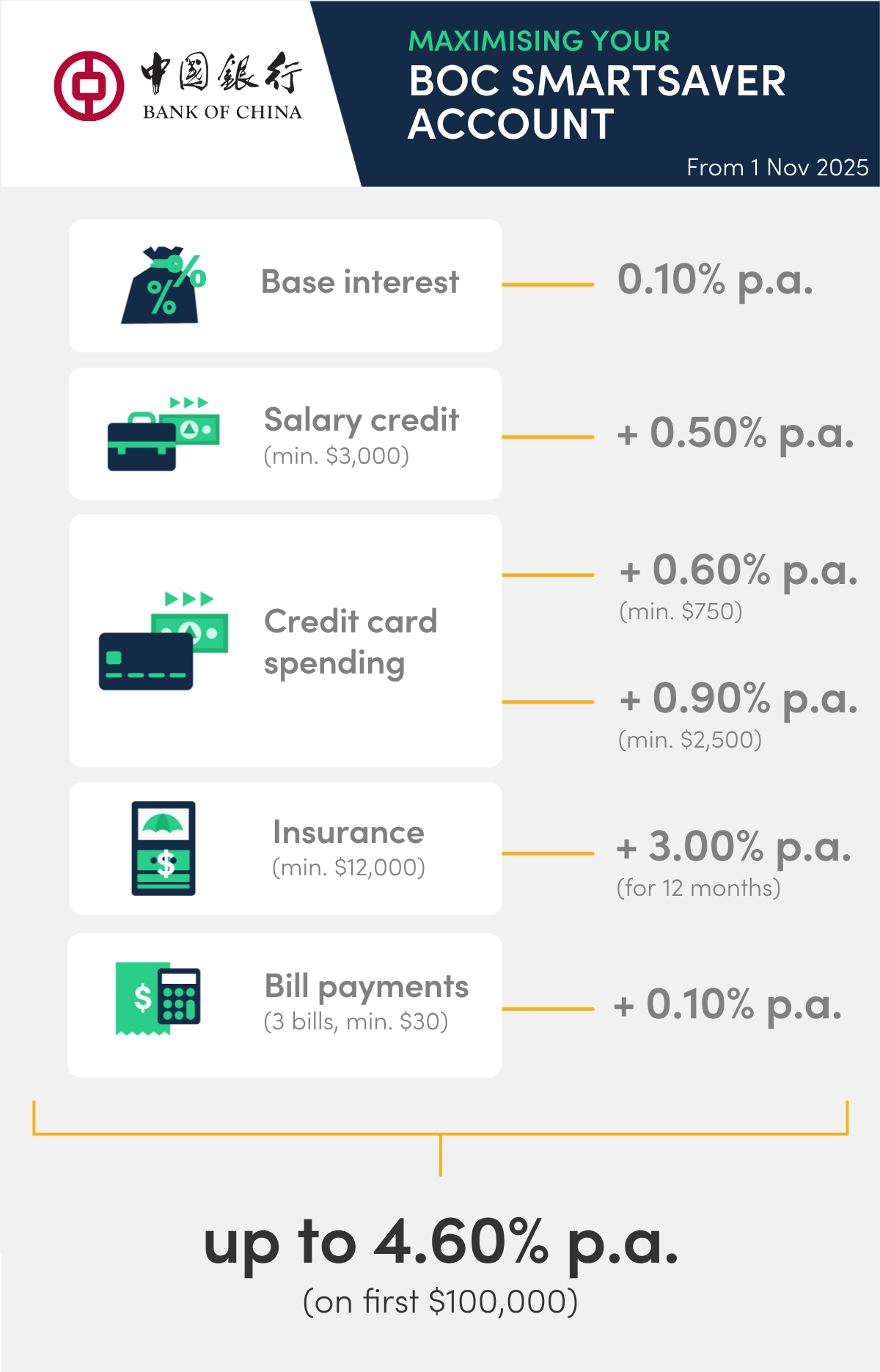

| Transactions | Interest rate |

| None (base interest) | |

| Insurance plan spending | + 3.00% p.a. for 12 consecutive months |

| Salary credit (minimum $2,000 before 1 Nov 2025, increased to $3,000 from 1 Nov 2025) | + |

| Credit card spending | + |

| 3x bill payments of at least $30 each (GIRO or internet/mobile banking) | 0.1% p.a. |

| (For account balance above $100,000) Extra bonus interest when you fulfil any one of the requirements for Card Spend, Salary Crediting or Payment bonus interest |

Source: Bank of China

With the Bank of China SmartSaver account, you now get 0.60 per cent p.a. just for opening the account and crediting your salary to it.

The Bank of China SmartSaver account also awards a wealth bonus of 3.00 per cent per annum for 12 consecutive months. However, to qualify, you'll have to put down a pretty hefty sum on their insurance products. These are your options:

If you max out the bonus interest in all categories, you can currently enjoy a rate of up to 5.35 per cent p.a. on your first $100,000 saved with the Bank of China. After the Nov 1, 2025 nerf, the maximum interest rate on your first $100,000 will drop to 4.60 per cent p.a.

On the other hand, let's say you only credit your salary and spend ($750 a month). You'll earn an interest rate of 0.1 per cent (base) + 0.50 per cent (salary) + 0.60 per cent (credit card) = 1.20 per cent p.a. on your first $100,000. You're better off with OCBC 360 or UOB One.

Bank of China SmartSaver

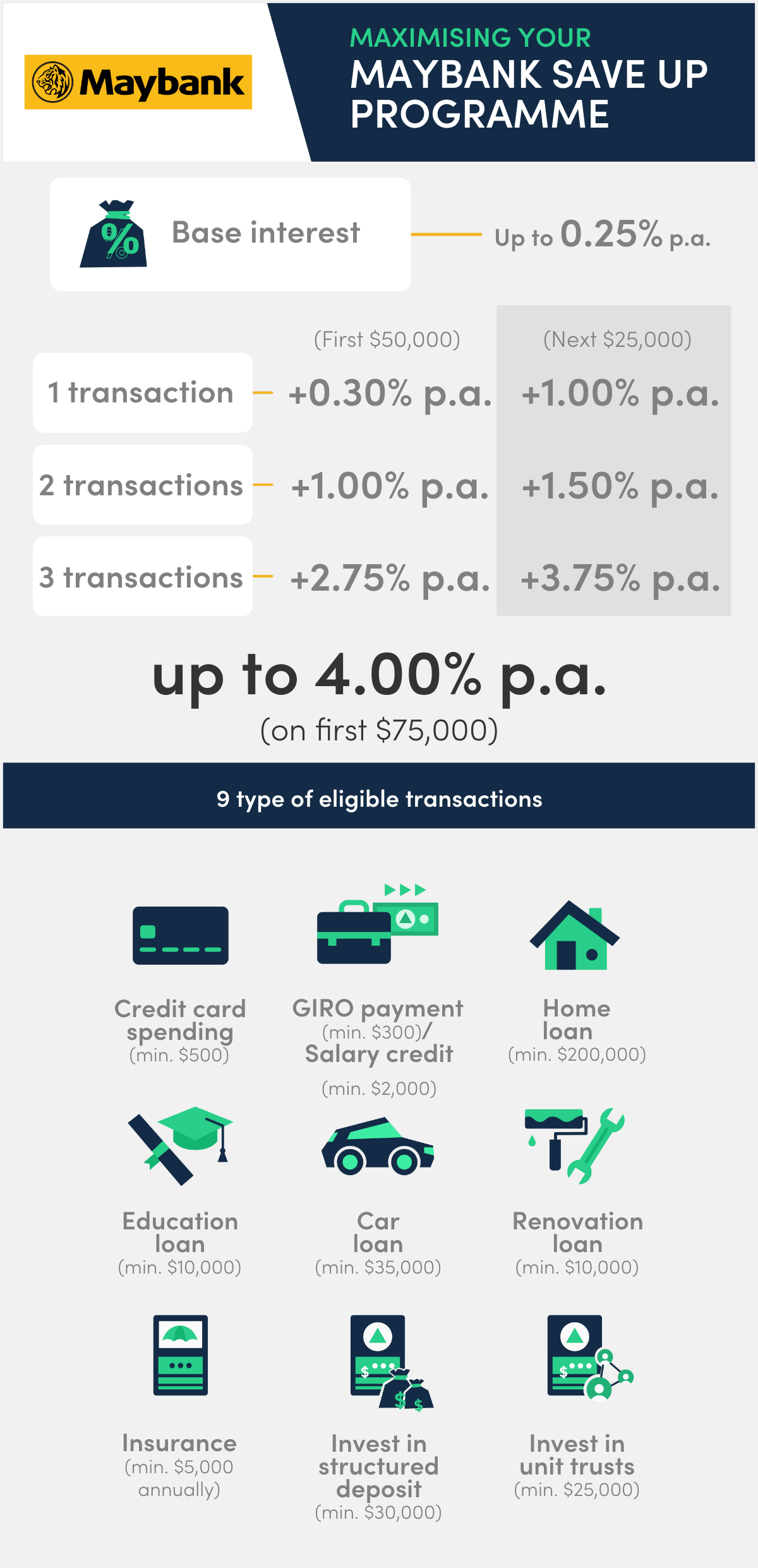

Interest rates | ||

| Transactions | First $50,000 | Next $25,000 |

| None (base interest) | Up to 0.25% p.a. | |

| 1 x transaction | + 0.30% p.a. | + 1.00% p.a. |

| 2 x transactions | + 1.00% p.a. | + 1.50% p.a. |

| 3 x transactions | + 2.75% p.a. | + 3.75% p.a. |

Base interest

The Maybank Save Up Programme starts with a higher base interest rate than most other savings accounts… sorta. The base interest is actually tiered:

Your base interest's effective interest rates are hence:

Bonus interest

Next, the Maybank Save Up Programme then lets you choose from nine different Maybank products/services to get bonus interest:

The bonus interest rates aren't competitive unless you fulfil three transactions. Assuming you hit three transactions and start with a bonus interest rate of 0.25 per cent, you'll get an EIR of around 2.99 per cent p.a. on your first $50,000 and 4.00 per cent p.a. on the next $25,000. Together, you're looking at 3.33 per cent p.a. EIR on the first $75,000, inclusive of base interest.

For comparison, the OCBC 360 account will give you an EIR of 2.45 per cent p.a. on $100,000 for hitting three categories-crediting your salary, saving, and spending on your credit card.

UOB One is handing out an EIR of 2.50 per cent p.a. on the first $150,000 if you spend on a card and credit your salary via GIRO. These are lower rates but on a larger sum-and, for the UOB One account, simpler mechanics.

Speaking of credit card spending, do note that Maybank only considers credit card spending on the Maybank Platinum Visa Card and Horizon Visa Signature Card. Spending on other Maybank credit cards doesn't count. On the plus side, these cards give you good cash rebates both locally and overseas.

Maybank Save Up Programme

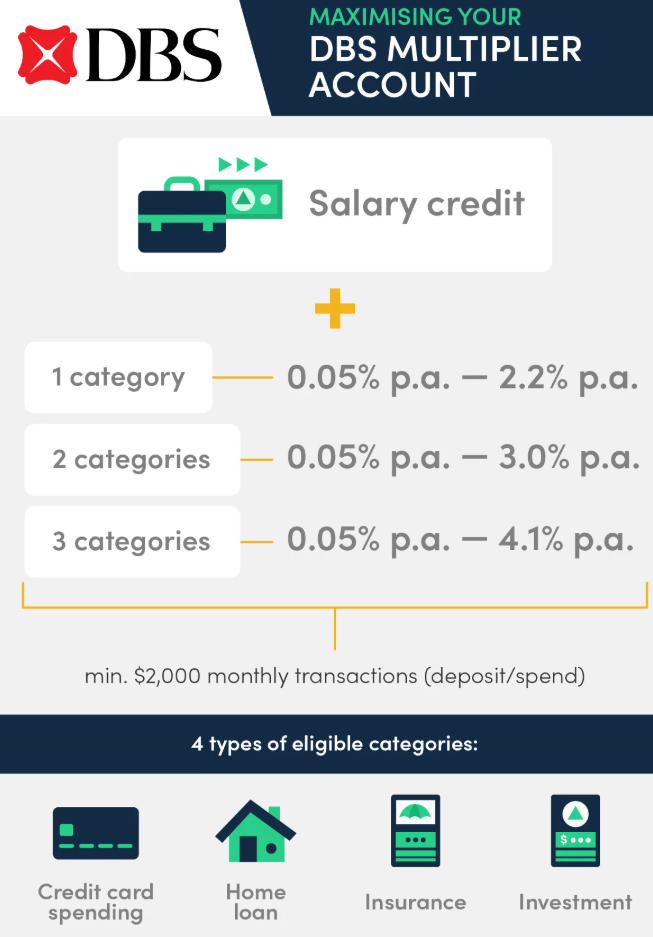

The DBS Multiplier account's interest rates are only competitive if you hit three categories across credit card spending, home loan, insurance, and investment.

| Total monthly transactions | Income + 1 category | Income + 2 categories | Income + 3 categories |

| First $50,000 | First $100,000 | First $100,000 | |

| $500 to $14,999 | 1.80% | 2.10% | 2.40% |

| $15,000 to $29,999 | 1.90% | 2.20% | 2.50% |

| $30,000 and up | 2.20% | 3.00% | 4.10% |

The rates in the table above apply to you if you credit your salary/dividends/SGFinDex to any DBS or POSB account (yes, it doesn't need to be your DBS Multiplier account!). You need to have at least $500 worth of transactions from one or more of the following categories:

The more categories you hit, the higher bonus interest rates you get.

One thing I really like about the DBS Multiplier is that there is no minimum amount required for the credit card or DBS PayLah! spend.

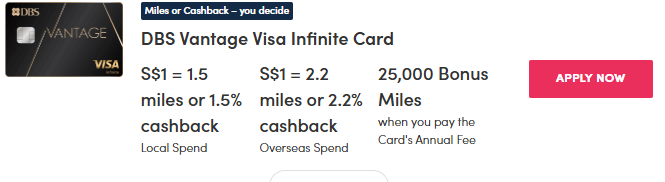

You can also choose either, although I would recommend the credit card route for extra cashback or miles. You can earn up to 10 miles per dollar with the DBS Altitude Visa Signature Card on your travel spend at Expedia and Kaligo, and 2.2 miles per dollar on other overseas spend.

The DBS Vantage Visa Infinite Card comes with an even bigger welcome miles bonus, although it isn't the most accessible credit card due to its high minimum income requirement.

What if you don't have any DBS credit card, insurance, or investments? If you're 29 years old or below, you can still earn 1.5 per cent p.a. on the first $50,000. You don't need to credit your salary to a DBS/POSB account, but DBS will still require you to at least use PayLah!.

The good news is that there isn't a minimum amount for PayLah! spend. Just use it to pay for anything, even if it's a $1+ cup of kopi at your local coffeeshop. Easy!

Overall, the DBS Multiplier account makes it easy to earn bonus interest with its zero minimum spend transaction categories and the flexibility to credit your salary into any DBS account, not necessarily the DBS Multiplier.

However, DBS Multiplier account interest rates start pretty low, especially if you don't credit your salary to a DBS/POSB account. Comparatively, CIMB FastSaver's interest rates start at 1.50 per cent p.a. for just opening the account and depositing a minimum of $1,000.

DBS Multiplier

The CIMB FastSaver account works a bit differently compared to others on this list. It does have the usual suspects-salary and credit card spend requirements-but these are only required for you to unlock the highest interest rate (currently 2.50 per cent p.a.) on the first $25,000.

After you meet those requirements for the initial $25,000 balance, you can enjoy up to 2.18 per cent p.a. Yup, no conditions to buy insurance, sign up for an investment, or any other hoops to jump through.

| ccount balance | Prevailing interest rate | Additional interest rate (credit salary or schedule a recurring GIRO transfer of at least $1,000) | Additional interest rate (spend on CIMB Visa Signature Credit Card) | Total interest rate |

| First $25,000 | 0.50% p.a. | + 0.50% p.a. | + 1.00% (min. $300 monthly eligible spend) + 1.50%^ (min. $800 monthly eligible spend) | 2.50% |

| Next $25,000 | 1.08% p.a. | – | – | 1.08% p.a. |

| Next $25,000 | 1.58% p.a. | – | – | 1.58% p.a. |

| Above $75,000 | 0.50% p.a. | – | – | 0.50% p.a. |

If we assume you hit the requirements to earn 2.50 per cent on your first $25,000, your effective interest rates are:

| Balance | EIR |

|---|---|

| First $25,000 | 2.50% |

| First $50,000 | 1.79% |

| First $75,000 | 1.72% |

| First $100,000 | 1.42% |

If you only have $25,000 to park in a savings account, CIMB FastSaver is a good choice. You're not going to get rates like this on such small amounts with other savings accounts, where the highest rates are unlocked at higher balances only.

This account is also perfect for most young adults starting out their career, because of the very low minimum balance of $1,000 and no fall below fee.

CIMB FastSaver

What if you want to open a savings account, but don't want to do anything but credit money into it? The best zero-effort contender is the POSB SAYE (Save As You Earn) account.

You need to set up a standing order to credit a fixed amount every month (anything from $50 to $3,000) into your SAYE account, then resist the urge to touch it for two years. As a reward for your restraint, you earn 3.5 per cent p.a.

Note that it's a whole lot less liquid than any other savings account, so for the love of God, please don't put your emergency stash in here.

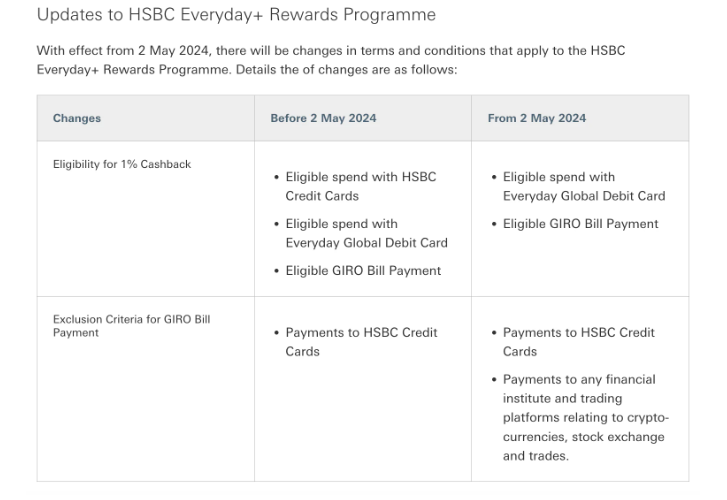

Our last savings account on this list is the most headache-inducing. The HSBC Everyday Global Account is a multi-currency account that also doubles up as a savings account… masquerading as an interest/cashback-earning hybrid. Yikes. Let me explain.

The HSBC Everyday Global Account lets you transact in 11 different currencies, but that's probably not the reason why you're reading this article. More importantly for our purposes today, it also functions as a savings account.

Unlike the others on this list, the HSBC Everyday Global Account doesn't stack bonus interest the more you spend/save/borrow/invest/insure. Instead, the account works hand in hand with the HSBC Everyday+ Rewards Programme to, collectively between the account and the programme, earn you an extra one per cent bonus interest and one per cent cashback per year.

HSBC Everyday Global Account: How much interest can I earn?

When you have an HSBC Everyday Global Account and also qualify for the HSBC Everyday+ Rewards Programme, you can earn up to 1.55 per cent - 2.00 per cent p.a. from now to Nov 30 2025:

Combined, these bring your total interest to 3.10 per cent p.a.

How do I qualify for the HSBC Everyday+ Rewards Programme?

The third component above (one per cent additional interest) comes from qualifying for the HSBC Everyday+ Rewards Programme. Here are the requirements:

Make five eligible transactions, with no minimum amount. These can be any combination of the following types:

1. Transactions made with a HSBC personal credit card*

2. Transactions made with a HSBC Everyday Global Debit Card

3. GIRO bill payments

4. Fund transfers to a non-HSBC account

What do I earn from the HSBC Everyday+ Rewards Programme?

Qualifying for the Everyday+ Rewards Programme gets you:

* Note that you can use an HSBC credit card to qualify for the HSBC Everyday+ Rewards Programme, but credit card spending won't earn you cashback once you qualify the programme. The one per cent cashback you receive is pegged to your spending on your HSBC Everyday Global Debit Card, not your credit card.

This change was implemented by HSBC on May 2, 2024 and is also spelled out in their updated terms and conditions.

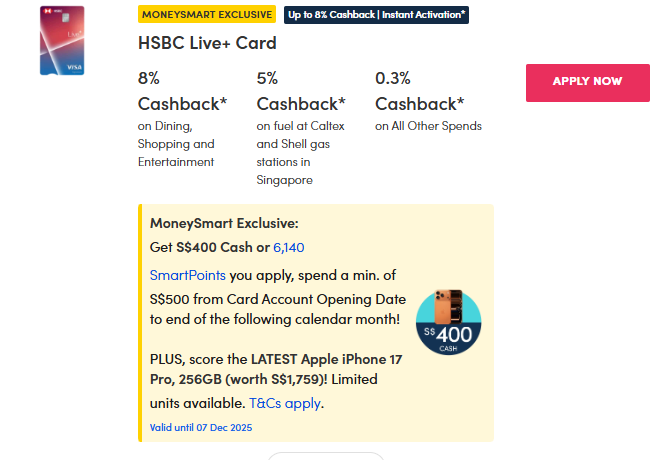

On the plus side, HSBC doesn't limit you to a select few credit cards for the credit card spending criteria, so take your pick of the HSBC credit cards available. My personal pick is the new HSBC Live+ Credit Card, with which you can earn up to eight per cent cashback on this card on selected dining, shopping, and entertainment spending.

On top of the interest and cashback, HSBC will give you one-time cash bonuses of up to $150 (for Personal banking customers) / $300 (Premier customers) when you deposit at least $100,000 (Personal banking) / $200,000 (Premier Banking) and meets the eligibility criteria above for the first six months.

How to register for the HSBC Everyday+ Rewards Programme

To register, send an SMS to 74722 with the following format:

EGAfirst 9-digit of your Everyday Global Account number (e.g. EGA 123456789)

[[nid:725606]]

This article was first published in MoneySmart.