10 common misconceptions about home buying in 2022

If you last bought a home a decade or more ago, today's property market might give you a headache. A lot has changed since then, so brace yourself for some major differences.

On top of that, there are some age-old misconceptions about the transaction process, that have continued to linger for years. We've put together some of the most common ones on this list. Do take note before you buy:

The minimum down on a home is 15 per cent when using an HDB loan, or 25 per cent for bank loans (of which the first five per cent has to be in cash).

However, note that if you have more than the minimum down payment in your CPF Ordinary Account (CPF OA), you have to use all of it except for up to $20,000.

For example:

Say you have $120,000 in your CPF OA, and the minimum down payment for your home is only $60,000. You cannot choose to pay only $60,000, and hoard the remaining $60,000 in your CPF. You can at most keep $20,000 in your CPF only – $100,000 has to go toward the down payment.

This is to prevent you from borrowing the largest amount you possibly can.

It doesn't matter whether the EC has been privatised, or is still an HDB property. You can never get an HDB loan for an EC.

This means buyers must be prepared to cover the first five per cent of the costs with hard cash. Note that this is the same whether you buy a resale EC or a new EC; even with the Progressive Payment Scheme, the initial booking fee is still five per cent.

It also means the minimum down payment is going to be 25 per cent (for resale) or 20 per cent (for the Progressive Payment Scheme). The first five per cent is always in cash, and the next part can be in cash or CPF.

This also affects the next point:

The Mortgage Servicing Ratio (MSR) caps the monthly loan repayment at 30 per cent of your monthly income.

The Total Debt Servicing Ratio (TDSR) caps your total debt obligations – inclusive of credit cards, personal loans, and so forth – at 55 per cent of your monthly income.

For HDB properties, the MSR always applies; so if you buy an EC, you need to meet both HDB's MSR requirement, as well as the bank's TDSR requirement.

There are some instances where buyers have high outstanding debts, and find they can meet the MSR but not the TDSR.

Review your existing debts with care, before you decide to buy.

The banks will use your credit report from the Credit Bureau of Singapore (CBS). However, it takes time for your CBS report to reflect the changes in your debt situation.

As such, buyers who try to clear their debt in a very short time before a loan application can still fail to get Approval In Principle; or they may be approved for a much smaller loan quantum.

Most mortgage brokers advise that you start paying down debts 12 months before your loan application, to ensure everything is properly reflected. Some brokers might be able to negotiate on your behalf, but it's best not to take the risk.

Besides this, note that some issues in your credit report, such as frequent late repayments or prior defaults, are not instantly erased the moment you repay debts. It can take a few years for these to go away.

The most notable issue here is bankruptcy: even if you've cleared the debt and gotten your official Letter of Discharge, it typically takes around five to seven years before you can be approved for most home loans.

(Non-banking Financial Institutions may still grant you a home loan as soon as you're discharged; but the interest rates are often higher. Consult a qualified mortgage broker for help, and don't go to payday lenders).

One final point as this is less known, but having regular usage on your credit card (whether or not you pay on time) can also contribute towards your loan eligibility. This can come to effect if you anticipate getting a loan may be difficult, so do watch over how many credit cards that you have on hand.

To ensure you can cope with rising interest rates, the bank will use a rate of 3.5 per cent for the TDSR. So a $1 million loan, for 25 years, will be projected to cost about $5,006 per month.

This is higher than the actual rate (at the time of writing, around $4,300 per month). If you find that your loan is being rejected, this may be the issue.

The bridging loan is meant to temporarily cover the costs of the new home, until the sale proceeds of your previous home come in. But if you don't have a realtor, mortgage broker, or other expert helping you, it can be a tricky tool to use.

The first thing to know is that bridging loans have a maximum loan tenure of only six months. This is significant if you're waiting for en-bloc proceeds, which can sometimes take up to a full year.

You need to double-check the timelines involved, lest you be saddled with a giant debt repayment before the cash is available.

The second thing to note is that bridging loans are not cheap (although it can be argued that it is worth it with respect to the convenience it offers).

The interest rate on most bridging loans is between five to six per cent, or about 0.5 to 1.5 per cent per month. This is before adding various administrative fees, which differ between banks.

It's generally best to plan your timeline such that a bridging loan is not necessary at all.

When you buy your property (including your flat), you'll be asked to declare the manner of holding. This is whether you want to be joint tenants (all the borrowers count as a single entity), or tenancy in common (different borrowers can own different percentages of the property).

Some Singaporeans are under the mistaken impression that, for the latter, a higher percentage of ownership means more rights over the property; but it doesn't work that way: even if a borrower has just one per cent of the property, they are still entitled to the same rights to enjoy it.

This means, for instance, the person with 99 per cent ownership cannot unilaterally decide to sell the property, or evict the person who only owns one per cent.

The percentage ownership does matter in other areas, such as division of sale proceeds, survivorship, stamp duties, when transferring their share, etc. But it's not like ownership in a company, where having the bigger share means you get to call the shots.

The Buyers Stamp Duty (BSD) is based on the price or valuation, whichever is higher. So if you buy a property valued at $1.5 million, but sold for $1.75 million, your BSD would be $54,600 (based on a price of $1.75 million) instead of $44,600 (based on a valuation of $1.5 million).

This means that prices above valuation don't just cause a higher cash outlay; they also cause you to pay higher stamp duties.

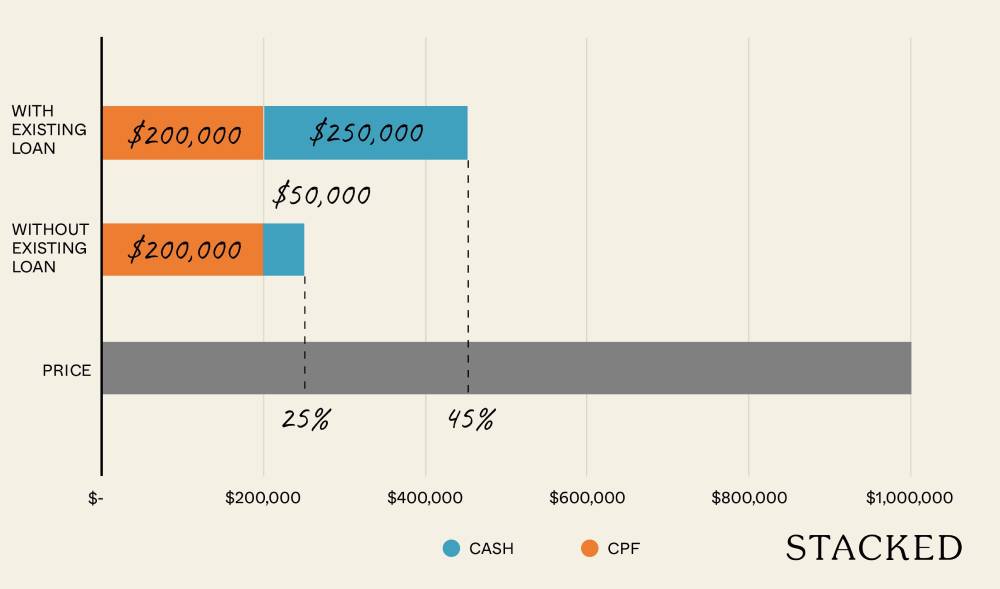

If you cannot get the sale proceeds to discharge your existing home loan, but you go ahead and buy a new property, you may be saddled with both loans for a short time.

This can cause an administrative pickle – the bank can't give you the full 75 per cent loan quantum, if you have an outstanding home loan. You may need to prove your existing property is being sold (i.e., the OTP is signed) before you can get the loan.

We also understand from some brokers that banks may reject you anyway, even if you have a signed OTP for your previous home – they may insist you discharge the existing loan before taking the new one, as having two loans at the same time might bust your TDSR limit.

It may also strain your cashflow if you need to service two loans at once for a few months.

If you've exercised an Option To Purchase (OTP), and the seller takes legal action, the Court can compel you to proceed with the purchase.

So even if you have the disposable income to shrug off the initial deposit, it's inadvisable to assume you can back out of "any" deal later on.

Be absolutely certain of your purchase before signing anything.

This article was first published in Stackedhomes.