11 proposed developer changes to help homebuyers

URA is proposing some amendments to the venerable Housing Developers Rules. This set of laws covers a whole range of topics, from the way properties, are marketed, to the way you book a new launch unit. We will be going through each of the proposals and how they will affect you as a buyer, should they come into play:

The following amendments are only being proposed, they’re not implemented yet. From now till 5th February, the public is invited to give feedback on these, on the URA website.

Some of the most notable proposals are:

Some of the exterior features include landscaped areas, pick-up and drop-off points, and water features. Developers must also indicate the placement of refuse chutes and chambers, water tanks, power generators, pedestrian side-entrances, etc.

You may notice that some developers omit these in earlier marketing brochures, as they may not be certain of the exact placement yet. It’s also possible, under the current system, that the placement of these features may not match the brochures – this usually happens when the developer has to change its plans, to accommodate building regulations.

Under the proposed change, developers must obtain permission for these external features first, before using them in advertisements.

This is especially helpful if you’re considering a ground-floor or lower-floor unit.

Under the current system, lower-floor units do carry a bit more risk, if the layout gets shuffled. For example, if you’re on the ground floor unit, and an unexpected side entrance gets placed near your home, you may experience some loss of privacy.

Overall, this is a change that would make it easier to pick the best stack and provide more assurance.

Even when a development is completed, developers right now may not display the exact Temporary Occupancy Permit (TOP) or Certificate of Statutory Completion (CSC) date. The proposed change is for developers to show the date once they have it.

This is a boon to buyers faced with complex transaction timelines, such as HDB upgraders. They’ll appreciate knowing exactly when they can move in. That said, if you have a good property agent, they’ll probably have checked to let you know already.

The most notable certification here is the Construction Quality Assessment System (CONQUAS). This is a national-level certification for quality of building, and is ranked from A to F; the same way as a school grading system. You can see the full details of this on the BCA website.

Developers will also show their Quality Mark and Green Mark certifications. These amount to voluntary disclosures for workmanship and sustainability (not that developers need much prompting to show these off anyway!)

Besides these, developers will also have to show their track record for the past five years.

Most major property developers are eager to show these off anyway; and it’s almost expected that they get an A.

Buyers do benefit, however, because you’ll know if you’re dealing with a new or inexperienced developer (e.g., a boutique developer that hasn’t put up many projects in the past five years). As such, many realtors opined that small developers, with boutique projects, may look worse in comparison.

While site layouts and unit floor plans are already the norm, we don’t currently have layouts for individual floors.

The new change will show the location of lifts, refuse chutes, service ducts, utility rooms, etc. on the same floor as your unit. This will have to be disclosed to buyers, before they book a unit.

This will resolve a longstanding issue, where buyers complain that common corridors are narrower than expected; or that they have less exterior space because a utility room/emergency staircase is right next to them.

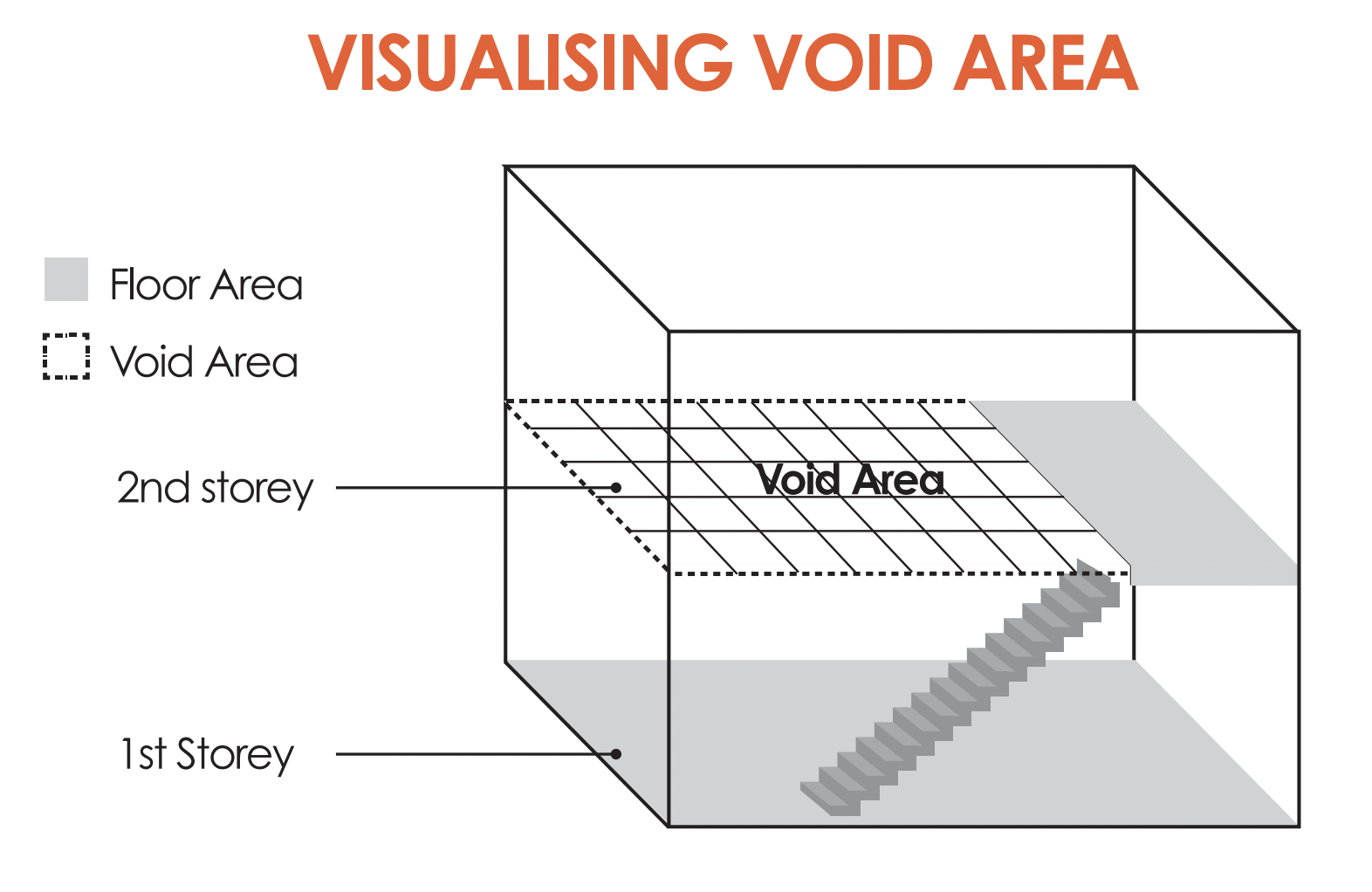

Developers will be required to mark and label void areas in the unit. We previously covered the significance of this, with regard to strata void spaces (i.e., the space between the floor and the ceiling, for which buyers can be charged).

Developers will also have to state the location and number of air-con units, on each air-con ledge.

The types of walls (load-bearing or non-load bearing), types of doors (swing or slide), service pipes, and refuse chutes must all be indicated as well; and developers must note which areas are excluded from the square footage.

This helps to ensure you don’t waste money on void spaces, or huge air-con ledges, or at least, are aware of what you are paying for before you make the commitment.

That aside, it’s a significant help when considering renovations. You will, for example, know exactly which walls can be hacked and which ones can’t; and your interior designer/contractor will probably have an easier time drawing up plans.

This is similar to point 5 above, but it also extends to landed properties. There will have to be plans for each floor, with information on types of walls, doors, placement of refuse chutes, etc. (as in point 5 above).

Realtors told us that many landed developers, in recent years, already provide such scaled plans of their own volition; buyers tend to demand it anyway. Other than that, this will help landed property buyers the same way as in point 5 (you can better visualise renovations and possible themes).

It’s possible for a 99-year leasehold property to be sitting on land that’s freehold (or on a 999-year lease). In this case, the owner of the actual land – called the reversionary owner – effectively “rents out” part or all of the land plot for 99-years.

Note that in some cases, home buyers also have to pay “ground rent” to the reversionary owner; although this is quite rare.

Buyers of the property don’t get to know the identity of the reversionary owner, or much about the nature of the deal with the developers; not unless it’s voluntarily disclosed. Under the new rules, these details will be known.

This is significant because it impacts en-bloc potential . If the reversionary owner is another property developer, for example, there’s a real risk they may not want to renew the 99-year lease for an en-bloc sale; the reversionary owner may have plans to develop a condo of their own.

In general, leasehold land carved out of freehold land is disadvantageous, compared to “normal” leasehold properties. It’s good that home buyers are made more aware of this (check the OTP, it should describe such arrangements).

We won’t be surprised that there are some owners out there who have bought a property with hopes of an en-bloc sale in the future, not knowing that the property is actually “rented out” on a 99-year lease instead.

The old Progressive Payment Scheme (PPS) is described here.

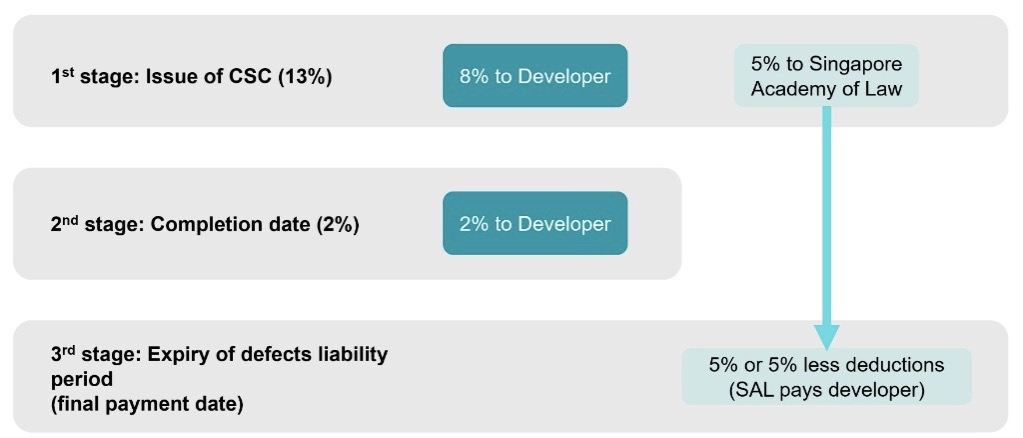

URA is proposing a simplified version that changes the payment of the final 15 per cent (The rest of the PPS is unchanged):

So instead of paying 15 per cent upon CSC, home buyers will instead pay 13 per cent: eight per cent to developers, and five per cent held by the Singapore Academy of Law (SAL)

Upon full completion, homebuyers pay the final two per cent.

After the end of the Defects Liability Period (DLP), the time in which developers are obliged to fix defects at their cost, money held by SAL is disbursed to developers, minus any deductions for defects.

This helps a bit in financial planning, as you’ll know when your loan repayments are about to rise (the bank will handle disbursements to the developer – you’ll just get a letter telling stating your home loan repayments are about to rise accordingly).

Previously, the payment for the final 15 per cent was variable, depending on whether the completion date or CSC would occur first.

The Defects Liability Period (DLP) is usually 12 months, during which the developer must fix defects at cost. This currently begins right after the date of vacant possession, or the 15th day after the notice of TOP payment (whichever comes first). The same applies to the start of maintenance fees.

Under the proposed change, the 15-day rule will be extended to 35 days.

This is fairer to home buyers, as you have only 14 days to pay after the notice of TOP payment; but the developer has 21 days to hand over the unit. Under the current rules, this would mean the DLP and maintenance fees start before you actually get the keys.

The extension also gives you more time to check the unit for defects.

A shortfall claim happens when your unit turns out to be smaller than the developer stated.

To make such a claim, your unit must be at least three per cent smaller than the area stated in the Sale & Purchase Agreement. Under the new rule, this will be reduced to two per cent.

ALSO READ: URA wants property developers to be more transparent, asks home buyers for feedback

It’s been a long time since we’ve heard of any buyers making shortfall claims. Developers today are very careful in their documentation and are unlikely to make such mistakes.

Nonetheless, it’s added assurance that you won’t be cheated out of precious space (remember: one square foot could be costing you around $1,500).

If the developer wants to change the unit’s floor plan, or make any changes to the site layout (e.g., repositioning a common facility like the gym), the new rule would require the buyers’ consent.

The only exception is if there are new building rules that emerge after the OTP, which mandate the changes.

In the event that developers have to make refunds, developers may be required to refund interest paid on loans, loan cancellation fees, and legal fees if a transaction is annulled (capped at 15 per cent of the purchase price, on top of refunding the usual instalment payments and stamp duties).

Most developers don’t make big changes after buyers have signed the OTP anyway, as buyers have recourse to the authorities even now. Most realtors we asked couldn’t come up with a single example of changed floor plans, repositioned facilities, etc. after the OTP.

So rule or no rule, we’re sure developers are acutely aware of the risks of being sued, should they make drastic last-minute changes.

We see this proposal as more of a way to maintain the current high standards, rather than as a way to rectify any specific issue.

This article was first published in Stackedhomes.