27 new launch condos in 2020: Here's how they've performed

It’s possible that more happened to the real estate market in 2020 than in the whole of the past two to three years combined.

An unprecedented circuit breaker period, construction and manpower issues, Singapore’s worst recession in 50 years…and yet, the private homes market, resale flat market, and landed homes all managed to trend upward.

Before the next slew of projects hit us, here’ a quick summary of the more recent condos on the market:

Data on remaining units is based on take-up rates shown on Square Foot Research. Information shown is right as of December 2020.

| Project Name | Address / District | Est. remaining units | Take-up rate | Last known pricing | Freehold / Leasehold | Est. TOP date |

| The M | Middle Road (District 7) | 120 out of 522 | 77 per cent | $2,374 to $2,913 psf | 99-year leasehold | 2024 |

| Cairnhill 16 | Cairnhill Rise (District 9) | Unknown, 39 units total | – | No recorded transactions at this time | Freehold | 2023 |

| Kopar @ Newton | Makeway Avenue (District 9) | 211 out of 378 | 44.2 per cent | $2,123 to $2,590 psf | 99-year leasehold | 2023 |

| The Avenir | River Valley Close (District 9) | 336 out of 376 | 10.6 per cent | $2,754 to $3,359 psf | Freehold | 2023 |

| 15 Holland Hill | Holland Hill (District 10) | 53 out of 59 | 10.2 per cent | $2,700 to $3,063 psf | Freehold | Dec 2022 |

| 19 Nassim | Nassim Hill (District 10) | 99 out of 101 | 2 per cent | $3,401 psf | 99-year leasehold | Dec 31, 2023 |

| Dalvey Haus | Dalvey Road (District 10) | 25 out of 27 | 7.4 per cent | $3,192 psf | Freehold | Dec 31, 2022 |

| Hyll on Holland | Holland Road (District 10) | 314 out of 319 | 1.6 per cent | $2,515 to $2,756 psf | Freehold | 2025 |

| Leedon Green | Leedon Heights (District 10) | 565 out of 638 | 11.4 per cent | $2,414 to $2,909 psf | Freehold | 2024 |

| Van Holland | Holland Road (District 10) | 51 out of 69 | 26.1 per cent | $2,570 to $3,045 psf | Freehold | 2024 |

| Peak Residence | Thomson Road (District 11) | Unknown, 90 units in total | – | No recorded transactions at this time | Freehold | TBD |

| The Landmark | Chin Swee Road (District 3) | 287 out of 396 | 27.5 per cent | No recorded transactions at this time | 99-year leasehold | 2025 |

| Verticus | Jalan Kemaman (District 12) | 140 of 162 units | 13.6 per cent | $1,773 to $2,162 psf | Freehold | Dec 31, 2024 |

| Myra | Meyappa Chettiar Road (District 13) | 69 out of 85 units | 18.8 per cent | $2,016 to $2,273 psf | Freehold | Dec 31, 2023 |

| Noma | Guillemard Road (District 14) | 14 out of 50 | 72 per cent | $1,480 to $1,808 psf | Freehold | 2023 |

| Penrose | Sims Avenue (District 14) | 164 out of 566 units | 71 per cent | $1,396 to $1,856 psf | 99-year leasehold | 2025 |

| Rymden 77 | Lorong H Telok Kurau (District 15) | Unknown, 31 units total | – | No recorded transactions at this time | Freehold | 2022 |

| Forett @ Bukit Timah | Toh Tuck Road (District 21) | 361 out of 633 units | 43 per cent | $1,635 to $2,120 psf | Freehold | 2024 |

| Ki Residences | Sunset Way (District 21) | 516 out of 660 units | 22 per cent | No recorded transactions at this time | 999-year leasehold | 2026 |

| The Linq @ Beauty World | Upper Bukit Timah Road (District 21) | Sold out | 100 per cent | $1,998 to $2,429 psf | Freehold | 2023 |

| Verdale | De Souza Avenue (District 21) | 208 out of 258 units | 19.4 per cent | $1,606 to $1,862 psf | 99-year leasehold | 2024 |

| Clavon | Clement Ave. 1 (District 5) | Unknown, 640 units total | – | No recorded transactions at this time | 99-year leasehold | Jan 31, 2025 |

| 77 @ East Coast | Upper East Coast Road (District 15) | 33 out of 41 units | 19.5 per cent | $1,671 to $1,897 psf | Freehold | Dec 31, 2023 |

| Tedge | Changi Road (District 14) | 29 out of 42 units | 31 per cent | $1,535 to $1,742 psf | Freehold | 2022 |

| Ola | Anchorvale Crescent (District 19) | 352 out of 548 units | 35.8 per cent | $1,011 to $1,303 psf | 99-year leasehold | 2023 |

| Parc Canberra | Canberra Walk (District 27) | 72 out of 496 units | 85.5 per cent | $967 to $1,166 psf | 99-year leasehold | 2023 |

| Mooi Residences | Holland Road (District 10) | 20 out of 24 units | 16.6 per cent | $2,504 to $2,669 psf | Freehold | 2023 |

The following condos – while announced in 2020 – are not yet launched, and still have their details forthcoming:

In summary, these are:

For more details on the above, please see our quarterly review for top launches.

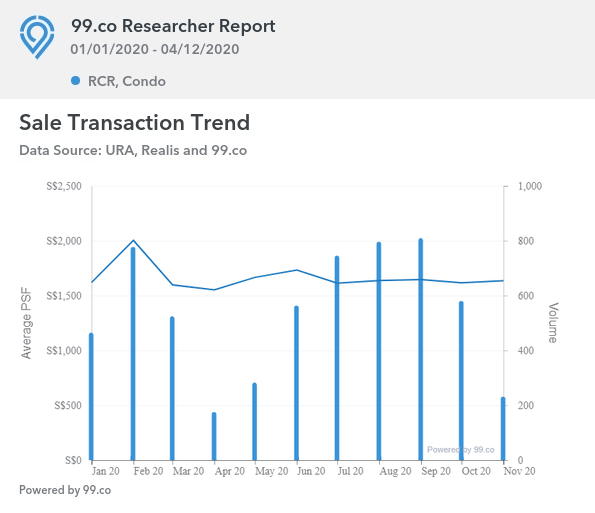

At the start of January this year, the average price of a condo (excluding ECs) was $1,652 psf. By end-November 2020, the average had risen to $1,706 psf.

At the start of January 2020, condo prices in the CCR averaged $2,379 psf. By end- November 2020, the average was $2,305 psf.

At the start of January, average prices stood at $1,619 psf. By end-November 2020, they averaged $1,635 psf.

At the start of January this year, the average condo price was $1,165 psf. By end-November 2020, the average price was $1,252 psf.

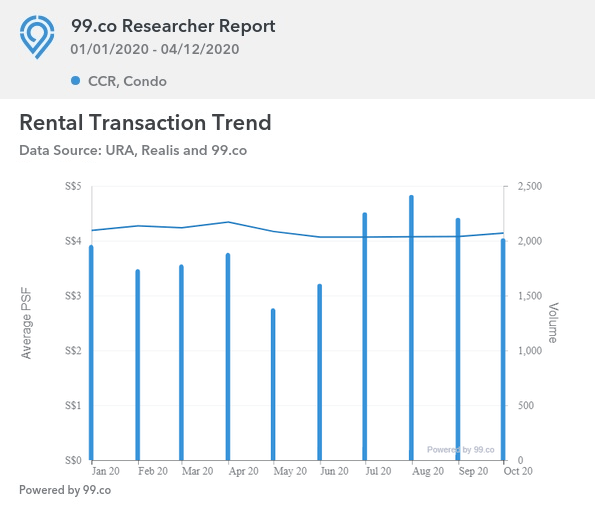

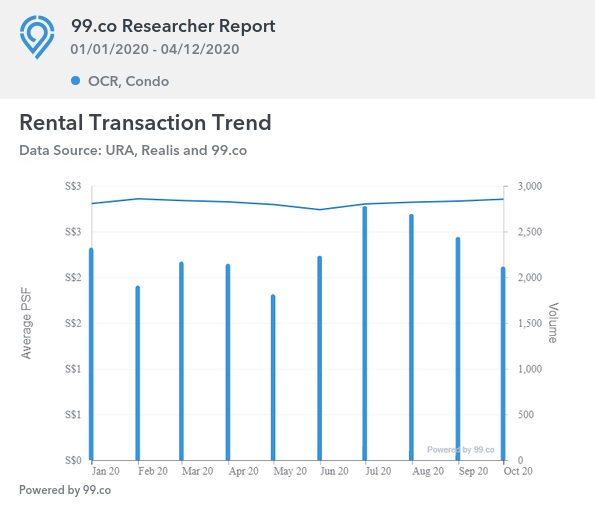

The average condo rental rate in January was $3.46 psf. This had risen to $3.48 psf by end-November 2020.

CCR rental rates were at $4.19 psf in January, and were at $4.14 psf by end-November 2020.

In January, rental rates in the RCR averaged $3.55 psf. By end-November 2020, they averaged $3.58 psf.

At the start of January, rental rates averaged $2.81 psf. As of end-November 2020, condo rental rates averaged $2.85 psf.

For a comprehensive explanation on this, do see our previous article .

As of Sept 28, 2020, developers are no longer allowed to re-issue your Option To Purchase (OTP) if the validity period lapses.

The OTP is a non-refundable deposit, made when purchasing a property. It gives the buyer a period of 21 days to complete the Sale & Purchase Agreement. Failure to do so results in the Option fee being forfeited.

Prior to the new ruling, developers could agree to repeatedly re-issue lapsed OTPs, sometimes for as long as two years. Now however, an OTP cannot be re-issued within 12 months of the previous OTP expiring.

However, issuing the OTP would lead to the transaction being lodged with URA, suggesting a sale. As such, authorities felt the practice led to inflated sales figures.

The new restriction will affect mainly upgraders, who now have a tighter timeline to sell their previous home, before completing the sale of their new condo unit. It could also lead to lower sales figures being reported.

For a detailed look at this, please see our previous analysis .

Prices in District 7 overtook District 9, on a per square foot basis this year. This is mainly due to the ongoing development of the Ophir-Rochor Corridor, which could shift the centre of gravity (in terms of work and lifestyle) further from the traditional CBD zones.

In addition, District 7 saw several condo launches priced at a high price psf, but with a low quantum, such as The M and Midtown Bay.

Starting this year, the TEL line – from Woodlands North to Sungei Bedok – begins rolling out its new series of stations. This line includes stops at Marina Bay and Orchard.

Some developments likely to benefit from the TEL include Amber Park, 8 St. Thomas, and Meyer Mansion.

ALSO READ: 6 fastest-selling new launch condos

Following rate cuts by the US Federal Reserve, many home loan packages in Singapore fell to record low rates. We have a more detailed explanation of this in an earlier article.

The Fed is committed to keeping rates near zero to stimulate economic recovery from the Coronavirus outbreak; as such, it’s unlikely that rates will rise any time soon.

At present, home loan interest rates average 1.3 per cent per annum, or about half the HDB Concessionary Loan rate of 2.6 per cent.

We’ve yet to see the full impact of Covid-19 right now. Government support measures, such as home loan deferments, are all still in effect. It remains to be seen how the economy will change once these wear off.

It will be interesting to note if the private homes market can maintain its momentum, despite doing remarkably well for the current situation. This year, as well as 2021, may convincingly demonstrate that investors still think of the Singapore private property market as the best port in any storm.

This article was first published in Stackedhomes.