3 things you must do if you're cash-strapped but want insurance coverage

If you just graduated and have entered the workforce, you may be wondering about getting insurance coverage. However, insurance can be costly and with so many plans on the market, getting a plan (or several) on top of your already piling bills may seem overwhelming.

To help you get started, we break down the most important things you should consider if you are low on cash but are looking to start investing in insurance coverage.

If you find yourself living paycheck to paycheck, the first thing you need to do is to take a serious look at your budget. Are you overspending in some places? Is there a lot of discretionary spending that is unnecessary?

To start, you can create a simple budget spreadsheet where you can track your past expenses. This helps you visualise where most of your money goes.

Next, you can create a budget with your ideal ratios of spending and saving. If you don't know how to budget, you can start with a basic 50-30-20 budget. Add your ideal insurance budget to your expenses to help you adjust your spending to fit in your premium payments.

If your issue is a lack of funds rather than too much discretionary spending, you can still find ways to reduce your monthly expenses.

First, if you are still living with your parents, you can ask if they're willing to reduce the amount of allowance they receive from you or if there are any bills you can temporarily stop paying until you get a higher salary.

If you're living on your own, you can find ways to cut down on your current bills. This includes switching to cheaper electricity providers, looking into getting a better mortgage rate or seeing if you qualify for government subsidies.

Next, you'll need to identify which insurance plans you really need. It's easy to get caught up in the marketing of different types of policies that promise high coverage amounts and a plethora of benefits. However, if you're still in your 20's and just starting out, you may only need a few core policies.

This includes private health insurance to cover any hospital stays, a basic term life policy and a critical illness policy if you want added financial protection if you develop a serious illness.

[[nid:486489]]

On the other hand, endowment/savings, personal accident and maternity (if you are expecting) insurance may not even be necessary until you have more income to spare.

What separates the plans you need from the plans you don't are your personal risks and the expected cost if you incur that risk. For instance, healthcare in Singapore is very expensive, with out-of-pocket medical costs making up 37per cent of all healthcare expenditure.

Since MediShield Life may not fully cover all your expenses if you get hospitalised, a private health insurance plan may be at the top of your priorities. Since these plans are cheapest when you're young and healthy, it's also something you'll benefit most from by getting it early in life.

Second, you may want a basic term life policy to protect you from death or permanent disability (general rule of thumb is a sum assured that is 10 to 15 times your salary). It's a cheaper alternative to a whole life policy, which may be more suitable for heads of households.

Lastly, you may want to consider a critical illness plan if you also want additional financial protection if you get diagnosed with a critical illness.

Once you find out the type of insurance coverage you need, you should spend a good amount of time comparing policies to find the ones that best match your budget and needs. Even policies that may seem standardised across insurers may have significant price differences.

Take Integrated Shield Plans. They're all pretty standard in terms of benefits, but the priciest insurer will cost you more than $140 per year compared to the cheapest insurer for an A ward coverage plan.

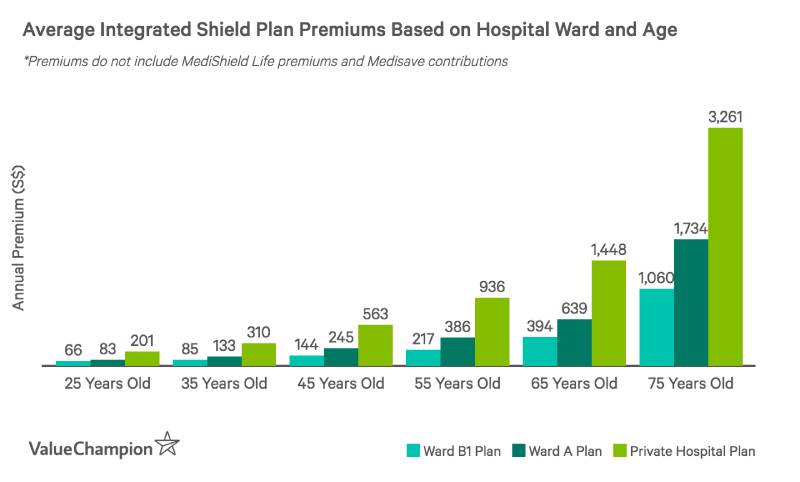

You'll also need to consider how much you're willing to spend for more coverage. For instance, when it comes to health insurance, the ward the plan covers will have a significant impact on your premium. A 25-year-old will pay $135 more for a private hospital plan than for a B1 ward plan.

When it comes to life insurance, you'll pay nearly twice as much per month for a $400,000 sum assured plan as you would a $200,000 plan. As you start comparing different policies, you'll begin to notice how even seemingly small price differences can change your budget by a few hundred dollars per year.

To avoid overpaying, pick a few benefits that are non-negotiable and choose insurers that offer these benefits at the best rate.

Since it's tough to compare policies across insurance individually, you can use comparison sites that show multiple plans on one page.

For instance, ValueChampion rounds up the best insurance policies on the market and analyses the average cost and benefits of different insurance plans to make your research easier.

Once you bought your policies doesn't mean you should just pay and forget about them. Instead, you should always be on the lookout for better plans.

[[nid:484417]]

Singapore has a very competitive insurance market , so it's not uncommon to see competitors pop up that can undercut current competition while offering better benefits. Switching policies can easily save you a few hundred dollars per year.

However, the ease of switching your policy depends on the type of insurance. Switching plans is easier for general insurance policies (home, travel, car) since you are not investing money into your plan and your premiums aren't dependent on your age and health.

Health insurance can be switched if you don't have pre-existing health conditions. Otherwise you run the risk of losing coverage for that condition or face high premiums. Life insurance policies are the hardest to switch.

While a short term life policy (5 years) will be easiest to switch as it will end soon enough and you are not investing your premiums over a long period of time, switching a whole life policy while it's still in force may result in lost premiums and termination fees.

Living in Singapore is expensive, whether you are on your own or living with your parents. Knowing it's possible to financially cripple yourself if you get into an accident or get sick adds even more stress to an already stressful life.

However, with prudent financial planning, it is possible to get affordable coverage. It's enough to start with just the bare minimum, as even some coverage is better than none. Once you start making more money, you can start upgrading your coverage to something that better suits your lifestyle.

This article was first published in ValueChampion.