7 things to know about the 2022 BTO launch sites

2022 will be an interesting year, with the debut of the Prime Location Housing (PLH) flats, as well as demand being at a peak.

On top of that, HDB has promised to ramp up production starting this year, to avoid the increasingly burdensome issue of oversubscription, or desperation pushing up resale prices in the future. For those deciding on if 2022 is the year to BTO, here’s what you need to know:

Starting from May of 2021, HDB changed its practice of indicating sites six months in advance. We now only receive the information three months in advance; until then we won’t know the exact location, type, number of flats, etc.

In the meantime, here’s what you need to know about the upcoming launches:

The supply of BTO flats will be ramped up by 35 per cent, over 2022 and 2023. This comes to about 23,000 new flats, up from just 17,100 new flats last year. HDB also made the startling announcement that they’re prepared to launch up to 100,000(!) new flats from 2022 to 2025, should that prove necessary.

This is all due to increasingly heated complaints about oversubscription.

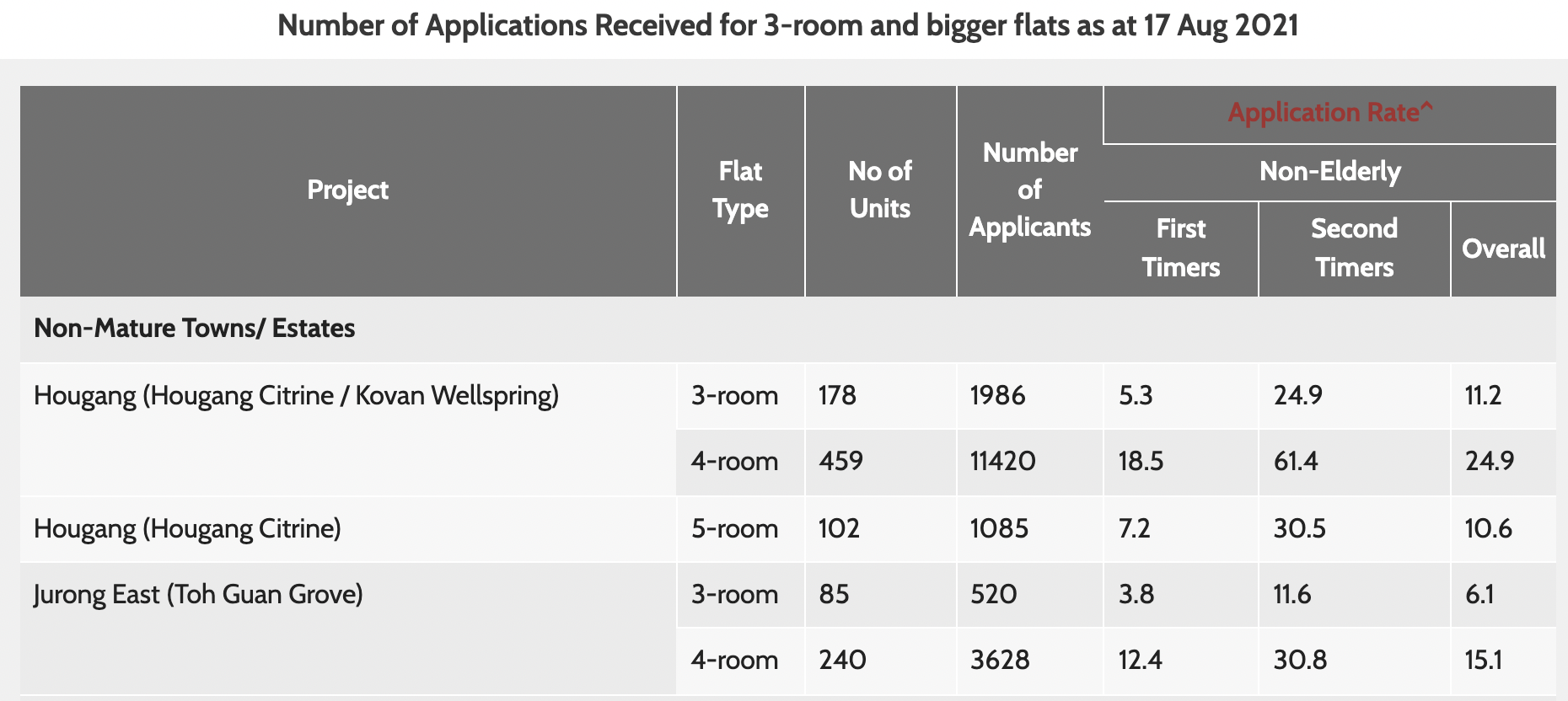

Between 2017 to 2020, for example, average over-subscription rates for non-mature estates rose from being 2.1 to 4.8 times oversubscribed. For mature estates, the oversubscription rate rose from 2.8 to 6.7.

The difficulty of securing a BTO flat may partly explain rising resale flat prices, which are now at an eight-year high.

Overall, ramped-up production will be good for genuine home buyers; Singaporeans purchasing BTO flats have a better chance this year. On the other hand, owner-investors – particularly those who already own their flats – might be worried about potential supply gluts in the future.

A large portion of these new flats will, at some point, join the supply of resale flats after the five-year Minimum Occupancy Period (MOP). That could put some downward pressure on resale flat prices, although the effect is much further down the road.

The Kallang/Whampoa launch site is the most anticipated for February 2022.

It’s located at the intersection of King George’s Avenue and Jalan Sultan, within walking distance of River Peaks I & II (the pilot batch of PLH flats). As we’ve pointed out in an earlier article, PLH flats can cause an “across-the-street” effect, boosting properties sitting on the edge of PLH zones.

For example, the Kallang/Whampoa site is within walking distance of River Peaks; it shares many of the same advantages in terms of location. It’s in distance to Lavender MRT, as well Jalan Besar MRT (which is connected to River Peaks). With only the inconvenience of a five to seven-minute walk, all the eateries and shops at River Peaks are also amenities to those living at the Kallang/Whampoa site.

The difference, however, is that the Kallang/Whampoa site only has a five-year instead of 10-year Minimum Occupancy Period (MOP), has no Subsidy Recovery (SR), and may even be priced lower than River Peaks.

As such, most buyers have been quick to surmise that this site offers PLH-level amenities, with none of the PLH restrictions; a fact that future buyers are also likely to pick up on (the 10-year MOP applies even to buyers who purchase PLH flats as resale).

This simple fact has made the Kallang/Whampoa site one of the most anticipated. But with only 390 units of 3-room and 4-room flats, we think it’s a long shot for most buyers.

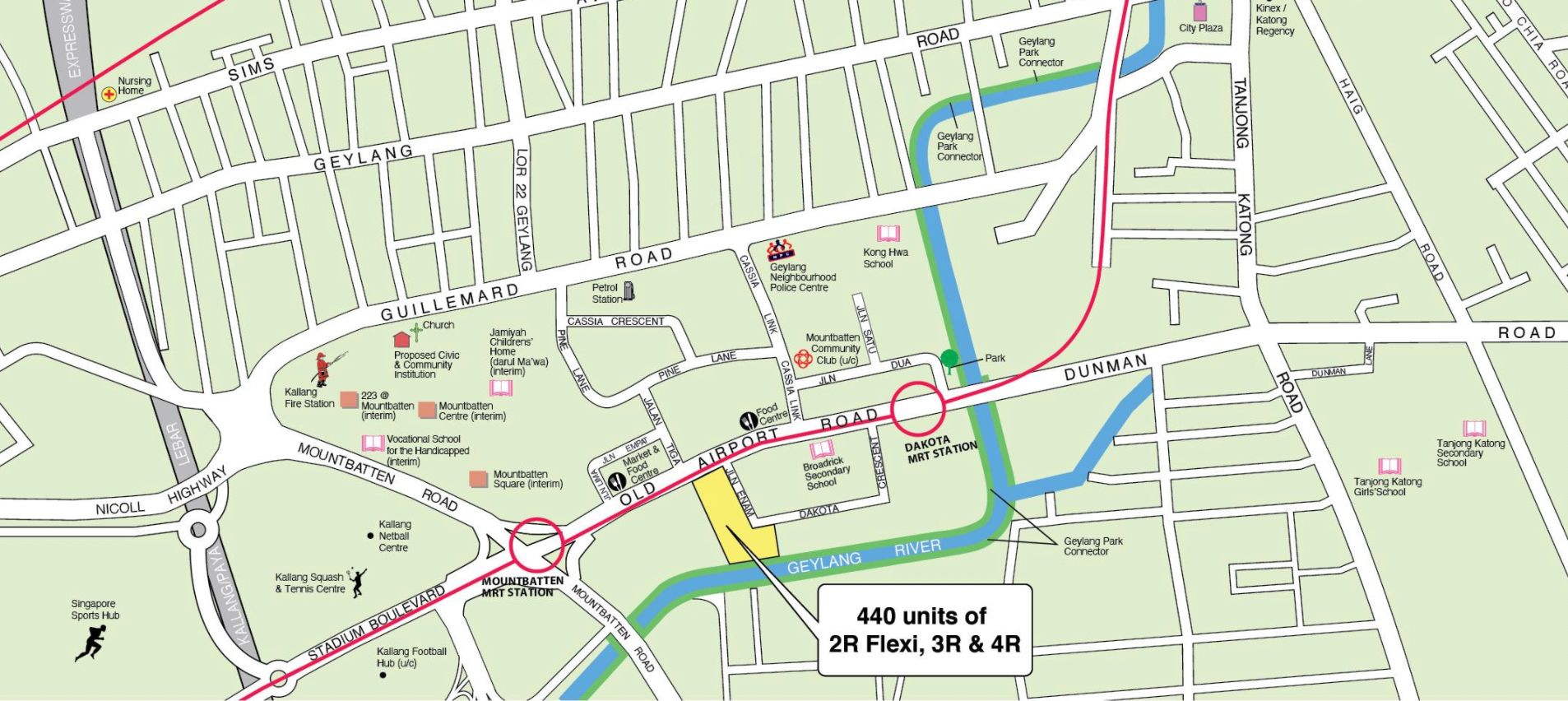

The BTO launch in Geylang is right across the road from the famous Old Airport Road Food Centre, where Old Airport Road meets Jalan Enam.

This is the first time we’ve seen a BTO launch here in a long while – the most recent flats we can think of here are Pine Close and Pine Green, which were completed in 2000 and 2005 respectively. Some of the other nearby flats here, like Blocks 93 to 95 along Old Airport Road, date all the way back to 1969!

This is the next most “in-demand” launch site for February, thanks to Dakota and Mountbatten MRT (both on the Circle Line) being just a five-minute walk. It may even trump Kallang/Whampoa as a choice for parents, as this launch site has plenty of top schools nearby – Broadrick Secondary is next door, while Chung Cheng, Dunman High, and Tanjong Katong Girls’ School are all in the priority enrolment range.

By comparison, the Kallang/Whampoa site has no schools in close proximity.

There are only 440 units of 2, 3, and 4-room flats, so we’d be surprised if this isn’t oversubscribed four or five times over.

As HDB now releases exact site locations only three months ahead, we only know the town names for May – nothing more specific.

For February, we already know it’s four towns: the two “rock star” locations of Geylang and Kallang/Whampoa above, plus two non-mature locations in Yishun and Tengah.

If these don’t appeal to you, May has a much wider selection:

There are potentially up to 5,700 new units for May (up from around 3,930 in February), so you stand better chances for balloting in general.

We notice, interestingly, that HDB has decided not to push Tengah for May. Surprising, as we’ve seen Tengah crop up in launch after launch consecutively.

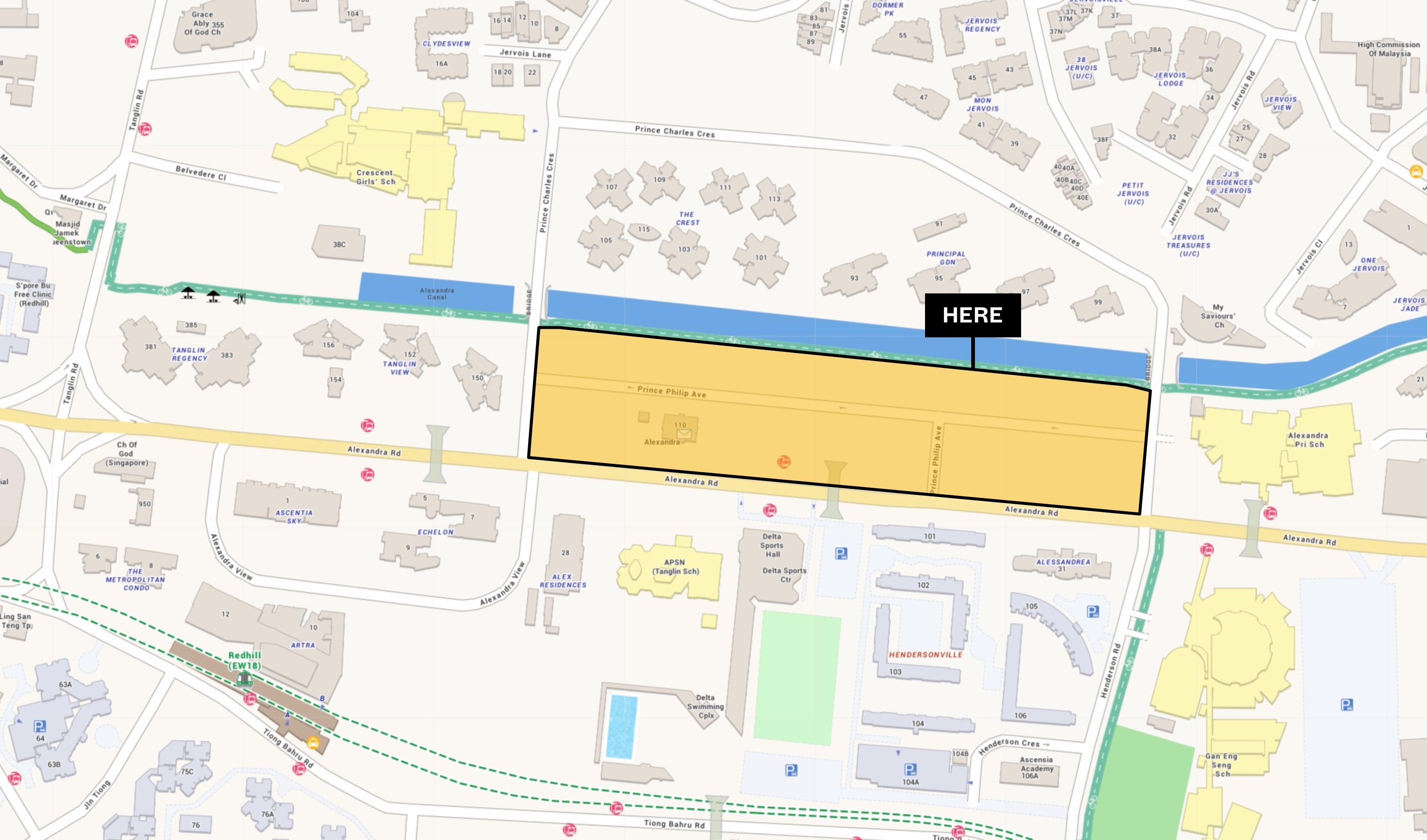

HDB has said they aim for one PLH launch every year, and right now the smart money is on the Bukit Merah site. We have the full details in this article.

This launch site is squarely within the Central Area, and is a short eight-minute drive to Orchard Road; you can even bike there in about 11 minutes. It’s also an estimated 8 to 10-minute walk from Redhill MRT (depending on the location of your block), which puts Holland Village and Raffles Place within four train stops on the North-South Line.

It is very unlikely such a location would be considered non-prime. In terms of convenience, this site easily rivals River Peaks; and many resale 4-room flats in Bukit Merah already average $740,000.

On the upside, we understand the plot can yield as many as 1,500 new homes, which improves balloting odds. Those who don’t mind PLH drawbacks might want to keep an eye on this one (if you can’t get Kallang/Whampoa in February).

Part of the reason for raising production is the rising number of homeowners, coupled with smaller household sizes. With fewer Singaporeans starting families, it seems the authorities are beginning to accept that we’ll have more singles and couples moving out and buying their own flats.

This could see a trend with more, but smaller, flats being built. It will at least answer the increasingly vocal calls among singles or lifelong singles, who have been rather ignored until recent years (e.g., even the PLH flats exclude singles from purchasing them).

With recent changes, singles may finally see housing policies bend more toward them.

ALSO READ: 4 reasons why Alexandra may just be the next hottest BTO launch site

Just a quick reminder for homebuyers in 2022 that new cooling measures are in place.

For those using HDB loans, note that the maximum financing has fallen to 85 per cent of the flat’s price, rather than the previous 90 per cent – so you should make sure you can cover at least 15 per cent of the total cost for the down payment.

(There’s no change for those using bank loans, it remains at 75 per cent).

Most Singaporeans end up paying more than 15 per cent down, however, so we don’t see it being an issue for the majority.

For more on the HDB launch sites as they crop up, follow us on Stacked so we can provide you with early notifications. You can also check out in-depth reviews of new and resale condos alike, if you want a private alternative.

This article was first published in Stackedhomes.