All you need to know about the condo payment scheme

The most unappealing part of buying a condo isn’t having to stand in snaking queues in showflats. Rather, it’s realising that you have to pay for the property that usually takes the thrill out of the whole affair. That’s why you should know all about the condo payment schedule before you enjoy the home-hunting experience. Let this article fill you in.

Buying a condo unit typically falls in either of two categories:

There are a variety of factors that might push you towards one or the other. For example, you might not be willing to wait three plus years for your unit to be constructed, or you want to purchase a unit in a development that’s already been completed (and can be inspected with your own eyes). The thing is that, while the condo payment schedules for the two types aren’t vastly different from each other, there are differences you should know.

Let’s take the example of newlywed couple Eddie and Alexandra, who are both Singapore citizens with a combined income of $14,000/month, and CPF balance of $60,000.

They’re interested in purchasing a unit in a new development that hasn’t started construction yet, at a price of $1,500,000. To help process their transaction, they’ve engaged private legal counsel who have agreed to charge $3,500 for the entire purchase, and have obtained their valuation report at $350.

Since this would be their first bank home loan, they are entitled to up to 75% of the purchase price according to the loan-to-value (LTV) limit. This means that if they were to take out the full 75% financing, the loan quantum would be S$1,125,000.

As for the stamp duty, as they’re both Singaporeans and this is their first property, they’ll only have to pay the Buyer’s Stamp Duty (BSD).

You can use 99.co’s Stamp Duty Calculator to conveniently calculate how much BSD you’re subjected to.

Here’s what their condo payment schedule would look like, if they opt for the progressive payment scheme that’s available for new launch condos.

| Fee payable/stage of work | Approximate timeframe | Per cent of purchase price | Amount payable | Payment mode |

| Exercising the option (Option or booking fee) | 5 per cent | $75,000 | Cash | |

| Sign the Sale and Purchase (S&P) agreement to exercise the OTP | Within 3 weeks of receiving it | |||

| Buyer’s Stamp Duty (BSD) | Within 14 days of signing the S&P | 1 per cent of first $180,000 | $44,600 | Cash/CPF |

| 2 per cent of next $180,000 | ||||

| 3 per cent of the next $640,000 | ||||

| 4 per cent of the next $500,000 | ||||

| Downpayment | Within 8 weeks of exercising the option | 15 per cent | $225,000 | Cash/CPF |

| Legal fees | ~$2,500 – $4,000 | $3,500 | Cash/CPF | |

| Valuation fee | ~$350 – $500 | $350 | Cash/CPF | |

| Foundation of work | ~6 – 9 months from launch | 10 per cent | $150,000 | Cash and/or bank loan |

| Reinforced concrete framework | ~6 – 9 months later | 10 per cent | $150,000 | |

| Brick walls of unit | ~3 – 6 months later | 5 per cent | $75,000 | |

| Ceiling of unit | ~3 – 6 months later | 5 per cent | $75,000 | |

| Door and window frames in position, wiring, internal plastering and plumbing of unit | ~3 – 6 months later | 5 per cent | $75,000 | |

| Car park, roads and drains serving the project | ~3 – 6 months later | 5 per cent | $75,000 | |

| Notice of vacant possession | TOP date | 25 per cent | $375,000 | |

| Legal completion date | Date of legal completion/certificate of statutory completion (CSC) | 15 per cent | $225,000 | |

| Total | $1,548,450 |

Keep in mind that the booking fee of S$75,000 needs to be paid entirely in cash, and cannot be supplemented using CPF or a bank loan.

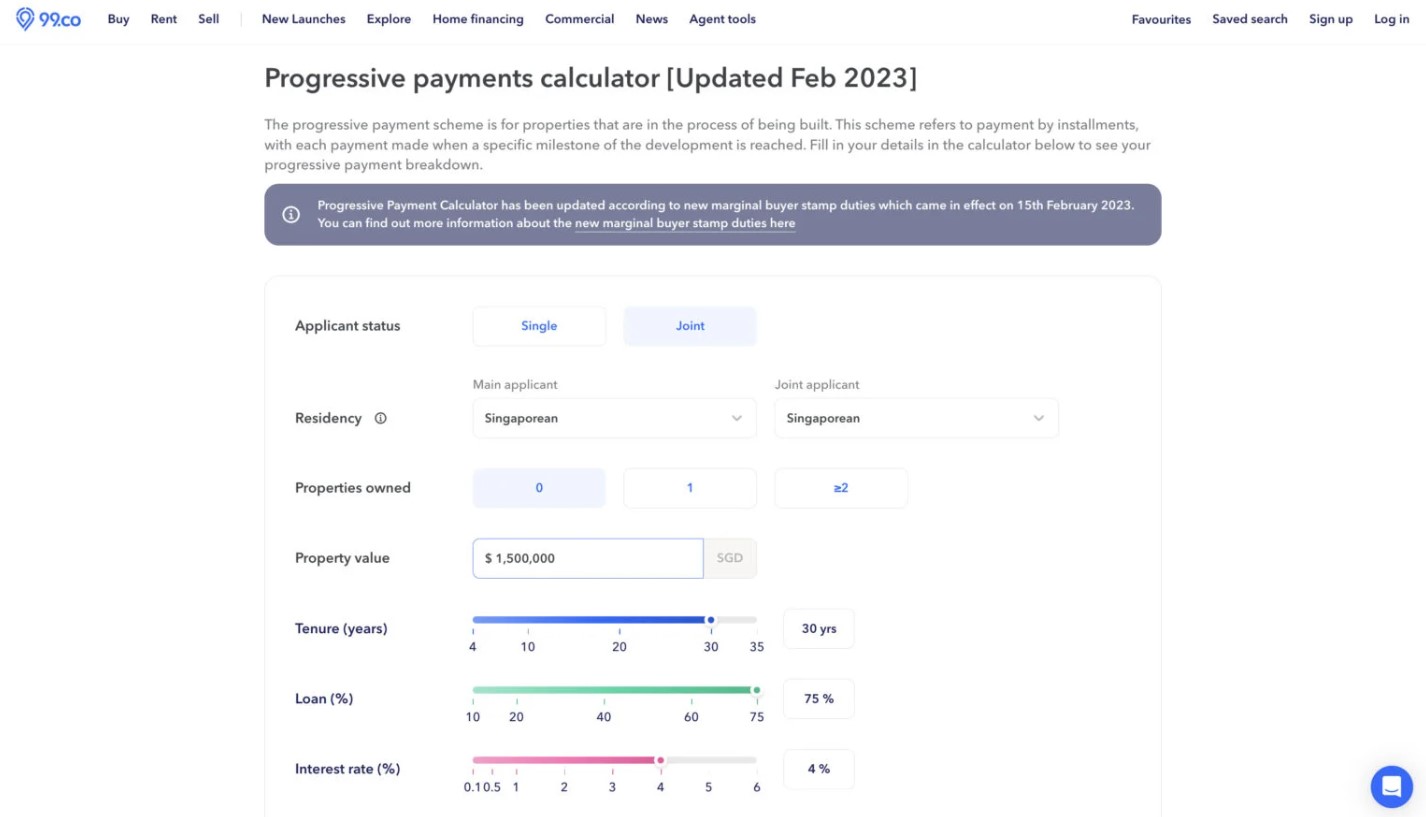

To get a breakdown of how much the couple would pay per month with the progressive payment scheme, we filled up the following details on 99.co’s progressive payment scheme calculator. We assume the home loan is on a 30-year tenure and an interest rate of 4 per cent per annum.

Here’s how much the couple would pay per month, as the condo gets built.

You can also use 99.co’s progressive payment calculator to do the math for you!

Now let’s see how the finances work out if Eddie and Alexandra decide to buy a completed development (i.e. a resale condo) instead.

| Fee payable/stage of work | Approximate timeframe | % of purchase price | Amount payable | Payment mode |

| Grant of option (Booking fee) | 1% | S$15,000 | Cash | |

| Exercise of option (Option fee) | Within 14 days of grant of option | 4% | S$60,000 | Cash |

| Buyer’s Stamp Duty (BSD) | Within 14 days of exercising the option | 1% of first S$180,000 | S$44,600 | Cash/CPF |

| 2% of next S$180,000 | ||||

| 3% of the next S$640,000 | ||||

| 4% of the next S$500,000 | ||||

| Legal fees | ~S$2,500 – S$4,000 | S$3,500 | Cash/CPF | |

| Valuation fee | ~S$350 – S$500 | S$350 | Cash/CPF | |

| Legal completion of sale and purchase at lawyer’s office | ~ 8 – 12 weeks of exercise of option | 95% (balance of purchase price) | S$1,425,000 | Cash and/or bank loan |

| Total | S$1,548,450 |

Again, the S$75,000 in booking and option fees will need to be paid completely in cash; CPF funds and bank loans cannot be used.

Likewise, assuming the couple would take a 30-year home loan at an interest rate of 4% per annum, here’s how much they’ll have to pay for the monthly instalments. This is calculated with 99.co’s mortgage calculator.

One of the costs will be renovation costs, which will depend on how extensive the renovation will be.

Plus, there’s the condo maintenance fee that you’ll have to pay every three months. This depends on the condo, but it can range from $250 to $1,000 a month.

Also, don’t forget about the property tax, which is based on the annual value of a property. In general, the annual value of a condo unit is higher than an HDB flat.