All you need to know about income tax in Singapore

It's that time of the year again. This tax period YA 2020, you will be paying taxes for the income earned last year in 2019. So, we put together a checklist of the details you need to know when filing your income tax.

Taxes are considered contributions towards nation-building in Singapore. During Budget 2020, the Deputy Prime Minister and Finance Minister Heng Sweet Keat announced a slew of support measures from the government to aid businesses, families and individuals in Singapore.

Across the world, tax rates vary across countries. Here, in Singapore, with a progressive tax system in place, here's all you'd need to know when filing this Year of Assessment (YA) 2020 for the year that ended on 31 Dec 2019.

WHO NEEDS TO PAY INCOME TAX IN SINGAPORE?

You will need to pay income tax if you earn, derive or receive income in Singapore, unless specifically exempted under the Income Tax Act or by an Administrative Concession.

Also, you must file an Income Tax Return if you receive a letter, form or an SMS from the Inland Authority of Singapore (IRAS) informing you to do so.

More specifically, these are the following groups of people that will need to pay tax in Singapore:

1. Individuals working in Singapore: Those who receive payments (whether in the form of cash or benefits-in-kind) for any service rendered in or any form of employment from Singapore

2. Individuals doing business in Singapore: Self-employed individuals such as sole-proprietors, partners, freelancers, taxi drivers, hawkers, commission agents, among others, who derive their income in Singapore.

3. Individuals with investments in Singapore: Those who derive income from their investments in property, shares, unit trusts, fixed deposits, etc. in Singapore (unless their investment is specifically exempted under the Income Tax Act).

4. Individuals working outside Singapore:

[[nid:469744]]

5. Individuals who are not working but receiving income: This includes income from investments, NSman income (including all awards and allowances including IPPT monetary incentives), Part-time income, Royalty income, Pension, or Supplementary Retirement Scheme (SRS) withdrawals.

You will not need to pay income tax if you are earning gross income of $22,000 or less in a year, or if you do not derive or receive any income in Singapore. If you receive a letter or SMS informing you that you have been selected for No Filing Service, you are not required to file a tax return.

You can also check your filing requirement if you have not been contacted by IRAS.

WHAT IS TAXABLE AND WHAT IS NOT?

You are taxed based on the income earned in the preceding calendar year. This means that for income earned in 2019, you will be taxed in the Year of Assessment (YA) which is 2020.

Taxable income refers to:

Income that is non-taxable include:

HOW MUCH TAX WILL YOU NEED TO PAY?

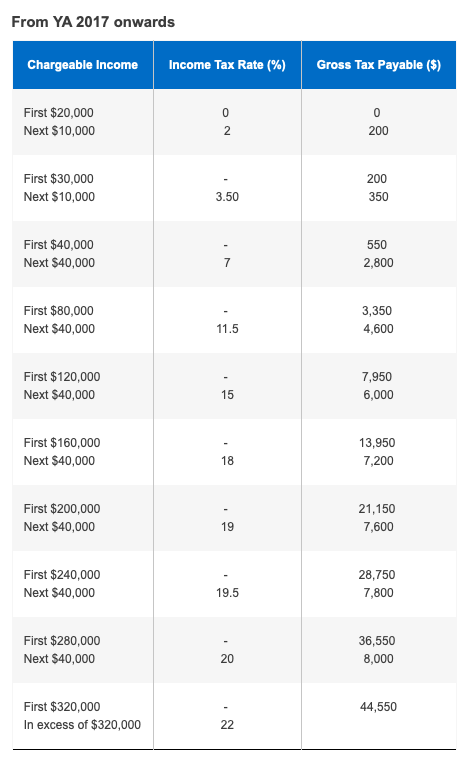

Singapore has a progressive income tax system in place for resident taxpayers. This means that higher income earners pay proportionately more tax. The current highest personal income tax rate for the higher earners is 22 per cent.

Here's the resident tax rates that you can refer to in order to find out how much you will need to pay in taxes.

WHAT IS THE DEADLINE FOR YOU TO FILE YOUR INCOME TAX?

Do your taxes before:

After filing, you will receive a copy of your tax bill (Notice of Assessment) for YA 2020 from end-April 2020 onwards. This will show you how much tax you need to pay. You might also receive an SMS alert once your tax bill is finalised and ready for online viewing, if you have updated your mobile number with IRAS.

You have one month from the date of the Notice of Assessment (NOA) to pay your taxes.

HOW TO FILE YOUR INCOME TAX

To file your tax return, please log into myTax Portal using your SingPass. You can do so either on your desktop or on your mobile phone. You will need SingPass 2FA to login to myTax Portal.

There are 5 parts to filing your income tax.

1. INCOME

[[nid:465773]]

Declare your income. This includes employment income, trade, business, profession or vocation income, rental income and any other income.

If your employer is participating in the Auto-Inclusion Scheme (AIS) for Employment Income, you do not need to declare your employment income information, and this information will be pre-filled in the form.

However, if your employer is not participating in the AIS, you would have received a IR8A form from your employer and you will have to input details such as your income and bonuses.

You should also have records of your income on hand to help you accurately declare it in your tax return.

2. EXPENSES

This section refers to expenses incurred while earning your income. This could include employment expenses, business expenses and other expenses.

3. RELIEFS/REBATES AVAILABLE TO ALL TAXPAYERS

These tax reliefs help promote specific social and economic objectives. For example, making a donation at a registered charity is eligible for tax relief. The reliefs under this section for individuals include:

These tax reliefs on your income tax, assessed in YA 2020, has to be undertaken during the year in which you earned your income (2019 in this case). This is something you can keep in mind before 2021 arrives.

4. ADDITIONAL RELIEFS/REBATES AVAILABLE TO MARRIED/DIVORCED/WIDOWED TAXPAYERS

This includes:

5. ADDITIONAL RELIEFS/REBATES AVAILABLE TO MARRIED/DIVORCED/WIDOWED FEMALE TAXPAYERS

This includes:

There is a personal income tax relief cap of $80,000 for each Year of Assessment. You can find the full list and information on deductions for individuals (reliefs, expenses, donations) here.

INCOME TAX PAYMENT METHODS

When you receive a copy of your tax bill (Notice of Assessment) for YA 2020 sometime after the end of April 2020, you will have to pay the amount indicated in the tax bill.

Here are a few ways you can pay your income tax:

Here are all the details on the tax payment modes available for individuals. You get one month from the date of the Notice of Assessment (NOA) to pay your taxes (even if you have filed an objection and are awaiting the outcome).

WHAT HAPPENS IF YOU PAY YOUR TAX LATE?

[[nid:427494]]

Similar to a credit card bill or monthly repayment for loans, you will incur late charges. If you miss the payment due date, you will incur a late payment penalty of 5 per cent and subsequently an additional 1 per cent for every month (up to a maximum of 12 per cent of the tax outstanding).

A letter will be sent to you regarding this 5 per cent late payment penalty. You will have to make payment before the due date stated on the letter to avoid further penalties.

If the tax continues to remain unpaid, further enforcement actions could be done for IRAS to recover the taxes, such as:

With just a few weeks left to file your income tax, it's a good time to visit myTax Portal to get started and get yourself familiarised. You could also use this handy guide by IRAS for step-by-step instructions on e-Filing via MyTaxPortal.

This article was first published in SingSaver.com.sg.