Analysing unprofitable condominiums: 6 reasons why The Tennery has performed badly

As a continuation from our piece on 13 condos with the most unprofitable transactions, here’s where I (try to) dig deeper into why each particular condo has not done well.

Some may say that these reasons may only be obvious on hindsight, but as the saying goes:

Those who cannot remember the past are condemned to repeat it.

Like I mentioned in my analysis on Stellar RV, there is never just one reason why a property may not do well.

Sure, some reasons may be more important than others, but it is almost always a combination of it all.

In today’s analysis, I will be looking at The Tennery and the possible reasons why it has not fared too well in the resale market today.

For those that might have remembered its launch in 2010, it was one of those hot launches back in the day.

Built by reputable developer Far East Organisation, it had a line of cars at the showflat during its launch – they even had to have car valets.

That hype obviously translated to sales, as in its first month of launch, it had sold 261 out of its 388 total units.

ALSO READ: Can an old condo be a better investment?

Let’s get right to it.

Location: Woodlands Road (District 23)

Developer: Dollar Land Singapore Pte. Ltd.

Lease: 99-years from 2010

Completion: 2014

Number of units: 388 units

Profitable transactions: 31

Unprofitable transactions: 33

Pricing

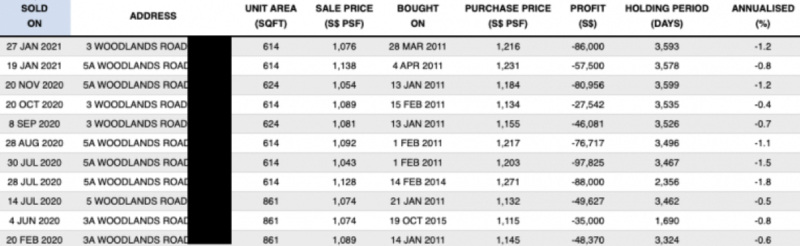

While The Tennery has recorded 33 unprofitable transactions so far, it has actually also managed to chalk up 31 profitable transactions.

The average profit so far has been $53,108, while the average loss is -$72,710.

But if you want to be really pessimistic about it, a good number of the profitable transactions would actually be just about breakeven or unprofitable if you were to take into account transaction costs (lawyer fees, agent commissions, interest).

So as of today, prices currently stand at $1,083 psf.

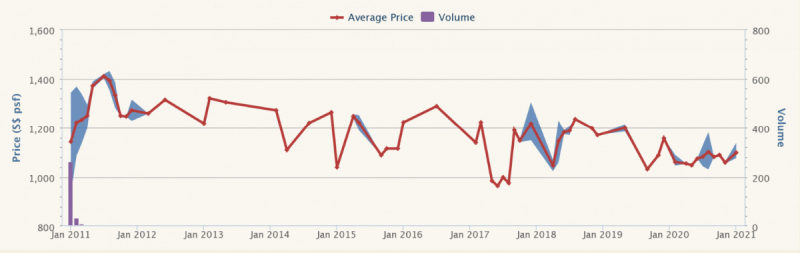

The Tennery definitely did garner lots of talk when it first launched back in 2011.

You might be aware of Far East Organisation’s tendency to price at a premium wherever they launch – The Tennery was no different.

At that time, the average price for new launch condos in District 23 was $1,138 psf. In contrast, The Tennery had an average launch price in January 2011 of $1,143 psf.

Doesn’t sound like much in it, right?

Well, that is until you find out that The Tennery garnered the majority of new launch transactions that month – 98.1 per cent to be exact.

It’s closest comparison, Mi Casa, only had five transactions out of 266 total new launch transactions.

At $883 psf, this represented a premium of 29 per cent.

Still, as mentioned earlier, that didn’t stop too many people as it did sell 261 out of its 388 units in the first month.

Now that we’ve gone through the pricing, let’s look at some of the possible reasons for its resale performance so far.

Let’s now look at some of its competition in the area at that time.

Frankly, it actually didn’t have much close comparisons as newer developments like Hillion and Hillsta only came about a couple of years later.

But just to give you an idea, here are its two closest resale competitors at the time: Maysprings and The Linear.

Note, these are exact (lowest) prices taken at the time of launch.

| Project | TOP | Tenure | Two-Bedroom Size | Quantum | PSF |

| The Tennery | 2014 | 99 years | 850 sqft | $863,689 | $1,016 |

| Maysprings | 1998 | 99 years | 818 sqft | $680,000 | $831 |

| The Linear | 2006 | 999 years | 936 sqft | $750,000 | $801 |

As you can see from the table above, while there is a significant age gap, the sizes of Maysprings and The Linear are about equivalent to The Tennery.

It doesn’t take a genius to see that the prices at Maysprings and The Linear are definitely more affordable on an overall quantum basis.

And while you can argue that Maysprings is considerably older than The Tennery, that nearly 30 per cent premium will also be a big factor particularly for buyers who will be more sensitive at this price point.

ALSO READ: Top 10 Singapore districts with the highest property appreciation

But that’s not to say that Maysprings and The Linear did not come with its own set of complaints.

Many people do single out the small swimming pools of Maysprings and the awkward narrow layout of The Linear as a point of contention.

That said, here’s what would have happened if you had bought a unit at either Maysprings or The Linear instead.

I would have liked to show actual transaction data here, but because of a lack of transactions in this time frame, I took the average psf from the past year of the two-bedroom units in each development.

| Project | Two-Bedroom Size | Price in 2011 | PSF 2011 | Current Price | Current PSF |

| The Tennery | 850 sqft | $863,689 | $1,016 | $901,000 | $1,060 |

| Maysprings | 818 sqft | $680,000 | $831 | $750,924 | $918 |

| The Linear | 936 sqft | $750,000 | $801 | $992,160 | $1,060 |

While each of the developments have appreciated, you can see that Maysprings and The Linear have both fared better than The Tennery. (Of course, let’s not forget The Linear is essentially a freehold property).

The thing is, many buyers were buying in at that higher price point because of their perceived value of what is supposed to come (Downtown MRT line, spillover rental tenants from the Jurong Lake District).

While some might say that the reaching effects of the JLD has yet to be fully realised, I would say the ceiling for The Tennery has been somewhat hampered by the presence of these two comparables in the area.

Which leads me to my next point.

In most cases, having a new launch in the area will help to boost the prices because of the new higher price that it is launched at.

That is, unless it is priced competitively (Penrose vs Sims Urban Oasis, for example).

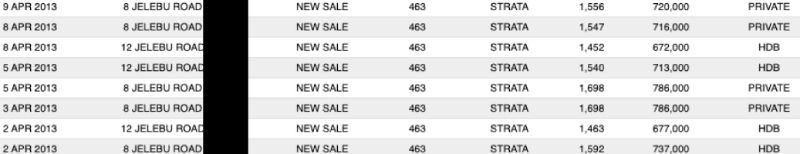

With The Tennery, this was impacted by the launch of Hillion Residences in early 2013.

It boasted a bigger retail mall below, and it was right smack where the Downtown MRT station would be.

In other words, it was the best location in terms of convenience in Bukit Panjang.

Naturally, you would expect it to push the boundaries of pricing in Bukit Panjang – and it did, as the average selling prices in the first 2 months was about $1,363 psf, a good amount higher than The Tennery.

But as mentioned by Ryan previously here , new launches are attractive because the overall quantum is actually lower.

If we were to compare between the prices transacted during 2013, you can see the difference in prices.

So while the unit was much smaller at Hillion Residences on paper, it also translated to a lower overall price.

Which is why despite the difference in size, that price point plus added convenience meant that most people would see Hillion Residences as the more appealing option.

And by it being the newer project, it would mean there would be a cap on the prices that The Tennery could command.

But frankly, the Hillion Residences hasn’t exactly set the world alight either – so the limitations are there for all to see.

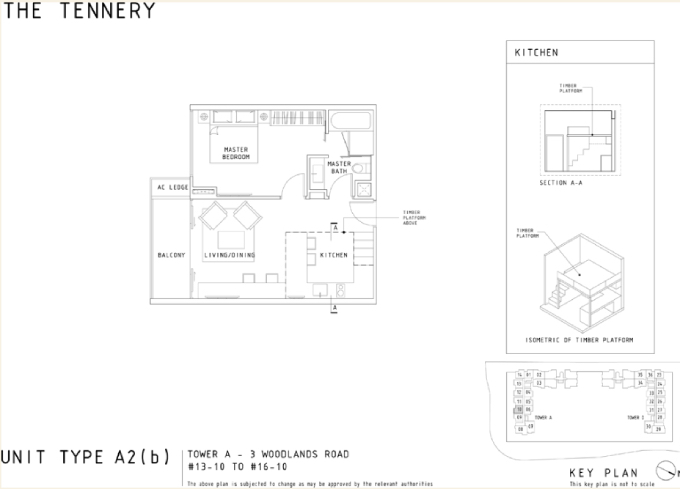

While this was a trend back in 2011, having a loft unit today is more commonly seen as an inefficient use of space.

In today’s market, you are much more likely to see loft units featured in the special units (top floor, bottom floor, penthouse) rather than the entire development like The Tennery.

Bear in mind, that these loft units were at a height of 3.4 metres – which if you think about it, could also be pessimistically classified as just a unit with a high ceiling.

I can’t speak for everyone, but I reckon a proper loft unit would really only be useful at at least four metres in height – so you could at least stand on the platform quite comfortably.

At 3.4 metres while you are able to incorporate a platform to have extra space, the height limitations are quite restrictive to what you could actually do to it.

I’m guessing when it came down to a situation of a bigger unit with high ceiling but further away from MRT (The Tennery) versus smaller unit but directly above a better mall plus MRT (Hillion Residences), the choice was quite straightforward for many.

As much as mixed-developments are being flaunted as a must have, it really only becomes a draw when the curation of its tenants are well-rounded.

Case in point: places like North Point Residences or Watertown Condo.

I would go so far to say that Far East malls aren’t as competent as their competitors like Frasers when it comes to shopping malls.

ALSO READ: Why are Singapore property prices returning to pre-Covid-19 levels so quickly?

I’m not going to go through their entire list of malls here, but a few that pop to mind like Pacific Plaza, West Coast Plaza or Clarke Quay Central aren’t known to be the most attractive spots.

When first launched, Junction 10 (the mall at The Tennery) was definitely meant to be a draw for residents. And to a certain extent, it was.

Initial tenants included shops like Giant, Watsons, Guardian, BreadTalk, ToastBox, BBQ Chicken and Kumon.

Today, most of them have been replaced with new tenants like Sheng Siong (which undoubtedly is great for residents).

But the resulting current unit mix isn’t good enough that footfall to the shopping mall is satisfactory.

The tenant mix reads something like a small neighbourhood mall than it does a proper retail destination.

And well, you can’t really be expecting much when the retail space consists of only two small floors.

The biggest kicker was when they actually closed the Ten Mile Junction LRT station at The Tennery in 2019 – the reason being low ridership numbers.

This was also the first ever MRT/LRT station to be removed from operations.

Clearly, this signified that even with an LRT station for residents in Bukit Panjang to easily access the mall, it wasn’t enough to draw people in.

338 units. 227 one-bedroom, 111 two-bedroom.

[[nid:526549]]

It’s plain to see that investors were the main target audience for such a project.

More commonly than not, you’ll find that projects geared towards rental will have investors that have lesser staying power.

If they’ve made their money from rent, they are more inclined to let go of their property – even at a loss if they have identified better opportunities elsewhere.

Contrast this to an own stay project where the homeowner would need to sell at a palatable price in order to upgrade or fund for retirement – the mindset there is very different.

And so, that leads me to the final point.

Of course, if the rental numbers that you’d get from The Tennery were good, it would be a different story.

| Hillion Residences | Maysprings | The Tennery | |

| Year | 700 – 800 sqft | 700 – 800 sqft | 800 – 900 sqft |

| 2014 | – | – | $2,450 |

| 2015 | – | – | $2,445 |

| 2016 | – | $2,167 | $2,440 |

| 2017 | $2,450 | $2,073 | $2,312 |

| 2018 | $2,360 | $2,069 | $2,292 |

| 2019 | $2,428 | $2,099 | $2,353 |

| 2020 | $2,439 | – | $2,348 |

| 2021 | $2,600 | – | $2,275 |

I’m only showing the two-bedroom units here, as the Maysprings has no-one bedroom units to compare with.

But you can see that while The Tennery used to be able to command above $2.4k a month in rent, this dropped once Hillion Residences was introduced to the scene.

And again, it’s not difficult to see why.

It is the newer development of the two, the shopping mall is a proper one, and the MRT station is right there.

| Project | Size | Rent | Quantum | Rental Yield |

| The Tennery | 861 | $2,275 | $930,000 | 2.9 per cent |

| Hillion Residences | 710 | $2,600 | $1,020,000 | 3.05 per cent |

It isn’t a stark difference here, but it is a higher rental yield nonetheless.

To be honest, there could be even more factors.

Heavy vehicles heading to and from JB and Kranji plying the flyover, possibly even not enough support from HDB prices in the area (I will need to study this further).

ALSO READ: 5 highest-yielding Paya Lebar condominiums under $1.4m

As always there is never just one reason, but a mix of different reasons.

Things could change in the future, when the vision of the JLD is fully realised. But for now, these are the current issues that this development is facing.

This article was first published in Stackedhomes.