Are higher floor units better in terms of profitability?

Did you know that in the UK, it wasn’t too long ago that living in a tall building was considered to be the opposite of luxurious living?

But that’s slowly changing.

Increasingly, tall buildings are being regarded as a sign of luxurious accommodation. From the stunningly tall and slim 432 Park Avenue to our very own Wallich Residence, it’s commonplace that the higher up you go the more money you’d have to pay.

This is why the conventional wisdom and sales pitches from property agents surrounding property purchases tend to direct consumers’ attention towards units located on higher floors.

With attractive reasons being mooted such as better privacy and views that are likely to be unobstructed – a definite draw especially in a concrete jungle like Singapore. In return, your future buyers will likely pay you more for such exclusivity – or so, some may claim.

So just how true are these claims?

Undoubtedly, this has been a question on many people’s minds. As such, we have ran the numbers to find out the appreciation of units to see the difference between the ground and high floors. So to find out which one gives you the better bang for your buck, read on!

Before we present our findings, we wish to highlight a few points on how we conducted this analysis:

We gathered some key findings based on the insights we gleaned from the data and have summarised them as follows:

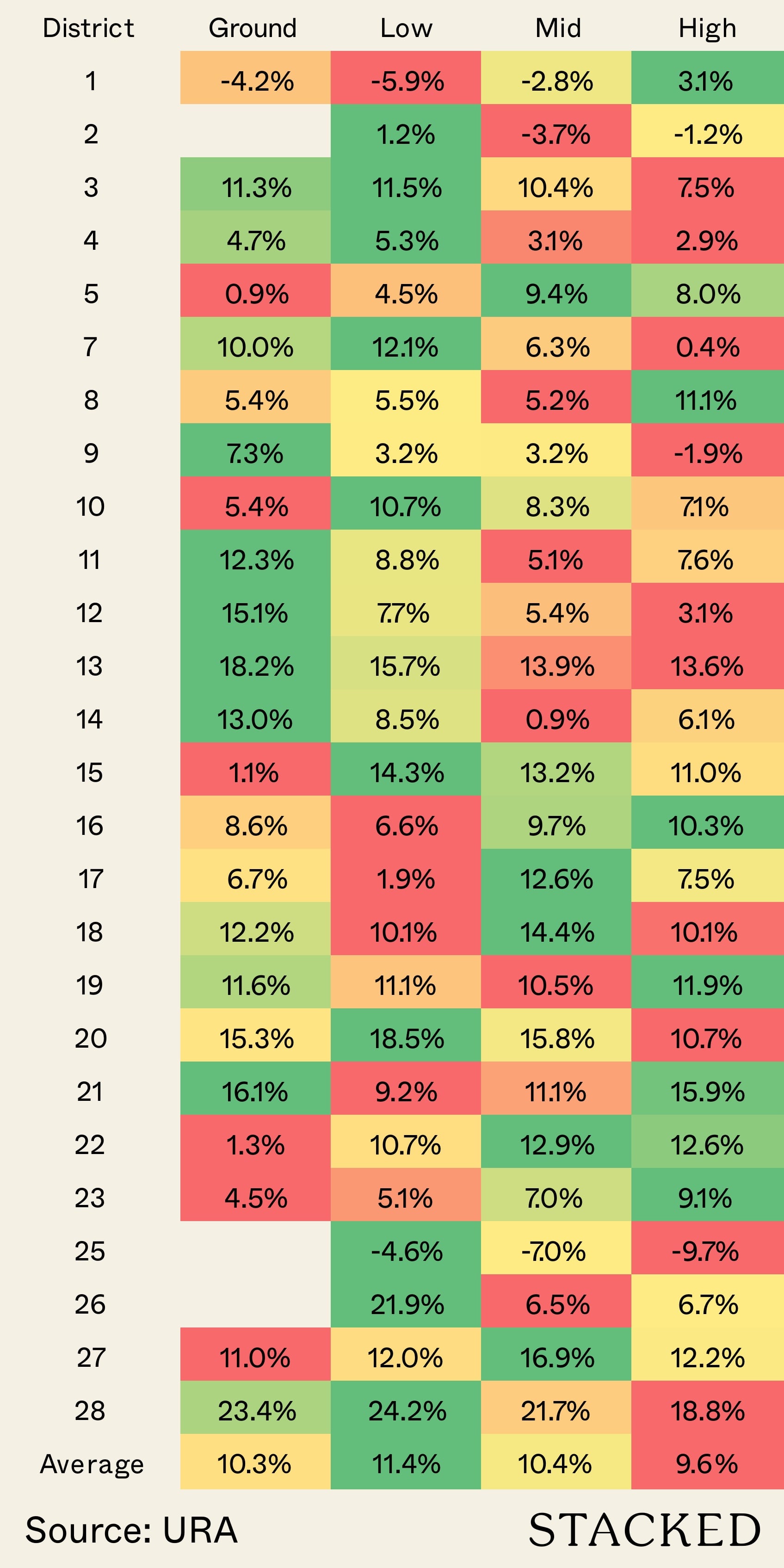

Contrary to the notion that ground and lower floor units should be shunned as they are more susceptible to dust, noise, pests, and intrusion of privacy (which makes them more difficult for owners to offload and reap decent returns), our findings revealed otherwise as shown in Figure 1.

The chart above illustrates that ground to mid-floor units saw better appreciation than units on high floors in general.

One reason why this could be the case is due to lower floor units having more room to appreciate. For example, HDB upgraders may prefer staying in the vicinity of their previous flats due to the proximity to schools, parents/in-laws, and amenities.

To them, affordability and convenience is a key consideration, where lower floor units are likely to fit the upgrader’s housing needs. There is little need to pay a premium for a high floor unit, thus the pool of buyers for these lower floors would be bigger.

The next section shares more on how the location determines the profitability of ground to high floor units.

“Location, location, location”. We hear this mantra being preached to us religiously either from our family/friends or property agents, whenever we think of venturing into the property market. For starters, developments in prime locations are touted to be the crème de la crème with the highest potential for attractive capital growth. However, our findings present a completely different picture as shown in Figure 2.

Figure 2: Average Appreciation By Region (Source: URA)

| Market Segment | Ground | Low | Mid | High | Average |

| Outside Central Region | 10.8 per cent | 13.4 per cent | 13.8 per cent | 12.5 per cent | 13.2 per cent |

| Rest of Central Region | 10.6 per cent | 10.8 per cent | 8.3 per cent | 7.7 per cent | 8.9 per cent |

| Core Central Region | 7.1 per cent | 7.4 per cent | 4.9 per cent | 4.0 per cent | 5.5 per cent |

| Average | 10.3 per cent | 11.4 per cent | 10.4 per cent | 9.6 per cent | 10.4 per cent |

Figure 2A: Average Appreciation By Region (Source URA)

As indicated in the preceding section, lower floors (with the exception of ground units) recorded better returns in the OCR. This could be so as they are more palatable financially for buyers, who are likely to be upgraders.

The trend continues as with the Rest of Central Region (RCR) and Core Central Region (CCR), where we observed that the low floor units surpass mid-floor units, which surpass high floor units in terms of capital appreciation. Notably, we saw that mid to higher floor units in the CCR do not appreciate well, as compared to the lower floor units in the same region.

We’d have to study this more, but this is likely because the entry prices at the mid to higher floors could already be steeper from day 1 and would have eroded much of the gains that one could possibly have.

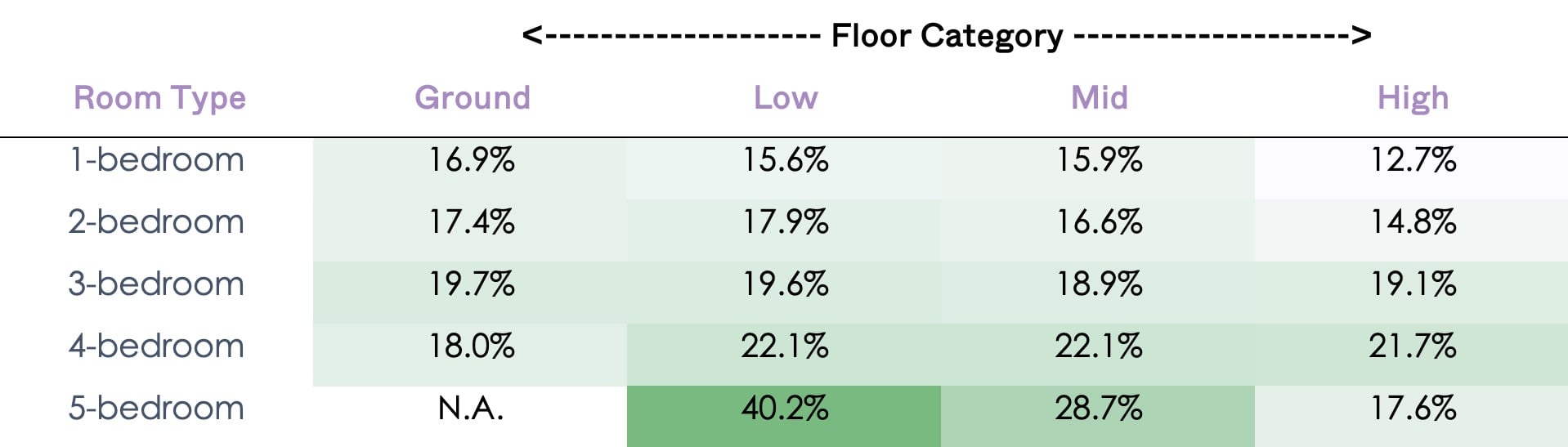

Besides location, another interesting trend that we observed is the direct relation of the unit size and their respective appreciation.

Table 1 : Average Appreciation By Unit(Source: Edgeprop, SRX, URA)

Table 1 tells us that the gains from units on lower floors generally rose as the size of the units increased, which corroborates with our earlier findings in the previous section that upgraders may favour units on lower floors due to their affordability and more attractive entry point.

We may see this trend persists as the current work-from-home arrangement continues, as home buyers prioritise space when seeking new homes.

In fact, returns from units on lower floors have generally outperformed their counterparts on higher floors across all unit types, especially for the 1 and 2 bedroom unit types, which are more popular for investment purposes* and located in the RCR and CCR (*We have previously covered to a greater extent on the investment potential of 1 and 2 bedroom unit types, particularly the latter, in this link here ).

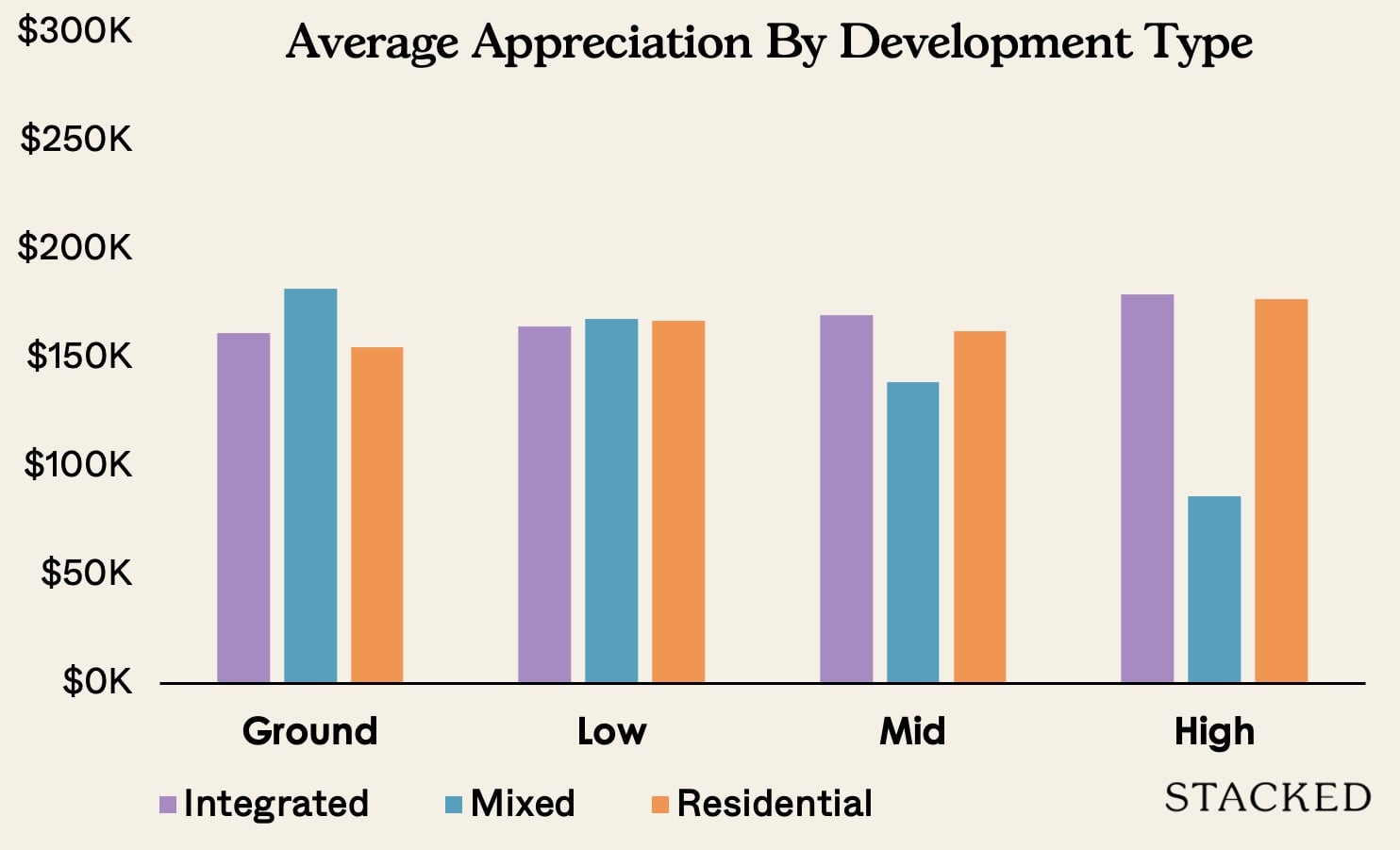

We have previously touched on the allure of integrated and mixed developments in our previous posts, as well as their price performance. While it is obvious that these developments have been holding their values well given the convenience (i.e. Live, Work and Play in one stop) that they can offer to potential owners, we thought it would be interesting to add another dimension on floor levels to see how the numbers would fare.

Figure 3 shows that there is not much difference in terms of capital gains between integrated, mixed, and pure residential developments. But that is with the exception of the mid to high floor units, where the returns for mixed developments trail those of the integrated pure residential developments.

Our theory is that for residential developments that are in matured estates (e.g. Clementi) where amenities are bountiful (complemented by the ubiquitous online food delivery and ride-hailing services) there is no strong impetus for buyers to pay substantially more for integrated and mixed developments over their pure residential counterparts.

To conclude, our findings show that it does not necessarily mean lower floor units yield poor returns and neither are high floor units guaranteed to appreciate better.

Fundamentally, a unit on a lower floor with the right attributes (e.g. entry price, location, size of the unit) can still appreciate better than units on higher floors. It always boils down to the same conclusion – there are a lot more attributes that go into the performance of a unit in the resale market – and it’s never just down to one attribute only.

While these findings are interesting, do note that we’ve only looked at 25 total developments when comparing between bedroom and property type – so you could choose to take this all with a grain of salt. But we can consider this good enough evidence to support the theme that the difference between a high floor and ground floor isn’t conclusive – but it’s not an empirical study by any means.

However, a more relevant question for you to ponder would be the purpose of your purchase (i.e. investment or own stay). An investor would definitely require the aforementioned attributes, while a homeowner type purchase is very much dependent on an individual’s preference that is intangible and cannot be measured by potential appreciation alone.

This article was first published in Stackedhomes.