Are Lulelemon shares too expensive?

To say that Lululemon has been on a hot streak is a major understatement. The Canadian athletic apparel maker's revenue and earnings per share soared 21 per cent and 34 per cent respectively in the first nine months of 2019.

Consequently, market participants have driven Lululemon's shares up by 79 per cent in the last year. That brings its five-year gain up to 273 per cent.

But with its share price sitting near its all-time high, have investors missed the boat?

I decided to do a quick assessment of Lululemon's investment potential based on my blogging partner Ser Jing's six-point investment framework.

COMPANY DESCRIPTION

Before diving into my analysis, here is a quick brief on what Lululemon does. Lululemon is one of the first companies to specialise in athletic apparel for women. Its products are distributed through its network of company-operated stores and direct online sales channels.

Lululemon's products are unique in that it has its own research and design team that source advanced fabrics that feel good and fit well. Customers of Lululemon tell me that its products indeed feel more comfortable than other brands.

With that, let's take a look at how Lululemon fits into our investment framework.

1. IS ITS REVENUE SMALL IN RELATION TO A LARGE AND/OR GROWING MARKET, OR IS ITS REVENUE LARGE IN A FAST-GROWING MARKET

One of the key things we look for in companies is whether they have the ability to grow. A company can grow either by increasing its market share in a large addressable market or by participating in the growth of a growing market.

I think Lululemon can do both.

Lululemon's revenue is tiny compared to its current total addressable market size in the sports apparel space. According to Allied Market Research, the sports apparel market was valued at US$167.7 billion (S$226.2 billion) in 2018 and is estimated to reach US$281 billion by 2026.

[[nid:474357]]

Comparatively, Lululemon's net revenue of US$3.7 billion is just 2 per cent of the total addressable market in 2018.

In particular, the athletic apparel brand has set its sights on enlarging its menswear segment and has seen some solid progress in recent years. In the most recent quarter ended 3 Nov 2019, sales of Lululemon's men's category increased by 38 per cent.

The Canadian brand is also increasing its international presence, which presents a huge market opportunity for the company. Revenue from countries outside of the US and Canada increased by 35 per cent in the three quarters ended 3 Nov 2019. And yet, sales outside of North America still contributed just 12 per cent of Lululemon's total revenue.

In 2019, management introduced its "Power of Three" plan to grow revenue by the low double-digit range annually over the next five years. To do so, it plans to double its men's and digital revenues and quadruple its international revenue.

Based on Lululemon's addressable market size, I think these are very achievable goals. Given that traditional sports apparel powerhouses such as Nike and Adidas derive most of their sales outside of their home turf, I foresee that Lululemon's sales outside of North America will also eventually outgrow its North American sales.

2. DOES LULULEMON HAVE A STRONG BALANCE SHEET WITH MINIMAL OR A REASONABLE AMOUNT OF DEBT?

Lululemon has a pristine balance sheet. As of 3 Nov 2019, the Canadian company had US$586 million in cash and no debt.

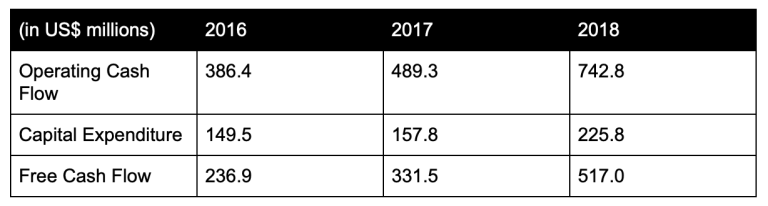

It has also been consistent in generating cash from its operations. Lululemon generated US$386 million, US$489 million, and US$743 million in operating cash flow in fiscal 2016, 2017 and 2018 respectively.

Lululemon's strong balance sheet and steady cash flow have allowed it to use internally generated funds to open new stores, invest in research for new products, and to open new geographical markets.

The company has also used some of its spare cash to reward shareholders through share buybacks. In the last three full fiscal years, Lululemon used more than US$700 million for share buybacks.

3. DOES LULULEMON'S MANAGEMENT TEAM HAVE INTEGRITY, CAPABILITY, AND AN INNOVATIVE MINDSET?

Calvin McDonald was appointed as chief executive officer of Lululemon in Aug 2018. So far, McDonald has overseen Lululemon's steady growth in sales over the last one and a half years, while building the brand in Asia and Europe.

[[nid:164353]]

I think he has done a good job so far and his plans to grow internationally and in the menswear segment seem sensible.

On top of that, McDonald brings with him a wealth of experience. He was the president and CEO of Sephora Americas, a division of LVMH group of luxury brands in the five years prior to joining Lululemon. During his tenure there, LVMH enjoyed double-digit growth in revenue.

I also believe that the management team has done well in maintaining Lululemon's brand image. The company is also consistently upgrading and increasing its product offerings.

The top executives are currently paid a performance bonus based on financial performance goals, weighted 50 per cent on operating income and 50 per cent on revenue. I think the performance goals are in line with shareholder interest.

That being said, I would prefer that the executives also have long-term goals in place that would encourage management to think of long-term strategies.

But overall, I still think that Lululemon's management has proven itself to have integrity and capability in increasing shareholder value.

4. ARE ITS REVENUE STREAMS RECURRING IN NATURE?

Recurring revenue is a beautiful thing for a company. Besides providing a reliable revenue stream, it also allows the company to spend less time and money to secure past sales and focus on other aspects of its business.

As Lululemon has built up a strong brand in its core markets in North America, I think that repetitive customer behaviour will result in recurring revenue for the company.

Another good indicator that customers are spending more at Lululemon's stores is its substantial comparable-store sales growth. Its comparable-store sales soared by 18 per cent for the fiscal year ended Feb 2019. Importantly, that figure has held up well this year too, increasing by 10 per cent (excluding the 30 per cent growth in direct-to-consumer channels) in the three quarters ended 3 Nov 2019.

While it is difficult to say how much of this was from existing customers, the fact that same-store sales have grown at a double-digit pace certainly bodes well for the company.

[[nid:474633]]

Lululemon also managed to increase its gross margin by 70 basis points to 55.1 per cent, which illustrates the brand's strong pricing power.

Its same-store sales growth is made even more impressive when you consider that Lululemon has been ramping up its store count by around 10-plus per cent per year.

5. DOES LULULEMON HAVE A PROVEN ABILITY TO GROW?

Lululemon is becoming the envy of retail. While numerous others are struggling to cope with the emergence of e-commerce, Lululemon has been growing both its brick and mortar sales, as well as its direct-to-consumer business.

Its net revenue and net income have increased at a compounded annual rate of 12 per cent and 15 per cent, respectively, from fiscal 2015 to fiscal 2018.

More importantly, that growth looks unlikely to slow down any time soon, with revenue and net profit for the first three quarters of fiscal 2019 increasing by 21 per cent and 34 per cent, respectively.

Lululemon's focus on international growth and men's apparel should see it comfortably hitting its target of low double-digit growth over the next five years.

6. DOES LULULEMON HAVE A HIGH LIKELIHOOD OF GENERATING A STRONG AND GROWING STREAM OF FREE CASH FLOW IN THE FUTURE?

The true value of a company is determined not on profits but on the cash that it can generate in the future. That is why Ser Jing and I look for companies that will not only generate profits but a growing stream of free cash flow per share.

In Lululemon's case, it has already been generating a steady stream of free cash flow each year. The table below shows Lululemon's operating cash flow and capital expenditure over the past three years.

Another point worth noting is that Lululemon's management has been sensible in the way it has reinvested its cash. It is consistently using around a third of its operating cash flow generated for new store openings and expansion of existing stores. It is also returning excess capital to shareholders through share buybacks.

As such, investors can rest easy that the company will not be unnecessarily hoarding cash that it doesn't need. Its net cash position has hovered between US$664 million to US$990 million at the end of the past five fiscal years.

[[nid:474410]]

RISKS

A discussion on a company will not be complete without talking about risks. The biggest risk to Lululemon's business is the mismanagement of its brand.

A good example of a growing sports apparel brand that ultimately lost traction with consumers is Under Armour. Under Armour devalued its brand by trying to cater to both the high-end and the low-end markets at the same time. Unfortunately selling cheaper products ended up hurting its brand appeal in the premium market.

Lululemon will need to manage its brand and price-point to prevent a similar scenario from hurting its sales. The company will need to be extra careful as it ramps up its menswear apparel.

Lululemon had previously positioned itself as a brand for women. Increasing its men's apparel sales could devalue this proposition and end up eroding the goodwill it has built with some of its existing customers.

Competitors can also eat into Lululemon's existing market share. Currently, Lululemon enjoys strong brand loyalty and boasts a product that customers are willing to pay up for.

If competitors develop new products that have similar look and feel to Lululemon's core offerings, it may be faced with eroding margins and difficulty retaining or growing its business.

Lululemon also faces the risk of keeping itself relevant. So far, the company has adapted well to the changing business conditions and have been one step ahead of competitors through new product offerings. For it to continue to grow at its projected five-year pace, Lululemon needs to continue expanding its product offering to retain customer loyalty.

VALUATION

What is a good price to pay for Lululemon? As with any company, this requires a reasonable amount of estimation and judgment.

The fast-growing retailer said that it expects to grow at a low double-digit pace over the next five years. If it manages to grow its earnings by around 15 per cent per annum, it will be generating around US$931 million in net income in five years' time.

Nike shares currently trade at a price-to-earnings ratio of around 36. Using that same multiple on Lululemon, I calculate that the Canadian sports apparel giant could be worth around US$33.5 billion by then.

[[nid:469073]]

Using that estimate, Lulelemon shares have a 5 per cent upside based on its current market cap of around US$31.8 billion. That doesn't seem like much.

However, let's assume the company also grows its bottom line by 15 per cent annually from year 6 to year 10. Given the huge addressable market outside of North America, a 15 per cent annualised growth rate over a 10-year period seems possible.

By 2030, Lululemon will have a net profit of US$1.9 billion. Taking a 35 times earnings multiple, it will have a market cap of US$65.3 billion. That's more than twice its current market cap, which translates to a decent 8 per cent or so annualised return over 10 years.

THE GOOD INVESTORS' CONCLUSION

Lululemon ticks all six boxes of Ser Jing's investment framework. It has a history of strong growth and is still small in comparison to its total addressable market. Management has also been proactive in returning excess capital to shareholders.

In addition, my valuation projection is fairly conservative. Lululemon could potentially grow its bottom line by more than 15 per cent annually.

On top of that, investors may be willing to pay a larger premium than 35 times its earnings, especially if Lululemon continues to grow at fast rates.

As such, even though its shares are trading at a seemingly rich valuation of around 56 times trailing earnings, if the company can sustain its growth over the next 10 years, investors who pick up shares today could still be well-rewarded over the long term.

This article was first published in The Good Investors. All content is displayed for general information purposes only and does not constitute professional financial advice.