Budget 2022 Singapore preview: What will it bring?

As a personal finance platform in Singapore, one of the year’s most significant events is the Singapore Budget.

The reason for this is simple.

The budget will have a material impact on the personal finances of everybody living in Singapore.

This year’s budget is no different as hot button issues like the rising cost of living in Singapore, a re-examination of wealth taxes, and the 2024 revised carbon tax rate will be covered.

Not to mention details of the timeline for the impending goods and services (GST) hike after Prime Minister Lee Hsien Loong announced in December 2021 that the Government will ‘start moving’ with its plans to increase GST from 7 per cent to 9 per cent for Budget 2022.

We will be covering the Singapore Budget 2022 live on Friday, Feb 18, 2022 at 3.30pm.

But for now, we will cover what we know so far and answer some popular questions people have about the budget.

I’m stating the obvious here, but you need to spend money to run a country.

Singapore’s healthcare, housing, educatio, economy, security and sustainability all come at a cost.

This is where the Singapore Budget comes in.

Before the start of each financial year (FY), the Singapore Government will take into consideration the country’s needs to develop the annual budget.

FYI: The financial year starts on April 1 and concludes on March 31 the year after.

The annual budget can be broken down into two main components:

In addition, the budget will answer questions like:

So you might be wondering when these questions will be answered.

The budget will be presented by the incumbent Minister for Finance, Mr Lawrence Wong, on Friday, Feb 18, 2022 at 3.30pm.

This will also be the first time Minister Wong will be presenting the budget statement in Parliament as Singapore’s Finance Minister, having taken over the role from Deputy Prime Minister Heng Swee Keat back in April last year.

As mentioned above, this year’s budget will cover the revised Government revenue and expenditure for FY2021 and Government revenue and expenditure for FY2022.

For the FY2022 budget, the primary entity responsible is, of course, the Ministry of Finance (MOF), Singapore.

The budget will then have to be approved by Singapore’s Cabinet Parliament and finally the incumbent President of Singapore, i.e. Madam Halimah Yacob.

You can check out the breakdown of this whole process below:

Like many Governments around the world, Singapore’s Government gets its revenue from taxes like:

ALSO READ: Budget 2022: Singaporeans to get help with cost of living, more Covid-19 support

In addition, the Government gets revenue from fees and charges like:

In addition, Singapore’s annual budget is supplanted by the Net Investment Returns Contribution (NIRC).

According to MOF, NIRC comprises:

The annual NIRC amount is published in each year’s Government Budget.

If you are interested, you can find a full breakdown of FY2021’s revenue and expenditure numbers here.

Well enough about revenue.

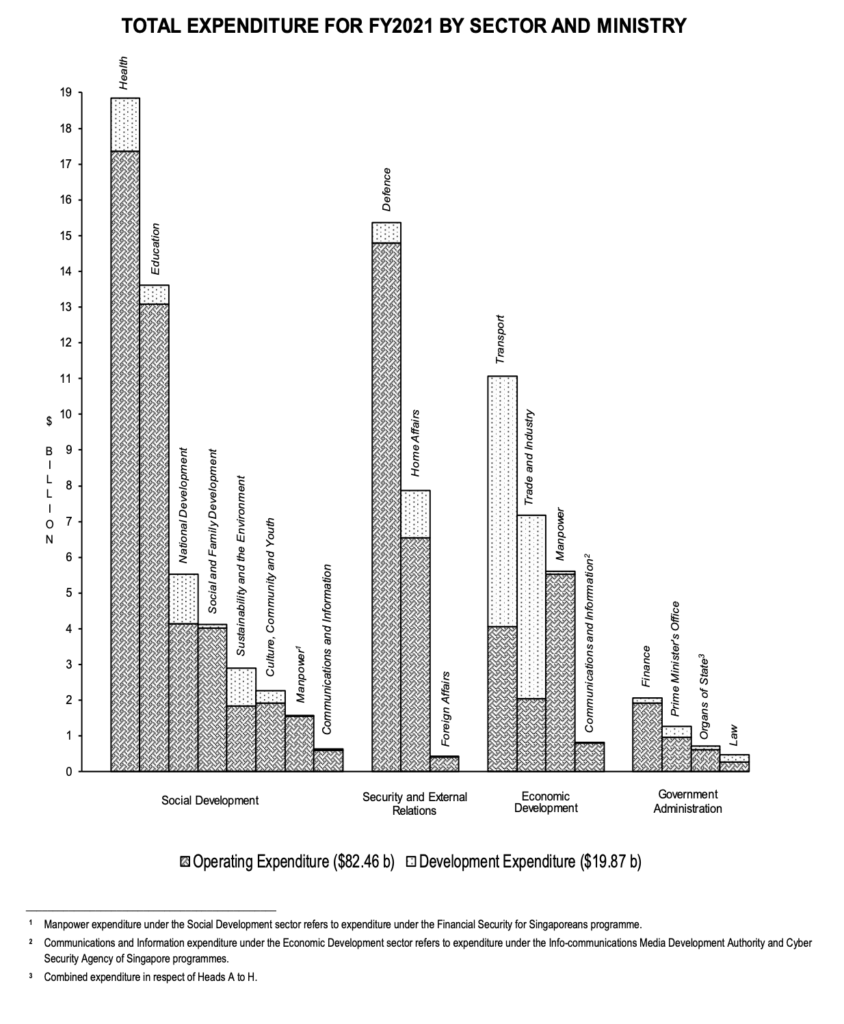

You might be wondering which ministry has the highest budget.

Well, the answer is straightforward if you look at the Singapore Government’s projected expenditure for FY2021.

The Ministry of Health has the highest budget as its expenditure is the highest.

As mentioned above, Singapore spends the most on healthcare, with the Singapore Government allocating 18.4 per cent of its total expenditure to healthcare:

Now that you’ve learnt a bit more about Budget 2022, here is how you can catch the 2022 Budget Statement.

On Friday, Feb 18, 2022 at 3.30pm, Minister Wong will deliver the Budget Statement in Parliament. This will be broadcasted on live television radio and streamed on the Singapore Budget website.

This article was first published in Seedly.