Cash management accounts with good interest rates and high liquidity in Singapore

Amidst this low-interest-rate environment, the banks have cut the interest rates for OCBC 360; Standard Chartered JumpStart; DBS Multiplier; and CIMB FastSaver multiple times this year.

With bank accounts and Singapore Savings Bonds interest rates dropping like grapes; you might be looking elsewhere for alternatives with good returns and high liquidity to store your emergency fund , save up, fund an upcoming expense or fund a future investment.

Enter Cash Management Accounts: which are defined as cash accounts offered by non-banking financial service providers such as brokerages and investment firms.

These accounts have an investing element, as the funds, you deposit are invested into low-risk funds like cash funds, money market funds (MMF) and short-duration bond funds.

Although these accounts are designed not to be used as everyday savings accounts, they share similar features, as you allowed to deposit money and withdraw funds, all while earning interest.

Disclaimer: We are not sponsored by any of these companies. Check out our Seedly Code of Ethics for more information. Information accurate as of Dec 4, 2020.

| Account | Net Yield (Non-Guaranteed) | Minimum Initial Deposit | Funding Sources | Withdrawal Time (To Bank) |

|---|---|---|---|---|

| MoneyOwl WiseSaver | 0.25 per cent p.a. | $10 | Cash | SRS | 1 - 2 business days |

| Phillip Smart Park | SGD: 0.59 per cent | $100 U$100 |

Cash | 1 business day |

| Phillip Smart Park | USD: 0.66 per cent | |||

| FSMOne Auto-Sweep | 0.80 per cent p.a | $50 | Cash | 3 business days |

| StashAway Simple | 1.40 per cent p.a. | No deposit requirements | Cash | SRS | 3 - 4 business days |

| Endowus Cash Smart Core | 0.90 per cent - 1.10 per cent p.a. | $10,000 (for new Endowus users) | Cash | SRS | 6 business days |

| Endowus Cash Smart Enhanced | 1.5 per cent - 1.7 per cent p.a. | Cash | SRS | ||

| Syfe Cash+ | 1.75 per cent p.a. | No deposit requirements | Cash | 2 - 4 business days |

All projected annual returns are net after accounting for any fees.

We will be comparing these cash management services based on the following criteria:

Before we start, it is important for you to know more about the difference in the risk of the cash management products these funds invest in — from cash funds, money market funds (MMF) to short-duration bond funds.

An important thing to note is that these cash management accounts are investment products, which means your capital is not guaranteed by Singapore Deposit Insurance Corporation (SDIC).

In the fund space, cash funds are the safest asset class amongst these three funds. For this asset class, the fund generally invests in a diversified portfolio safe institutional bank fixed deposits and treasury bills. the cash fund has the lowest downside risk compared to the other two funds.

For example, the Fullerton SGD Cash Fund is a cash fund that invests in safe income instruments like Singapore Dollar (SGD) Fixed Deposits with Singapore-registered banks and Singapore Government Treasury Bills.

Fun fact: the Fullerton Cash Fund had never seen a day of negative returns since inception.

Money Market Fund (Safer):

MMFs are slightly riskier than cash funds. Although MMFs also invests in safe institutional bank fixed deposits and treasury bills like cash funds, MMFs also invest in high quality investment-grade and very short term government and corporate debt instruments.

On average, these debt instruments are set to expire in about one year or less which makes them quite low risk.

For example, the LionGlobal SGD Enhanced Liquidity Fund is an MMF that invests in high-quality debt instruments which are broadly diversified with no target industry or sector.

Similarly, the Lion Global SGD MMF is an MMF that invests in short-term money market instruments and debt securities like government and corporate bonds, commercial bills and deposits with financial institutions.

There is also the Phillip Money Market Fund for SGD, and Phillip US Dollar Money Market Fund A for USD.

The Fund will invest primarily in short term, high-quality money market instruments and debt securities. Such investments may include government and corporate bonds, commercial bills and deposits with financial institutions.

These difference between the funds is geography.

The Philip Money Market Fund for SGD invests in Singapore based investment products while the Phillip US Dollar Money Market Fund A invests in US-based investment products.

Short Term Bond Fund (Safe)

Last but not least we have the short bond funds which are riskier than MMFs but still rather safe. They invest in the same instruments as MMFs.

However, where they differ is that the short term debt instruments that these funds generally invest in. On average, these debt instruments are set to expire in about two years or less.

This makes these funds slightly riskier than MMFs as the longer duration introduces uncertainty, as events like falling interest rates which will affect the returns of the bond negatively.

For example, we have the UOB AM United SGD Fund, a short-term bond fund that invests in global high-quality investment-grade bonds that aim to beat Singapore dollar deposits.

For context, here are the funds that these cash management accounts invest in.

| Underlying Funds | Asset Class | MoneyOwl | FSMOne Auto-Sweep Account | Philip SMART Park (SGD) | Philip SMART Park (USD) | StashAway Simple | Endowus Cash Smart Core | Endowus Cash Smart Enhanced | Syfe Cash+ |

|---|---|---|---|---|---|---|---|---|---|

| Fullerton SGD Cash Fund | Cash Fund | 100 per cent | 25 per cent | - | - | - | 50 per cent | - | - |

| LionGlobal SGD Enhanced Liquidity Fund SGD | Money Market Fund | - | 55 per cent | - | - | 50 per cent | 50 per cent | 50 per cent | 35 per cent |

| Phillip Money Market Fund | Money Market Fund | - | - | 100 per cent | - | - | - | - | - |

| Phillip US Dollar Money Market Fund A | - | - | - | - | 100 per cent | - | - | - | - |

| LionGlobal SGD Money Market Fund | - | - | - | - | 50 per cent | - | - | 30 per cent | |

| Cash Account | Cash | - | 20 per cent | - | - | - | - | - | - |

| UOB United AM SGD Fund | Short-term Bond Fund | - | - | - | - | - | - | 50 per cent | - |

| LionGlobal Short Duration Bond Fund | - | - | - | - | - | - | - | 35 per cent |

However, an important thing to note is that all these funds are all still quite low risk in nature compared to something like an all-equity portfolio.

First up we have the safest MoneyOwl WiseSaver cash management account. To access this you will need to signup for an account with MoneyOwl.

At the time of writing (Dec 4, 2020), the MoneyOwl WiseSaver account’s current historical 5-day moving average (as at Nov 24, 2020) gross yield is 0.40 per cent p.a.

MoneyOwl has chosen to publish this rate for more transparency so that customers will get a more accurate reflection of the returns. This rate of returns will also be updated once a month.

However, after factoring in their fund manager fee of 0.15 per cent p.a., the net projected yield you get is 0.25 per cent p.a.

MoneyOwl has chosen to publish this rate for more transparency so customers will get a more accurate reflection of the returns.

Do note that this rate of returns is updated regularly by MoneyOwl periodically and may go up or down according to economic and market conditions. Hence, the returns are not guaranteed.

This interest is prorated, accrued and credited to your account on a daily basis.

To start a MoneyOwl WiseSaver account you are only required to make a minimum initial deposit of $10, regardless of whether you are opting for one-time savings or a monthly regular savings plan (RSP).

However, they do charge a fund manager fee of 0.15 per cent p.a. paid directly to Fullerton Fund Management.

In terms of liquidity, you can withdraw the money anytime to your bank account with no lock-in period or early penalty cost and retain control over your cash flow.

The returns you receive will be calculated based on the price at which you redeemed your units within 2 business days.

In terms of risk, this is as safe as you can get in the fund space.

The funds you deposit into this account are funnelled to the safest Fullerton SGD Cash Fund – Class A.

In addition, the good thing about WiseSaver is that you can invest using cash or your Supplementary Retirement Scheme (SRS) account.

Phillip SMART Park manages your spare cash into the largest retail SGD money market fund in the market (based on Total Net Assets).

There’s no lock-in period for your deposits, and you can enjoy more than 1 per cent interest (correct as of writing) now for deposits in both SGD and USD.

Best of all, there’re no sales charges or administrative fees levied either.

This fund is slightly riskier than FSMOne as the account holdings consist solely of an MMF.

You’ll be glad to know that Phillip SMART Park is the only cash management account that channels the funds into a fund managed by the same company.

To access this account, you will need to sign up for a POEMS account and opt-in to the SMART Park facility.

At the time of writing the one-year rolling projected net yield is 0.59 per cent p.a . for the SGD version of this account.

Whereas for the USD version of this facility the one-year rolling projected net yield is 0.66 per cent p.a.

Do note that this interest rate for both options are updated regularly and may fluctuate according to economic and market conditions. Hence, the returns are not guaranteed.

Although there are no sales charges or administrative fees , Phillip charges a 0.45 per cent p.a. fund-level fee included in the stated rate of returns.

To start, you need to make a minimum initial deposit of $100 and US$100 (S$132). Subsequently, you will need to top up the account in denominations of $100 in the respective currencies.

Also, to enjoy the returns of SMART Park, you must maintain a minimum account balance of $100 for the SGD fund and US$100 for the USD fund.

In terms of liquidity, there are no lockups . You can make unlimited transfers in and out from the account into your bank account freely.

When you submit the online withdrawal request before 10am, the funds will be available in your bank account on the next business day.

The funds you invest are channelled into the Phillip Money Market Fund for SGD, and Phillip US Dollar Money Market Fund A for USD.

For the Phillip Money Market Fund for SGD, it was constructed with the aim to preserve principal value and maintain a high degree of liquidity while producing returns comparable to that of Singapore Dollar savings deposits.

The Fund will invest primarily in short term, high-quality money market instruments and debt securities. Such investments may include government and corporate bonds, commercial bills and deposits with financial institutions.

| Time Period | Performance (per cent) | Volatility (per cent) | Ratio |

|---|---|---|---|

| 1 Year | 0.58 | 0.07 | 8.51 |

| 2 Years | 1.93 | 0.1 | 18.52 |

| 3 Years | 3.03 | 0.14 | 21.84 |

| 5 Years | 4.8 | 0.15 | 31.91 |

| 10 Years | 7.63 | 0.22 | 35.08 |

Source: Philip Securities

Source: Philip Securities

The investment objective of the Phillip US Dollar Money Market Fund is to provide liquidity and manage risk while looking to provide a return which is comparable to that of USD short-term deposits.

This Fund will invest in high-quality short-term money market instruments and debt securities. Some of the investments may include government and corporate bonds, commercial bills and deposits with financial institutions.

| Period | Performance (per cent) | Volatility (per cent) | Ratio |

|---|---|---|---|

| 1 Year | 0.65 | 0.07 | 8.99 |

| 2 Years | 2.66 | 0.14 | 18.53 |

| 3 Years | 4.3 | 0.17 | 25.72 |

| 5 Years | 5.9 | 0.2 | 29.55 |

| 10 Years | 9.12 | 0.26 | 35.42 |

Source: Philip Securities

However, even though the returns are slightly better, do note that this will expose you to forex risk.

Phillip US Dollar Money Market Fund A Performance

The average weighted maturity timeline for these funds is about approximately 397 days or less.

To put it differently, they are instruments that will mature in less than a year, and hence capital appreciation from price movement is close to zero.

Though Phillip Money Market fund is not principal guaranteed, it has not experienced any default since its inception in 2001.

As always, I would like to remind you that past performance is not indicative of future performance.

However, one limitation of this account is that it is cash-only, meaning you cannot put in money with your Supplementary Retirement Scheme (SRS).

Next, we have the FSMOne Auto-Sweep Account offered by FSMOne Fundsupermart .

To access this, you will need to set up an online brokerage account with FSMOne and opt-in for the auto sweep account.

Like the name suggests, the FSMOne Auto-Sweep Account will automatically sweep up and invest the excess monies you have in your brokerage account.

These excess monies will be consolidated by FSM on a daily basis and automatically invested into the Auto-Sweep Account after one business day.

Note: A consolidated amount of more than $10 in a single day will be invested into the Auto-Sweep Account.

For example, if you receive $6 from Fund A, $3 from Fund B and $3 from Fund C, FSM will sweep the consolidated amount of $12.

But, the amount deposited will only be reflected in the Auto-Sweep Account balance after two business days.

You can also use this account to pay for your investments in FSMOne instantly.

On top of the sweeping, you can also deposit money into the Auto-Sweep account by depositing money into your Cash account via FAST/Paynow.

At the time of writing, the FSMOne Auto Sweep Account’s current projected net yield is 0.80 per cent p.a. Do note that the rate of return is updated on a weekly basis and is subject to fluctuation based on economic conditions. Hence the returns are not guaranteed.

Also, these returns are accrued on a daily basis and credited to your account.

The good thing about this account is that there is no account limit, no sales charges and no platform fees

However, they charge fund-related expenses and FSM management fee of 0.05 per cent per quarter which is already included in the above-mentioned current rate of return.

To start using this account you will need to deposit at least $50.

In terms of liquidity, you can withdraw the money to your bank account anytime with no lock-in period or early penalty cost and retain control over your cash flow.

However, there is a minimum withdrawal amount of $50 and a minimum recurring top-up amount of $100.

You will also get your cash approximately T+3 business days (T = transaction date) later if you make the withdrawal before 3pm on a business day .

You can also transfer your money (Available Balance) between Auto-Sweep Account and Cash Account (SGD Only).

If you perform a transfer before 3pm on a business day , the transfer will be completed on T+1 business day after the following timing:

The funds you deposit into this account are funnelled to a low-risk investment portfolio in Singapore Dollar (SGD) consisting of these funds:

This account is slightly riskier compared to MoneyOwl WiseSaver as it has exposure to the LionGlobal SGD Enhanced Liquidity MMF as well as its cash account.

However, one limitation of this account is that it is cash-only, meaning you cannot put in money with your SRS .

First up we have StashAway Simple, a cash management account offered by StashAway.

Like its name suggests, StashAway Simple’s value proposition is simple.

At the time of writing, the account’s projected net yield is 1.40 per cent p.a. on any amount you deposit into the account; with no limit on the balance that can earn a projected rate!

This interest is accrued on a daily basis and credited to your account.

However, do note that this rate of return is not guaranteed and might fluctuate due to economic conditions.

Start an account with StashAway Simple is easy as you’ll be glad to know the account has no deposit requirements.

The good thing about this account is that there are no StashAway management fees charged for any deposit.

Also, if you are StashAway user, the balance you have in the StashAway Simple account are not included in the calculation of fess for your investment portfolio.

However, the account has an approximately 0.35 per cent p.a. expense ratio.

But, StashAway gives a 0.125 per cent p.a. rebate which results in about a 0.23 per cent p.a. net expense ratio fee for the account.

But, you do not have to worry too much about this 0.23 per cent fee, as it is included in the calculation for the yield the account offers.

In terms of liquidity, there is no lock-in period or withdrawal restrictions. This means you can make unlimited transfers in and out of the account at no cost, giving you control over your cash flows.

However, StashAway stated that it would take approximately 3 to 4 business days to withdraw the money.

The money that you deposit into the StashAway Simple account is between two funds:

*StashAway invests in the institutional (Class I) version of this fund which has lower expense ratios compared to the version (Class A) catered towards retail investors.

However, StashAway Simple is slightly riskier compared to the Endowus Cash Smart Core Fund due to the dual exposure to these two MMFs, which is part of the reason why they can offer a higher return.

The good thing about these accounts is that you can invest using cash or SRS.

Next up we have Endowus Cash Smart, the latest cash management account offered by Endowus .

The Endowus offering is interesting as they are offering two different portfolio choices for the Endowus Cash Smart account.

For the Endowus Cash Smart Core, the current net yield of this portfolio is 0.90 per cent – 1.00 per cent p.a. (after fees).

Endowus have stated that they chose to offer a range, as the range is a more accurate and realistic reflection of the potential returns investors will receive.

Do note that this interest rate is updated regularly by Endowus and may fluctuate according to economic and market conditions. Hence, the returns are not guaranteed.

These returns are also accrued on a daily basis and credited to your account.

However, to enjoy these returns, you will need to make a minimum initial investment of $10,000 if you do not have an Endowus account.

In terms of account limit, there are no limits to the amount that can receive interest in the account.

For the Core portfolio, the account has a 0.18 per cent p.a. net level fund fee charged by the fund manager as well as an Endowus Access Fee of 0.05 per cent per year.

This is after taking into consideration the trailer fee rebate that Endowus provides to investors.

These fees are included in the above-mentioned current rate of return so investors need not do anything else.

In terms of liquidity, there are no lockups. You can make unlimited transfers in and out of the account. But, there is a minimum transaction amount of $100.

In addition, there is no minimum balance that must be maintained in the account.

The funds you deposit into the core portfolio are funnelled into an investment portfolio consisting of these funds.

The core portfolio is rather safe, with a risk profile similar to FSMOne Auto Sweep. However, the cash portion is what makes the FSMOne account riskier.

The good thing about this account is that you can invest using cash or SRS.

We also have the riskiest Endowus Cash Smart Account offered by Endowus.

Endowus is offering investors the option to invest in the riskier enhanced portfolio.

But with higher risk comes higher returns as this portfolio’s net projected returns are 1.7 per cent – 2.0 per cent p.a. (after fees).

Do note that this rate of returns is updated regularly by Endowus and may fluctuate according to economic and market conditions. Hence, the returns are not guaranteed. These returns are also accrued on a daily basis and credited to your account.

However, to enjoy these returns, you will need to make a rather large minimum initial investment of $10,000 if you do not have an Endowus account.

In terms of account limit, there are no limits to the amount that can receive interest in the account.

For the Enhanced portfolio, the account has a 0.30 per cent p.a. net level fund fee charged by the fund manager as well as an Endowus Access Fee of 0.05 per cent per year.

This is after taking into consideration the trailer fee rebate that Endowus provides to investors.

These fees are included in the above-mentioned current rate of return so investors will not need to do anything else.

In terms of liquidity, there are no lockups. You can make unlimited transfers in and out from the account although there is a minimum transaction amount of $100.

In addition, there is no minimum balance that must be maintained in the account.

The funds you deposit into the enhanced portfolio are channelled into these funds:

The Enhanced portfolio is riskier than StashAway Simple as although they share the same LionGlobal SGD Enhanced Liquidity MMF, the enhanced portfolio invests in the riskier UOB AM United SGD fund, the riskier short-term bond fund.

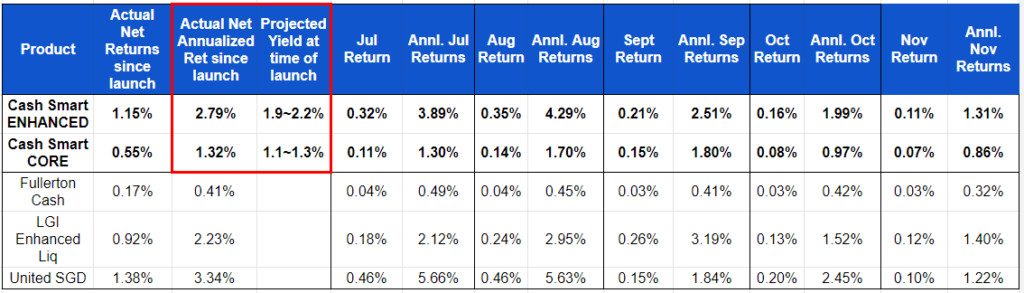

In terms of performance, Endowus Cash Smart has actually outperformed the projected yield.

On Dec 2, 2020, Endowus provided an update about the actual net annualised returns since launch.

For Cash Smart Core, the net annualised returns from July 1, 2020 to Nov 27, 2020 stands at 1.32 per cent. Whereas for Cash Smart enhanced, the annualised rate of returns stands at 2.79 per cent.

Altough past performance are not indicative of future performance, it is promising that the Cash Smart has outperformed the projected yield so far.

Last but not least, we have the new Syfe Cash+ account by Syfe.

To access this you will need to signup for an account with Syfe.

You don’t need to invest in any other Syfe portfolios to invest in Cash+. If you do, you can move your money from your Cash+ account to your other Syfe investment portfolios (and vice versa) anytime with no fees incurred.

In addition, you get to have complimentary access to wealth experts, where you can get personalised guidance on how to achieve your financial goals using Syfe’s range of portfolios.

At the time of writing, the account’s projected net yield is 1.75 per cent p.a. on any amount you deposit into the account; with no limit on the balance that can earn a projected rate.

This interest is accrued on a daily basis and credited to your account.

However, do note that this rate of return is not guaranteed and might fluctuate due to economic conditions.

Start an account with Syfe Cash+ is easy as you’ll be glad to know the account has no deposit requirements.

Although there are no sales charges or administrative fees , Syfe charges a 0.35 per cent p.a. fund-level fee as included in the stated rate of returns.

There is a 100 per cent trailer fee rebate and there is no management fee by Syfe.

In terms of liquidity, there is no lock-in period or withdrawal restrictions.

You can make unlimited transfers in and out of the account at no cost, giving you control over your cash flows.

However, Syfe stated that it would take approximately 2 to 4 business days to withdraw the money.

The money that you deposit into the Syfe Cash+ account is between three LionGlobal funds:

This makes Syfe Cash+ slightly riskier as compared to the Endowus Cash Smart Core Fund due to the exposure to the MMFs, which is also the reason why they can offer a higher rate of return.

One limitation of this account is that it is cash-only, meaning you cannot put in money with your SRS .

When comparing all these cash management accounts, it all boils down to your risk appetite and why you are placing these funds in the accounts.

I would pick MoneyOwl WiseSaver if my appetite for risk is really low and if I already have, or am planning to open an account with MoneyOwl.

I would choose the FSMOne Auto-Sweep Account for a similar reason too.

Similarly, I would pick the Phillip SMART Park if I already have or are planning to open a POEMS brokerage account.

StashAway Simple would appeal to me if my appetite for risk is slightly higher. The lack of withdrawal restrictions are pretty attractive as well.

As for the Endowus Cash Smart account, I would pick the Core portfolio if I wanted something slightly safer than StashAway Simple. If I wanted something riskier, I would use the Enhanced portfolio.

However, one drawback of the account you need to take note of is that you will need to deposit $10,000 if you do not have an account with Endowus.

But if you’re looking for other options which could possibly give you a better rate of return.

You might want to consider an insurance savings plan.

This article was first published in Seedly. Disclaimer: The information provided by Seedly serves as an educational piece and is not intended to be personalised investment advice. Readers should always do their own due diligence and consider their financial goals before investing in any investment product.