Cluster house: All you need to know + 25 years of price trends

If you gave us Singaporeans the option of which type of residential housing we’d prefer, I’m guessing that a large portion of us would jump at the opportunity of living in a landed home.

It’s a no brainer afterall right?

Big living space, outdoor garden, and a ton of privacy to boot – it’s everyone’s dream especially in a city like Singapore.

There’s only one problem (and a big one at that)… the price.

Interestingly enough, there is a unique market in Singapore which, ideally, gives you the best of both worlds.

It’s one of the rarest landed housing types in Singapore, and an apt choice for those who long for the convenience/abundance of recreational facilities of a condo, while also enjoying the exclusiveness of a landed home.

In other words, cluster houses.

In this article, we shed some light on what a cluster house actually is, before expanding on a comparison/analysis of historical price trends against its distant landed property and private condo relatives.

We also have a look at what the future holds for cluster houses in general toward the tail-end of this piece.

Without further ado, let’s get started!

Officially known as strata-landed houses, you could say that a cluster house is the ‘best of two worlds’.

Cluster homes are essentially a hybrid housing type with a strata title – a unique cross between a low-rise condo and a landed property.

In other words, residents of cluster homes often have access to typical communal facilities you’d find in a condo (gymnasium, saunas, jacuzzi, pools, playgrounds, etc).

Similarly to living in a landed property, you can also look forward to a higher degree of privacy and spaciousness (not to mention, a ‘relatively unobstructed’ unit with ground contact).

Let me also briefly expand a little on what a strata-title means.

With a strata title, you are entitled to a share of the whole project, which means that all other residents share joint ownership of the land and its common areas.

The units can either stand on their own, or can be conjoined side-by-side, sometimes even resembling terrace or semi-detached houses, or bungalows.

To add to that, residents can also enjoy the luxury of a basement car park – a huge contrast to parking on the roadside, if you stay in a typical, landed property.

Ultimately, these units can be arranged in a multitude of different kinds of layouts (forming a literal ‘cluster’), within a gated estate.

Some examples of aesthetically-pleasing cluster developments include…

Alana

…and the Watten Residences

It is also worth noting that purchasing a cluster house does entail one significant restriction…

Under the Residential Property Act , Foreigners (and PRs) are not allowed to own a cluster house without approval from the Singapore Land Authority – which they can apply for from this link .

By law, they are only eligible to purchase a strata-landed or any other type of landed property that is situated within an approved condo development.

On the bright side, however, if you are a foreigner/PR looking for a cluster house, you can always take at purchasing something else relatively similar – Townhouses.

We’ll leave that one for another day, but rest assured that we’ll be following up with another article on that in the near future!

This may seem like old news to some, but between 2014 and 2017, it was very apparent that more people were starting to take interest in cluster housing – sales rose by an astounding 168 per cent between those 4 years!

(Hint: This was not the first time that it happened – as we’ll observe shortly)

This was a much higher increase compared to that of sales of land-titled houses (141 per cent) during that same period.

Before we go intro price-trend analysis, let’s find out a little more about what makes this housing type so special.

Year after year, demand for cluster housing has constantly been on the rise, considering the mere handful of new development popping up each year.

Let’s take a look at past events.

Between ‘10 and ’14, 26 cluster housing projects were added to the market with a yield of just 896 units in total.

Following that, from ‘15 to ‘17, only 5 projects with a yield of 107 units were launched.

That only goes to show you how rare this housing type really is.

And in a country like ours with forever-shrinking available land space, a rare housing type with unique perks means only one thing – Exclusivity!

Which also leads to my next point.

The exclusivity (and lavish design) of a cluster house plays a significant role in two prime things that home-hunters and investors always have their eyes on – Appreciation Potential and Rental Yield .

Take, for instance, the average value per square foot for cluster house units in Singapore was a meagre $331.13 back in 1999.

Fast forward two decades later, and the average psf value is $784.60. An increase in valuation by more than double the original psf-values!

[[nid:488287]]

Of course, most of us would know that this isn’t something to really be surprised about. Housing prices, in general, have come a long way since those years.

If you were to delve closer into current appreciation terms actually (as we will in a bit), you’ll simply find that cluster housing prices are decent at best.

Based on our comparisons, cluster house price movements are just not as impressive as that of condo and landed properties.

Now here’s the catch.

While they might not be as ‘appreciation-worthy’ as their counterparts, a cluster house actually prices rather well on the rental side of things.

Based on past rental figures across a number of condos, we’ve seen that cluster houses are indeed capable of producing rental yield figures on par with that of landed homes, despite being more affordable than them (and in many cases, full-fledged private condo projects).

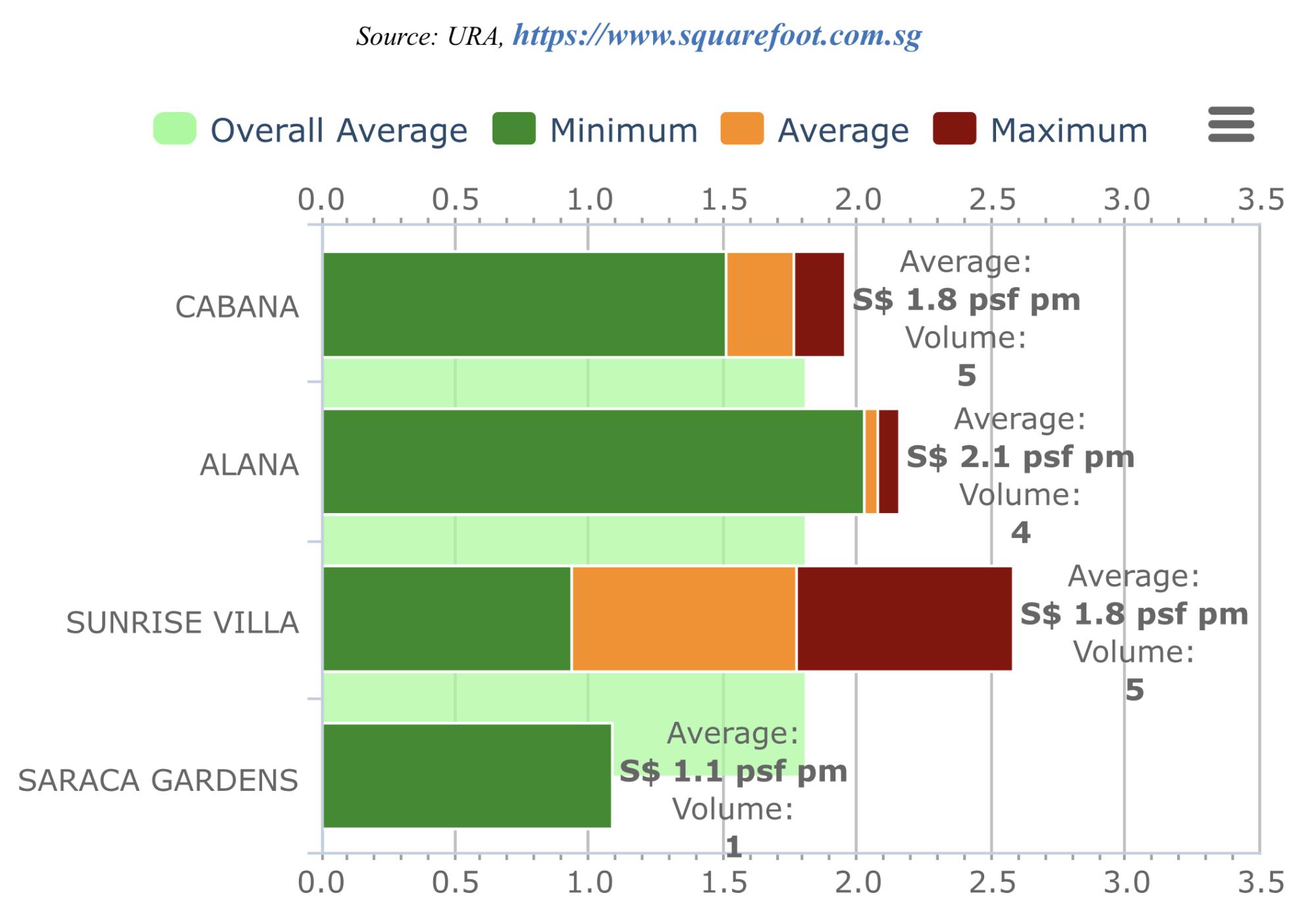

Greenwood Mews vs nearby landed home, Hillcrest Villa Alana vs nearby Sunrise Villa and Saraca Gardens Cabana vs nearby Sunrise Villa and Saraca Gardens

In other words, where you lack in potential appreciation returns for the average cluster house, you make up for with monthly cash flow based on increased rental demand/yields.

This is perhaps the most significant of our 3 pointers as it highlights the material benefits that you can gain from a cluster house as a home-dweller, especially if you have a family.

Let’s dive into it.

Similarly to condominiums, the maintenance and upkeep of the estate is handled by a managing agent.

What that means is that you won’t have to bear the full maintenance cost of your individual unit/property – as is the case for those who own landed houses in Singapore (hint: it’s a tad more expensive!).

Residents are thus subject to paying maintenance fees monthly.

Some examples of maintenance in cluster houses include the repair of damages around the estate, maintenance of hygiene of the pool(s), and ensuring the security team are paid a reasonable salary.

But unlike condos, however, the total maintenance and service costs are split between the respective owners in a cluster house development.

This is often a drawback for the same reason. Cluster houses are often smaller in total residential units, meaning that each resident has to contribute more per month based on their equal contributions.

These maintenance fees are thus higher than what you would expect to pay when living in a condo on most occasions.

I cannot name a single landed homeowner who does not appreciate the higher degree of privacy than what tends to be experienced in high-rise residentials.

Being landed properties themselves, cluster houses also share this feature.

Staying in a high-rise residential like a condo or HDB flat does have its benefits, but units are ultimately compacted closer together.

As a former flat-owner myself, I never felt comfortable when a passing neighbour took a peek through my window – and I think most of you would agree with me on this.

What’s more, you also get to share these facilities with fewer residents in a cluster estate, as compared to the multitude of people you have to share with inside a bigger residential development ( Stirling Residences or Jadescape for example).

Finally, there are several kinds of communal spaces in a cluster estate.

That said, units in these developments are typically built around a central one, like a swimming pool or playground (e.g Cabana with that central pool).

This makes it much easier for your kids to step outside (in every sense of the word) and play. It just makes things all the more convenient for you as you keep an eye on them from the comforts of your home.

Let’s move on to the meat of the article.

In this section, we’ll explore a comparison of price trends between 3 housing types over 25 years – Cluster, Condo and Landed.

Following that, we’ll also pop in a brief analysis based on the trends.

Let’s have a look at the data.

| Year | Cluster Hous e (PSF) | Condominium (PSF) | Landed (PSF) |

| 1995 | $ 480.14 | $ 684.62 | $ 633.54 |

| 1996 | $ 534.32 | $ 782.63 | $ 673.13 |

| 1997 | $ 482.26 | $ 710.23 | $ 656.05 |

| 1998 | $ 404.14 | $ 500.75 | $ 476.23 |

| 1999 | $ 331.13 | $ 600.71 | $ 490.70 |

| 2000 | $ 407.81 | $ 684.36 | $ 573.28 |

| 2001 | $ 410.85 | $ 549.10 | $ 493.77 |

| 2002 | $ 347.76 | $ 560.95 | $ 498.29 |

| 2003 | $ 334.83 | $ 549.46 | $ 449.58 |

| 2004 | $ 333.80 | $ 578.81 | $ 455.09 |

| 2005 | $ 346.41 | $ 636.47 | $ 457.89 |

| 2006 | $ 384.01 | $ 755.35 | $ 505.53 |

| 2007 | $ 611.81 | $ 1,021.83 | $ 644.37 |

| 2008 | $ 565.11 | $ 907.22 | $ 693.32 |

| 2009 | $ 568.91 | $ 935.43 | $ 721.15 |

| 2010 | $ 642.52 | $ 1,136.99 | $ 899.82 |

| 2011 | $ 684.95 | $ 1,146.09 | $ 1,064.53 |

| 2012 | $ 743.08 | $ 1,161.16 | $ 1,245.34 |

| 2013 | $ 844.40 | $ 1,269.65 | $ 1,331.05 |

| 2014 | $ 862.78 | $ 1,289.50 | $ 1,285.60 |

| 2015 | $ 785.73 | $ 1,176.27 | $ 1,268.12 |

| 2016 | $ 697.92 | $ 1,231.85 | $ 1,226.21 |

| 2017 | $ 734.12 | $ 1,303.93 | $ 1,257.98 |

| 2018 | $ 774.94 | $ 1,435.02 | $ 1,322.63 |

| 2019 | $ 784.60 | $ 1,562.54 | $ 1,353.74 |

| 2020 | $ 724.53 | $ 1,541.25 | $ 1,399.01 |

If you take a close look at the first graph, you may notice that the trend pattern basically resonates with that of the Singapore Property Cycle .

For those who are relatively new to property, this cycle is both directly and indirectly affected by the performance of a tight network of global markets.

Based on that, the price trends naturally align with periods of recession and other significant economic downturns.

Here are a few prominent examples if you refer to the graph:

1997: Falling prices as a result of the Asian Financial Crisis when the Thai Baht collapsed.

Years leading up to 2007: Formation of a housing bubble where housing prices increase steeply to unsustainable levels, and then plummet

2007-2009: The unforgettable Global Financial Crisis, where certain events set off chain reactions of asset bubbles bursting, with stock market and real estate prices hitting the deck.

2014-2017: A period of weakened property market sentiment in Singapore.

(Not to mention, the impact of the newly-implemented cooling measures since 2009 – which has helped to maintain a consistently steady eb-and-flow in price trends)

Now that we’ve added some context to the picture, here’s some analysis on the housing type price trends.

At first glance, it might look like cluster housing price trends tend to be on par with that of condominiums and landed properties.

The truth of the matter, however, is that their price trends actually go much deeper than that.

This is especially true during times of price trend returns across different periods of the property cycle – recovery from the ‘97 Asian Financial Crisis, and the housing bubble right before the Global Recession.

Based on the graph, we see that the first points of note are the delays in the peak and dips of cluster housing price trends in 2000 and 2002 respectively – as compared to that of condo and landed properties (which reached these price extremes much earlier).

A possible oversight (or lack of attention) to cluster houses back then perhaps?

Well, people must have thought so, because the next major point we see in this graph brings us to ‘07, where we see cluster housing prices skyrocketing… though if only for a short while.

Sadly, things never really kick-off for cluster houses in Singapore, and that massive rise is quickly compounded by a massive drop as soon as the financial crisis of 08/09 hits.

Cluster housing prices would never manage to climb back to those heights again over the coming years.

The third and final point stems from the 2013 cooling measures, where we once again see cluster housing prices reacting a tad slower to the 2013 cooling measures than the other housing-types listed here.

[[nid:460411]]

That said, they do take the dip a year on from there, falling to the bottom of the price trend averages in 2016 before catching up again as we’ve seen time and time again.

From these points, we observe some patterns.

Cluster housing price trends are often ‘delayed’ during major property market impacts versus that of other housing types.

Cluster housing price trends eventually return to the total housing-type price trend average at some point.

As of 2019, price trends have taken a dip once more, with cluster housing diving lower than condo and landed properties.

Could this be due to a lack in production of cluster housing developments of late, and hence an opportunity for cluster housing prices to briefly ‘fly under the radar’ from the public eye in recent times?

It’s definitely a possibility.

We know that this ‘price trend delay’ stems from both the lack of attention to these houses, as well as the generally lesser units in these housing-types which naturally make owners more reluctant to sell their units, hence reducing the overall sample size and thus price volatility.

At the end of the day, it is important to bear in mind that both cluster housing owners and those who are in the market for them are naturally already in the loop of cluster houses price trends, and it is.

Therefore, the general/newer-entry public (who often have the power to raise and reduce prices based on their demand) that might be unaware of these housing-types.

As for the potential for massive upside in the near future, that’s always a possibility given what we’ve seen in ‘07.

But with cooling measures in place to prevent similar peaks, I wouldn’t bet too many of my bucks on it just yet.

As of today, we see that despite the exclusive perks that staying in a cluster home can provide, cluster housing appreciation returns generally did worse against both housing-types across the years.

For my fellow data lovers, here’s another tabulation of the same data to support this sentiment.

| Years When Cluster Housing Did Worse in Terms of Appreciation Trends Versus – | ||

| Condo | Landed | |

| No. Of Years | 16 | 13 |

| Years When Cluster Housing Did Better in Terms of Appreciation Trends Versus – | ||

| Condo | Landed | |

| No. Of Years | 9 | 12 |

As you can see, the number of years when condos and landed properties had higher price valuations exceeds that of cluster houses.

Over the 25 years, cluster housing types experienced lower price appreciations of 1.52 per cent compared to condos, and 1.21 per cent less than landed homes.

That said, cluster housing does experience a relatively similar ‘winning price trend years’ when compared with landed properties.

Coincidence? Possibly.

At the end of the day, much more analysis is required to go deeper into understanding these trends. For now, this is just a brief stat-check based on the data that we’ve seen today.

That said, we can definitely determine who won the best yearly appreciation trend in the Cluster Housing Vs Condo Vs Landed Price comparison.

This is how they shape up.

| Years during which this Housing Type Did Better in terms of Appreciation Trends (1996 – 2020) | |||

| Cluster | Condo | Landed | |

| No. Of Years | 6 | 11 | 8 |

As for which of the 3 housing-types cost more psf-wise, you might just be in for a slight surprise.

| Years during which this Housing Type cost the most per square foot (1996 – 2020) | |||

| Cluster | Condo | Landed | |

| No. Of Years | 0 | 23 | 3 |

A whopping 23 times when average condo prices emerged higher than all the other housing types!

Naturally, this was due to the cost of higher-end condo transactions – another point that this data doesn’t actually show; and the reaffirmation of a key point that deeper analysis of individual housing-types is definitely required to accurately ascertain price points/trends.

Now that we’ve got the past price trends out of the way, let’s second guess at how things look for cluster housing in time to come.

First, let’s explore the possibilities in terms of demand and appreciation for this housing type.

In terms of demand, the cluster housing type is a somewhat niche in the market; an area of interest for a possibly limited number of people – meaning a small pool of buyers (may make it harder to resell a cluster home in the future too).

Additionally, ever since the change in development guidelines set by the URA back in 2014, we have seen lesser cluster development launches year after year – which could just contribute to an (unlikely) spike in demand months/years down the road.

Either way, even with ever-increasing demand due to shrinking available land space, we feel that demand for cluster housing will not increase drastically.

Appreciation-wise, as long as Singapore’s economy continues to grow and we don’t see the global and local scene completely hammered by the Covid-19 issue in years to come (or any other issues for that matter – whether economical/political), I do feel that cluster homes are still likely to gradually appreciate as steadily as they have been for the last 20 years.

That said, they probably will not appreciate as greatly as condo or landed properties do, even if they stand a much higher chance of ‘price-peaking’ as we saw in 07’ based on their ‘exclusive’ nature.

This article was first published in Stackedhomes.