This company might be the biggest winner in this crisis

The bear market is here! Chances are most of us have been experiencing the fear gripping us currently.

But there are bright spots in the current bearish market too. During the multiple lockdowns in many countries, I stumbled upon an outperformer in the market.

This company has actually risen up close to 80 per cent since the start of the year of 2020 as of time of writing. The prospects and share price went up drastically as more companies chose to use their services now.

This company is Zoom Video Communications Inc (NASDAQ: ZM).

Zoom is a company listed on the US Nasdaq stock exchange. It's services include video conferencing, scheduling online meetings, chat and also mobile collaboration.

Barely 10 years old, Zoom was founded in the year of 2011, by a lead engineer from Cisco Systems, Inc. In the year 2017, it entered the "unicorn" club.

Unicorns are privately held companies valued at over US$1 billion (S$1.4 billion). It wasn't until the year 2019, Zoom eventually listed on the US Nasdaq stock exchange. As of today, Zoom has hit 12.92 million monthly users.

The Covid-19 outbreak drove up the user counts, where employees worked and communicated with each other from home

Zoom's mission is to make video conferences frictionless. It managed to shine amidst the strong competition. In fact, Zoom managed to emerge as the Company of the Year in the Global Video Conferencing Industry.

Zoom provides a video-first unified communications platform. They offer frictionless video, phone, chat, and content sharing capabilities via their platform.

Their list of products include Zoom Meetings, Zoom Phone, Zoom Chat, Zoom Rooms, Zoom Conference Room Connector, Zoom Video Webinars, Zoom for Developers, and Zoom App Marketplace.

Zoom's services have the ability to integrate with various other apps or platforms, such as Atlassian, Dropbox, Google, LinkedIn, Microsoft, Salesforce, and Slack.

Zoom is nowhere close to replacing Microsoft Corporation or Google's G drive and apps. But users are able to integrate current applications and tools into Zoom.

Zoom's key advantage is enabling large-scale online events, like town hall meetings and workshops. It can enable 100 panelists to host and communicate to over 10,000 attendees.

Other video services often suffer with lag and disconnection. So the ability to host more attendees without connectivity issues made the switch to Zoom easy for users.

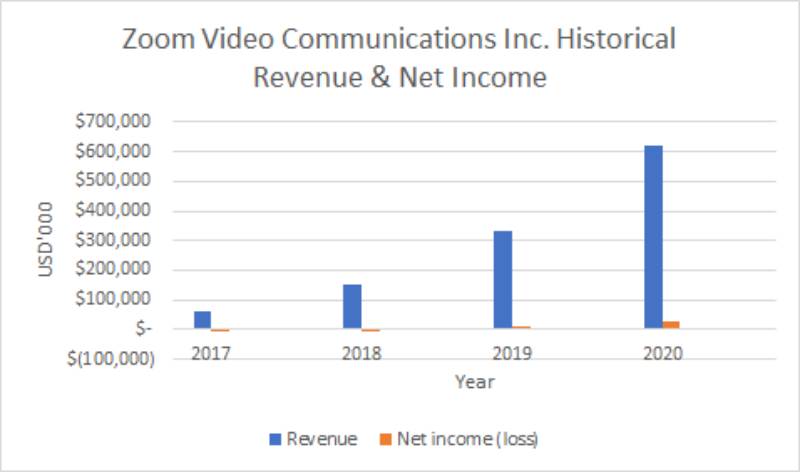

Zoom Video has seen rapid growth over the past 4 years. In the year of 2017, revenue was barely just US$ 61 million but surged to US$ 623 million as of the latest fiscal year of 2020. Zoom has been one of the tech companies to be in the black in their IPO year of 2019.

As of the year 2020, Zoom has already tripled their profits to US$ 25 million, compared to the US$ 7.5 million profits they achieved in the year 2019.

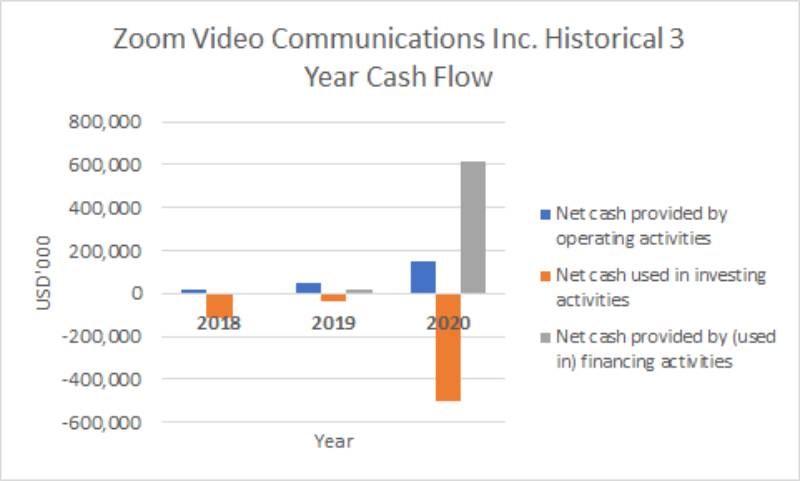

Zoom has also seen its operating cash flow on an increasing trend too. Yet, a lot of cash outflows in the year 2020, which were spent on buying marketable securities. They also invested heavily in their Research and Development.

All in all, Zoom shows a lot of promise based on their short but impressive financials.

Zoom Video earns money by selling their video conferencing subscriptions. They do provide free usage, but it's capped at 40 minutes per session. I feel that their services and connectivity are far better than Skype and also Hangouts.

To continue growing, Zoom has to be more aggressive in challenging bigger players. This includes companies like Microsoft Corporation, Alphabet Inc. Apple Inc. and Facebook Inc. since all 4 giants have their own video streaming and conferencing functions.

[[nid:483593]]

Plus, their current Price to Earnings valuation is very high (1,595 times!). They would have to grow at a rapid rate for the current trailing Price to Earnings ratio to normalise.

On top of that, existing subscribers have to continue subscribing to Zoom. Only then will Zoom be able to stack on their revenue growth. Failure in retaining existing users or increasing new users will be costly.

The greatest weakness of Zoom is that it's a very good video conferencing service provider. But nothing more. Video conferencing is just a small part inside a basket of tools that employees use.

To make a comparison, Microsoft Office 365 allows users to type documents, formulate spreadsheets, craft slideshows, and also host meetings. Zoom on its own can't be a total software solution.

Zoom's superior video conferencing capabilities allowed it to grow at a rapid pace. But for it to continue growing at the current rate, there are plenty of challenges ahead.

The company's future is heavily dependent on Eric Yuan, the founder and CEO of Zoom.

Any unwanted news happening to the CEO would heavily impact the share price. JD.com Inc's Richard Liu is a key example of a company too dependent on its CEO.

As for now, I would put Zoom into my watchlist, and observe for a little longer on its next game-changing plan. Only then, I reckon, would be a better time to cast a net over the next potential tech darling.

For the latest updates on the coronavirus, visit here.

This article was first published in Value Invest Asia. All content is displayed for general information purposes only and does not constitute professional financial advice.