This could disrupt your portfolio in 2020

2019 has seen its share of challenging events.

As we begin a new decade, many investors are all but ready to embrace the new year.

There has been no shortage of big events in 2019.

The US-China trade war, which started in mid-2018, escalated in 2019. Amid slowing global growth, there were notable bright sparks in Singapore such as the listing of LendLease Global Commercial REIT, three REIT mergers, and the partial takeover of Keppel Corporation Limited by Temasek Holdings.

And that's not the end of it.

As we turn the corner and enter 2020, there is one key theme that we think will matter for Singaporean investors.

DIGITAL BANK LICENSES

Earlier this year, the Monetary Authority of Singapore (MAS) announced that it would allow digital banks to operate in Singapore in 2021 by offering five digital-banking licenses.

Two of these will be full licenses, with the other three being restricted licenses.

[[nid:469472]]

The maiden license offer has led to a scramble among financial and payment players in Singapore to be part of the pioneer batch of digital banks.

Companies that have indicated their interest to apply for a license include iFast Corporation Limited, Singapore Telecommunications, Grab, Oversea-China Banking Corporation Limited, FOMO Pay and Alibaba Group's Ant Financial.

As we look through the list of digital-bank candidates, it is likely that a non-traditional bank will win a license.

Notably, Hong Kong has issued eight virtual bank licenses to a mix of tech companies, traditional banks, and private equity firms such as Ant SME (under Ant Financial), Livi VB (a joint venture between JD Digits, BOC and Jardines), and Infinium (a joint venture between Tencent, ICBC and Hillhouse Capital).

The first batch was awarded in March 2019 and will have to complete a year of operation before the second wave is awarded.

THE ROLE OF A DIGITAL BANK

A key requirement is that the new digital banks will need to tackle segments that are currently under-served while providing a road map towards profitability in the medium-term.

There are three main functions of a digital bank - spend, send, and lend. "Spend" enables customers to purchase financial products in order to grow their wealth. "Send" allows customers to send money to other parties (i.e. funds transfer), and "lend" represents a key function of a traditional bank - lending out money to individuals and businesses.

The benefits of a digital bank are numerous. Firstly, it allows the customer to bank anytime and anywhere in the world, providing 24/7 access to a full range of banking services as long as there is an internet connection.

Secondly, customers are likely to enjoy lower fees as digital banks have lower expenses compared to traditional banks as they do not operate physical branches. As such, these cost savings can be passed on to their customers.

ENTERING THE DIGITAL BANKING ARENA

[[nid:466819]]

Singapore is moving towards a future where banking is pervasive, seamless and virtual.

With a smartphone penetration rate of 80 per cent, one of the highest in the world according to Media One, the city state is particularly well-suited for digital banking adoption.

In other words, the prize is significant.

Not every applicant will qualify for the coveted license, though. Applicants will have until end-2019 to submit a formal application.

The award of the licenses will be announced by mid-2020, and the digital banks are expected to begin operations by mid-2021.

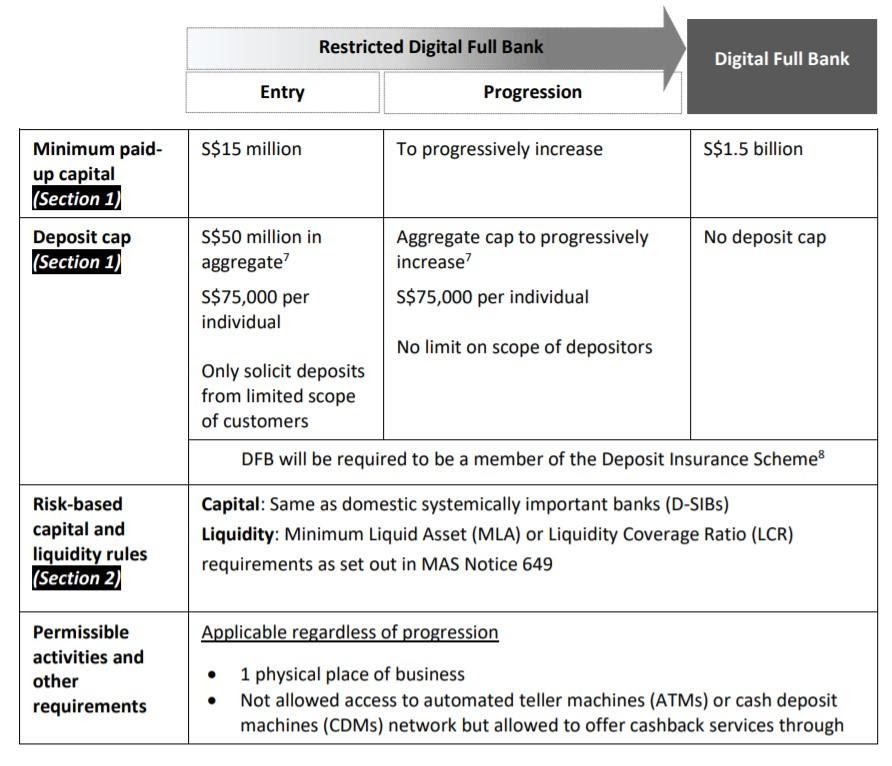

The assessment criteria are stringent: digital full banks need a minimum paid-up capital of $15 million and within three to five years, need to increase this to a minimum of $1.5 billion.

One of the parties in the applicant group will need to have a track record of three or more years operating a business in the technology or e-commerce field.

The applicant needs to deliver a suitable value proposition to justify its digital-banking business model and demonstrate its ability to manage a business by charting a path toward profitability.

THE IMPACT OF DIGITAL BANKING

So, the question here is whether digital banks may be a threat to the incumbents DBS Bank, United Overseas Bank, and Oversea-Chinese Banking Corporation?

There are two opposing camps, each offering differing views on whether they think digital banks are an imminent threat to the incumbent banks.

My view is that the banking industry is indeed facing its first potential disruption in a very long time. This move, though, is long overdue as the world is evolving and changing rapidly with the advent of technology and connectivity. Traditional banks need to evolve and adapt to changing circumstances in order to remain relevant.

To their credit, we think that the three incumbents have done an admirable job. Digital banks may steal some market share away when they go live, but we believe the ecosystem is large enough for all players to co-exist and grow in tandem with one another.

Though Singapore already has a heavily banked population, digital banks are expected to target unserved or under-served segments and "fill the gaps".

Hence, we believe digital banks will thrive over time, and will not affect the market share of the incumbents immediately.

This article was first published in The Smart Investor. All content is displayed for general information purposes only and does not constitute professional financial advice. Royston owns shares in iFast.