Couldn't get your BTO flat of choice? Here are 5 alternative steps to take

The BTO launch exercise is over, and the dust has settled. Amid the debris, you get the dreaded email, telling you in a few curt lines that your application is unsuccessful. Before you throw something at the screen, know that Stacked is always around to help.

We’ve compiled some alternatives to consider, if you can’t get your desired BTO flat. It may involve a bit of compromise – but maybe you can get the location you want, or avoid having to wait even longer:

Alternative steps if your BTO application failed:

If the issue is your failure to secure the HDB Loan Eligibility (HLE) letter or bank loan, you can skip to the bottom paragraph.

Most first-timers will succeed on at least the third or fourth try. This is because first-timers get an additional ballot chance (a total of three), if they fail to get to flat the first two times. However, this bonus chance only applies if you’re going for a flat in a non-mature estate.

So if you can wait, and you’re not fussy about living in a built-up estate, just keep trying. Your odds are improved from the third try onward.

There are cases where first-timers have failed to get a flat, even after six or seven attempts. If this happens to you, it may be time for some direct intervention.

Talk to your MP about your situation – bring up any critical issues you’re facing, such as your in-law’s homes being too small to house your family as well, or the effect on your plans to have children.

Your MP can write to HDB, or contact the relevant people on your behalf.

(But please don’t stop there; try the other alternatives on this list as well, even after talking to your MP).

You can look for unsold (balance) BTO flats from HDB. There are two ways to do this:

The first is to participate in the Sale of Balance Flats (SBF), which always happens in May and November of every year. Once the announcement for SBF is made, you can apply for it on the HDB website – the application period will be open for one week.

A ballot is used to determine your queue position to book the flat.

To be blunt, the odds of getting a flat through SBF can be even slimmer than through the usual balloting for BTO flats; the demand in SBF exercises is often through the roof. However, there’s no harm in just trying.

The second method is to use HDB’s Open Booking system. This allows you to book whatever unsold flats are available, on a first-come, first-serve basis. Unlike SBF, open-booking allows you to try and get a flat all year round.

You don’t need to wait for a certain month to apply; and you can even book a flat by as early as the next working day.

In both of these cases, the usual eligibility requirements apply (i.e. you must be applying under one of the HDB schemes).

There are some pros and cons to note, when getting balance flats:

We understand that not everyone can get an Executive Condominium (EC). But if it is within reach, note that 70 per cent of the units in an EC are prioritised for first-timer families, during the first month of the launch.

So if you’re in a hurry and can afford it, you may want to keep an eye out for any EC options.

At present, ECs average $937 psf across all districts. We would define affordability as a quantum (total cost) that does not exceed five times your annual household income. You can more read here on our analysis into 53 executive condominiums in Singapore.

While this may sound extremely obvious, this isn’t to tell you about this option, but more of a reminder to those who are looking that you should reconsider the resale flat option – it is still the most convenient choice if you need a home right now.

Of course, resale flats are admittedly more expensive, and there are issues of age and lease decay.

Also, note that with a BTO flat, you’d wait around three years for it to be built, and then five more years for the Minimum Occupation Period (MOP). With a resale flat, you only face the MOP, after which you can rent out the whole unit, or sell it and upgrade.

It may be worth thinking about, if you’ve already failed to get a BTO flat and are tired of waiting.

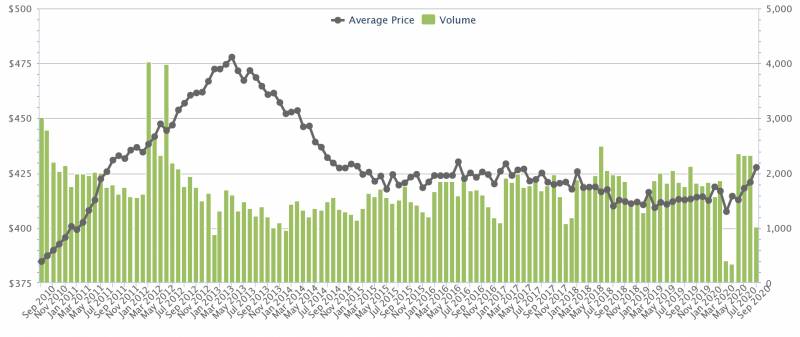

You can expect to pay about $428 psf for a resale HDB flat (average price across Singapore), at the time of writing.

If you’re a pure home owner, here’s another way to look at it: say you pay $385,167 for a 3-room flat in Holland (a must sought after location, and rightly so). The flat is 46 years old, with 53 years left on the lease.

That comes to roughly $606 a month; not a bad deal to live in the Holland area ultimately isn’t it?

Because if you’d to think about it, you can barely even rent a one bedroom at that amount, let alone a whole unit.

Just to be clear, this isn’t with interest costs and miscellaneous costs included, just purely based on the selling price.

What to do if the issue is failure to secure the HLE letter

Note that, to secure an HDB loan, you must meet the Mortgage Servicing Ratio (MSR). This is not the same as the Total Debt Servicing Ratio (TDSR), which is twice as high.

Under the MSR, your home loan repayment must not exceed 30 per cent of your monthly income. So if your monthly income is $3,500, the monthly loan repayment on your flat cannot exceed $1,050.

(Don’t confuse this with the TDSR which adds your other debt obligations, and is capped at 60 per cent).

You may also fail to secure the HLE because of credit history. If you have been bankrupt before, note that you may need to wait for a certain amount of time after your official discharge from bankruptcy, before you can be given a home loan.

If you’re having trouble getting a home loan, do drop us a message on Facebook , and we can connect you with experts who can help.

There’s psychological appeal to having a brand-new home for sure; and you do pay less for BTO flats. However, practicality needs to be at the forefront. If you’ve tried and failed repeatedly to get a flat, it may be better to avoid wasting more time.

Besides this, there are some real benefits to getting a resale flat instead of a BTO flat. Not only can you move in immediately, you may be able to get a home in a mature area, where the odds of a BTO launch happening are slim to none.

Plus, let’s not overlook the benefits of knowing exactly what the neighbours are like, and being able to physically inspect the property.

This article was first published in Stackedhomes.