EC vs resale flat: How much more can you end up paying?

Google ECs versus resale flats, and you’ll encounter any number of sites warning you that resale flats have poor appreciation compared to executive condos.

This is actually true. We’ve said in previous articles that, for over almost a decade, resale flats haven’t appreciated as well as executive condos.

But that aside, capital appreciation is not the sole concern for every Singaporean. Affordability is also a big issue; there’s no point buying an EC for “better appreciation”, and then be forced to sell it because you run out of funds.

It’s also important to look at the numbers in more detail; such as the bigger cash outlay, higher maintenance fees, property taxes, etc.

Here’s a comparison between a “typical” EC and resale flat:

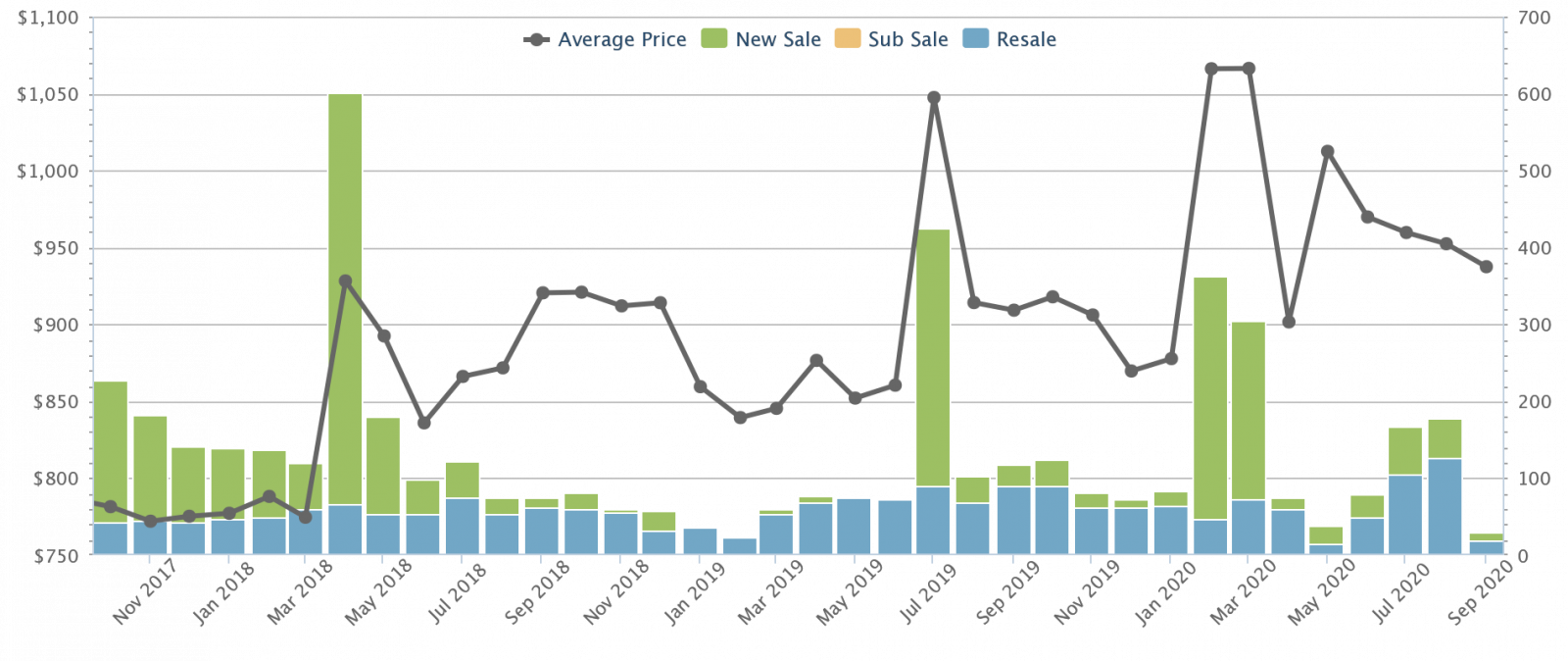

The most obvious difference between ECs and resale flats is the quantum (overall price). This is what it looks like across Singapore at the moment:

Island-wide, the typical EC project costs around $937 psf. The most common-sized EC unit for families today is between 1,050 to 1,200 sq.ft (note that this is close to the size of a five-room flat, which averages 1,184 sq. ft.)

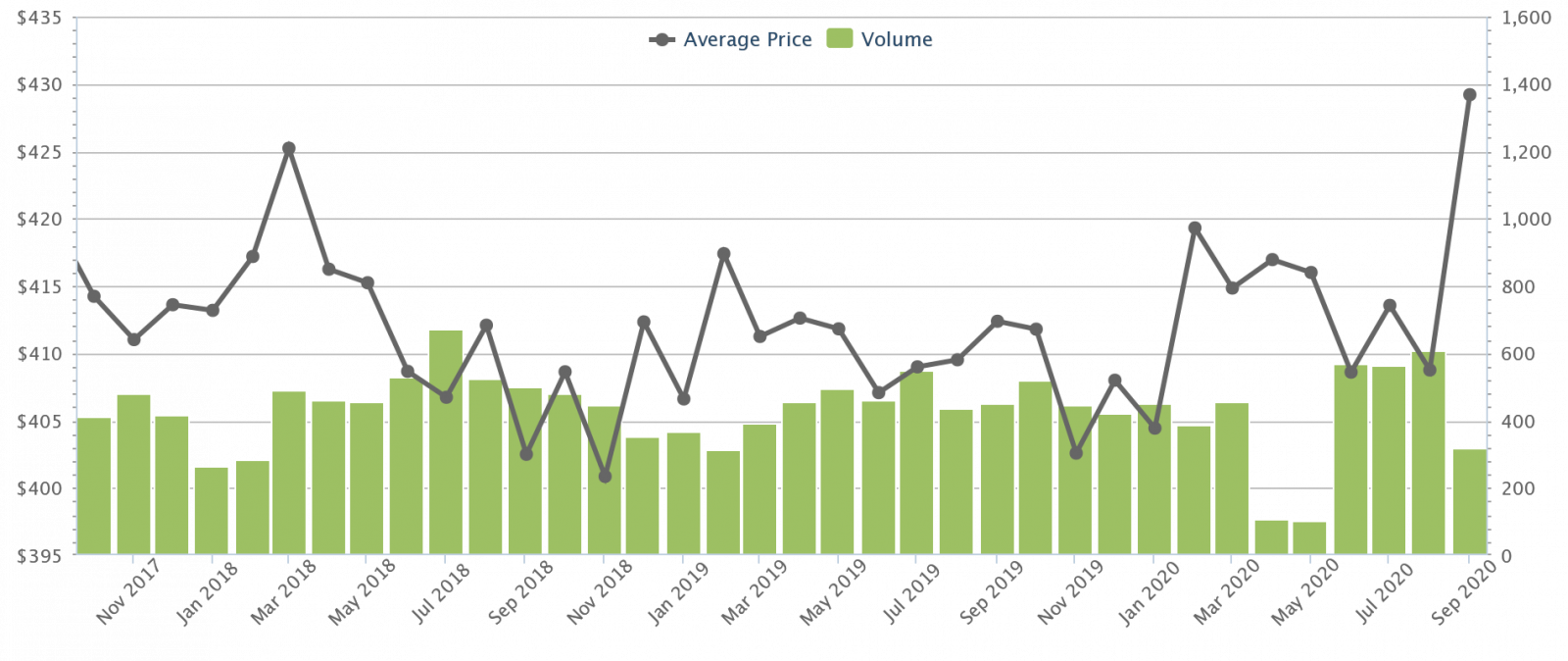

The average price of resale five-room flats, across Singapore, is currently about $429 psf:

This suggests that on average, an EC is more than double the price (118.4 per cent higher) than resale flats on a per square foot basis.

If we go by average quantum, the typical EC today costs about $1.04 million overall. Conversely, via our own data, the average quantum of a five-room flat today is about $524,000.

So home buyers should be aware that – on average – they will pay more than twice the price for an EC, compared to an equivalent sized resale flat . This is something to bear in mind, the next time you hear that ECs appreciate better than HDB flats.

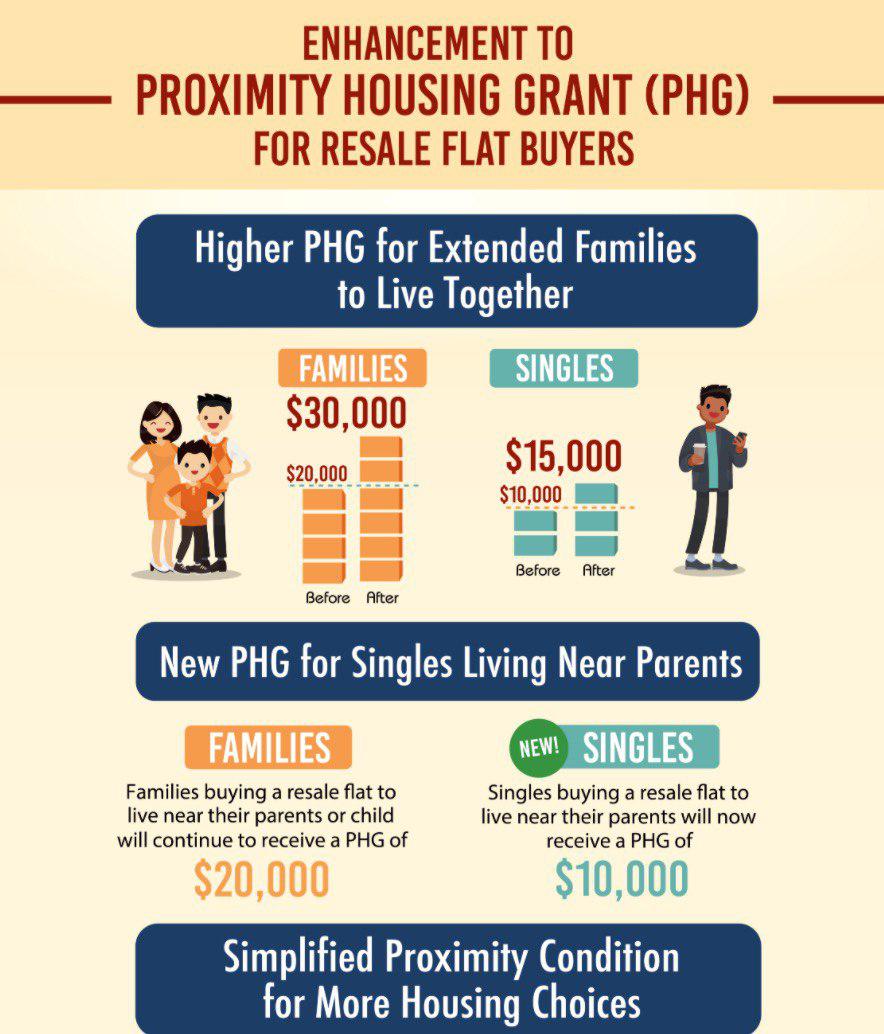

The maximum possible grants for a resale flat add up to $160,000 (although it’s improbable for most Singaporeans to get the full amount). These are:

(Please refer to the HDB website to see the qualifying requirements for each of the grants)

For ECs, however, you can only get a Family Grant of up to $30,000.

On a practical level, however, you wouldn’t even be considering an EC if you could qualify for the full $160,000 of grants (e.g. your average monthly household income can’t be above $1,500 to get the full EHG, and you can’t buy reasonably buy an EC at that income level anyway).

So it’s reasonable to mainly just consider the PHG and family grant.

In terms of the Family Grant, you could lose out on up to $10,000 ; that’s the difference between the $40,000 grant for five-room or bigger resale flats, versus the $30,000 Family Grant for ECs.

As there are no HDB loans for ECs, you’ll have to use a bank or other financial institution.

You need to make a minimum down payment of 25 per cent of the property. In addition, the first five per cent of the property must be paid in cash.

So with regard to a $1.04 million EC, for instance, you would pay at minimum $52,000 in cash, and $208,000 in any combination of cash or CPF.

You need to pay five per cent of the property in cash, to make the booking. Within nine weeks of the date of option, you pay another 15 per cent in any combination of cash or CPF.

For a $1.04 million new EC, this means $52,000 in cash to book the unit, and then $156,000 in any combination of cash or CPF.

With a resale flat, you can choose to use an HDB loan or a bank loan.

The minimum down payment is 10 per cent of your flat price or valuation, whichever is lower. This is payable in cash or CPF. So for a $524,000 flat, you would pay $52,400; it’s possible for the full down payment to come from your CPF ($0 in hard cash).

Do note that your OA will be depleted before your loan is granted. So the maximum amount you can leave in your OA is $20,000 per person.

As an example, if you had $400,000 in your CPF OA, you would have to use $380,000 for your resale flat – no questions asked.

This is the same as the EC. On a $524,000 flat, you would pay at least $26,200 in cash, and $104,800 in any combination of cash or CPF.

The key difference between ECs and resale flats is the cash component of the down payment. You need to be prepared to fork out roughly $50,000 in cash for ECs in the $1 million range.

Say you take an HDB loan of $471,600 (for a $524,000 flat), with a loan tenure of 25 years. The interest rate for HDB loans is 2.6 per cent per annum. You’d pay about $2,140 per month, with cash or CPF.

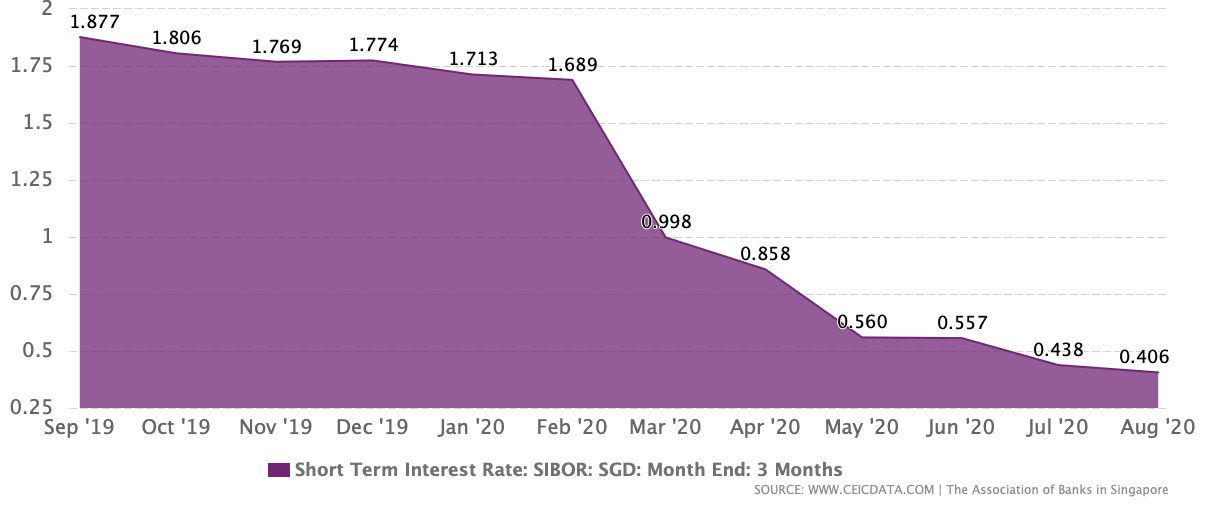

For new ECs, you will make monthly home loan repayments via the progressive payment scheme. Say you use a 25-year loan, at 1.3 per cent per annum.

Assuming you borrow $780,000 (for a $1.04 million EC), your monthly repayments could look something like this:

(Just to give you an example)

And so on and so forth, until the condo is complete three years later. By then, monthly repayments would rise to about $2,729 per month. This can all be paid with cash or CPF.

For completed ECs, if you borrow $780,000 over 25 years at 1.3 per cent, you’d pay about $3,047 per month, via cash or CPF.

Bank interest rates are unpredictable. Today they’re about half the HDB loan rate; but if you go back to the 1990’s, you’ll see bank rates were around four per cent, while HDB loan rates were still at about the same rate as today.

This is a long-term cost factor to consider when buying ECs, and it’s more or less luck-based. If interest rates stay low, you’ll pay less interest for an EC than a flat. If interest rates go back to historic levels, you’ll pay even more interest for your EC than for a flat .

This one is straightforward. Some of the highest conservancy fees for five-room flats are about $90 a month.

As for an EC this is dependent on the size and range of facilities. To give you an example, the newly launched Ola EC which has one of the bigger ranges of facilities will have maintenance fees of between $300 – $440 per month.

Your (owner-occupied) property tax rate is based on the Annual Value (AV) of your house. This is estimated by IRAS, based on the likely rental income you could earn (even if you don’t rent the property)

You can use the IRAS tax calculator to work out the amount.

The median AV of a five-room flat , at the time of writing, is about $10,380. That’s about $95.20 in property tax.

The median AV of an EC, on the other hand, is $22,000. That’s about $560.

This is a highly subjective area, as it depends on how you renovate.

What we can say is that ECs come with basic fixtures like sinks, toilet bowls, white goods, etc. and save you the cost of buying these.

Also, ECs are built by private developers, which usually means higher-end finishing. You may find there’s no need to improve elements like the flooring.

Of course, all of this is moot if you decide to hack it up and renovate it to your liking anyway.

(Also, there’s nothing to stop you from more sparsely renovating a resale flat, thus making this a moot point again).

To summarise, here are the definite cost differences between our example EC, and five-room resale flat:

Here are the variable costs:

This article was first published in Stackedhomes.