How much can you actually save by moving from a condo to an HDB flat?

In the past few decades, we have seen a dynamic Singapore property market.

The ever-changing property regulations, fluctuations in mortgage interest rates and uncertainty of the economic future have led some to take a pragmatic approach of "downgrading" to affordable housing as opposed to over-leveraging financial facilities for acquiring a property that puts them in greater debt.

The truth is, buying and selling property takes a lot of careful calculations, and any misguided move can lead to major financial mishap that can impact one's financial stability for a long time.

According to a survey released in October, local property buyers are beginning to take a 'wait-and-see' approach due to the looming concerns of the Singapore economy.

There are also declining interest rates due to the sky-rocketing prices of private homes and negative projection of rental yields. With all these uncertainties surrounding the property market, it is no wonder that some are going against the flow with a measured approach of humble living.

WHAT TO CONSIDER WHEN SWITCHING TO AN HDB FLAT

If you are planning to move from a condo to an HDB flat, there are several factors that will require consideration. It is important to start by checking your eligibility for owning an HDB flat.

The local housing authority has very stringent guidelines for who is eligible and what buyers are eligible for.

[[nid:24713]]

A single buyer must be at least 35 years old and a Singapore Citizen before he or she is permitted to purchase a two-room BTO flat or a bigger resale flat. For couples planning to downgrade to an HDB flat, do note that at least one spouse must be a Singapore Citizen or both must be Singapore Permanent Residents before you can be approved for buying a new or resale HDB flat.

For both categories of buyers, it is mandatory for them to dispose of any private properties (in Singapore or overseas) within six months of purchasing a resale flat.

If you are considering downsizing, it is also worth checking to see if you are eligible for the Silver Housing Bonus.

The next criterion is trickier and most down graders who wish to purchase a new BTO flat tend to get disheartened by this-single or couple buyers must wait 30 months before they are eligible for purchasing a new BTO flat.

This implies that buyers must have an alternative place to live in during the 30-month period.

If bunking in with friends and family is not an alternative, then renting a residential home, for the time being, will be a quick fix but is the rental cash outlay worth it?

COST COMPARISON BETWEEN BUYING A RESALE AND NEW BTO FLAT

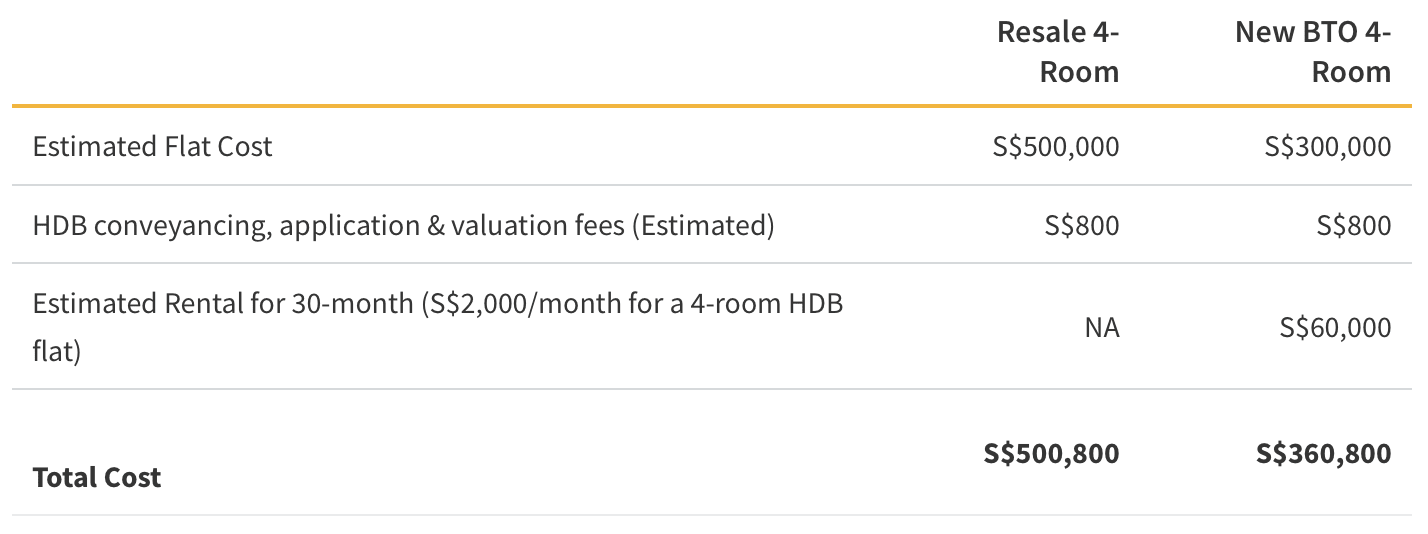

For those who are adamant about downgrading, here is a simple calculation to help you decide if buying a resale or brand new BTO flat is a better option for you.

Let's take an example of a Singapore couple, ready to sell their two-bedroom condo apartment and eventually move into a resale or new four-room HDB flat in Sengkang.

The simple calculation in the table provided a quick overview of the cost comparison between buying a new and resale flat.

There is a significant $140,000, nearly 28 per cent, saving if buyers are willing to go through the hassle of waiting out the 30-month period. It is also worth noting that HDB grants have not been factored into the calculation.

Depending on the eligibility of the buyers, they can claim for as high as $40,000 grant subsidy after the 30-month period. Of course, these savings are subjected to buyers' available cash funds to pay for the monthly rental during the entire period.

THE VALUE OF WAITING

[[nid:466479]]

The 30-month waiting period may seem like a difficult choice at one glance.

But if we can take some time to examine the details, there can be value in waiting.

Whether it turns out to be a more viable choice to buy a resale or BTO flat, looking into the various options and comparing the cost and effect will allow you to make more informed decisions.

Seeking the advice of an agent who is well versed in the downgrading process or sitting down with an HDB officer who can provide details of your eligibility will open up a lot of possibilities that you may not have seen before.

This article was first published in ValueChampion.