How much in GST vouchers will I be getting in 2020?

The GST Voucher scheme is a permanent scheme introduced by the Government in Budget 2012 to help lower-income Singaporeans to cope with the rising cost of living.

Eligible Singaporeans can look forward to subsidies and support given under this scheme every year, which comes in three separate components - Cash, U-Save and MediSave. The permanent nature of the GST Voucher makes it a sustainable support, rather than a temporary relief.

However, given the current Covid-19 pandemic, an expanded slew of measures was announced in Budget 2020. The Government has also announced that the Goods and Services Tax (GST) will not be increased in 2021.

Here is everything you need to know about the GST Voucher benefits for 2020.

The GST Voucher - Cash component is given to lower-income Singaporeans. To qualify, you must meet the following criteria:

You should note that your Income Earned in 2018 is based on the Assessable Income for the Year of Assessment 2019 as declared to IRAS.

In addition, the Annual Value (AV) of your home is the estimated amount of rent you can collect in a year if you are renting it out. The AV can be checked by logging into IRAS myTax Portal or by referring to your yearly property tax bill.

To check for your eligibility, you can log in to GST Voucher website after 1 July 2020. Eligible Singaporeans will also be notified in July.

Here is how much those who qualify will stand to receive:

You can choose to receive your GST Voucher - Cash via direct crediting to your DBS, POSB, OCBC or UOB savings/current bank account or cheque.

By default, the designated bank account would be the last account that has been used to receive cash payouts from the government.

If you wish to check or change the bank account, you can do so at the GST Voucher website.

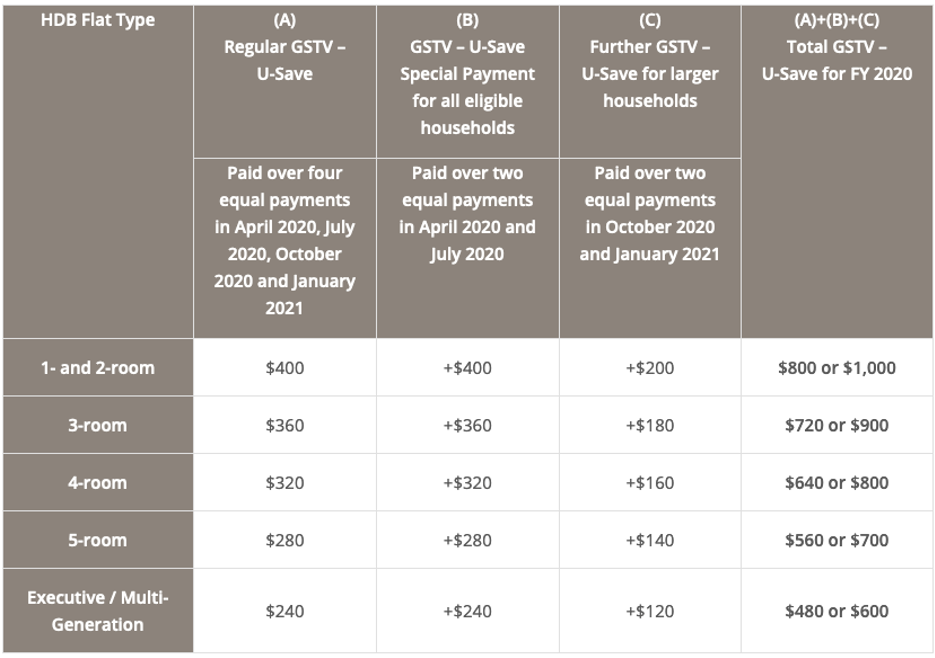

Singaporean HDB households will receive quarterly rebates over four quarters in April, July and October, as well as in January the following year, to help them offset their utility bills.

For this year, eligible households will receive a one-off GST Voucher - U-Save Special Payment in addition to their regular GST Voucher - U-Save.

Larger households with 5 or more members will receive a further GST Voucher - U-Save rebate. In total, Eligible households can receive up to $1,000 in GST Voucher - U-Save, and up to 2.5 times their regular GST Voucher - U-Save rebate this year.

To qualify, households must meet the following criteria:

In addition, immediate family members living in the same flat must not own or have any interest in more than one property.

Each household will receive only one benefit based on the HDB flat type. The rebates will be credited directly into the HDB flat's utilities account.

The final benefits component of GST Voucher is MediSave top-ups, which will be paid out in August.

To qualify, you must meet the following criteria:

The amount of MediSave top-ups is dependent on your age and AV of your home.

The timeline for payment under the 2020 GST Voucher are as follows:

| 2020 | |

| April | 1st U-Save Rebate 1st U-Save Special Payment for eligible households |

| July | 2nd U-Save Rebate 2nd U-Save Special Payment for eligible households |

| August | GST Voucher – Cash GST Voucher – MediSave |

| October | 3rd U-Save Rebate

1st Further U-Save for larger households |

| 2021 | |

| January | 4th U-Save Rebate

2nd Further U-Save for larger households |

Eligible Singaporeans will be notified via SMS (to their mobile numbers registered with SingPass) or letters to their address as per their NRIC.

Of course, it is faster and more convenient to receive SMS notifications, than to wait for the notification letters to arrive in your mailbox.

To subscribe to the SMS service, simply log on to SingPass website to register your mobile number. Once you have done so, you can enjoy greater convenience and timely updates.

This article was first published in Dollars and Sense.