How much should I pay for property agent commission?

A good property agent more than deserves his/her commission, but many buyers and sellers are often unsure about how much to pay. And it’s the same with landlords and tenants.

There are many factors that determine property agent commission in Singapore; even seasoned sellers, buyers and renters do get confused about industry standards.

So here’s our guide to help you be absolutely sure about the commission you should pay for any type of property transaction, be it selling, buying or renting as a landlord or tenant.

This is any property agent appointed by the landlord or seller to market a unit. This agent:

A CEA*-registered property agent representing the landlord or seller is obliged to have his/her client’s best interests at heart.

*CEA stands for the Council for Estate Agencies — the regulatory body of property agents in Singapore.

This is any property agent who assists a potential tenant or buyer in the following:

The buyer/tenant’s agent also provides valuable input in the form of professional advice (e.g. location) and guides them through the proper process of buying or renting a property, including the necessary paperwork.

Similarly, a CEA-registered property agent representing the buyer or tenant is obliged to have his/her client’s best interests at heart.

Agents are not legally allowed to be both the landlord’s/seller’s agent and the tenant’s/buyer’s agent in a single deal, as this will present a conflict of interest.

For rental cases, the landlord’s agent (and sometimes the tenant’s agent) often assists the landlord and tenant throughout the period of the lease for any maintenance issues and disputes, although he/she is not obliged to do so.

This describes a situation where two agents agree to broker a deal together — one as a landlord’s agent and the other as the tenant’s agent.

Although there are no universal, industry-standard rental commission rates imposed here, there are industry best practices — based on several experienced property agents that we spoke to.

However, take note that the commission rates may vary depending on situational factors such as the urgency and complexity of the deals. Prospective landlords/tenants should inquire with the relevant agents to understand the rationale behind the requested commission rates if they differ from the below.

If there’s only a landlord’s agent (i.e. the tenant contacted the landlord’s agent on his/her own), the landlord pays the landlord’s agent one-month commission, which he/she keeps. The tenant pays no commission.

If the renter has a tenant’s agent who assisted the tenant and represents his interest, the landlord pays the landlord’s agent one-month commission. The landlord’s agent then splits the commission with the tenant’s agent. The tenant pays no commission.

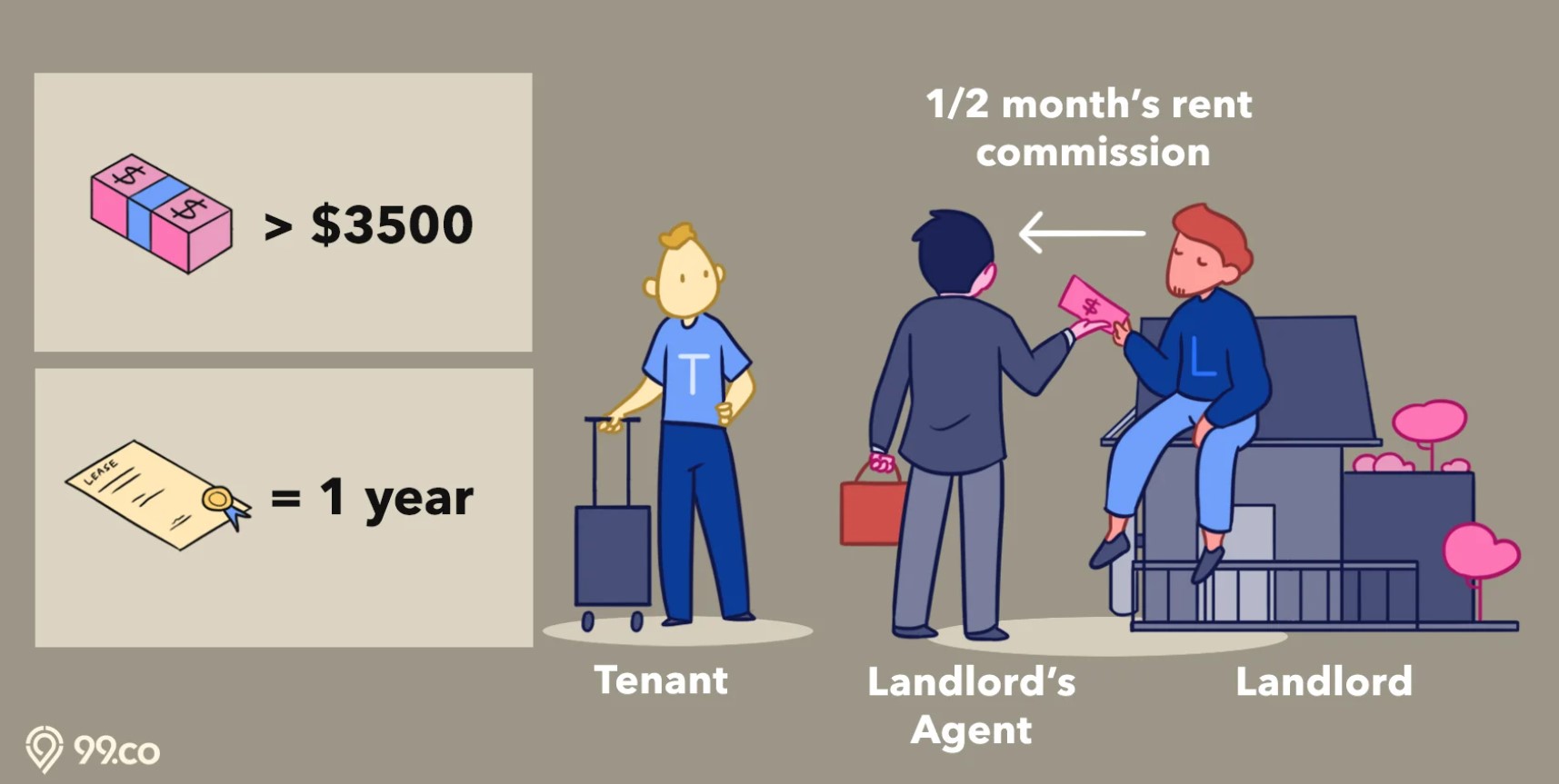

If there’s only a landlord’s agent (i.e. the tenant contacted the landlord’s agent on his/her own), the landlord pays the landlord’s agent half a month’s commission, which he/she keeps. The tenant pays no commission.

If the renter has a tenant’s agent who assisted the tenant and represents his interest, the tenant pays the tenant’s agent half a month’s commission, while the landlord pays the landlord’s agent half a month’s commission.

Landlord’s agent collects a one-month commission from the landlord.

Tenant’s agent collects a one-month commission from tenant. If there’s no tenant’s agent, the tenant doesn’t pay any commission.

Landlord’s agent collects half a month’s commission from the landlord.

If the tenant has a tenant’s agent, the tenant’s agent collects half a month’s rental from the tenant. If there’s no tenant’s agent, the tenant doesn’t need to pay.

It’s important to remember that these are just common practices. There is no hard and fast rule on whether the landlord or tenant should be paying their agents and how much. It all depends on the situation and how much the tenant/landlord needs the services of the agents. Some notable exception cases include:

Seller usually pays 2 per cent (sometimes up to 4 per cent).

Buyer pays nothing regardless of whether they’re using a buyer’s agent or not. Seller’s agent splits the commission with the buyer’s agent.

Seller usually pays 2 per cent commission.

Buyer usually pays 1 per cent commission.

Seller usually pays 2 per cent (sometimes much higher; there’s more room to negotiate as situations tend to be more unique).

Buyer pays nothing regardless of whether they’re using a buyer’s agent or not. Seller’s agent splits the commission with the buyer’s agent.

Similar to rental commission, again there are no fixed rules on commission and everything is negotiable depending on the situation. The commission structure on buying properties is usually even more negotiable as situations tend to be even more unique. Notable exceptions include:

If you want to try saving on property agent commission in Singapore by selling or buying a property without an agent, you might want to reconsider it. Property, being one of the most expensive decisions you make in your lifetime, demands a thorough knowledge of specialised law and regulations.

On top of that, property agents have knowledge and experience in negotiation, and can successfully go toe to toe with an opposing agent.

On the other hand, if you’re not familiar with the market and the various regulations, representing yourself can result in a messy and slow transaction at best, and costly legal entanglements and monetary loss at worst.

In any case, do compare commission fees and services offered by different property agents before deciding to appoint one or more.

A seller’s agent may also seek Exclusive Rights, a legal agreement to become your sole property agent in marketing and selling your property.

If you’re a landlord, having a landlord’s agent can save you from a whole lot of headaches. A landlord’s agent has experience in not just finding but screening out potentially bad tenants, and may be able to help you deal with tenant issues along the way (depending on agreed upon responsibilities with the agent).

If you’re a tenant and can afford the time to search and arrange viewings for a rental property yourself, you could choose to forgo a tenant’s agent.

In this case, our advice is to always find a landlord who’s represented by a landlord’s agent as there has been countless cases of devious landlords taking flight with a tenant’s deposit, or sudden and unfair evictions.

ALSO READ: We reveal how much property agents in Singapore are really making

Even if the lease is only for a year, having a property agent on either or both sides can provide peace of mind.

If you found this article helpful, check out Here’s how to make your home-selling journey smoother, according to property agents and The future of co-living spaces in Singapore in the next five years.