If you can afford something, should you still take a loan to get it?

If you can afford something, should you still take a loan to get it?

In our recent Pocket Change poll, 51.7 per cent of you said you would take a personal loan even if you didn't strictly need it, because "sometimes it's about flexibility, not desperation". The other 48.3 per cent said no way. If you can afford it, you'd rather just pay outright.

I felt that split quite personally, because I have been on both sides of that thinking.

At one point, I even floated the idea of taking a loan to my fiance for our upcoming overseas wedding we could technically afford, just so we could "keep some cash aside". In my head, that sounded smart and strategic. To her, it sounded unnecessary.

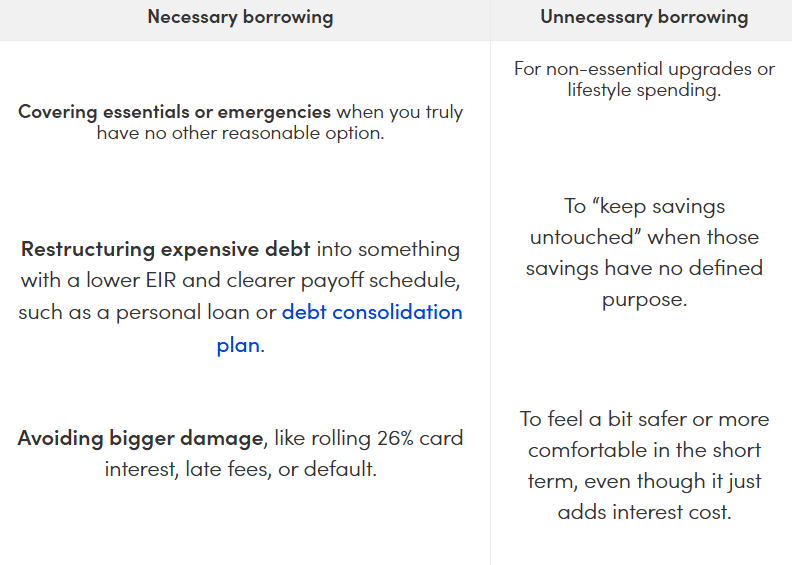

This piece is not here to tell you that loans are bad, or that you should feel guilty if you have one. Instead, it is about drawing a clearer line between:

If you have ever thought, "I could pay for this, but maybe I should take a loan and keep my cash," this is for you.

When we say things like "I'm taking a loan for flexibility" or "It's a strategic move", it sounds smart. But strategy is not just a nicer way of saying "I feel better with more cash in my account".

For borrowing to be truly strategic, a few things need to be clear:

If those pieces are missing, it is not really strategy. It is just borrowing with a nicer label.

A much more useful way to think about loans is this:

Both groups can involve personal loans. The difference is whether the loan is solving a real financial problem, or simply adding cost to your life.

In the rest of this article, we will stay on the side of necessary or genuinely helpful borrowing, and be fully transparent about where the line is.

Once you strip away the "flexibility" story, there are really only a few situations where taking a personal loan can genuinely help rather than just add cost.

If you are using a loan to pay for something essential, like medical treatment, a critical car repair, or keeping up with basic bills so you do not default, that is very different from borrowing for a holiday or a gadget.

In a situation like this, the question is not "Is this perfectly optimised?". It is "Which option does the least long-term damage?"

If the alternatives are things like:

then a personal loan with a structured repayment plan can be the lesser evil, as long as you are realistic about the monthly instalments.

For a sense of what you might face, many bank personal loans have effective interest rates (EIR) somewhere in the 6-12 per cent p.a. range, depending on your profile and tenure. That is not cheap, but it is still usually lower than rolling unpaid charges or penalty fees month after month.

The key here is that the loan is solving a real problem, not funding a "nice to have".

This is one of the clearest use cases where borrowing can actually improve your position, if you handle it properly.

Credit cards in Singapore often charge around 25-26 per cent p.a. interest on outstanding balances. If you are carrying a few thousand dollars across multiple cards, that rate can snowball very quickly.

In that situation, moving your debt into:

can reduce your interest cost and give you a clearer end date, provided you stop adding new debt on top.

For example, a DCP typically charges much lower annual rates than credit cards. Our guide to Debt Consolidation Plans notes that DCPs in Singapore often sit in the single-digit range, while card rates are closer to 27-28 per cent p.a.

The catch is important:

Used properly, this kind of borrowing is less about being clever and more about cleaning up a mess in the most controlled way possible.

Sometimes the value of a loan is not just in the interest rate, but in the structure it gives you.

No clear idea when you will actually be debt-free

can make it much easier to budget, stay consistent, and see progress. Even if the interest rate is not dramatically lower, the psychological and practical benefits of having one line to manage instead of five can be meaningful.

Again, this only counts as "helpful" borrowing if you also change the behaviour that created the problem. A cleaner structure does not fix overspending on its own.

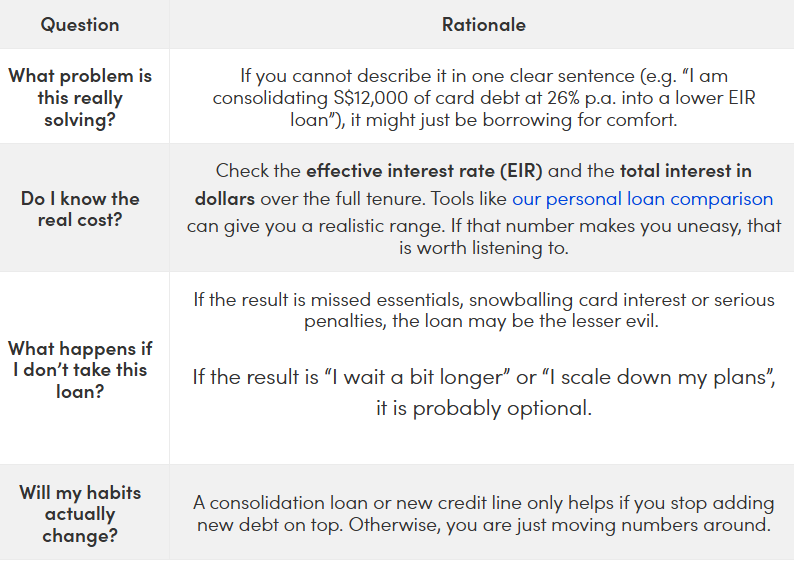

If you skim everything else in this article, remember this bit.

Before you sign on a personal loan, run it through these questions:

This is not about having the "perfect" answer. It is about being honest with yourself before you commit.

That little convo I had with my fiance about whether we should take a loan still sits in the back of my mind. On paper, we could afford what we were paying for. In my head, a loan felt like a clever way to keep some cash untouched. To her, it sounded like paying extra for no strong reason.

Then I saw the poll results and realised a lot of you are standing in that same space. Half of us are drawn to the idea of "flexibility". The other half would rather see the balance drop than pay interest for it.

Just remember, loans are not villains, but they are not magic either. They are just tools. Sometimes they help you get through a rough patch, tidy up expensive debt, or put a clear end date on something that was spiralling. Other times, they quietly charge you for a comfort you might not actually need.

So these days, when I am tempted to call a loan "strategic", I use one simple test:

If I took away words like "flexibility" or "breathing room", would this loan still make sense in numbers and in my actual situation?

Said yes? Then, it might be a responsible move. Said no? it just means this "strategic choice" might not be worth the full price tag.

[[nid:724917]]

The article was first published in MoneySmart.