A look at one of Australia's best performing stocks of the decade

a2 Milk Company Ltd is one of Australia’s best-performing stocks.

If you had bought shares in 2015 after its listing in Australia’s market, you would be sitting on a gain of over 3,000 per cent.

In this article, I’ll take a look at how the company got to where it is and what’s in store for the future.

a2 Milk Company may be one of Australia and New Zealand’s most successful business stories, but its journey has been anything but smooth.

a2 Milk Company is actually the successor of the much-maligned A2 Corporation, which was co-founded by scientist Dr Corran McLachlan.

In 1994, McLachlan began his research on the effects of milk consumption and heart disease and concluded that there was a correlation between A1 beta-casein protein (found in milk) and ischaemic heart disease, childhood type 1 diabetes, and other ailments.

Inspired by his research, McLachlan co-founded A2 Corporation in 2000. He used genetic testing to identify cows that produced milk that contained only A2 beta-casein protein.

However, Dr McLachlan’s research on the harmful effects of A1 beta-casein protein in milk was not widely accepted by scientists. They felt the findings were correlative, rather than causative.

Even today, a lot of the research done on milk with A2 beta-casein protein is funded by a2 Milk Company and there is insufficient data to prove that A1 beta-casein protein predisposes consumers to these ailments.

Moreover, A2 Corporation ran into more significant problems along the way.

In 2003, both Dr McLachlan and co-founder Howard Peterson passed away. The company was also facing financial difficulties. Just five months after it went public in May 2003, A2 Corporation had to go into administration in October and was liquidated in November.

A2 Corporation set up a new subsidiary to license and sell A2 milk in Australia. It sold a stake of that to Fraser and Neave and focused on expanding its international business.

By 2006, A2 Corporation was able to buy back most of the stake it sold to Fraser and Neave and by 2011, A2 Corporation finally made a profit for the first time in its history.

It raised another $20 million through a secondary listing in New Zealand and used the funds to expand its business.

A2 Corporation changed its name to a2 Milk Company in April 2014 and has since seen remarkable growth (more on this later).

Although data about the harmful effects of A1 beta-casein protein in milk is still inconclusive, a2 Milk company enjoyed two key catalysts that saw a spike in demand for A2 beta-casein milk.

[[nid:487936]]

First, the publication of a book titled Devil in the Milk by Keith Woodford in 2007 caused a spike in A2 milk sales in New Zealand and Australia.

Woodford discussed A1 beta-casein protein and the perceived health risks.

Next, the Chinese milk scandal in 2008, which resulted in six baby deaths and 54,000 hospitalisations, led to a spike in demand for infant milk formula from trusted Australian milk companies.

a2 Milk Company was one of the beneficiaries from that scandal as its milk formula sales in China exploded.

FY2011 (financial year ended 30 June 2011) was the turning point for the company.

After turning a profit 11 years after its founding, a2 Milk Company was able to grow its revenue and profit steadily, leading to a significant jump in its share price.

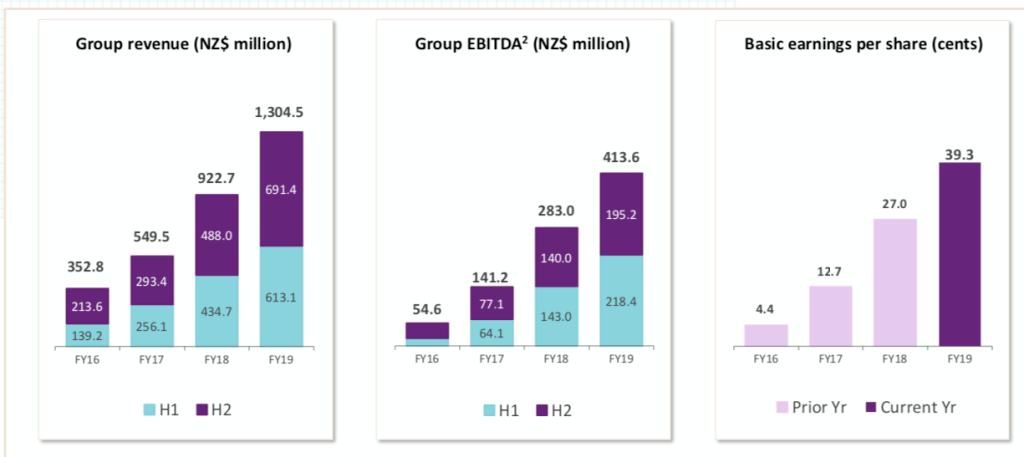

Revenue has jumped 30-fold from NZ$42 million (S$36 million) in FY2011 to NZ$1.3 billion in FY2019.

Earnings per share increased by almost 100-fold from NZ$0.004 in FY2011 to NZ$0.39.

Crucially, that growth has been fairly consistent and has continued in recent times.

The charts below show a2 Milk Company’s revenue, EBITDA (earnings before interest, taxes, depreciation, and amortisation), and basic earnings per share over the last four financial years.

Today, a2 Milk Company is more than just a liquid milk company. As mentioned earlier, the company has its own infant milk formula and other nutritional products, such as pregnancy and Manuka products.

All its three product segments saw significant growth in FY2019.

Liquid milk sales increased 23 per cent from NZ$142.4 million in FY2018 to NZ$174.9 million.

Infant nutrition has grown to become the most important product segment; in FY2019, infant nutrition revenue was up 47 per cent to NZ$1,063 million.

a2 Milk’s three key geographic markets - (a) Australia & New Zealand; (b) China & other Asian markets; and (c) the US – saw sales growth of 28.3 per cent, 73.6 per cent, and 160.7 per cent, respectively, in FY2019.

a2 Milk Company already has a strong presence in Australia and New Zealand with its a2 Milk brand of fresh milk achieving an 11.2 per cent market share in its segment.

Meanwhile, its infant formula brand, a2 Platinum, is the leading brand in its category.

[[nid:485481]]

So the main driver of the company’s growth should come from its less developed markets in the US, China, and other parts of Asia.

a2 Milk Company’s main product in China is infant milk formula (IMF).

In FY2019, infant nutrition revenue from China and Asia was NZ$393.1 million. This is still a fraction of the NZ$652.9 million in revenue that the same business-line generated in the Australian and New Zealand market.

Considering that Australia and New Zealand have a combined population that is about 2 per cent the size of China’s, you can just imagine the huge addressable market in China that a2 Milk Company could grow into.

To management’s credit, a2 Milk Company is investing prudently to unlock this vast potential in China.

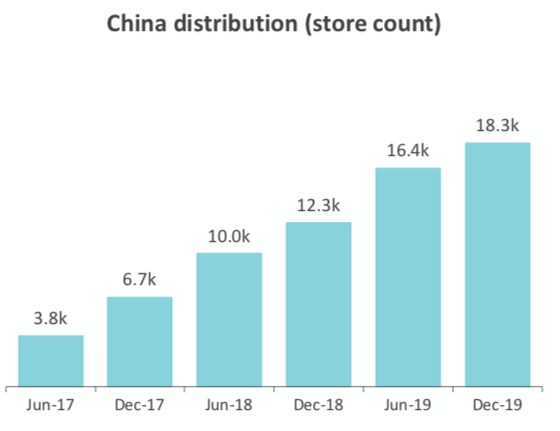

The company has increased its physical footprint. As of 31 December 2019 its products are now sold in 18,300 stores in China, up from 16,400 in June 2019.

There’s been a steady increase in the company’s distribution store count in China, which is partly fueling the increase in brand awareness and sales in the country.

The chart below shows the store count numbers from 2017:

a2 Milk Company’s China label IMF products has also grown from a mere 2 per cent of the product-category’s total sales in FY2016 to 22 per cent in the first half of FY2020.

This suggests that the company’s investments in marketing in China is paying dividends in terms of brand recognition.

a2 Milk Company’s infant nutrition consumption share in China has also increased from 4.8 per cent in June 2018 to 6.6 per cent in December 2019.

That’s still a small number, and there’s potential for the company to increase wallet share in China considerably in the future.

Growth in the US has also been steady, as revenue in the first half of FY2020 jumped 116 per cent to NZ$28 million.

Although the US still represents a small fragment of a2 Milk Company’s total sales, the size of the US market could result in it becoming a more important revenue contributor in the future.

Since 2011, a2 Milk Company has completely turned its business around. From a company that had to be liquidated back in 2004, a2 Milk Company now stands on solid ground, financially.

It boasts NZ$618 million in cash and no debt (as of 31 December 2019). It also milked NZ$286 million in free cash flow in FY2019.

Its capital-light business model, decent margins, and strong free cash flow should enable it to reward shareholders with buybacks and dividends in the future.

a2 Milk Company has certainly come a long way since its bumpy start in the early 2000s.

Since 2011, the company has seen tremendous growth and is in a great position to capitalise on its strong brand in China.

On top of that, the company boasts lots of cash on its balance sheet that can be reinvested into growing internationally.

[[nid:484982]]

Although it is currently not paying a dividend, I believe it is in a great position to start rewarding shareholders in the near future.

a2 Milk Company does come with risks though.

Its stock trades at a high valuation of around 46 times trailing earnings. There are also concerns about regulatory changes in China.

International expansion also has an element of risk, and a2 Milk Company has had its own share of failures, including its inability to expand meaningfully in the UK. It ultimately ended up announcing the closure of its UK business in 2019.

Nevertheless, despite the risks and high valuation, I think a2 Milk Company still has a favourable risk-reward profile.

Its huge market opportunity in China alone could provide a significant tailwind for the company and I think shares at these rich valuations still have a decent risk-return profile.

This article was first published in The Good Investors.