Looking ahead at 2020: An investor's guide

In 2019, the slowing global economy, the US-China trade war, Brexit and President Trump's impeachment dominated headlines. The media painted a dismal picture of these events and markets reacted erratically over the course of the year.

Yet, markets still performed very well: By the end of 2019, the S&P 500 returned 31.3 per cent, Straits Times Index (STI) returned 10.4 per cent, and the FTSE World Government Bond Index (WGBI) returned 5.9 per cent.

With these types of returns, it's easy, in hindsight, to shrug off the doubts and accept the wins. But, we can expect 2020 to be fraught with continued political tension and economic changes.

As we anticipate the uncertain political and economic environments, let's examine 2018 and 2019's risk factors to understand the importance of thinking about risk in relation to returns in such environments.

We're here to emphasise what investors should do in the face of the inevitable short-term market volatility that we'll see this year in order to achieve long-term investing success.

MARKETS CLIMBED OVER A MOUNTAIN OF WORRIES IN 2019

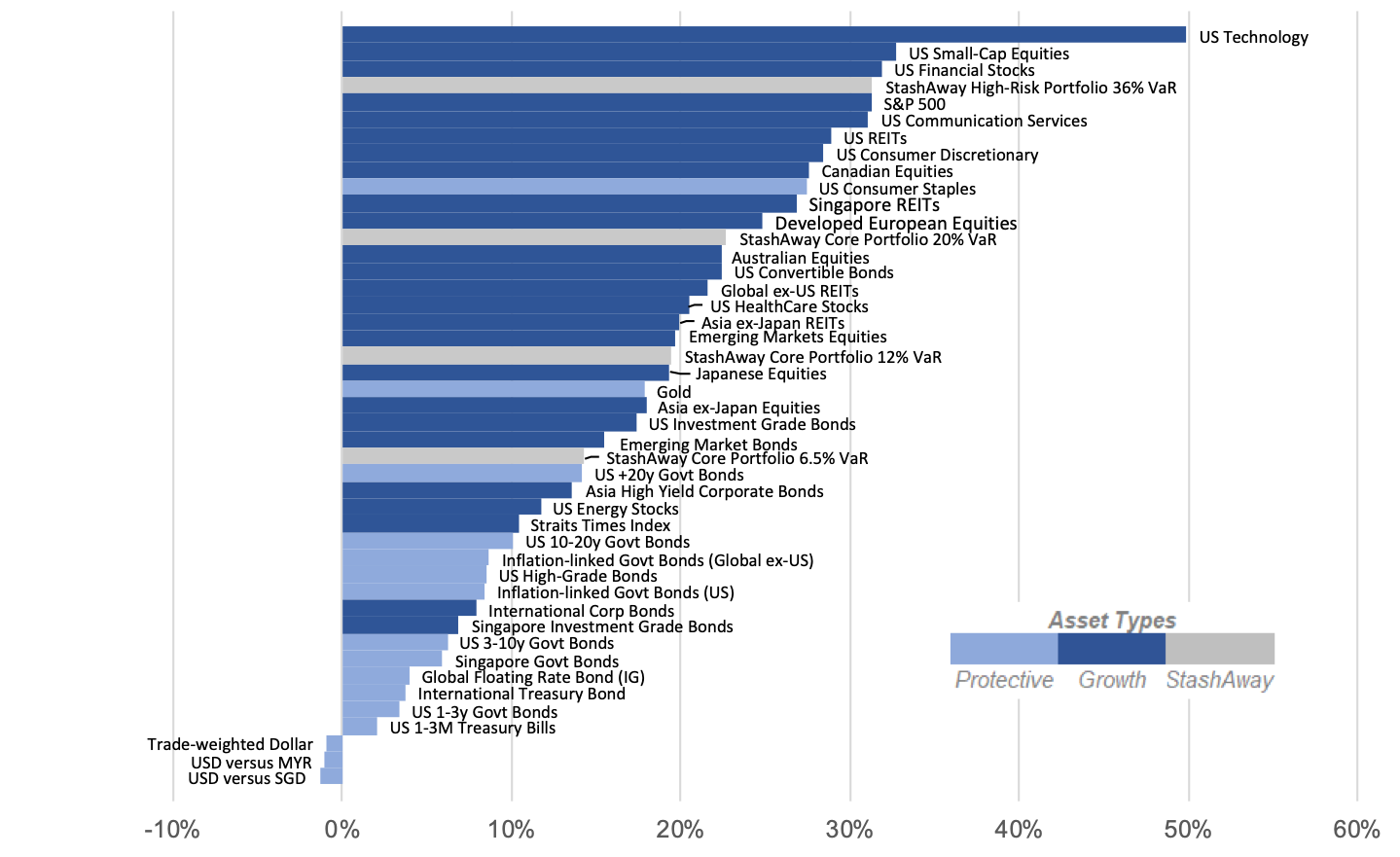

In 2019, geopolitical disputes, notably the US-China trade war and Brexit, dragged on for the entire year. Despite the onslaught of political concerns, the markets persisted. All the asset classes in our purview generated positive YTD returns with the exception of USD versus SGD, USD versus MYR and Trade-weighted Dollar which declined slightly (Figure 1).

US technology stocks outperformed with a 49.9 per cent return in 2019 YTD, while Singapore equities lagged at 10.4 per cent. Our General Investing portfolios returned between 14.3 per cent and 31.3 per cent, depending on the risk level chosen.

[[nid:473294]]

The MSCI World Equity Index and the S&P 500 are trading at their all-time highs by the end of 2019. Some attribute the markets' bullishness to the central banks' easing throughout the year.

As for the economy, US growth, along with the rest of the globe, decelerated as 2019 went on, sparking the media to declare unsubstantiated fears of an impending recession. Looking ahead, the US Federal Reserve and other major central banks continue to express readiness to support their respective economies.

LET'S NOT FORGET ABOUT 2018'S VOLATILITY

With a year as strong as 2019, it's easy to forget how gut-wrenching 2018 was, even though it really wasn't that long ago.

The US technology sector is an example of the painful drawdowns we experienced in 2018. Remember that US technology stocks suffered significant volatility, experiencing a drawdown of almost 25 per cent from its peak that year.

Facing that 25 per cent drawdown, would you have held or sold US technology stocks? If you tend to let your emotions interfere with your investing decisions, you may have panicked and sold the sector in 2018 only to miss out on some of the most impressive returns in 2019! In January 2019, the market rallied and the sector outperformed with a 49.9 per cent return by year-end.

We saw a lot of clients selling their investments out of fear during the December 2018 market correction and miss out on the market rally just a month later. We also saw clients trying to get back into the market in January 2019, driven by fear of missing out on great returns but they weren't able to capture this full return.

Though, the investors who were patient and rode the inherent ups and downs of the markets were the ones who enjoyed the greatest returns. As the saying goes; time in the market beats timing the market.

LOOKING AT POTENTIAL RISK FACTORS IN 2020

If you want to be one of the investors who enjoy the greatest returns, then you need to be prepared to persevere in the face of any volatility. In 2020, market volatility risk factors include the US general election and its impact on the US-China trade war and President Trump's impeachment, as well as Brexit, and any evolution out of the US-Iran escalation.

To prepare for another potentially volatile year ahead, you should be aware of future risk factors to help you emotionally commit ahead of time to filtering the noise, sticking to your plan, and maintaining a systematic, long-term mindset.

[[nid:473286]]

On our end, as investment managers, we're paying attention to the macroeconomic indicators that show both the health as well as momentum and direction of the economy. We're most interested in the economy's momentum and trajectory that determine our portfolios' asset allocations to minimise risk and maximise returns in a given economic environment.

After all, it's economic forces, not market noise, that drive medium-to-long-term asset class performance. That's why it's important not to react to market noise, and instead to reallocate investment portfolios only in an entirely new economic environment.

There are a few factors that we expect to shake the markets in 2020:

We previously studied past presidential impeachments' effects on the markets, and concluded that a presidential impeachment has no significant impact. Regardless, President Trump's impeachment in the Democratic-dominated House is unlikely to result in a conviction in the Republican-dominated Senate. Though the impeachment has gotten a lot of media attention, it won't get nearly as much attention as the US general election in 2020 will get.

We may see some short-term market volatility in the run-up to the Democratic Party National Convention in July 2020 as the leftist policies of most Democratic candidates, besides Michael Bloomberg or Joe Biden, aren't business-friendly with the promise of wealth tax and breaking up big firms.

After that, the markets will move their attention to the fight between the Democratic nominee and President Trump; early polls will inevitably affect President Trump's policies, and in turn, may impact the US-China trade negotiations. In the case that any of these political events spark market volatility, stick to your plan and stay invested.

The US-China trade war will also likely generate some short-term volatility. The phase 1 trade agreement was far smaller in scope than what President Trump once envisioned, and leaves major issues, such as structural reforms in China's business practices, hanging in the air.

Many politicians in Washington think that the trade deal gives away leverage, and that the US needs to seize a broader agreement. Depending on how polls shape up ahead of the 2020 general election, President Trump may do more "China Bashing" that could generate short-term volatility.

[[nid:473107]]

Again, in this case, ignore any market noise, and stick to your plan and stay invested.

Over in the UK, we might see some closure with Brexit. After winning approval for his Brexit deal in parliament on 20 Dec 2019, Prime Minister Boris Johnson has set a firm deadline to "get Brexit done" by 31 Jan.

Since the option to extend the deal past 2020 was waived by Prime Minister Johnson, there will be either a bare-bones deal or no deal at all. Fortunately, any near-term effect of Brexit is likely to be specific to assets exposed to the UK, not the rest of the world.

What should we do in the face any market noise that comes from this? Stick to the plan and stay invested.

GLOBAL ECONOMIES ARE STABILISING

In Aug, we re-optimised our clients' portfolios to an All-Weather strategy for assets based in the global ex-US region (US remains in disinflationary growth). This was done to equip our clients for the higher uncertainty in the global-non-US economies.

Leading indicators that our system tracks are now showing that these global ex-US economies seem to be stabilising. Our system will continue to monitor the indicators, and in the case that these economies show signs of rebounding, our system will re-optimise our clients' portfolios accordingly to equip them with the right amount of growth and protection in a new economic environment.

THE US ECONOMY IS SLOWING, BUT IT'S STILL NOT IN A RECESSION

The US economy continues to grow at a slower pace in 2019 than the previous year, but there are signs that growth is stabilising. The forward-looking indicator we use to measure US growth, the Conference Board Leading Economic Index (LEI), showed slower growth, from 3.5 per cent YoY in Jan 2019 to 0.1 per cent YoY in Nov 2019.

The Index shows that growth has slowed significantly over the past year, but it doesn't indicate that the US economy is going into a recession. In fact, there are signs emerging that the economy could stabilise.

For instance, US corporate earnings in Q4 2019 were more resilient than initially expected, and components of leading indicators, such as change in non-farm payrolls and the University of Michigan sentiment surveys, were better than expected.

[[nid:473103]]

And, the US Fed has explicitly pledged support to the markets by holding rates constant but ready to cut rates whenever necessary to prevent a recession. These are the indicators most important in managing long-term investment success; not short-term market volatility.

CHINA'S ECONOMY ON THE MEND

China's economy, which underwent a cyclical slowdown in 2019, is starting to bottom out. Signs of stabilisation are apparent on the broad-based, forward-looking indicators, such as the Li Keqiang Index, which tracks growth based on changes in bank lending, rail freight, and electricity consumption.

The Li Keqiang Index has rebounded strongly from the 6 per cent support level to 7.4 per cent in Nov 2019. And, China's industrial output and retail sales in Nov rose 6.2 per cent YoY and 8 per cent YoY respectively, providing further evidence of stabilisation.

There's also a good chance that the Chinese economy could regain its growth momentum, as the Price-Earnings Ratio (PER) of China's composite stock index still hovers around its historical low at 14.3x. If the scenario of economic stabilisation plays out, there could be significant upside for growth-oriented assets in China.

China's economic stabilisation is vital for Emerging Markets, because the country has an inherently outsized impact on these markets. In addition, the Chinese Li Keqiang Index tends to lead the global growth aggregate at major turning points in the past.

Macroeconomic indicators are showing that corporate earnings in the Asia ex-Japan region aren't slowing down as rapidly as they previously were. While it's still too early to judge, the leading rate-of-change indicators signal that the region's corporate earnings could bottom out.

PREPARE FOR VOLATILITY WITH RISK MANAGEMENT

In addition to refraining from making short-sighted, reactive trading decisions, it's equally important to make sure you've effectively prepared your investments with the right risk exposure. To illustrate, given the unusual market activity since Trump's presidency, we posed a question: Does the amount of risk an investor takes justify the returns she generates?

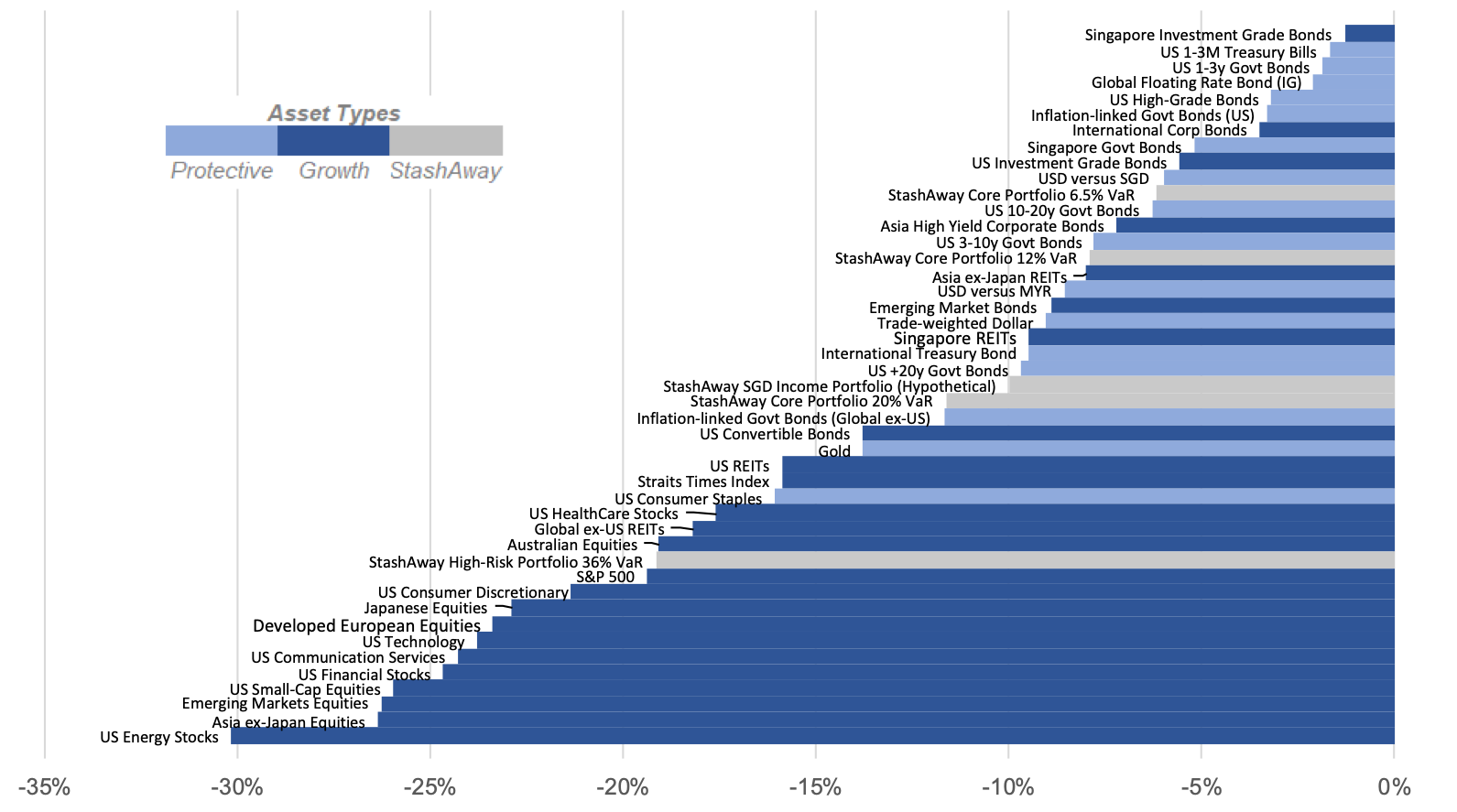

To answer the question, we compared the 2019 returns for each asset class that we track against their respective maximum drawdowns (falling from their peak to bottom) in 2018. The maximum drawdown (Figure 2) serves as a proxy for the risk incurred in each asset class. For each percentage point of risk exposure, how much return was delivered? This return-to-risk ratio for each asset class is shown in Figure 3.

For instance, the US energy sector, which returned 11.7 per cent in 2019, had a 30 per cent drawdown from its peak in 2018 (Figure 2), implying a return-to-risk ratio of 0.39x (11.7 per cent divided by 30 per cent) based on Figure 3. In other words, for every 10 per cent of risk an investor in US energy stocks is exposed to, only 3.9 per cent return was delivered.

[[nid:472735]]

In contrast, the return-to-risk ratio for Singapore investment-grade corporate bonds, a key building block of StashAway's SGD Income Portfolio, is 5.3x, follows by 3.1x for US investment-grade corporate bonds, which means for every 10 per cent of risk taken, an investor reaped 53 per cent and 31 per cent return respectively.

Our diversified portfolios delivered high return-to-risk ratios of 1.6x for our portfolios qualified by a 36 per cent StashAway Risk Index (SRI) and 2.5x for our portfolios qualified by a 12 per cent SRI in the 2018-2019 period.

Just because an asset gives a high return, doesn't necessarily mean that the amount of risk you were exposed to was worth that return. As we can see, some asset classes' return-to-risk ratios were low despite their returns being relatively high over the 2019 period.

A risk-managed investment means that it can achieve sustainable return-to-risk ratios over time and through economic and market cycles. Our system determines asset allocations as economic environments change in order to minimise risk and maximise returns. This risk-management is what prepares our investments for what could be another volatile year.

CLOSING THOUGHTS

The past few years have illustrated perfectly how risk management, not market timing, is the key to successful investing. We won't claim to know how any given asset class will perform in 2020; 2018 and 2019 show that it's almost impossible to predict with any degree of confidence.

Rather than predict what the markets may or may not do; we focus on economic fundamentals, risk management, and sound investing principles. We'll continue to rely on our investment framework, ERAA®, that intelligently mitigates the impact of short-term market risk factors by focusing on detecting shifts in economic cycles, such as slowing growth.

In the case of a changing economic environment, our system will make the appropriate adjustments to your portfolio to maintain your risk level while also maximising your returns.

As evidenced by the markets' behaviour through 2018 and 2019, investors who are prone to panicking, making emotional decisions, and selling during a market drop ultimately miss out on substantial returns. If you got out of the market during the market correction of Q4 2018, you'll know that emotional decisions can be expensive mistakes.

As you prepare for another tumultuous year, make sure that you're comfortable with the risk you've exposed your investments to, then promise yourself not to react to market volatility, stick to your long-term financial plan, and invest systematically to make the most of the natural upward trajectory of the markets in the long run.

Don't try to be a trader. Be an investor.

This article was first published in StashAway. All content is displayed for general information purposes only and does not constitute professional financial advice.