With rising interest rates, should you refinance your home loan now?

We’ve been enjoying ultra-low interest rates for the past few years on our home loans.

But with the Fed increasing interest rates by 0.5 basis points on May 4, 2022, the biggest hike in two decades, mortgage advisors interviewed by The Business Times are predicting a 0.75 per cent increase in Singapore’s mortgage rates by the end of 2022.

Some banks have already stopped offering fixed home loans and current home loan rates have already increased.

So if you haven’t already,

Now is the time to consider refinancing your home loan before interest rates increase further.

But before you refinance any home loan, be sure that you have enough capital to afford upfront costs (~$3,000).

As every refinancing situation is unique, make use of refinancing tools to help you determine if it is worth it, or engage a mortgage broker to help you.

Here are some useful refinancing tools that you can check out:

For those new to this, refinancing is switching out your current home loan for another one (within the same bank or a different bank) to enjoy lower mortgage rates.

This is usually done after two to three years of your home loan as that is when mortgage rates for the typical home loan package will rise.

Before we delve into how the rate change will affect your loans, let’s address the elephant in the room: the costs of refinancing your home loan.

[[nid:573393]]

Most banks require you to pay fees such as legal and valuation fees for refinancing your loan, and these can easily add up to sums above $3,000.

And if you are refinancing during the “clawback” period or before your property is completed, you must also consider penalty fees.

So be sure to have sufficient cash on hand and avoid a dumb home loan mistake.

Moreover, we must consider the “breakeven” point due to the upfront costs.

Upfront costs / Monthly savings = Breakeven Point

Eg. $3,000 / $200 per month = 15 months (before you actually start saving)

In essence, you will only begin to start saving money once your monthly savings overtake your upfront cost.

Disclaimer: The example below is solely for illustration purposes and based on mortgage analysts’ predictions from The Business Times. Interest rates may rise or fall in the coming years. Please do your own due diligence before refinancing a home loan.

Let’s say that we are currently holding a floating home loan package with the following details:

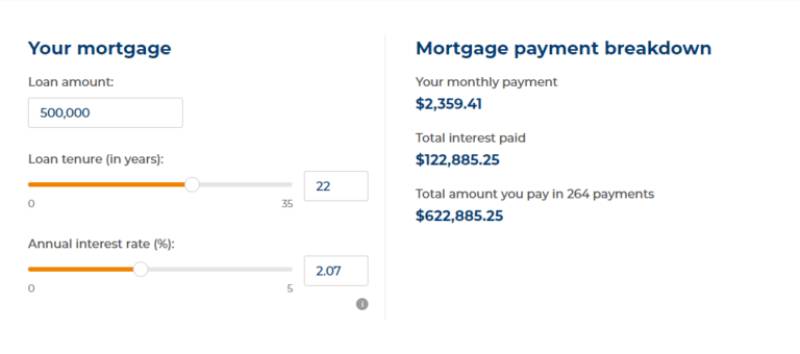

Assuming that predictions go through and mortgage rates are increased by 0.75 per cent, we will be looking at floating rates of about 2.07 per cent – 2.55 per cent.

Using an online mortgage calculator, we will be paying a total of $76,381.94 in interest at current rates.

If we continue without refinancing and assuming that the 0.75 per cent increase comes in one go now, here is what things would look like:

From 2023 onwards, we will be paying a total of $122,885.25 in interest.

This shows us that rising mortgage rates could cost us an additional ~$46,500 in interest.

With such a large sum of money on the table, now is definitely a time to reconsider your home loan package to mitigate the effect of rising rates.

Using our $500,000 home loan example, let’s compare the interest paid within a five-year timeframe to determine if it is worth refinancing.

If we were to switch to the five-year fixed home loan from DBS, here is how much we will be saving at the end of five years.

Amount paid without refinancing on a floating package (2.07 per cent): $141,564.60

Amount paid on a five-year fixed home loan with DBS (1.8 per cent): $137,701.80

Savings: $141,564.60 - $137,701.80 - $3,000 (refinancing costs)= $862.80

Update: Since our March 23, 2022 edition of this article, you might have missed out on a few thousand dollars of savings if you hadn’t refinanced then. Using the same example, this was how much we would have saved if we refinanced earlier this year.

Using our $500,000 home loan example, let's compare the interest paid within a five-year timeframe to determine if it is worth refinancing.

If we were to switch to the five-year fixed home loan from DBS, here is how much we will be saving at the end of five years.

Amount paid without refinancing on a floating package (1.99 per cent): $140,413.20

Amount paid on a five-year fixed home loan with DBS (1.5 per cent): $133,486.20

Savings: $140,413.20 - $133,486.20 - $3,000 (refinancing costs)= $3,927

So if you’re reading this today and have a home loan of more than $500,000, do seriously consider refinancing now or it will no longer be financially viable to do so.

As of May 5, 2022, many banks have also stopped offering fixed home loans as evident in the screenshots above.

For those with a lower loan amount of $500,000, things don’t look good at all.

If we were to compare with a $210,000 home loan ceteris paribus

Amount paid without refinancing on a floating package (2.07 per cent): $59,457

Amount paid on a five-year fixed home loan with DBS (1.8 per cent): $57,834.60

Savings: $59,457 - $57,834.60 - $3,000 (refinancing costs)= -$1,377.60

As evident in our calculations above, if your outstanding home loan is not large enough, you will actually be losing money due to refinancing costs.

Otherwise, switching to a fixed home loan now would generally save you a few hundred to a few thousand as you can lock in lower interest rates.

If you’re on a fixed home loan package, you would need to consider whether your fixed rates are high enough to offset refinancing costs and any penalty fees.

Again, every situation is unique and what you have just read is only based off of predictions and used for illustration purposes.

Interest rates may continue to rise or fall despite analyst predictions and there are no certainties when it comes to finance.

As always, do your own due diligence before refinancing your home loan package and engage a mortgage advisor if required.

This article was first published in Seedly.