Should you be upgrading to a condo in 2023?

If there’s a single defining feature of the 2022/23 property markets, it’s an increasing low supply and historical highs across the board. This has led many to wonder if it is still the right time to make their big step: to sell their flat and fund a condo purchase. But remember that, even if you sell your flat for record highs, you may end up buying condos priced the same way. Here’s what to know before you upgrade this year:

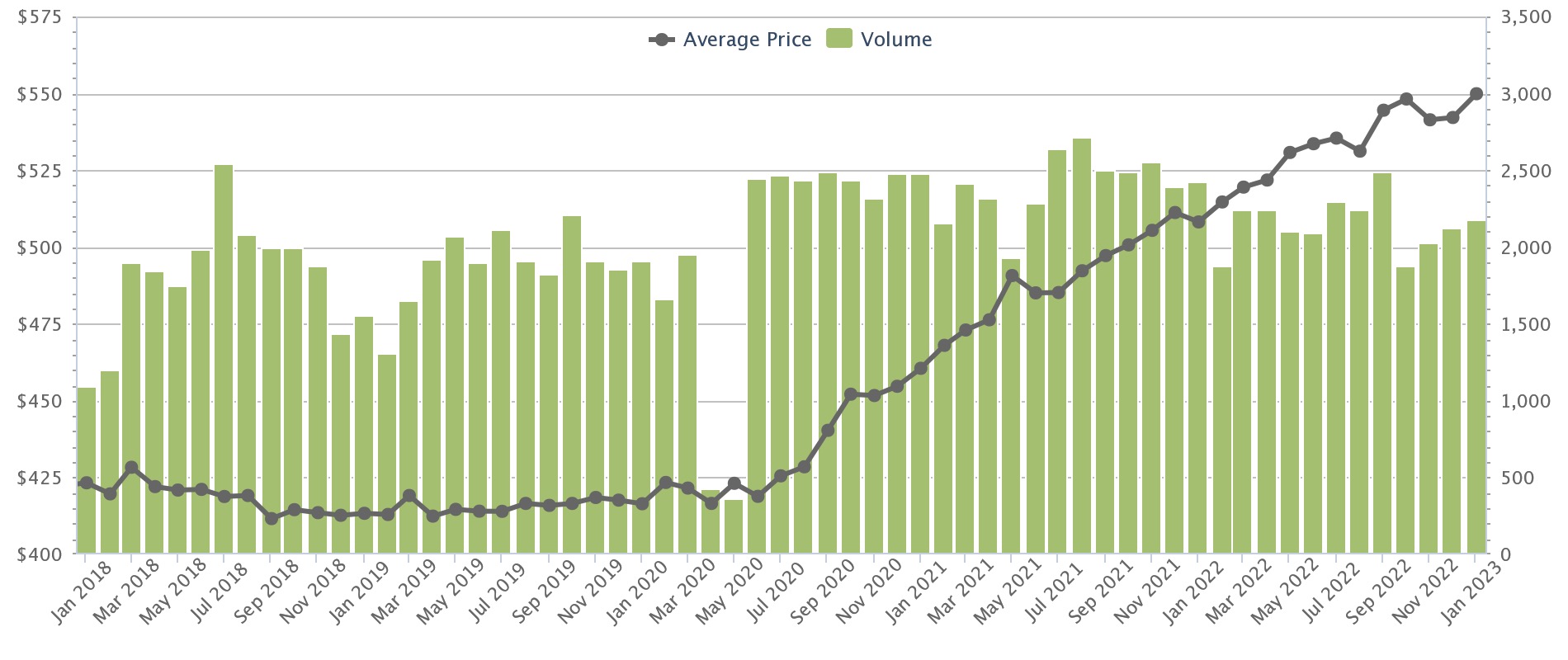

These two charts aren’t very specific, but suffice to demonstrate a general point. These are HDB flat prices over the past five years:

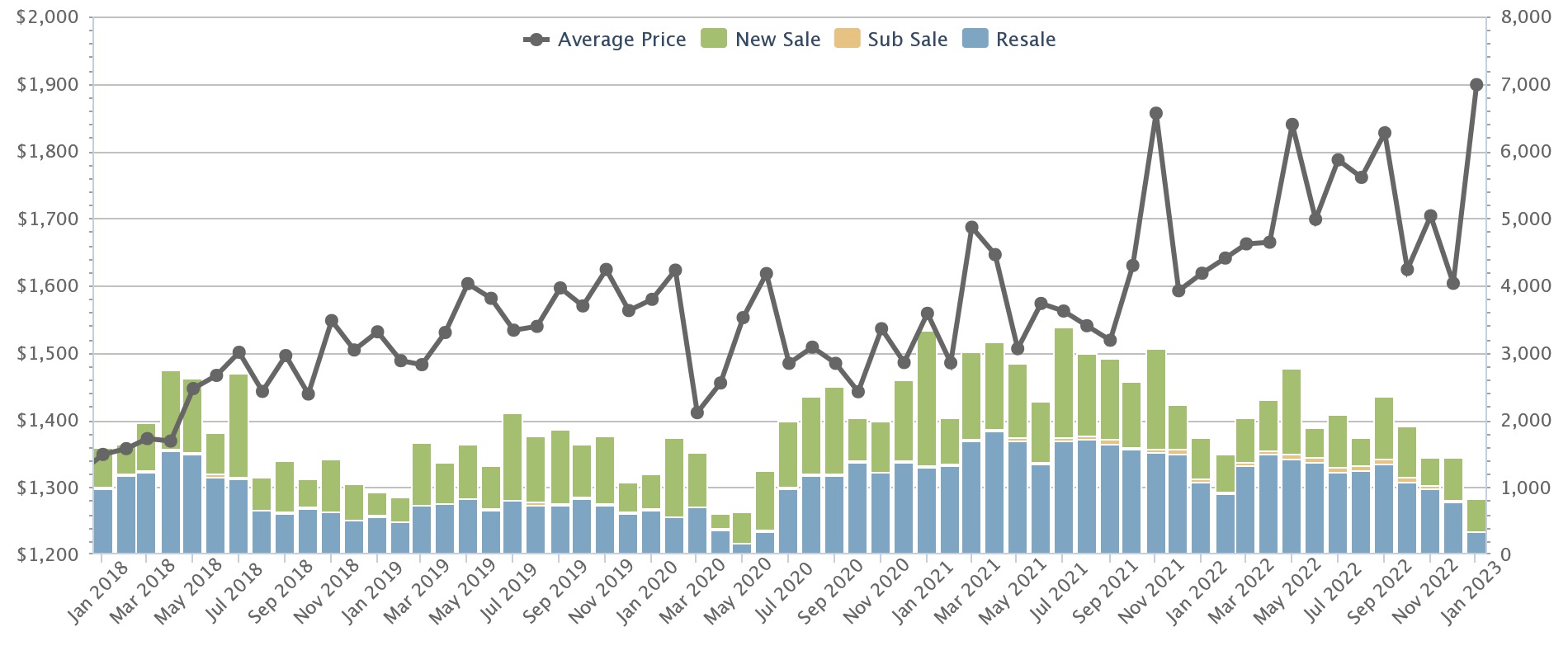

While these are overall private non-landed prices (without distinguishing new launches and resale):

Resale flat prices have made a spectacular climb from $443 psf to $550 psf, since 2018. This is a rise of just over 24 per cent.

Private non-landed prices have, on average, risen from $1,349 psf to $1,899 psf, an increase of around 40.7 per cent over the same time period.

It is generally true that, despite the sharp spike in resale flat prices, private homes have – as a whole – still outpaced the rising prices of HDB flats. Although this is not universally true (i.e., this all doesn’t consider district, new launch versus resale, age, or a myriad of other factors), it does mean that even historically high flat prices don’t mean it’s easy for everyone to upgrade.

It’s a large and nebulously defined group of people who could upgrade; but perhaps its clearer if we focused on who shouldn’t be considering it right now:

We’ve often pointed out that you should be able to service your mortgage for at least six months, even with a total loss of income – this can be saved either in your bank or your CPF.

If you’re going to upgrade to a private property, bear in mind that the savings fund for these six months has to grow accordingly. If you can’t meet the requirement, 2023 is likely to be a volatile year, and not one in which you should be taking chances.

This is also where perhaps it is worth highlighting the 3-3-5 rule of prudence (as unrealistic as some might deem it): You should have 30 per cent of the capital needed for your new property, the monthly loan repayment should be kept to 30 per cent of your monthly income or less*, and the total price shouldn’t be more than five times your combined annual income.

*For those who haven’t bought private property before, note that HDB regulated this for you when you bought a flat – your loan wouldn’t have been approved if it would have gone beyond 30 per cent of your monthly income.

However, you’re given much more leeway by banks, who allow up to 55 per cent of your monthly income to go toward loan repayments (this limit is inclusive of other debts like car loans). But just because you can, doesn’t always mean you should.

The interest rate floor, when determining your TDSR limit of 55 per cent, is currently set at four per cent.

For example, a loan for $1 million for 25 years is considered to have a monthly repayment of around $5,278, even if the actual interest rate on your package is lower.

This means a minimum income of around $9,596 per month is needed to qualify for such a loan (as repayments cannot exceed 55 per cent of your monthly income, inclusive of other debts).

You may find that, under the new interest rate floor, your income is insufficient to qualify for the desired loan amount. This usually means making a big down payment, and again paying more cash.

Besides this, do check on your CPF usage, and the amount you need to refund

If all this would mean wiping out your savings (see point 1), or leaving you with perilously low cash reserves, you’re probably not in a safe position to upgrade – not unless you can find a cheaper alternative.

ALSO READ: 5 hard-to-spot problems you should know before buying a condominium in Singapore

The average home loan interest rate is now climbing past three per cent, after over a decade at two per cent or below. It is not impossible that we may see rates as high as four per cent by end of the year, or even five per cent in the near future.

This is not a worry if you use an HDB loan however, which is always pegged at 0.1 per cent above the current CPF interest rate (frankly it almost never changes; it has been at 2.6 per cent for almost over 20 years by this point).

Buying a private property or an Executive Condominium requires you to leave the safety of the HDB loan, and turn to the banks. As such, people facing higher financial risks (e.g., gig economy workers, or small business owners facing a rocky economy) may not want to take on a mortgage at this point.

Note that we have no perpetual fixed-rate home loans in Singapore – all our fixed-rate loan packages only remain that way for a limited period (often three to five years) before reverting to a variable rate.

As an example of what can happen when you buy at a peak, check out our investigation into Urban Vista.

A significant number of unprofitable transactions (61 unprofitable to 19 profitable at the time) were at least in part due to timing: the launch of the property was in 2012, which was a run-up to peak prices in 2013. A subsequent slew of cooling measures then saw falling prices, and losses upon resale.

We’ve also recently seen two cooling measures (December 2021 and September 2022), which raised stamp duties and further curbed loans – this is a very clear sign that the government won’t hesitate to step in and force prices down further if they feel a dangerous bubble is forming.

All of these are danger signs for those who buy at the current peak, and expect to see fast returns (e.g., holding periods of five years or even less).

If you have sufficient holding power and can wait a long time, you might be able to ride out a coming down cycle and wait for the next peak. But if you don’t, or if you expect returns sooner than that, upgrading today can be seen as risky.

There is a fair argument that waiting longer could worsen your chances of upgrading later. When the supply of HDB flats increases, such as on the back of the ramped-up building in 2020 and 2021, we’re likely to see resale flat prices dip in the future.

Couple this with the speed at which private property prices are outpacing resale flat prices, and there may be an argument for some to make the jump while they can.

This could be food for thought for some, especially the younger you are. For example, even though you may think HDB prices may still go up in the future, it is also likely that condo prices in the area will be even higher.

So it could be worth upgrading now if you believe that condo growth will still outpace HDB prices, you have an advantage with a longer loan tenure, and your cash proceeds won’t be reduced as much because of accrued interest (and more importantly, you have good job security and progression).

However, your personal financial situation trumps any speculation on market situations – ensure you meet basic levels of prudence, and don’t rush into upgrading just because you fear the pace of rising prices. It’s much worse to buy what you can’t afford, than to just have to save up longer.

This article was first published in Stackedhomes.