Ultimate guide to the CPF Property Withdrawal Statement and how to get it

When it comes to Central Provident Fund (CPF) each new day is a day of discovery.

And today’s discovery is the CPF Property Withdrawal Statement: a document which provides information about all your CPF property transactions and is used for home loan refinancing applications.

Here is all you need to know about the CPF Property Withdrawal Statement and a step-by-step guide to obtaining it!

The CPF Property Withdrawal Statement is a document provided by CPF for CPF members which summarises all of the member’s property-related transactions using CPF.

With the statement, you can check the total principal amount withdrawn from your CPF and the accrued interest owed to CPF.

More specifically, the total principal amount withdrawn includes your:

In addition, the statement informs you about the amount that will be refunded to your CPF account upon the sale of your property as well.

In general, you will need to submit the CPF Withdrawal Statement for home refinancing loan applications in Singapore even if you have not used CPF to service your existing home loan.

This includes applications for:

*FYI: Repricing refers to switching to a new home loan package within the same bank while refinancing refers to closing your current home loan account and setting up a new home loan account with another bank.

**A Housing Equity Loan, Term Loan or Equity Term Loan all refer to the same thing and are often used interchangeably.

A housing equity loan is where you can borrow money by using the equity of your property as collateral. They are also known as “second mortgages” or “cash-out refinancing”.

But, this type of loan is only available to private property owners and Housing Development Board (HDB) executive condominiums owners who have satisfied the Minimum Occupation Period (MOP) of 5 years.

Now that you know more about the CPF Property Withdrawal Statement, let us dive into how you can obtain it.

Obtaining your CPF Withdrawal Statement is a simple four-step process:

First, you will need to prepare your phone and SingPass login details.

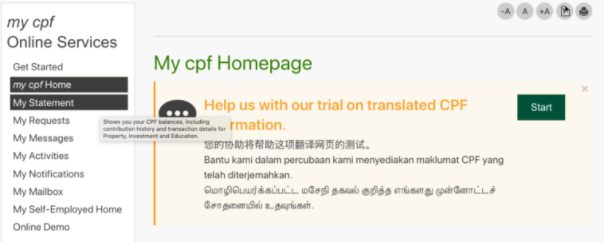

You will then need to login to the CPF website with your SingPass.

Click on the link which will bring you to the ‘My Statement – Property’ page.

On the ‘My Statement – Property’ page, click on ‘My Public Housing Withdrawal Details’.

If you own private property, the page will provide a ‘My Private Housing Withdrawal Details’ link.

Clicking on the link will bring you to your CPF Property Withdrawal Statement which can be printed or saved as a PDF!

This article was first published in Seedly.