Want to save more in 2020? 5 ways to resist consumerism and spend less

Living in Singapore, you're constantly bombarded by advertisements, from bus stops, MRT to shopping centres in every district. It can be pretty tempting to needlessly spend in a capitalistic society but consumerism isn't impossible to resist. Here's how.

We live in a culture of consumerism. Advertising has long proven to be effective in persuading consumers to buy products in increasing amounts by appealing to their social, emotional and functional needs. Unfortunately, rampant consumerism fueled by constant advertising impacts more than our shopping habits.

Consumerism has led to a "throwaway culture" that wreaks financial havoc on individuals and leads to negative environmental impacts. However, research suggests that "consumers are not always open to advertising".

As consumer behaviour evolves and mindful spending gains popularity, people have started to favour methods of avoiding advertisements like skipping ads on YouTube or installing ad blockers on their browsers. If you're looking for more ways to cut down on mindless consumption and save money, we outline 5 methods below.

1. DON'T CAVE IN TO ADVERTISING

It's impossible to be completely immune to advertising unless you're living off the grid without access to any form of media. People feel compelled to spend for various reasons. Besides, sensory marketing is made to appeal to your five senses, making you act on your emotional impulses rather than rationality.

For instance, the distinct smell of food from a popular fast food chain that you associate with your childhood, the music played in certain stores, and the use of the colour red that's associated with excitement are a few factors that lead you to spending, even if you don't need to.

Every time you see a commercial, hear a jingle, or see an ad, learn to recognise the tactics the establishments are using to appeal to you. Furthermore, you should adapt a "buy only what you need, not what you want" mantra to remind yourself of what is truly important to your needs.

While retail therapy makes you feel good, ask yourself "how often will I use or wear this item?" before purchasing it to avoid frivolous purchases.

[[nid:474381]]

This way, you'll only have possessions that you cherish, which not only saves you money, but also keeps you from accumulating unnecessary clutter and keeps you grateful for the things you do have.

It takes time to develop the willpower to control impulse spending and to delay the immediate gratification that comes from splurging on random purchases, but your efforts will pay off when you realise how much you've managed to save for a rainy day.

2. SHOP SUSTAINABLY

Fast fashion has raised ethical concerns in recent years. Not only does it negatively impact sweatshop workers who provide criminally cheap labour, the waste from the mass production of clothing is harmful to the environment.

It also fuels consumerism in unprecedented ways by forcing the quick turnaround of trends and using cheap fabric. If you have an fashion itch, you can opt for sustainable shopping instead of shopping at your typical fast-fashion store.

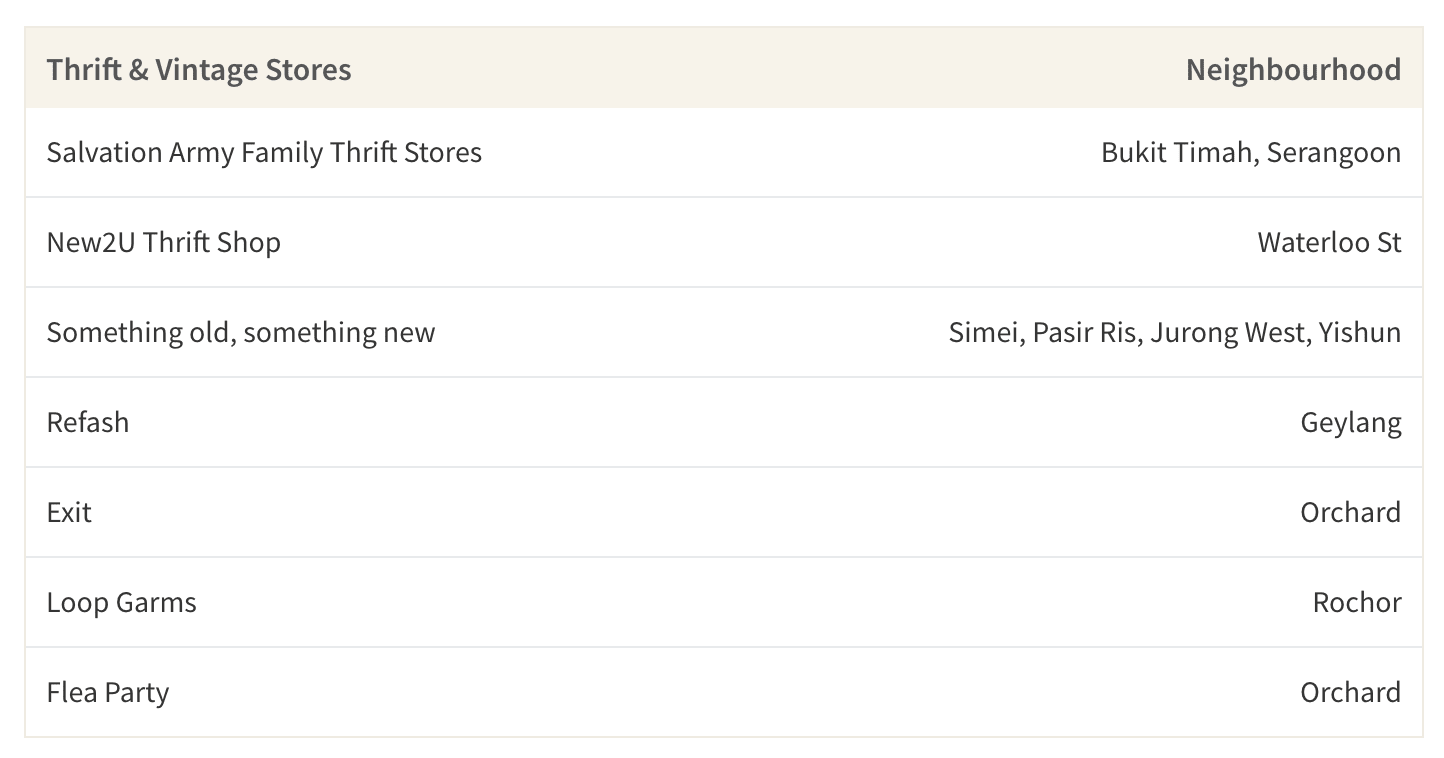

While we can't all afford custom tailored garments, we can still find affordable and sustainable options in second hand stores, thrift shops, at flea markets and even via clothes swapping with friends.

If you have stylish friends who want to give you their clothes in mint condition, accept them as clothing you can breathe new life into instead of seeing the garments as hand-me-downs. To take it one step further, you can even consider upcycling your clothing.

Not only does this reduce textile waste, but you can get a new clothing item for next to nothing.

[[nid:474358]]

HOLD OFF ON GETTING THE NEWEST TECH GADGETS

New models of smartphones and laptops are released every year and the increasingly advanced specifications can be very tempting. You may feel the need to upgrade their smartphones to the latest models year after year. But is that really necessary when your current phone is only a year old?

A 64GB iPhone 11 without contract costs $1,150 while the 512GB iPhone 11 Pro costs up to $2,200, and upgrading every year will cause your expenses to add up. Whether you're choosing the "cheapest" or the priciest option, using your phone until it stops working gives you more bang for your buck-although your mileage may vary.

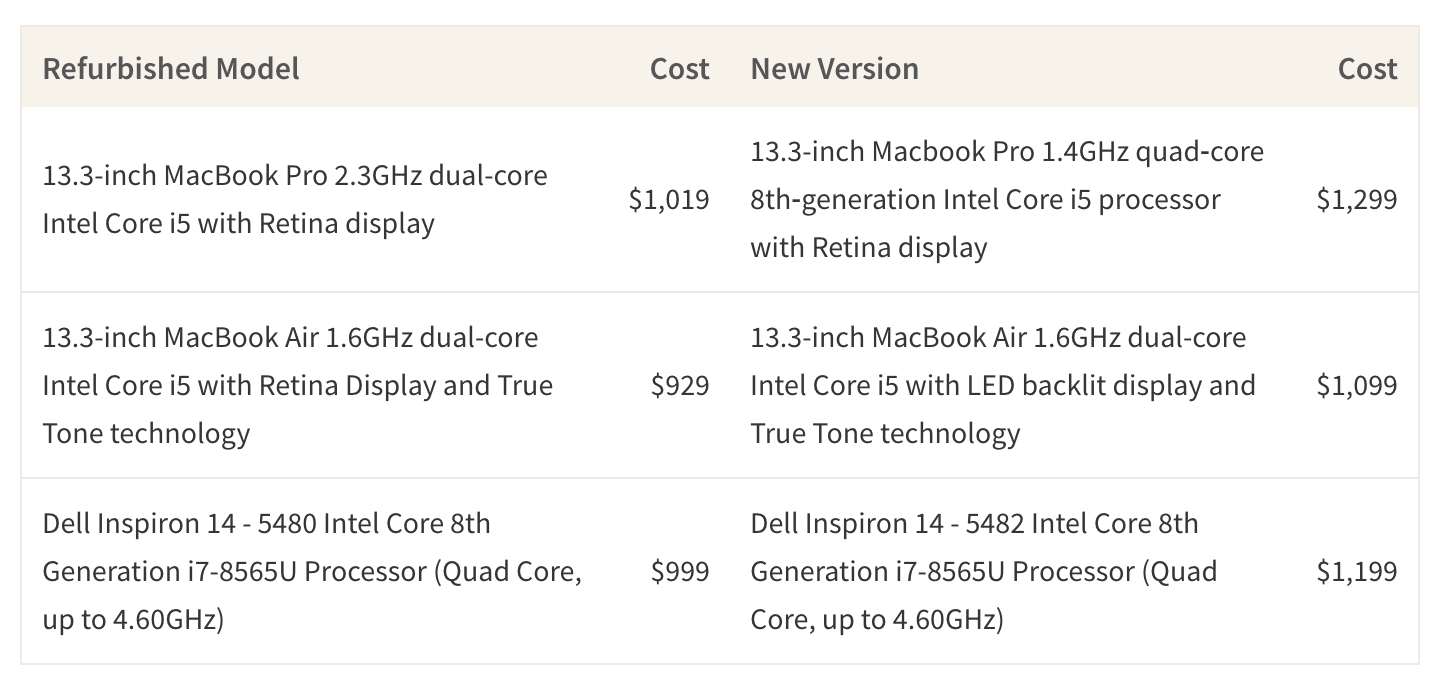

As for laptops, refurbished ones sold via the official website or flagship stores of your preferred laptop brand are as good as new, and can save you at least $200 compared to buying a brand new one. And whether you're purchasing a brand new or a refurbished device, spending that extra cash on an extended warranty can help you save money on costly repairs in case your phone/laptop breaks.

QUALITY OVER QUANTITY

It's more cost-effective to spend a little more on quality products that are durable, especially for things that you use often. Products made with cheap material wear out quickly, which means you will spend more on them over the long-run.

Even though high-quality goods cost more upfront, a well-made pair of jeans that you wear every day, a comfortable pair of running shoes, and even a sturdy mattress that you can comfortably sleep on every night are worthwhile investments.

To save money, you can make these purchases during clearance sales and use a cashback card that can give you up to a 6 per cent rebate on your online purchases. Buying products that lasts you at least 5 years to a decade is one way you can resist consumerism.

USE PERSONAL FINANCE APPS

Personal finance apps help monitor what you spend the most on so you can take control of your finances. They're also a useful tool to reduce consumerism because they force to come to terms with your spending habits.

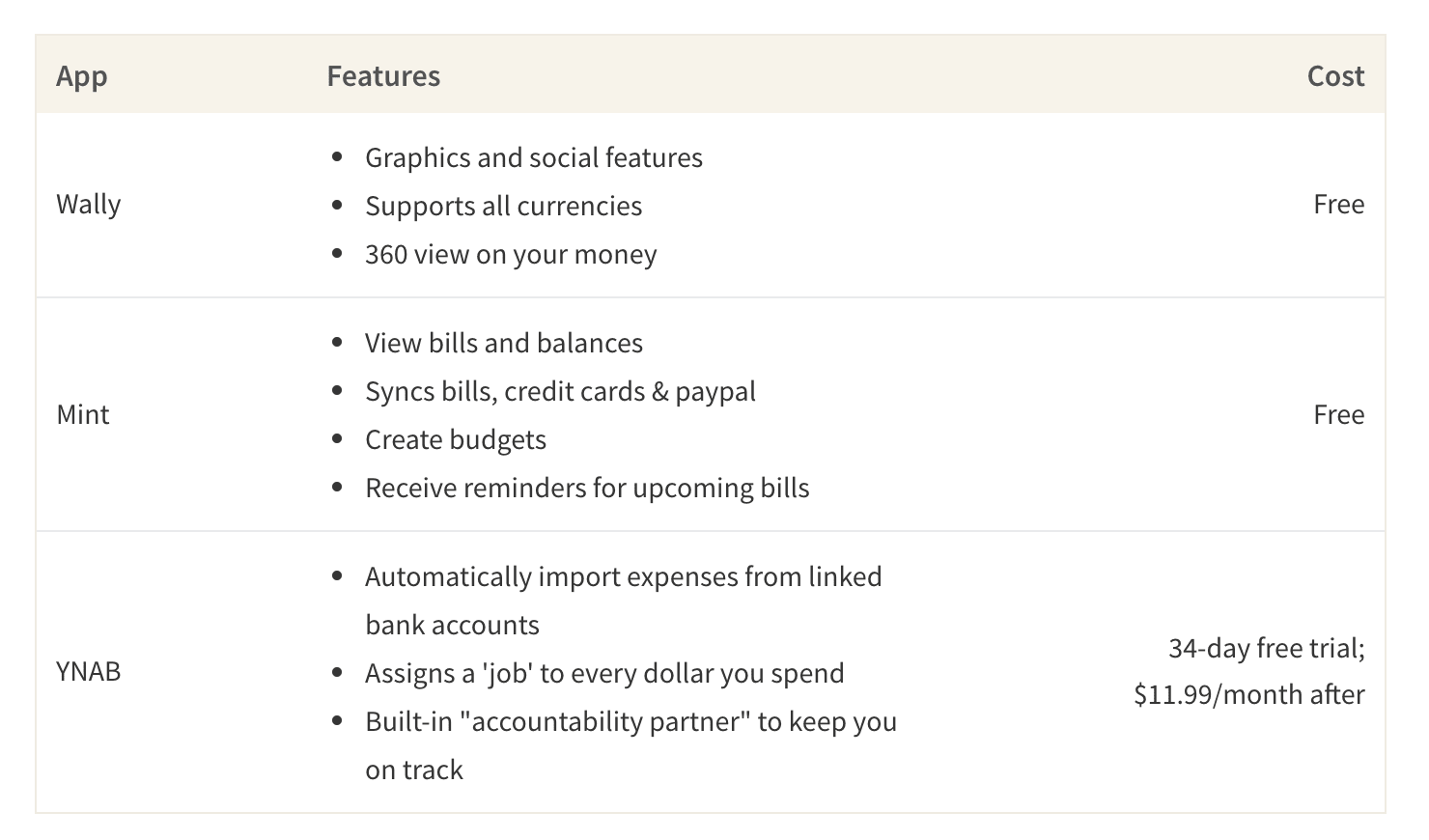

An app like You Need A Budget (YNAB) allows you to track and share your finances with a partner, as well as provide online classes with a live instructor that teaches you budgeting basics. Popular with millennials, Wally uses artificial intelligence to track your expenses and provide feedback on your spending.

Mint still remains the most popular expense tracking app as it's free and contains features like budgeting, expense tracking, credit monitoring, and managing bills. In case you've never used any, download a few apps to see which suits you better. As you start tracking your expenses, you can reevaluate your spending and savings.

DEVELOP AN AWARENESS OF YOUR CONSUMPTION

We all fall victim to consumerism and there is no one-size-fits-all solution on how to prevent that. However, if you can be cognizant of the psychological effects of advertising that pushes you to buy what you don't need, it can help you be more aware of what and how you're consuming.

Practicing gratefulness with your current belongings also helps, since you become more mindful of their role in your life and their purpose. Subscribing to a more ethical mindset is another way to be more conscious about how mindless consumerism affects the world you live in.

Even if saving the planet isn't on your list of priorities, fighting consumerism will at least help you save money for long-term goals rather than short-term gains.

This article was first published in ValueChampion.