Which S-REIT can survive this market meltdown?

Real Estate Investment Trusts (REITs) are considered by many to be a safe-haven asset class due to their relatively stable rental income and debt-to-asset ceiling of 45 per cent. However, it seems that REITs are still susceptible to steep drawdowns just as much as other stocks.

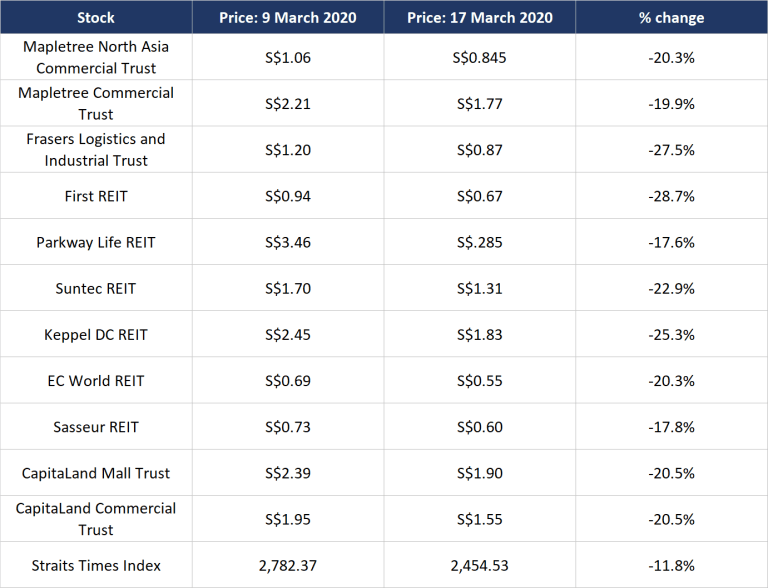

The REIT market in Singapore has been hammered as badly as the Straits Times Index, if not worse, over the past few days.

The table below shows the price changes of some of the REITs in Singapore since 9 March 2020. Even REITs backed by traditionally strong sponsors such as Mapletree Investments Pte Ltd and CapitaLand Ltd have not been spared.

WHY?

In my mind, the likely reason why REITs have been hammered so badly recently is that investors are worried that REITs' tenants will not be able to pay their committed leases.

Loss of revenue could potentially bankrupt businesses causing them to default on their rent.

REITs, in turn, will then face lower rental income in the coming months. This leads to a vicious cycle, where the REITs are then not able to service their interest expenses and may need to liquidate assets or raise capital in this extremely harsh environment.

Worried investors have been scared off from REITs during these difficult times and have flocked to "real" safe-haven assets such as treasuries and US dollars.

WHAT NOW?

[[nid:476354]]

I think this is a perfect time for investors to take a step back to reassess their portfolio. It is important to know which REITs in your portfolio can weather a storm and which are at risk of a liquidity crisis.

The share price of a REIT may not be truly reflective of its ability to weather the storm. Some REITs that have been sold off hard may actually have the means to run the course, while others that have yet to be sold down may end up having to raise more capital.

So I am more interested in the fundamentals of the REIT, rather than the price action.

WHAT I AM LOOKING OUT FOR

In these unprecedented times, here are some things I look for in my REITs:

If tenants can pay and renew their rents, REITs will have no trouble in these difficult times. For instance, REITs that have government entities as tenants are safer than REITs that have small and highly leveraged companies as tenants.

Elite Commercial REIT is an example of a REIT with a stable tenant. The UK government is its main tenant and contributes more than 99 per cent of its rental income.

In addition to the first point, REITs that have a highly diversified tenant base are more likely to survive. For instance, malls and office building owners whose buildings are multi-tenanted are likely to be less susceptible to a sudden plunge in rental income should any tenant default.

Mapletree Commercial Trust and CapitaLand Mall Trust have multiple tenants and are less susceptible to a collapse in net property income.

REITs such as Parkway Life REIT are more likely able to service its debt as its interest expense is much lower than its earnings. At the end of 2019, Parkway Life REIT had a high interest-coverage ratio of 14.1. So Parkway Life REIT should be able to service its debt even if there is a fall in earnings.

A low debt-to-asset ratio is important in these tumultuous times. REITs that have low gearing can borrow more to tide them through this rough patch. REITs such as Sasseur REIT and SPH REIT boast gearing ratios of below 30 per cent.

DON'T PANIC...

[[nid:478878]]

The last thing you want to do now is panic. In a time like this, is important to stay sharp and not do anything rash that can hurt your portfolio.

Breathe. Take a step back and reassess your positions. Don't focus too much on the price of a REIT. Instead, focus on its business fundamentals and whether it can survive this difficult period.

If so, then the REIT will likely rebound when this COVID-19 fear finally settles.

This article was first published in The Good Investors. All content is displayed for general information purposes only and does not constitute professional financial advice.